This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Can sake make it big in India?

Sake exports to India have risen by over 900% in the last decade, so what is the Japanese rice wine’s recipe for success among Indian consumers? Eloise Feilden finds out.

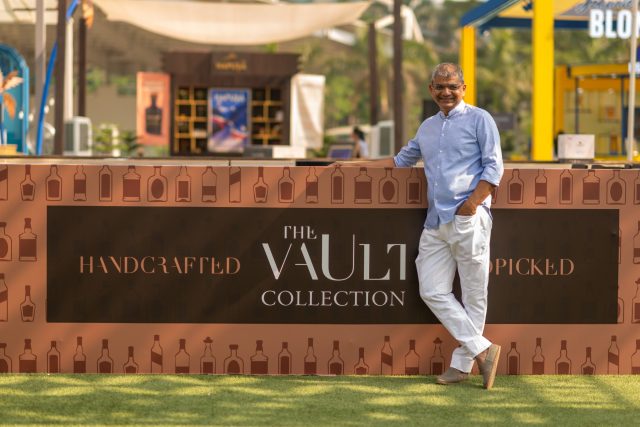

“The adaptive nature of the well-travelled Indian is a reason that sake is a top shelf ask at the moment,” says Keshav Prakash, whose event The Vault Festival (17-18 Feb 2024) offered 12 sakes to taste among the many wines and spirits at the festival in a dedicated section named ‘Sake Stories’.

The founder says there is an “exoticism and charm association with all things Japan”, be it food, drinks or culture, among Indian consumers, driving the popularity of products associated with the country. “There exists an affinity towards Japanese culture,” he says, driving a “growing discernment and acceptance among evolved Indian consumers into the realm of sake.”

Rising interest in sake among Indian consumers has been spurred on by the proliferation of Japanese restaurants especially in the bustling metros like Delhi, Mumbai, Bengaluru and Chennai. And tier two cities are fast catching up on the trend.

Ravi Joshi saw the trend coming in 2020, when he launched Sake Club India, an Indo-Japanese community aimed at promoting sake and other pan-Asian beverages in India.

Sake Club India, with Joshi at the helm, has now become instrumental in raising the profile of Japanese rice wine in the country. the Embassy of Japan in India has stepped up its efforts for promoting sake, enlisting Joshi’s help in doing so.

In 2021, even under the shadow of the Covid pandemic, the EoJ collaborated with Sake Club India on its first anniversary for an outdoor sake tasting. Sake Club India has represented groups of sake breweries at trade events like Vinexpo India and ProWine India, as also under the aegis of Japan External Trade Organisation (JETRO). The most recent promotional event for sake in India was hosted by the EoJ this month, with a range of producers showcasing products to importers and local media.

Joshi agrees that the rise in Japanese restaurants has triggered more Indian consumers to put sake on their radar. It also suits Indian tastes well. “As compared to wine, sake is more approachable with its lower acidity levels, no tannins and higher compatibility towards a variety of foods,” Joshi says.

However, with the exception of Japanese food, “cuisine pairing is not really a thing with sake as yet”, he explains. “Sake will take more time to get evolved in India, similar to what wine was two decades back.”

A growing Japanese expat community has also played a big role in its rising popularity. “More and more Japanese companies are setting up office in India,” Joshi says. “For example, in the Indian state of Gujarat alone, there are 350 Japanese companies already operating, with as many as 70 of the new ones participating in the recent Vibrant Gujarat Summit 2024. The story is similar in several other Indian states. Courtesy of this growing expat community, a strong demand is being created for all things Japanese, which includes sake.”

Hurdles ahead

Sake as a drinks category still faces big challenges in the Indian market, not least due to its tax structure, and Joshi believes they still have a long way to go.

“The majority of Sake producers tend to be over optimistic about the Indian market due to limited knowledge about the country’s high taxation structure on alcoholic beverages and each State of India having its own alcohol laws,” he says.

The rice wine has experienced some major import difficulties due to being “an entirely different genre of beverage,” Joshi notes. But India is in the process of registering Japanese sake as a geographical indication (GI), and once this is achieved, it is likely to clear up some of the import issues.

According to the Japan Sake and Shochu Makers Association (JSS), exports to India jumped 62.4% year-on-year in 2023. Indian exports also rose more than 900% in the last decade, suggesting the trend could be a long term one, particularly once some of the barriers to entry are lifted.

“Once the proper understanding of the Indian market among the potential sake exporters develops and the import mechanism becomes more facile, we are likely to see a substantial jump in the number of sake breweries coming to India,” Joshi says.