This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Cause for celebration: fizz outperforms rest of wine market

The sparkling wine category looks to be in robust health, with Prosecco, Cap Classique and crémant all thriving, reports Gabriel Stone.

IT’S ALL too easy to be captivated by the big picture. Headlines can create a feeling of global instability and stubborn inflation, while the wine trade battles the twin fronts of climate change and a steady decline in global consumption. Yet zoom in to a more personal level and there’s almost always a reason to celebrate: birthdays, promotions or perhaps just making it through to Friday.

That celebratory drink par excellence, sparkling wine, appears to be keeping the wine industry’s fortunes afloat.

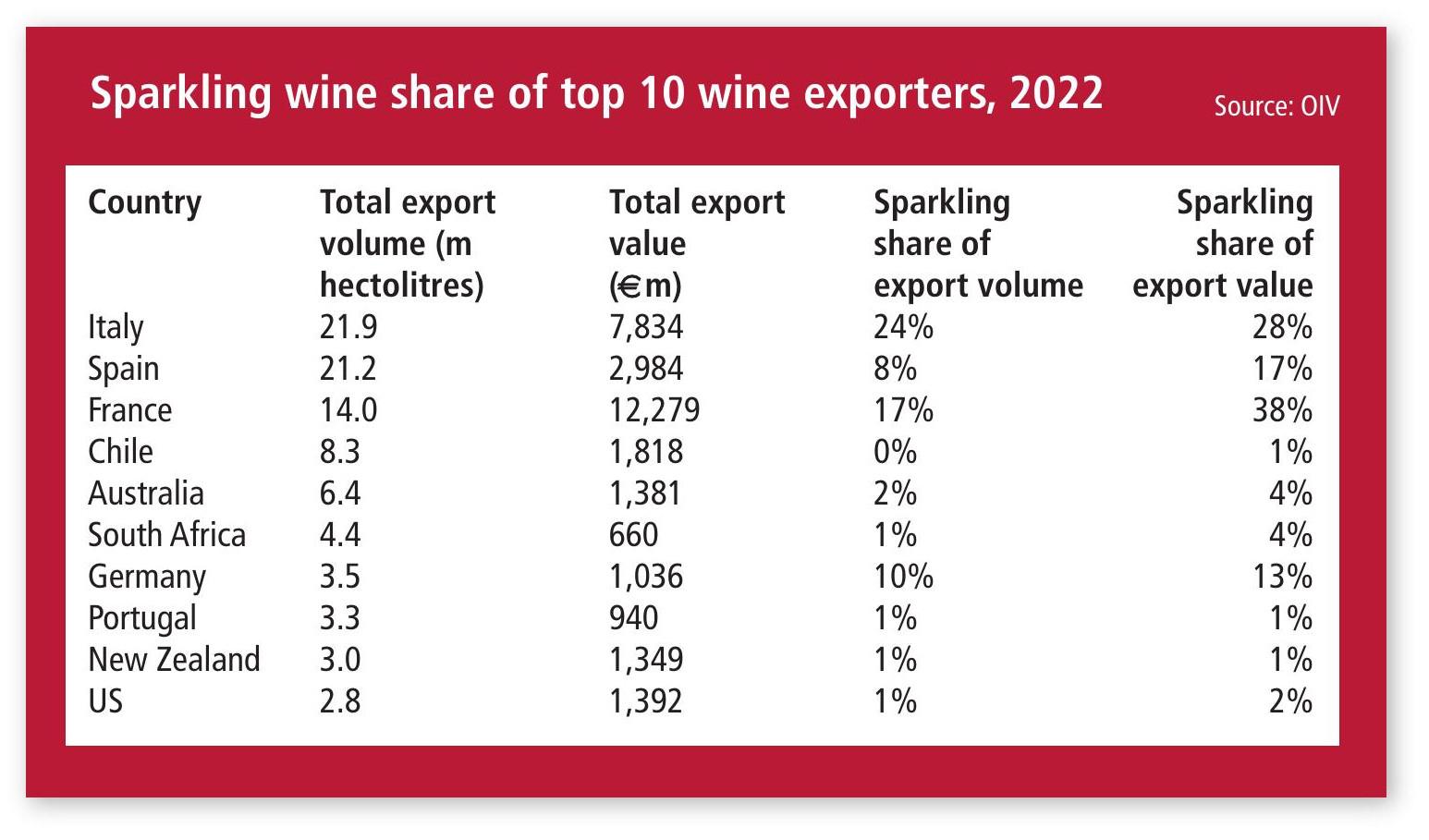

A report by the International Organisation of Vine and Wine (OIV) in late 2023 showed a “remarkable” decline in red wine supply and demand over the last two decades, counterbalanced by a sustained surge in white wine production – up 13% between 2002 and 2021.

