This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How can whisky makers prepare for UK-India free trade deal?

A UK-India free trade agreement could mean big business for Scotch whisky brands. But what of the impact on Indian distillers? Eloise Feilden reports.

IT’S OCTOBER and in the temple town of Ayodhya in Northern India, the banks of the Saryu are aglow with warm yellow light. Amid the million earthen oil lamps radiating like their own molten river, people gather to watch fireworks spark in the sky

A celebration of the spiritual victory of light over darkness, good over evil, knowledge over ignorance, Diwali sees Hindus, Jains, and Sikhs across the world illuminate their homes, temples, and workspaces with candles and lanterns. In London, Diwali is marked by music, dancing, and yet more fireworks.

Last year, the festival of light gained new significance in the UK, with Rishi Sunak entering Number 10 as the country’s first Hindu prime minister in the days following the celebrations. Diwali 2022 was also set to mark another key milestone in the relationship between India and the UK, the publication deadline of a draft agreement of the UK-India free-trade deal – a date decided when former Conservative leader Boris Johnson was still in power.

Two prime ministers later, and a free trade deal is yet to be reached. But there is hope – following six rounds of negotiations – that a draft agreement will be drawn up by the end of March. India is a vital market when it comes to global spirits sales. In 2010 India imported £36.5 million worth of whisky from around the world, which rose to £168m in 2020.

The UK is a competitive supplier of whisky to the country, exporting £110m to India in 2019. However, India imposes a 150% tariff on spirits imports – a figure that Mark Kent, chief executive of the Scotch Whisky Association (SWA), would “like to see come down”. It is estimated that annual duties on UK whisky exports to India were £164m in 2019.

Under the projected terms of the agreement this tariff could be much reduced or even abolished, opening up the market to smaller Scotch distilleries, and providing lower-income and younger Indian consumers with access to the category.

“As it becomes easier to export with tariffs going down, it opens up the market to more of our producers, especially on the smaller end of the scale,” Kent says. “We’re always looking to expand our markets, and a lot of our producers are looking at India with this aim.”

Analysis by the SWA suggests that a UK-India free trade deal which eases the 150% tariff burden on Scotch whisky could in turn allow for an additional £1 billion of growth over the next five years. “As India’s economy grows, people with the purchasing power to access Scotch will grow as well,” says Kent.

Indian consumers are thirsty for new serves. Spirits account for just under 60% of the total beverage-alcohol market in India. And in spirits, whisky is the largest sub-category, accounting for two-thirds of spirits consumption in 2021.

But if Scotch begins hoarding more of the market share of whisky sold in India, could it harm domestic producers?

