This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Pernod Ricard lowers full year guidance

Despite what chairman and chief executive Alexandre Ricard called a “robust” performance in the six months to Christmas, Pernod Ricard has lowered its sales guidance for the full year to the end of June.

Pernod Ricard now expects to see broadly stable organic net sales against previous predictions of broad-based and diversified growth.

Nevertheless, investors were relieved that Pernod Ricard does not expect to record a weaker performance than in 2023 – as predicted by some of its rivals – and the company’s shares rose by 5% in Paris.

Investors were particularly pleased that the French company reported market share gains in many of its key regions.

“We delivered a robust performance in the first half of the year, as we confidently steer Pernod Ricard through the normalisation of the spirits market, following two years of outstanding growth,” Ricard said.

“We achieved strong gross margin expansion on the back of substantial pricing actions, thanks to the power of our premium portfolio.

“With a diversified footprint spanning mature and emerging regions, and a broad presence across spirits categories, we are able to weather volatility and continue to gain share in many markets.

“I am convinced that our sound strategy …. will enable us to deliver our ambitions.”

Organic sales drop

With total sales of €6.59 billion for the six months to the end of December 2023, organic sales fell by 3% compared with the same period in 2022, which was in line with analysts’ expectations.

Overall, Ricard said, the market was affected by the “normalisation” of sales as demand levels out following two years of post-Covid boom.

Sales in the Americas, which account for 28% of Pernod Ricard’s business, declined by 7%.

That was due to a weak performance in Canada and high stock levels in the US, where Ricard confirmed the trend for some consumer resistance to price rises and consequent downtrading.

In addition, he noted that higher financing costs were prompting distributors and retailers to be conservative with their stocks.

In Europe sales fell by 4% but would have been in positive territory but for the embargo on selling to Russia. He said the performance in the UK had been “soft”.

In Asia and Rest of the World region, Pernod Ricard’s sales grew by 1% but were restrained by a poor performance in China which saw a 9% drop due to macro-economic conditions.

There was no mention of China’s threatened tariff penalties on EU exports of brandy which could affect Martell.

On the other hand, even without access to the Delhi market, where Pernod Ricard’s licence has been suspended, sales were 4% ahead and there was “good growth” in Japan, Taiwan, and Australia.

Net profit in the six months slipped to €.57 billion from €1.79 billion previously, ahead of analysts’ projections of €1.45 billion.

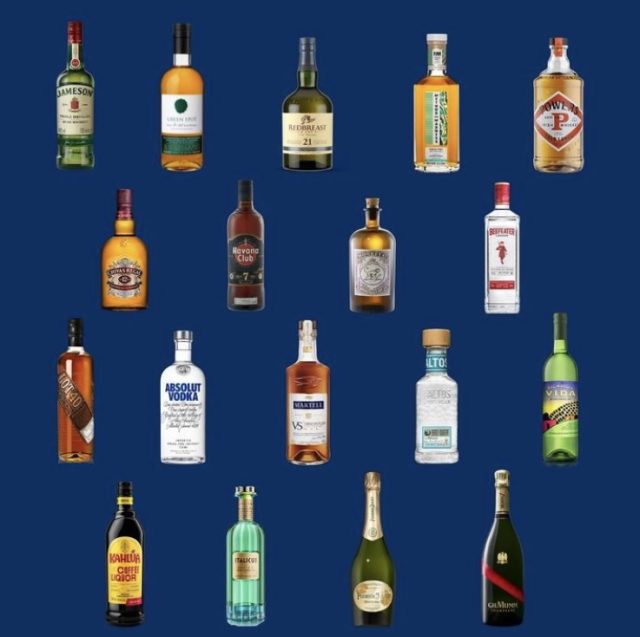

By product categories, the strategic international brands such as Jameson, Absolut and Chivas Regal suffered a 4% decline but the strategic local brands, notably Indian whiskies, were 4% ahead.

The company’s wine portfolio saw an 11% drop in sales, hit by difficult markets in the US, Canada and Britain.

It has been widely speculated that Pernod Ricard wishes to dispose of the wine division as it offers the lowest return on capital invested.

Despite its lowered 2024 sales forecast, the company confirmed its medium-term financial targets, including reaching the upper end of between 4% and 7% of net sales growth and organic operating leverage of 50 to 60 basis points.

Ricard predicted this could be achieved through a “continued focus on revenue management and operational efficiencies” leading to organic operating profit growing in the low single digits.

He also committed to capital expenditure of up to €800m in the year, focused largely on distilleries in Scotland, Ireland and Kentucky.