But rather than pick out 21st-century commercial success stories such as Marlborough Sauvignon or Italian Pinot Grigio, the OIV placed credit firmly elsewhere, remarking: “One of the main driving forces behind this increase is the boom of sparkling wine.”

Crucially, the report notes that this thirst for fizz from markets such as the US, Germany and UK “more than compensates for the decline recorded in large wine-consuming countries such as France and Spain.”

Against that backdrop, it’s no surprise that so many producers and regions, whether or not they have a deep heritage of sparkling wine production, are stepping up their focus on fizz. From Armenia to Calabria, Portugal to Uruguay, winemakers have spied an irresistible opportunity.

That’s reflected in turn by the retailers. In the last year, major UK supermarket Sainsbury’s has added no fewer than 10 sparkling wines to its range. These span traditional territory such as own-label DOC Prosecco and vintage Champagne right through to a sparkling offering from New Zealand’s Villa Maria which, while reassuringly familiar, is hardly a name or region primarily associated with fizz.

“An important trend Sainsbury’s is experiencing is the continued growth of products that sit outside of the ‘main’ sparkling categories,” observes Champagne & sparkling wine buyer Alex Little. “A primary example of this is crémant and English sparkling, both of which continue to prove increasingly popular with customers.”

It’s a similar story at competitor Waitrose, which revealed in March that crémant sales over the previous three months were up 51% on the same period a year ago. The category recently overtook Waitrose’s Cava sales, while the retailer reported a 4% decline for Champagne.

It all suggests that pressure on household budgets hasn’t diminished consumers’ thirst for fizz, but it has nudged them towards good-value, convincing alternatives to the most famous styles.

Does it matter? Well, the Prosecco DOC consorzio clearly thinks so. It spent more than £250,000 on a UK campaign in December 2023, warning consumers not to confuse Prosecco with the “common effervescent wine” now served on tap by many bars.

CAP CLASSIQUE ON THE UP

One clear beneficiary of this diversification trend is South Africa’s Cap Classique. Not only does the UK account for 38% of this category’s global exports by value, but data from industry body SAWIS shows a 19% leap in volume shipments to this market in 2023 alone.

“We do expect that growth to continue,” says Jo Wehring, market manager UK & Europe for Wines of South Africa. What’s more, she adds: “Given that the UK market is so influential in leading trends across the globe, we anticipate that this will be noted by other export markets and we’ll start to see the trend reach further afield.”

Indeed, Wehring points to “significant pick-up” in the US.

Over at The Wine Society, sparkling wine buyer Sarah Knowles MW confirms an “astonishing uplift” for Cap Classique.

While members have long recognised the value offered by crémant, which continues to be “huge” for The Wine Society, Knowles suggests that they still have a healthy thirst for Champagne too.

“It’s not been the best year for Champagne across retailers at Christmas, but we had a bumper year,” she reports.That’s not to suggest that this loyalty is entirely immune to recent price hikes.

“It’s not been the best year for Champagne across retailers at Christmas, but we had a bumper year,” she reports.That’s not to suggest that this loyalty is entirely immune to recent price hikes.

“We did see a change when one Champagne producer put up prices,”Knowles acknowledges, “but we didn’t lose Champagne volume; people just moved across to something else.”

That tallies with the view of Guillaume Buisson, export sales director for Champagne Besserat de Bellefon, who believes that “loyalty-building is first focused on the category, and then on the brand”.

However, Buisson draws a distinction between different tiers within the category, suggesting that, with its stronger reputation for quality and brand heritage, “premium Champagne should be less dependent on price perception”.

Where houses have a compelling product and story, “the perceived value should become more important than the price itself”, argues Buisson. It’s not only Champagne that is keen to emphasise this distinction between value and price.

The Clàssic Penedès designation was created in 2014 to distinguish this region’s most ambitious sparkling wine producers from Spain’s more generic cava classification.

“The consumer must understand that Clàssic Penedès sparkling wines, with long ageing, 100% organic and with Penedès origin, must have a high price,” explains DO Penedès director Francesc Olivella. That reputation for quality becomes even more crucial as Olivella acknowledges an upward effect on prices – in addition to the cost increases felt by wine producers globally – caused by Catalonia’s ongoing drought.

QUEST FOR VALUE

Back in Champagne, one beneficiary of consumers’ quest for value is Champagne Drappier. Co-owner and sales director Charline Drappier reports “a growing interest for more ‘boutique’ Champagne, more authenticity, quality and a story behind the bottle”. It’s an interest that has helped this family-owned, carbon-neutral, organic specialist in Pinot Noir and low dosage outperform its category. Indeed, Drappier reports growth in a domestic market that saw total Champagne shipments fall by 8.2% in 2023.

Nor does Drappier fear competition from the proliferation of competitor products from other corners of the world.

