War of the rosés: Can Provence keep the top spot?

As the rosé category continues to evolve, is Provence’s hallowed position at the apex of the pink wine pyramid under threat? Lucy Shaw investigates.

WITH EVERYONE from Brad Pitt to Kylie Minogue having skin in the game, the meteoric rise of Provence rosé has been one of the wine industry’s greatest success stories of recent times. But, with the cost of living crisis biting, and Provence facing competition not only from within France, but also from the rest of the world, is the grande dame of pink wine at risk of falling out of favour?

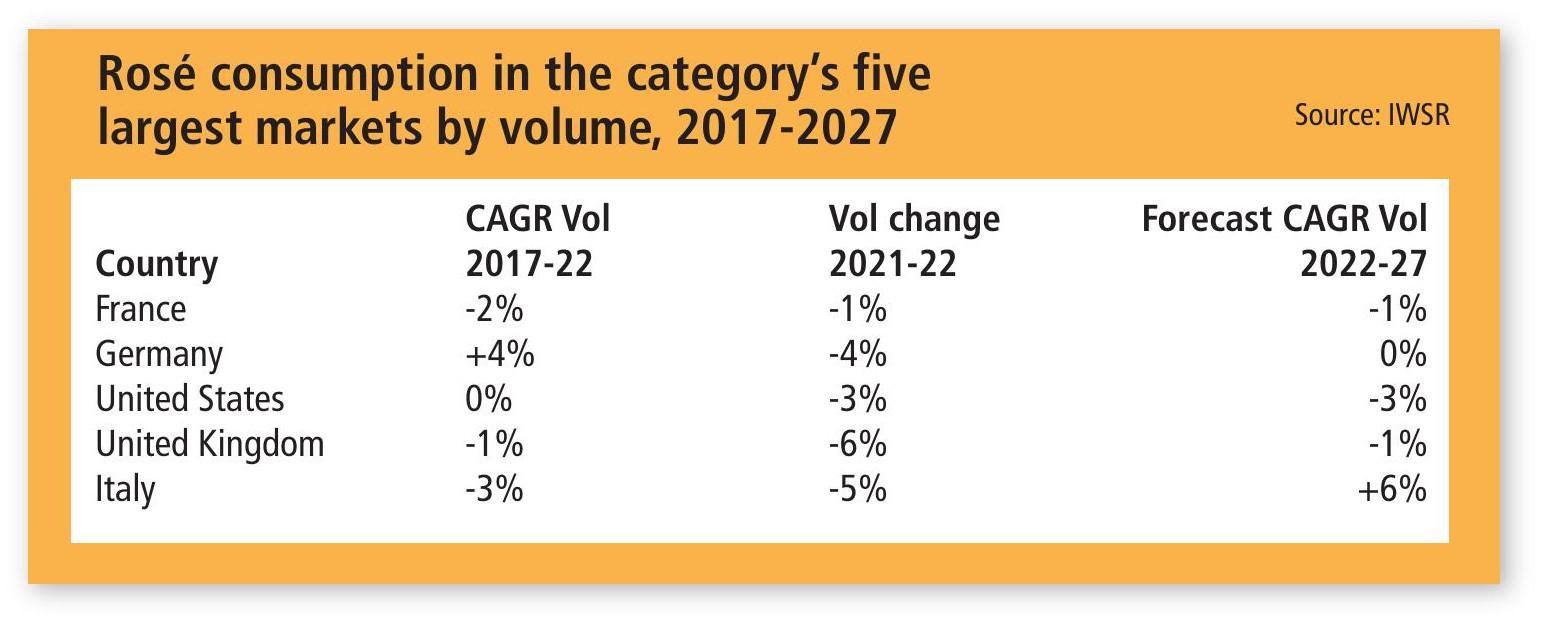

Provence had a tricky time of it last year on the exports front, seeing volumes decline in nine of its top 10 overseas markets, including a -12% dip in exports to the UK, a -19% drop in Germany and a – 35% slide in Australia. However, silver linings were to be found elsewhere, with value sales of Provence wines rising by 9% in Spain, 49% in Italy and 124% in Ireland.

Brice Eymard, managing director of the CIVP, puts the decline down to a perfect storm of “inflationary pressure, intensifying competition and lower purchasing power”.

With the US still out in front as Provence’s number one export market, receiving 20.8 million bottles of rosé from the French region last year, Eymard is hopeful that sales will bounce back. “The US remains by far our biggest market and still offers strong growth potential, particularly in states such as Illinois and Texas,” he tells db.

