This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

First Growth prices begin to outperform the second wines

If the difference in price between the first and second labels continues to stretch, there will be opportunities for buyers to pick up relative bargains, according to Liv-ex.

First Growth prices begin to outperform the second wines

In July 2019 Liv-ex noted that one could buy 2.8 bottles of a second wine for the same price as a First Growth grand vin. This was down from a ratio of almost 6:1 in 2007.

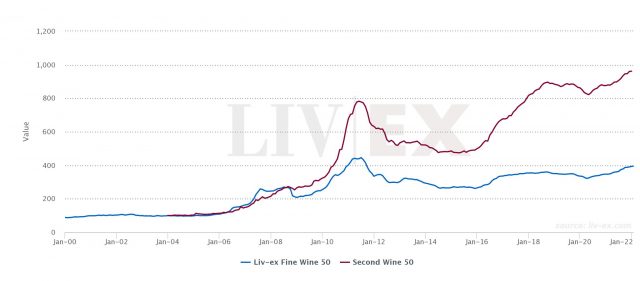

The Second Wine 50 – one of the strongest sub-indices in the Bordeaux 500 – flourished between 2015 and 2019. From July 2015 to June 2019, the index rose 85.7% – although its strongest stretch was between July 2015 and September 2018.

In late 2019, when prices were at their peak, there was the combined storm of political unrest in Hong Kong and the beginning of the Covid-19 pandemic in Asia – a key market for these wines. Although the index began to recover in mid-2020, its level remained below its former peak. It was only in April 2021 that the index recovered fully from this knock.

While its level remains much higher than the Fine Wine 50, it is the latter that has enjoyed stronger price performances in the last two years (see table below).

Better vintages means larger price gaps

This strengthening of First Growths prices is starting to widen the gap between them and the price of their accompanying second wines.

As can be seen in the table below, the differences between first and second wine prices is often greatest in highly-rated vintages.

For example, the Château Margaux 2015 is currently seven times the price of Pavillon Rouge 2015. Although impressive, there are important factors to consider here. Margaux 2015 was not only released in a commemorative bottle but it was also the last vintage by the late Paul Pontallier, both of which have boosted its secondary market performance.

The 2010 vintages of Château Haut-Brion and Château Latour are also rare 100-point wines from Neal Martin.

The second wines from these vintages should not be overlooked, however. Despite their less impressive scores, Martin’s notes for these second labels are filled with praise.

He said, the 2015 Pavillon was, ‘pure joy, pure class’; the 2010 Forts de Latour ‘frankly puts some of the Grand Vins in the shade’ and the 2016 Clarence de Haut-Brion was ‘full of tension and terroir expression’.

On the other hand, some of the smallest differences in price can be found in ‘off’ vintages. Château Mouton Rothschild’s 2017 vintage for example has a Market Price of £4,316 (12×75), while the same vintage of Le Petit Mouton is £2,580. That’s just a case and half of Petit Mouton for one case of the Grand Vin. There is a similar closeness in the prices of Mouton’s 2013 and 2011 vintages

The ultimate problem for the second wines has always been that they are not the Grand Vins. The closer their prices got to those of their parent labels the less compelling they became. If the prices of the First Growths continue to rise and the difference between first and second labels continues to stretch, there will be opportunities for canny buyers among the second wines once again.