Grace under pressure: the wines showing resilience in the downturn

With signs that prices may finally be rising again, some labels have fared better than others over the past three years, says Liv-ex.

In recent months, Liv-ex’s major indices have recorded their strongest gains in over three years, with the Liv-ex 50, 1000 and Bordeaux 500 all posting their first increases since early 2023. Whether this signals the end of the current market downturn remains uncertain, but prices for certain wines appear to be nearing their floors.

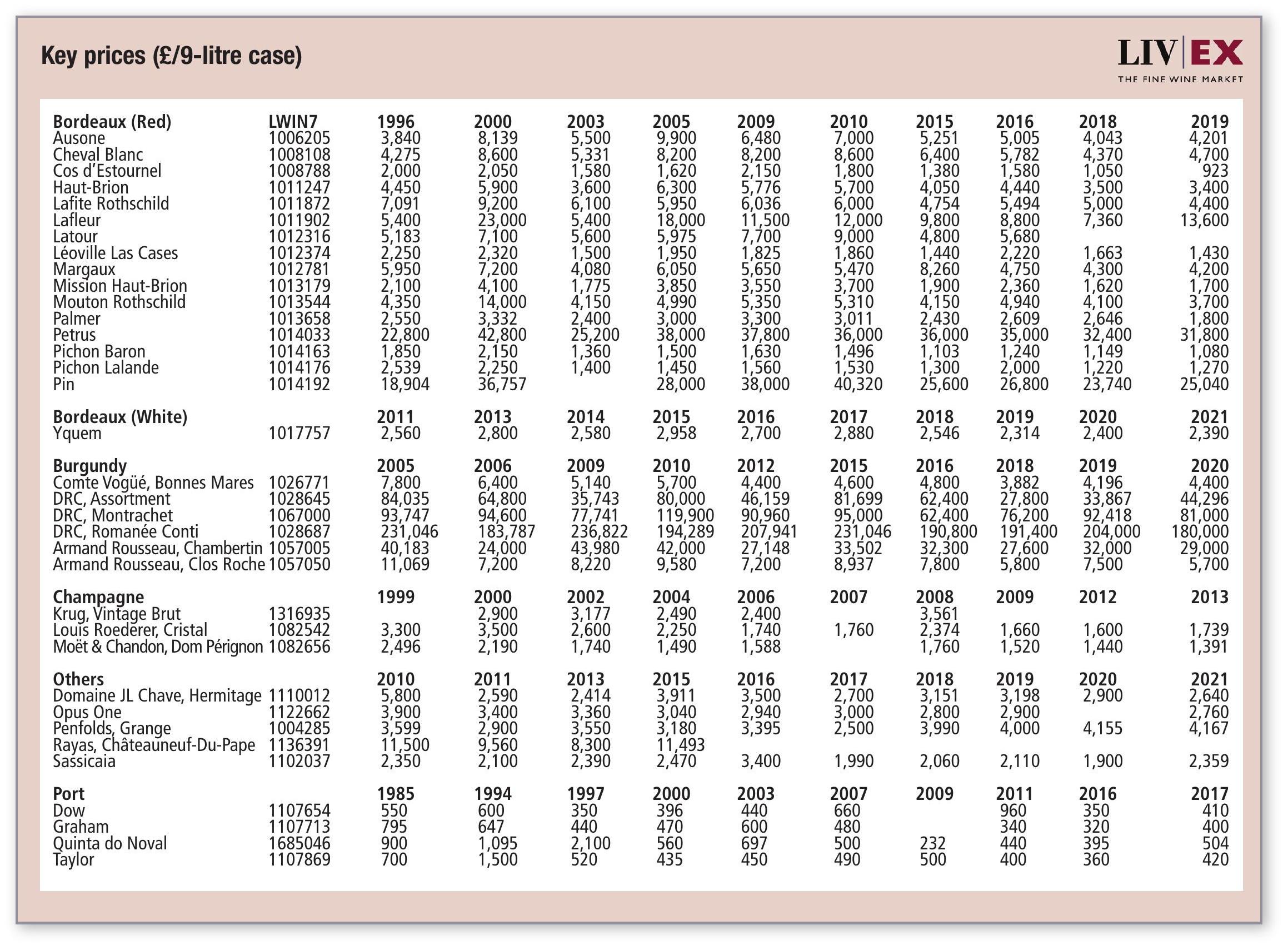

With recent price movements offering optimism, now is an opportune time to take stock of how the past three years have shaped the market, and how different labels have performed relative to their peers. The components of the Liv-ex 1000, the broadest measure of fine wine prices in the secondary market, demonstrate this variance.

Top performers in the Liv-ex 1000

September 2022 marked the peak of the market, and, since then, few have been spared. There are, however, a handful of labels that have proven more resilient.

Sauternes dominates the top 10, with all five components of the Sauternes 50 featuring. This sub-index has shown relative stability compared to others, falling only 5.7%, with Climens and Coutet even posting gains despite the downturn. Sauternes’ stability is likely a result of a modest rise during the 2020 bull run – and indeed over the long term – leaving its subsequent correction comparatively mild.

The only other Liv-ex 1000 component to avoid price decline over the period was Joseph Drouhin, despite the Burgundy 150 being the worst-performing sub-index of the Liv-ex 1000 (down 33.7%).

Less surprising is the resilience of Italian labels such as Solaia and Gaja, with the Italy 100 significantly outperforming the Bordeaux 500, Burgundy 150 and Champagne 50 over the past three years.

Partner Content

Worst performers in the Liv-Ex 1000

Having seen the most significant price rises in the 2020-2022 bull run, Burgundy and Champagne also fell hardest.

Cristal, Salon and Taittinger were among the worst affected in Champagne, each recording price declines of more than 30%, with Cristal 2012 and Salon 2008 falling the furthest.

From Burgundy, Domaine Georges Roumier suffered most, with its 2013, 2014 and 2015 vintages making up the bottom three performers across all Burgundy 150 components.

The Bordeaux first growths – and particularly their second wines – also recorded heavy losses. Across Bordeaux, 2018s and 2019s were hardest-hit, down 25% and 30% respectively, while earlier vintages proved more resilient, with 2013s and 2014s falling by less than 16%.

Looking forward

While recent gains in the Liv-ex indices suggest renewed optimism, the scars of the downturn remain visible across much of the market. Sauternes and select Italian labels have shown resilience, while Burgundy, Champagne and Bordeaux first growths bore the brunt of the correction. These declines, however, present buyers with an opportunity to secure key wines at their lowest prices since 2020, and demand in the secondary market is rising at these levels. The value of bids on Liv-ex is currently the highest since April 2023. Demand from UK and Asian buyers, in particular, is climbing, with bids from these regions up 135% compared to the 2024 average.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It gives access to £100m-worth of wine and the ability to trade with more than 620 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

ASC Fine Wines and Vinarchy strike exclusive distribution deal

Refined wines define Martínez Lacuesta's 130-year legacy

'Rare buying opportunities' as fine wine prices hit a five-year floor