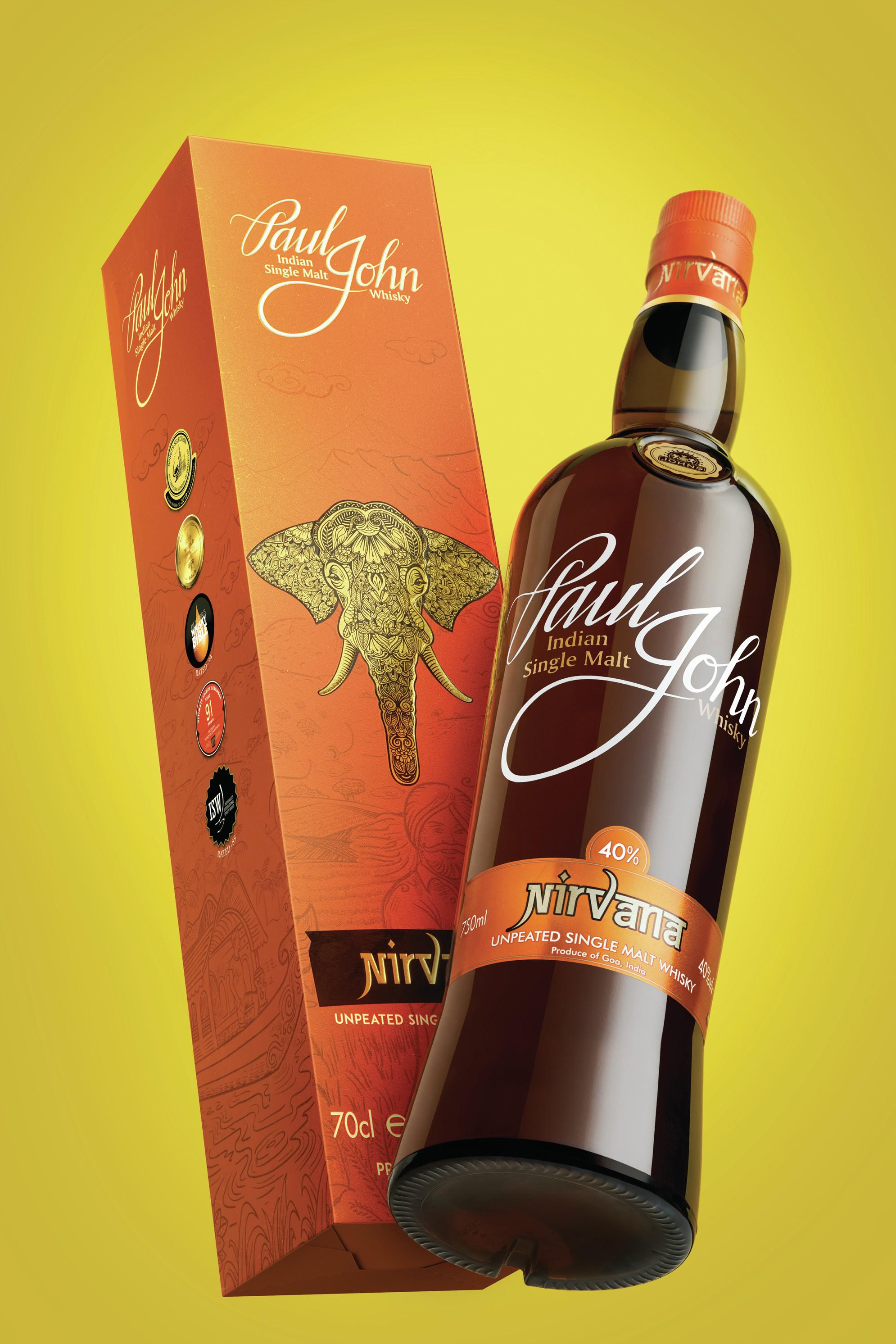

Paul P. John, chairman of Indian single malt and single cask whisky producer Paul John, is concerned with how lower-end Scotch whiskies could affect domestic sales. John believes that the free-trade deal’s projected tariff reduction “would not augur well for the Indian whisky industry. “If the duty cut impacts lower-end Scotches favourably, this would release the floodgates of low-value Scotch in India, which would affect the Indian alcoholic-beverage industry severely,” he says.

The deal threatens to favour Scotch producers that can easily capitalise on the booming Asian market, carving out a space that is occupied by Indian-made spirits. “The positive impact on Indian whisky products may be much lower than on Scotch imports into India,” John explains.

In 2022, India replaced France as the largest Scotch whisky market by volume in the world, according to figures released by the SWA in February. Last month Jean- Etienne Gourgues, chairman and CEO of Chivas Brothers, said the free-trade agreement could double the size of the Scotch whisky market in five years, a healthy figure that the company – owned by Pernod Ricard – is keen to capitalise on. “More importantly in the long term, there is a huge base of Indian whisky brands in the market, and there is fantastic potential of innovation for prestige and luxury whiskies, where Scotch whisky is beautifully positioned,” he says.

Ballantine’s and Chivas Regal would be the focus for the business in India, with the first innovation to come from Ballantine’s Finest, followed by Chivas, and Royal Salute “down the road”, Gourgues explained. “We will really target more activities in the coming years for the two brands. The FTA will heavily support that.”

