Is there light at the end of the tunnel?

The conditions are right for a reset of fine wine’s supply:demand imbalance, but the situation remains highly complex.

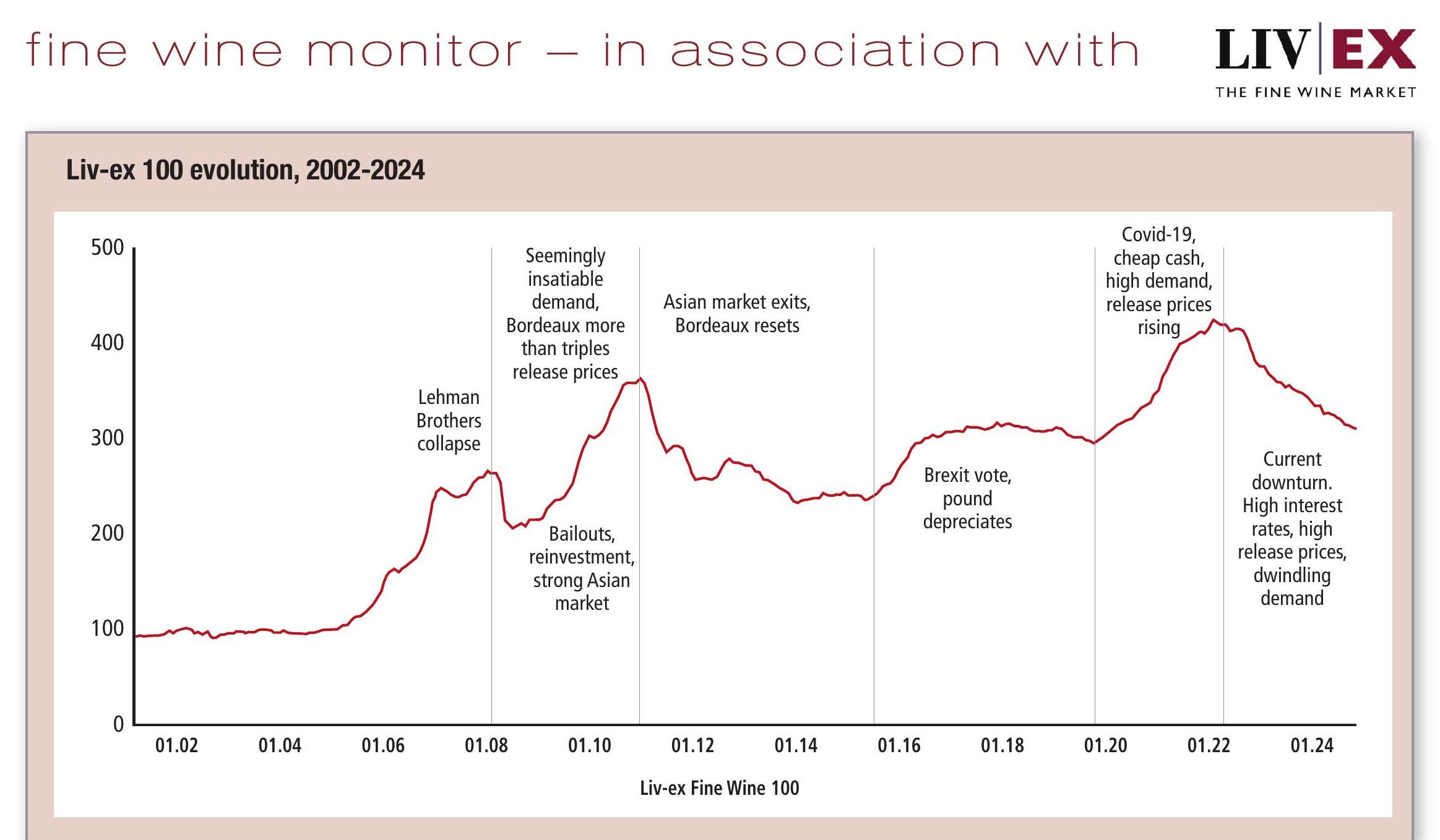

For many in the wine trade, the current downturn is the longest that they will have endured. While the end has felt just out of reach for a long time, it seems doubtful that prices have much further to fall. How does this downturn compare to those of the past? And are we finally nearing the end?

Where do we stand?

Year to date, the Liv-ex Fine Wine 100 is down 4.9%, marking a 26.6% decline since its peak in September 2022. Having now dipped below its 2018 peak, its 2020 low is the next available support – a full retracement of the index’s previous move up.

In its root causes and duration, we can draw the strongest comparison of the current downturn to that of 2011. Both have been symptomatic of a lack of demand, the problem exacerbated in both cases by overly ambitious release pricing and a withdrawal of a buying segment (China in 2011 and the US in 2025).

US dollar weakness

While this year has been a volatile period for equities, key stock indices have reached all time highs. The Fine Wine 100, as we know, has not been so lucky. This may not initially strike us as good news, but there is, in this, one clear benefit to the fine wine trade: wealth has been generated.

Although prices are low, few merchants are willing to take the plunge in terms of beginning to build their inventories. Instead, they are waiting for consumer demand to pick back up. Only a tiny fraction of the equity market needs to be reinvested into wine for the trade to see a serious increase in demand.

Partner Content

What are we waiting for?

