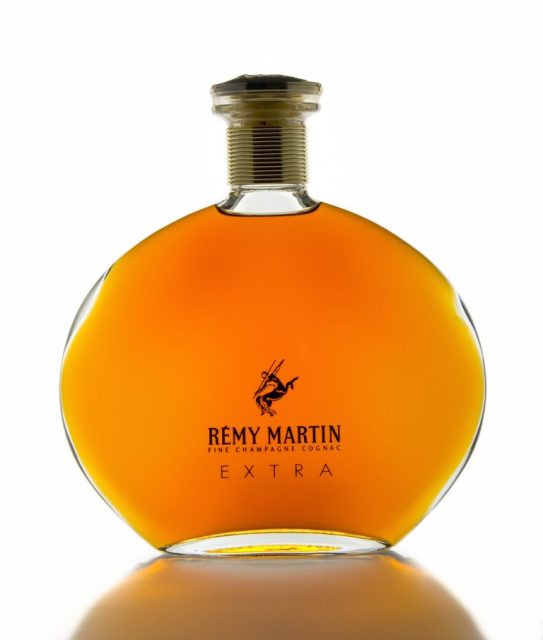

Rémy Cointreau shares jump after Cognac sales beat forecasts

The French spirits group delivered stronger-than-expected third-quarter sales, sending its shares sharply higher in Paris. Improved trading in the Americas and stabilising demand in China offered renewed encouragement after two difficult years.

Remy Cointreau’s shares had their best day in almost two years, rising by almost 9% in Paris immediately after it released its third quarter sales figures which easily beat market forecasts.

Global sales of cognac in the quarter rose by 3.2%, versus the increase of 1.4% predicted by analysts.

US and China

The group makes two-thirds of its sales from Cognac in the United States and China, and the consumer downturn in both markets, plus the China tariffs wrangle, meant the French company had suffered successive quarterly sales declines over the past two years, sending its already depressed shares almost 30% lower in 2025.

However, Remy’s latest quarter showed “solid sales” in the Americas region while demand in China remained “almost stable.”

Regional recovery gathers pace

Conditions in China remain challenging, and the figures were skewed to the downside by a later sell-in for the Chinese New Year than in 2025. Sales in the rest of Asia rose sharply while Europe, the Middle East and Africa returned to growth.

Third quarter sales of Cognac rose by 3.2% on an organic basis, while the liqueurs and spirits arm’s figures were 2.8% ahead of the 2025 level.

Partner Content

Overall, the company’s organic sales were 2.8% up to €245.8, compared with a consensus analysts’ forecast of a 1.7% increase.

Guidance unchanged

Remy maintained its full-year sales guidance unchanged, forecasting stable to low single-digit growth.

The recently appointed chief executive, Franck Marilly, has promised a return to growth in the current financial year and to revive volumes even if it means lowering prices.

That would be a reversal of strategy over the past several years and would lower margins and profitability.

To that end, the company revealed it is using an external consultancy to analyse problems and offer solutions that it plans to deploy later in 2026.

Contrast with LVMH performance

Remy’s Cognac progress was in contrast to the figures from LVMH’s Moet Hennessy arm earlier in the week, which showed continuing problems, especially for Cognac. Hennessy has been discounting prices in the US for some time to help ease stockist inventories.

Related news

Hennessy announced as official Cognac Partner of The BRIT Awards 2026