Despite double-digit growth, however, Scotch whisky still only comprises 2% of the Indian whisky market, while Indian whisky makes up 97%. As such, how big a dent can Scotch whisky really make? Kent believes that, particularly in a market seeing as much growth in the sector as India, “there is space for everybody”. With a population of 1.4 billion, one in six people on the planet live in India. Big players in the spirits world have set their sights on the country, both as a growing export market and as a source of high quality products.

In early 2022 Diageo India announced investment in its craft spirits project, with the addition of brands like single malt whisky Godawan, made from six-row barley grains from Rajasthan.

Diageo reportedly invested about 40 crore (£4m) in the new brand of craft whisky, which has matured in Rajasthan’s extreme heat before being finished in casks that had previously been steeped in Rasna and Jatamansi. Bermuda-based Bacardi also made its first foray into Indian whisky late last year with the launch of a new blend, called Legacy. The brand is described as Bacardi’s first “made-in-India whisky innovation”, and the only premium Indian whisky in the company’s portfolio.

The launch of Legacy is set to strengthen Bacardi’s growth strategy in India, and create a value price segment for its consumers, the company says. IWSR 2021 figures estimate that the Indian whisky category could exceed 250m nine-litre cases by 2026.

Bacardi named India as one of its fastestgrowing markets, with the company “rapidly investing behind its strategic and ambitious vision” for the country. At the time Sanjit Singh Randhawa, managing director, Bacardi India, said: “India presents an exciting growth opportunity for us, as it is the number one market globally for whisky, and our first-ever ‘made-in-India’ whisky, Legacy, will enable us to scale operations nationally as we continue to grow the brand by the end of this decade.”

Rampur by Radico Khaitan: ‘Globalisation is the order of the day’

Demand for whisky is only set to rise in the country, and the category is predicted to expand by a compound annual growth rate of 3% to 2026. And with such a relatively small share of the market, Kent quashes fears that Scotch could rival its Indian cousin.

“Even if we were to double, in a market that is growing you’re not going to see much percentage growth in the Scottish share of the market,” he says. Not all Indian producers are concerned about the impending free-trade agreement either. Sanjeev Banga is president of international business at Radico Khaitan, India’s fourth-largest liquor company. Banga says he is looking forward to a forthcoming deal.

“Globalisation is the order of the day, and any initiatives taken by governments to ease the trade between two countries is very welcome,” he says. Banga is also confident that premium Indian serves will be able to hold their own against their Scotch counterparts.

“India is now producing worldclass single malts, and the availability of locally produced and matured malt is on the rise. This has substantially improved the quality of Indian whiskies, and they are now competing with the best in the world,” he says. There are also whispers that the freetrade agreement will benefit Indian whisky sales in the UK. Speculation has been mounting over the UK government creating a separate category for Indian imported liquor. “The removal of non-tariff barriers by the UK on Indian whisky will go a long way in increasing exports from India,” Banga says.

The SWA’s Mark Kent is confident that the free-trade agreement would be “absolutely a win-win deal” for Scotch and Indian whisky producers alike. “We think that the benefits in India are pretty big,” he says.

“State and federal revenue we think could go up by £3.5bn with a deal, and that’s going to result in more jobs in India. “The whisky industry is very collaborative, and we’re seeing more investment from some of our members in India to produce and bottle locally.”

Another round of negotiations for a freetrade deal were delayed to “early 2023” from their original Diwali deadline, the UK government has said, with speculation they should be completed by the end of this month. Whisky tariffs are far from the only item on the agenda, and a fair and thorough agreement will take ample time. Kent is in no rush to see discussions concluded. “These trade negotiations take time to bear fruit,” he says.

“It’s been a long process already, and it’s important to get it right rather than to get there quickly.” Patience is a virtue necessarily held by all whisky makers, as the “concept of time” in ageing spirits, Kent says, is always measured on an extensive scale. “And this is no different.”