With Americans wanting their rosés fresh off the bottling line, Petra Frebault, trade marketing and communication manager of producer Barton & Guestier, says unrealistic expectations about delivery dates are causing problems in this key market.

“New Yorkers have been asking for the latest rosé vintage to be available at Christmas, and with the lightest colour possible. This has proved to be mission impossible for the cellarmasters, as the wines need time to gain complexity to be a true representation of Provence,” she says.

Sacha Lichine of Château d’Esclans – the man largely responsible for starting the prestige Provence rosé revolution with his Whispering Angel brand and top drop Garrus, admits that Provence “had a challenging time” in France last year.

“In Provence, the attractiveness of local rosés appears to be waning, and the competition intensifying due to the rise of rosés from IGP Méditerranée and Terres du Midi, which have been capturing volumes lost by Provence,” he says. Despite the challenges, Jeany Cronk, the English co- owner of Maison Mirabeau, is “cautiously optimistic” about the year ahead for Provence.

“The situation is feeling much better than last year and our orders are up by more than 60% in the UK. We’re seeing more stability in our main markets and more regular ordering coming through,” she says.

Golden opportunity

Keen to seize any market share lost by Provence, Florence Barthès, general director of IGP Pays d’Oc, believes the region has a golden opportunity to capitalise on the current climate via wallet-friendly offerings.

“The quality of the rosés we produce for their price point is a real advantage during the cost of living crisis,” says Barthès, who adds that the region is seeking to connect with Millennial and Gen Z consumers via occasion-led pink wines.

Increasing production to keep up with demand, Languedoc co-operative Foncalieu is on track to sell 10 million bottles of rosé per year by 2025.

“Our winemakers set great store by innovation and are tapping into a range of techniques, including lees ageing and oak maturation, to add greater complexity and longevity to our rosés,” says Nathalie Estribeau, Foncalieu’s wine director.

Another Languedoc brand making impressive headway around the globe is Bijou. The company’s Le Bijou de Sophie Valrose rosé is worth more than £5m in the UK off-trade, while volume sales across its range are up by 200% in the US.

Seeking to fill the gap in the market between entry-level New World rosés and premium Provence pinks are the wines from France’s IGP Méditerranée.

“The middle ground between the two, where quality meets value, is a great opportunity for us,” argues Jean-Claude Pellegrin, president of wine co-operative Intervins Sud Est. But it’s not only their neighbours that Provence producers need to keep an eye on, as rosés from other European tourist hotspots, including Greece, Italy and Corsica, are enjoying their moment in the sun.

“An increasing number of delicious rosés are launching from outside of Southern France, such as our Waitrose Loved & Found Susumaniello Organic Rosé from Puglia,” says Waitrose rosé buyer Poppy de Courcy-Wheeler.

Italian pinks are also going great guns at rival UK retailer M&S, which is gearing up for a record-breaking summer season.

“Britain’s love of rosé continues to smash all expectations. We’ve seen sales grow by more than 10% in the past three months and expect to sell a bottle of rosé every two seconds over the summer,” says buyer Giota Polizoudi, who reveals that the retailer ’s current best-selling pinks are two Pinot Grigio rosés from the Veneto. In addition to rising sales in Italy, Antonio Capaldo, president of Tenute Capaldo, has noticed a growing international thirst for Italian rosé.

“There’s a specific space for Italian rosé, particularly in the high-end on-trade,” says Capaldo, who is hoping to own the aperitivo hour moment with the launch of San Greg – an Aglianico rosé from Campania packaged in an attractive bottle that wouldn’t look out of place in a cocktail cabinet.

Meanwhile, Piccini CEO Mario Piccini believes Etna rosés made from Nerello Mascalese are Italy’s greatest asset and have helped to “fuel the renaissance of the rosé category worldwide”.

Partner Content

An open consumer mindset in the UK is driving consumers to explore outside Southern France for their pink wine fix, with wallet-friendly expressions from Portugal and Greece finding a fanbase at M&S.

“Our priority right now is showing customers that there’s a host of fantastic, great-value rosés from around the world. We’ve invested in everyday lower prices across our wine range, meaning more than half of our rosés are now £8 and under,” says Polizoudi.

Keen to remain relevant, heritage Portuguese rosé brand Mateus has added a drier, paler pink expression to its range, made from Syrah and native grape Baga from Bairrada.

At Majestic, Provence pinks rule the roost when it comes to sales, but expressions such as Côte des Roses from the Languedoc are gaining ground, as are those from Corbières and Corsica.

