Average price of a bottle of US wine hits $56.78

The price of American wine shot up 11% last year to more than $50 per bottle, reveals numbers crunched by Sovos ShipCompliant. But which regions saw the highest leaps? Sarah Neish investigates.

Certain US regions (Napa) have long had a reputation for commanding high prices for their wines. But the latest annual direct-to-consumer shipping report released by Sovos reveals that the prices of US wines across the board, not only those from the famed Californian region, are rising at speed.

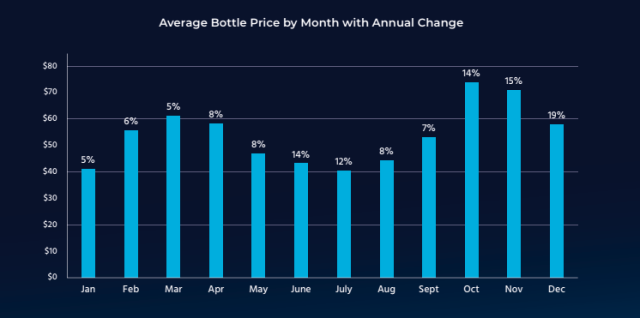

According to the report, 2025 saw a significant 11% increase in the average price per bottle shipped, to reach a record US$56.78.

The months of October, November and December 2025 saw bottles reach their highest prices, climbing by 14%, 15% and 19% respectively compared with the same months in 2024. The biggest spike occurred in October as average bottle prices shot up to more than US$70, before gradually dropping back down over the following two months.

Napa pushing overall prices up

Unsurprisingly, one region in particular was largely responsible for the climb in average bottle price nationwide. In Napa County, the average bottle of wine shipped in 2025 reached almost $100 ($99.97), up 9% on Napa’s average 2024 prices.

“Napa wineries are on a trajectory to reach more than $100.00 per bottle,” Sovos claims. “By comparison, the other six regions tracked in this report together achieved a $39.80 average price per bottle shipped in 2025.”

What not to do

The ‘rest of California’ region (which excludes Sonoma and California Central Coast, assessed separately) was perhaps an example of what not to do in difficult times. In 2025 wineries ramped up their bottle prices by an unprecedented 19% year-on-year to reach an average of $34.38.

As a result, says Sovos, “volume of shipments cratered by 32%.”

Cabernet Sauvignon prices from the ‘rest of California’ saw the highest price increases, leaping up by a staggering 53%, which correlated with a 26% decrease in volume (though a 14% increase in value).

The report said that while the ‘rest of California’ has previously been able to “mitigate a more precipitous decline in volume…clearly, that streak ended in 2025.”

Outside California

Oregon was more modest with its price increases, inching up its average bottle price by just 2% to $53.08. But Pinot Noir, which represents more than half of all Oregon wine shipments, was priced at the higher average of $62.53.

According to Sovos, “this suggests that the allure of Oregon Pinot Noir might provide a modicum of resilience in an exceptionally difficult market.”

Partner Content

Washington State, which ships the least amount of wine by both volume and value among the regions tracked in the report, upped its prices by 8% last year to $45.89.

While Washington’s sales of its most popular wines, Cabernet Sauvignon and Red Blends, fell slightly in volume (-13%) and in value (-4%), they fared better than Merlot and Syrah from the region, which “dragged down the state’s numbers with 17% and 21% declines, respectively” in volume terms.

Across the ‘Rest of the United States’, Riesling was a star player. Sovos says the variety “wildly outperformed” other grapes in 2025, representing 9% of the total volume of wine shipped. Riesling shipments saw 6% growth in volume and a 12% climb in the value of shipments, all while increasing their average price per bottle

shipped to $22.99, a 6% step up on 2024.

Comparing regional average bottle prices in 2025

- Napa County: $99.97 (+9%)

- Sonoma: $38.48 (+5%)

- California Central Coast: $50.41 (+1%)

- Rest of California: $34.38 (+19%)

- Oregon: $53.08 (+2%)

- Washington State: $45.89 (+8%)

- Rest of United States: $26.13 (+9%)

Survival strategy

The decision to increase bottle prices across the board was clearly one aimed at survival. And further data included in the Sovos report hints at exactly why. Significantly, the lowest price category tracked in the report — bottles under $15 — saw the greatest decline in volumes in 2025.

In fact, the lower the price category, the greater the declines in volume.

According to Sovos, it demonstrates “that this dynamic is not a matter of consumers simply trading up for more expensive wines. Rather, it appears that consumers buying at the lower ends of the DtC channel are not only purchasing less wine but are likely dropping out of the channel altogether.”

Related news

Pubs welcome business rates U-turn, but hospitality warns it doesn’t go far enough

Napa growers stay cautious as California declared drought-free

LVMH results offer cautious lift as wine and spirits remain under pressure