“The sparkling wine market might be more crowded, but that is mostly to respond to a growing demand,” she suggests. “I personally see it as an opportunity for new customers to discover the world of sparkling wines.”

Nevertheless, there’s a real sense that this ever-strengthening competition makes it imperative for Champagne to recover the sales and pricing equilibrium that has been so shaken in recent years.

“Consumers, retailers, distributors and even us as producers need to digest inflationary hikes we’ve all been through, at every level,” admits Romain Levecque, managing director at Champagne Collery.

While particularly upbeat about the UK and the “very dynamic” South Korean market, Levecque is braced for a “very challenging” year in terms of US sales.

“The bubble burst after 2022,” he reports.

“Shortages, price increases and other things have somehow damaged the trust of US consumers.”

STRONG DYNAMIC

Florent Roques-Boizel, CEO of Champagne Boizel, agrees that the US is “challenging”, although his own house expects a more buoyant 2024 in the country thanks to a new partnership with American Airlines. Boizel is also capitalising on the “strong dynamic” in Asia by opening new markets in South Korea, Thailand and Vietnam.

However, Boizel has not lost faith in established customers in countries closer to home. “After a quieter year, more mature markets such as the UK, Germany or Italy are showing a strong interest for 2024,” he reports.

One producer who feels rather less optimistic about the UK is Douglas Jacobsohn, co-owner of English sparkling wine brand Busi-Jacobsohn. Setting out a 2024 focus on export sales, he paints a dispiriting picture of what he describes as his “stagnant” home market.

In particular, complains Jacobsohn: “Much of the on-trade seems to prioritise low price before quality, which really is letting down their customers.”

That concern doesn’t seem to be holding back one fizz category on a decidedly upmarket push: the booming no- and low-alcohol sector. Having launched in 2021, French Bloom is now listed in Fortnum & Mason for around £35.

Moving in similar circles is 2022 arrival Wild Idol, which plans to entice new converts with half bottles this year. CEO Paul Beavis sets out the company’s “obsession with making it acceptable for people to drink premium, alcohol-free sparkling, ensuring that consistency, quality and authenticity are upheld in this dynamic category.”

While the premium on-trade has proved particularly receptive to Wild Idol in Europe, Beavis also highlights the Middle East as a market of “undeniable significance”, while confirming North America as “a focus for the brand’s ongoing expansion”.

Another relatively new face on this abstemious scene is Rheingau producer Schloss Vaux, which introduced 2% ABV fizz Nouvaux in 2021 and is keen to step up expansion beyond its core German market. With secondary fermentation in bottle and more than 24 months on the lees, this is a product that very much speaks the language of high-quality fizz – and Christoph Graf, CEO of Schloss Vaux, is clear that he intends to compete on this basis.

“It is not the idea of having something as a substitute to sekt,” he insists. “We like to create something which stands alone, and not as a compromise.”

It says something for the strength of this trend that even teetotal consumers have decided that there are few more reliable, affordable ways to lift the spirits than a glass of sparkling wine.

What key trends will affect sparkling producers in 2024?

Hannelore Chamaux-Rima, directrice générale, Champagne Castelnau “We have identified two major trends: one for rosé Champagne, another for extra brut. For the first one, Castelnau has the expertise, as red wines going into the blend of Castelnau rosé are made in a dedicated tank room in Reims. Extra brut stems from evolving tastes among Champagne connoisseurs and the realities of climate change in winemaking.”

Lisa Milward, strategy and insights controller, Freixenet Copestick “The [UK] sparkling wine category is currently growing +5.1% value in the on-trade, driven by the continued growth of Prosecco at +4.6% (CGA MAT 30 December 2023). We are also seeing growth of +11.5% from ‘other ’ sparkling categories, which include English sparkling, crémant and non-Prosecco sparkling Italian. Prosecco growth is being driven by price rises in the category, with overall volume growth +0.4%. Consumers are still engaged with the Prosecco category, but there are other areas of interest too for sparkling wine consumers.”

Delfí Sanahuja, oenology director, Perelada “In line with innovations and new consumption trends, we are developing initiatives to adapt to the evolution in the sparkling wine category. By mid-2024, we will inaugurate a new winery in Empordà, Catalonia. This modern facility will be dedicated to research, development and innovation, designed to excel in crafting lightly sparkling ‘needle’ and frizzante wines.”

Pablo Caamaño, head of UK & Ireland, Raventós Codorníu “Throughout 2024, we will probably observe a significant uptick in the desire for organic wines worldwide. This shift will be complemented with a clear movement toward no- or low-alcohol alternatives, reflecting consumers’ increasing emphasis on wellness and mindful consumption, favouring quality over quantity. Sparkling wines will maintain strong sales and surpass still wines in performance.”