The exchange’s overall bid:offer ratio (by value) currently sits at 0.15. During the 2008 financial crisis, when the Fine Wine 100 saw its sharpest decline on record as stockholders raced to liquidate assets, the ratio fell to 0.1.

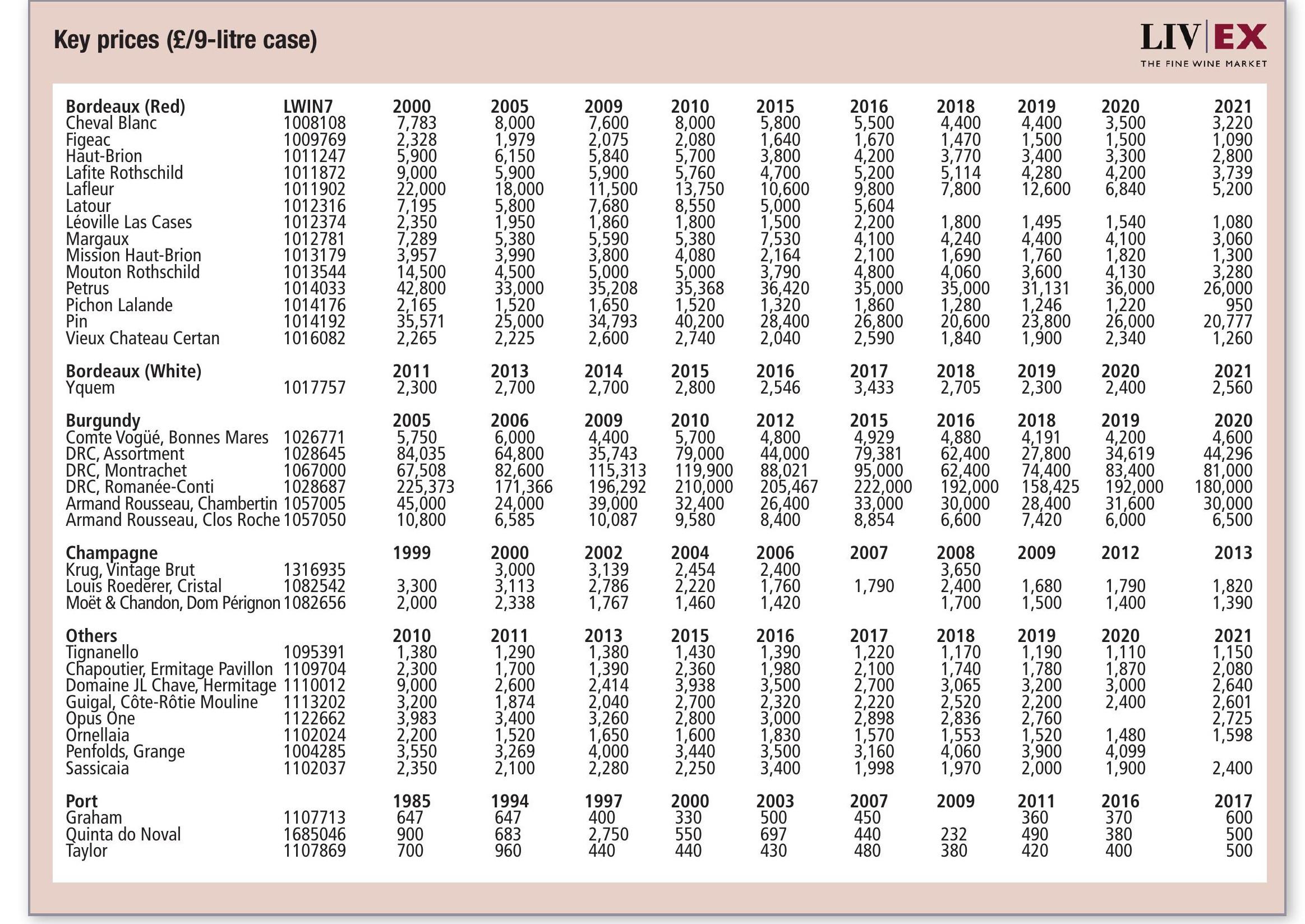

That we are approaching similar conditions may not strike readers as good news, but these are the necessary conditions to induce a reset of the demand:supply balance. Demand for wine is elastic – at low enough prices, seasoned buyers will return to the market and new ones will be tempted to enter it. Some sets are reaching the right levels more quickly (such as, for instance, Bordeaux 2021), and these levels vary by region, brand and vintage. With interest rates falling and potential consumers making gains in equities, there may soon be cash to spare on these correctly priced wines.

An increased willingness to spend, paired with lower prices, may be enough to draw us towards recovery, but the faster US buyers return to the market, the shorter the path will be. While trade wars between the EU and US seem interminable, once tariffs are set in stone, we can expect to see US buyers re-enter the market, albeit cautiously.

There is also some hope for a revival of the Asian market. Though it will take more time to confirm and understand this trend (demand may be growing or merchants may be replenishing stock), we have seen tentative signs of renewed demand from this segment, led by Hong Kong and Singapore.

The end is in sight but, unless US or Asian buyers make a strong return to the market, we may yet have to see some sharp cuts to reset the balance.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Crop thinning key to quality in 2023 from Domaine de la Romanée-Conti

What marks out Champagne from its southernmost sub-region?

Daniel Cathiard of Château Smith-Haut-Lafitte and Cathiard Vineyard, dies at 81