New Champagne releases are falling flat

The high demand experienced in 2022 has left Champagne with a hangover today – and little sign of immediate recovery, according to Liv-ex.

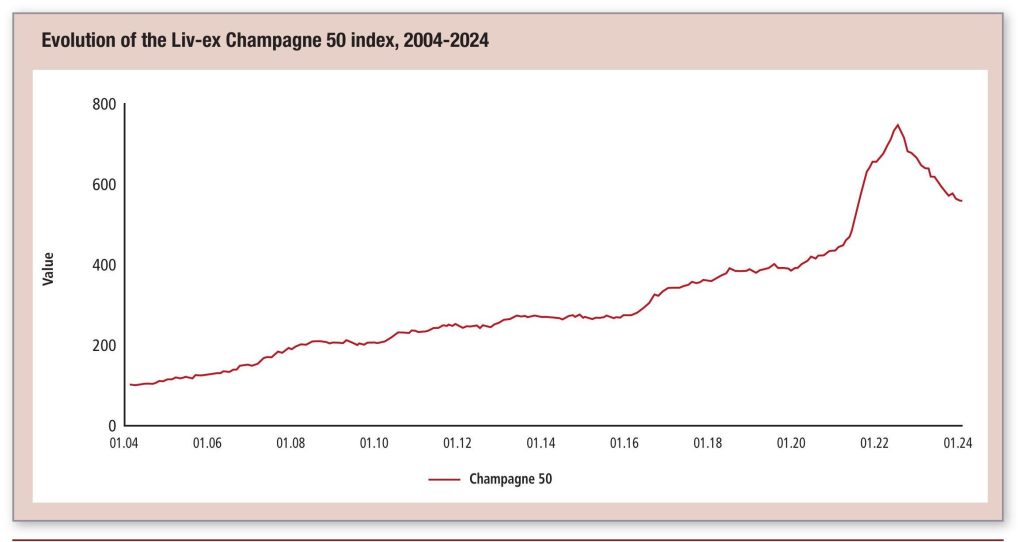

The Champagne 50 was one of the betterperforming Liv-ex indices last month, falling just 0.2% in May. The index closed at 559.09 in May, up 46.7% over the last five years. Year-on-year, however, the index is down 13.7% – it has fallen 25.4% since its peak in October 2022. The graph on the facing page illustrates this evolution.

Year-to-date, all bar 13 of the Champagne 50’s components are down. Interestingly, two rosé Champagnes were the strongest performers in May, with Taittinger, Comtes de Champagne Rosé 2007 and Perrier-Jouët, Belle Epoque 2014 up 12.2% and 10.1% respectively.

The worst performers in the index since the start of the year are from a range of labels and vintages, making it hard to identify the main culprits for this downward movement. EglyOuriet, Brut Millésime Grand Cru 2013 (-17%), Philipponnat, Clos des Goisses 2012 (-15.2%) and Louis Roederer, Cristal Rosé 2008 (-13.4%) were among the worst-performing in May.

But in terms of new releases’ performance, there is a ‘before’ and ‘after’ 2022 phenomenon, harking back to when Champagne prices bubbled from the demand. Take Dom Pérignon 2013, which was released in January 2023 for £1,830 per case, 38.6% above the higher-rated 2012’s release price. The wine is now trading around the £1,500 per 12x75cl mark.

By contrast, Dom Pérignon 2012 was released at £1,320 per case in September 2021. While the wine’s Market Price has been on a downward trend since the latter half of 2022, it benefitted from the frenzy of demand and subsequent price increases before that, its Market Price peaking at £1,990 per case in October 2022. The wine is currently trading just above £1,500 per case.

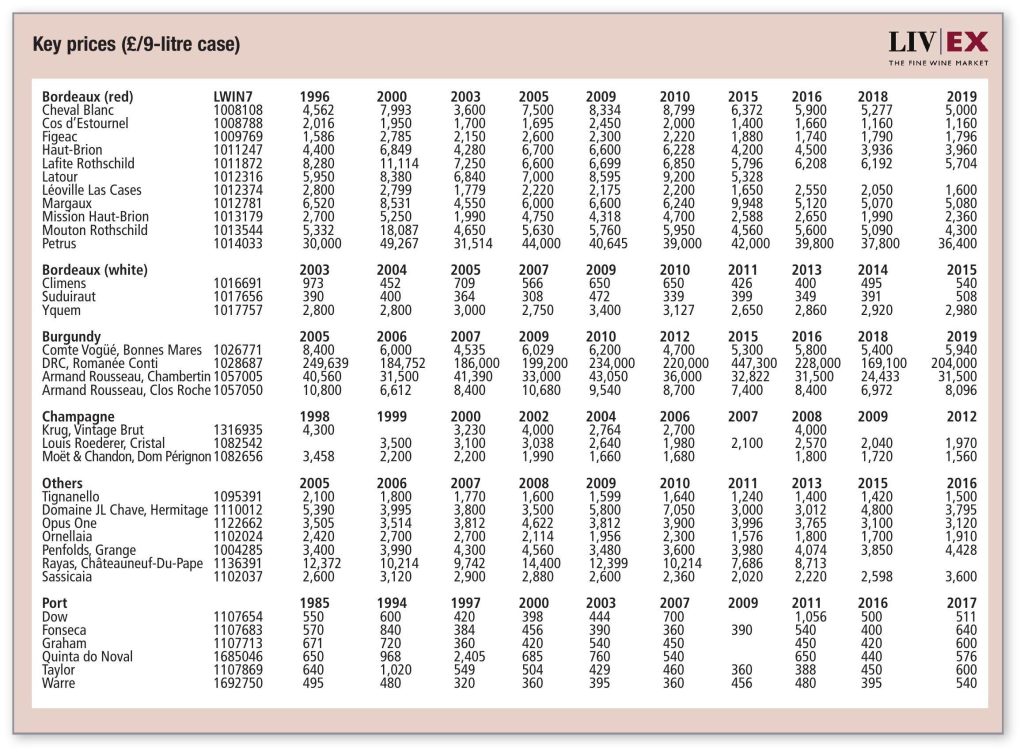

Other wines released since the start of the downturn have suffered a similar fate to Dom Pérignon 2013: Louis Roederer Cristal 2015, released in April 2023 at £2,600 per case, has been on a downward trajectory since its release. The wine is currently trading around £1,850 per 12x75cl.

Likewise, Salon Le Mesnil Grand Cru 2013 made its international debut at £10,980 per 12x75cl and has seen its Market Price fall since then, despite rave reviews from critics. It’s too early to tell how Krug 2011 will fare, but Pol Roger Sir Winston Churchill 2015, released in March 2023, is victim of the same fate. The wine is currently trading 25.2% below its original release price.

Savvy buyers have benefitted from these falling prices. In early June, Champagne was all the rage as the region boasted three wines among the top-traded by value: Louis Roederer Cristal 2015, Dom Pérignon 2013 and Salon Le Mesnil Grand Cru 2013. The first two also featured among the most-traded wines by volume. The trade volume behind these wines shows there is demand for them, but their release prices didn’t match buyers’ expectations or the downward market in which they were released. Most wines in the Champagne 50 are suffering from the hangover of 2022, when purse strings were loose and buyers were paying abovemarket prices for Champagne. Newer releases, however – those that have not benefitted from this surge of demand and thus have no growth to cling on to – are simmering down gradually with no sign of imminent redemption.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Queen Camilla gives speech at Vintners Hall

Master Winemaker 100: Alberto Stella

Australian Vintage sales dip 1.7% as turnaround plan targets stronger second half