Sake achieves second-highest export total on record

Newly released figures show sake exports growing for established markets, as well as a building momentum in Latin America. db crunches the numbers.

The latest figures for sake’s export performance, released by Japan’s Ministry of Finance, show a category in rude health. The export totals increased both in volume and value year-on-year compared to 2024, while sake is now exported to 81 markets.

The volume of sake shipped grew by 8%, hitting a total of 33.55 million litres, while the export value reached ¥45.9 billion, an increase of 6%. This means that sake exports hit the second-highest level on record and that the value of sake exports has approximately doubled since 2020 – a compound annual growth rate (CAGR) of 14%.

The news of such a high CAGR will be particularly welcome in the industry, as the Japanese government has set a goal of ¥76bn in sake export value by 2030. To hit that target, the category would need to achieve a CAGR of 10.6% over the next five years.

Established markets

Taking a wide view, a number of regions performed strongly in the year. Asia retained its position as the largest regional export market for the category (63% of the total), growing by 8% to reach ¥28.8bn.

Western Europe also grew its value, up 4% year-on-year. The region hit a record ¥3bn in export value, showing impressive growth of 157% since 2020.

North America was the notable outlier, showing the only regional decrease in export value, by 1% to ¥12.4bn. This was driven by a 3% decline in the dominant US market, caused by a downturn in the third and fourth quarters.

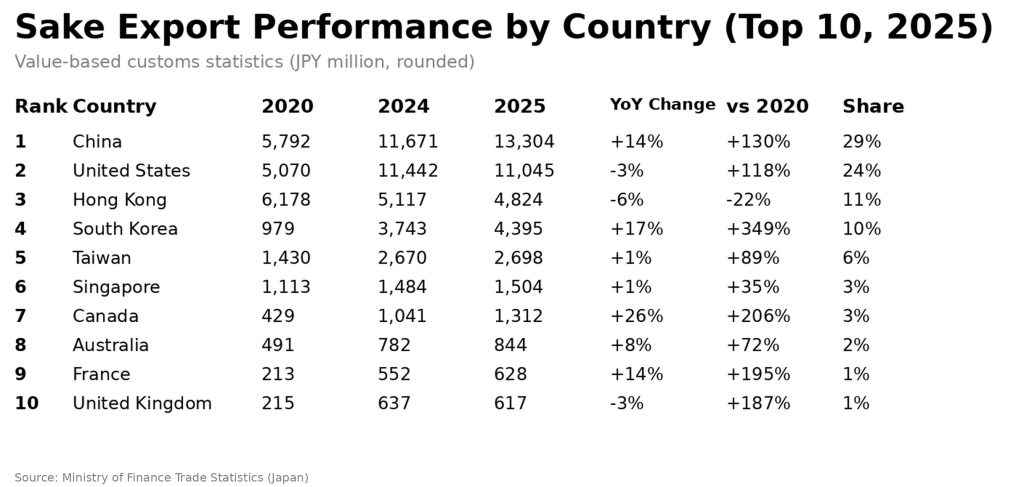

Among individual nations, two mature markets stand out for their strong performance. China, the largest single export destination, continued its rapid ascendancy, growing by 14% in value year-on-year.

South Korea, meanwhile, increased its value by 17% to reach ¥4.4bn. The nation has historically been a high-volume, lower-value export market, and its average export value still remains below the international average. However, it is on a powerful upward trajectory, with the average export price gaining ground and the total export value now 4.5 times higher than it was in 2020.

The strong international growth, according to Hitoshi Utsunomiya, director of the Japan Sake and Shochu Makers Association (JSS), dovetails with a more prominent international reputation for sake.

“In 2025,” he explains, “following the registration of traditional knowledge and skills of sake-making with koji mould as a Unesco Intangible Cultural Heritage in December 2024, we anticipated heightened global interest in koji culture and sake from the beginning of the year.

Moreover, he sees sake’s potential in a global food and beverage scene that is increasingly heterogenous and needs versatile food pairings to match.

“I believe that the diversity and uniqueness of sake’s flavor profiles, together with its strong potential for food pairing, are increasingly being recognized by fine-dining chefs, sommeliers, and consumers worldwide,” he continues.

New opportunities

The success seen in 2025 can be largely attributed to well-established markets. Yet beneath those headline figures is evidence that sake producers and trade organisations are looking beyond the obvious targets.

The JSS has led the charge, with year-round events that brought sake to a global audience. It exhibited at ProWein Düsseldorf, one of Europe’s largest international drinks trade fairs, as well as at the Osaka-Kansai Expo and its associated events.

Moreover, it has continued its partnership with the Association de la Sommellerie Internationale, with masterclasses in established markets (such as Singapore), but also in emerging ones (Malaysia, for example).

Beyond its more local markets, the JSS is strengthening its position in Central and Eastern Europe, building on activities there in 2024.

One emerging region, however, hit a particularly notable milestone. The value of exports to Latin America has nearly quadrupled since 2020, with ten of its markets importing sake in 2025 – a new record for the region.

That is a vindication for the JSS, which has positioned Latin America prominently in its global strategy. Last November, for instance, it invited Professor Júlio César Kunz, vice president of the Associação Brasileira de Sommeliers, to visit Japan. The programme of tastings and visits, including to sake breweries and to a koji mould producer, gave him the first-hand experience necessary to build awareness of sake in the association.

“I believe that both the taste profile and the symbolism of sake have strong potential to resonate with Brazilian consumers,” he commented after the trip. “The elegance, versatility, and cultural richness of sake can perfectly match the curiosity and openness of the Brazilian market.”

Although most of the value of the 2030 target will likely come from established markets, the JSS’s activities demonstrate that the sake industry is looking even further ahead. Given that the industry is centuries-old, investments in its long-term, global future are setting it up for success, whether that is months, years or decades ahead.

Related news

Top table: how Prosecco seduced the on-trade