“Rosé is a year-round drink now, not just a style that people buy during Easter or for summer barbecues. The fact that our year-on-year sales were up by 30% in December is a testament to that,” says Majestic buyer Matthew Fowkes.

Off-season sales were also strong for Provence brand Château Léoube, owned by Lord and Lady Bamford, who saw sales of Love by Léoube rosé at their Cotswolds farm shop and restaurant, Daylesford Organic, shoot up by 52% last winter, while magnums of AIX have become an après-ski favourite everywhere from Verbier to Val d’Isère.

Aspirational lifestyle

While Provence may be facing increasing competition from around the world, it remains untouchable when it comes to the quality of its rosés, the strength of its brands and its ability to sell the aspirational lifestyle of Southern France in prettily packaged bottles.

“We refer to rosé internally as the ‘perfume category’ because of the brilliant way the labels and bottle shapes are used to market the wines,” says Fowkes.

Victor Verhoef, marketing director of AIX, believes the region continues to set the benchmark for rosés around the world.

“While competitors may seek to capitalise on the popularity of Provence rosé, our commitment to quality and continued investment in vineyard management, winemaking techniques and marketing strategies ensures that our rosés retain their leading position,” he says.

Helping Provence to stand out in an increasingly crowded market are its tiered ranges at different price points and its diversity of styles, allowing fans an entry point into brands and a chance for progression as their spending power grows.

“We’ve been experimenting with bolder blends to meet a growing demand for complex rosés, working with old vine plots and longer lees ageing on our M-G Reserve rosé to build texture and refined aromas,” says Aline Gutowski, owner of Côtes de Provence estate Maison Gutowski.

Jeany Cronk of Mirabeau applauds the emergence of “more ambitious rosés that have complexity and terroir expression to them” in Provence, which is helping the region to reaffirm its status as the pinnacle of pink wine production.

“These more structured, gastronomic rosés, often with a subtle oak component, are ideal for autumn and winter, as they’re good food partners and have more body,” she says.

Seeking to create a ‘grand cru’ rosé with staying power, Languedoc legend Gérard Bertrand has won sommeliers over with his oak-aged, single-vineyard Clos du Temple rosé, which is among the most expensive in the world.

“Clos du Temple is finding its place in high-end restaurants, as sommeliers and chefs are increasingly seeking out rosés with greater structure and ageing potential to complement and elevate their dishes,” he says.

While competition for the pink pound heats up around the globe, Verhoef of AIX believes that Provence’s unique point of difference lies in its stylistic diversity. “From crisp pinks to oak-aged expressions, Provence rosés are showcasing increasingly diverse characteristics, which gives consumers more choice while elevating the category in the process,” he says, warning rosé glory-hunters that their days might just be numbered.

“Opportunists that jumped on the rosé bandwagon have realised that making and selling good rosé isn’t easy. The pink wine landscape is crowded and it takes time and effort to carve out a niche. The established, quality-driven producers that paved the way for rosé will start to regain ground, and the cards will be reshuffled until a new balance is struck.”

For Mirabeau, the secret to Provence’s continued success lies in building strong brands that fans remain loyal to. “People approach Provence rosé in a similar way to Champagne, choosing a favourite brand that they tend to return to,” says Cronk. “The lifestyle aspect is very important to rosé. People want to be taken on a journey, and that includes activations, merchandise, recipes and styling ideas.”

Roles to play

Château Léoube’s CEO, Jérôme Pernot, believes that, as in Champagne, both the big guns and smaller estates in Provence have important roles to play in the region. “Going forward, there will be a greater distinction between the large, brand-led rosé producers and smaller, family-owned wineries like Léoube, with both working together to collectively build Provence’s reputation,” he says.

However, CIVP managing director Eymard is wary of leaning too heavily on the Champagne model.

“New players have arrived in Provence from Champagne, but this doesn’t mean that Provence can function like Champagne,” he tells db. “We’re delighted to be able to benefit from the know-how of these companies, but we need to find our own path. Provence’s continued success will depend on growing our exports, maintaining our premium positioning and continuing to offer the world’s finest rosés.”

While Provence may have lost global market share due to customers trading down to more affordable rosé expressions, one thing is clear: the queen bee isn’t going to give up her position at the top of the pink wine pyramid without a fight.

Related news

Zamora Company to distribute Bottega sparkling wines in Spain

Cabernet Franc on track to become the official grape variety of New York State