Growing Pains – the expansion of La Place

The flurry of producers clamouring to join La Place de Bordeaux has led to fears of saturation in a depressed fine wine market. Arabella Mileham reports.

THERE’S BEEN much talk about the rapid expansion of global icon wines on La Place de Bordeaux, the ‘hors Bordeaux’ campaign of France’s famous distribution system, in recent years.

La Place has the potential to boost access to some of the world’s greatest wines, but alongside the positive enthusiasm, there have been dark mutterings about market saturation and escalating prices amid a fine wine sector already in trouble. So, which wines are arriving on ‘hors Bordeaux’, and where is the situation heading?

The roots of the campaign, which focuses on international (ie. non-Bordeaux) wines featured on La Place, lie in estates strongly affiliated to Bordeaux – Almaviva, a Chilean collaboration between Baron Philippe de Rothschild and Concha y Toro, was one of the first international wines to be sold via La Place, followed by Opus One, a similar joint venture between the Rothschilds and California’s Robert Mondavi. However, the system has long outgrown these obvious links and increasingly encompasses a wider range of wines from all over the world.

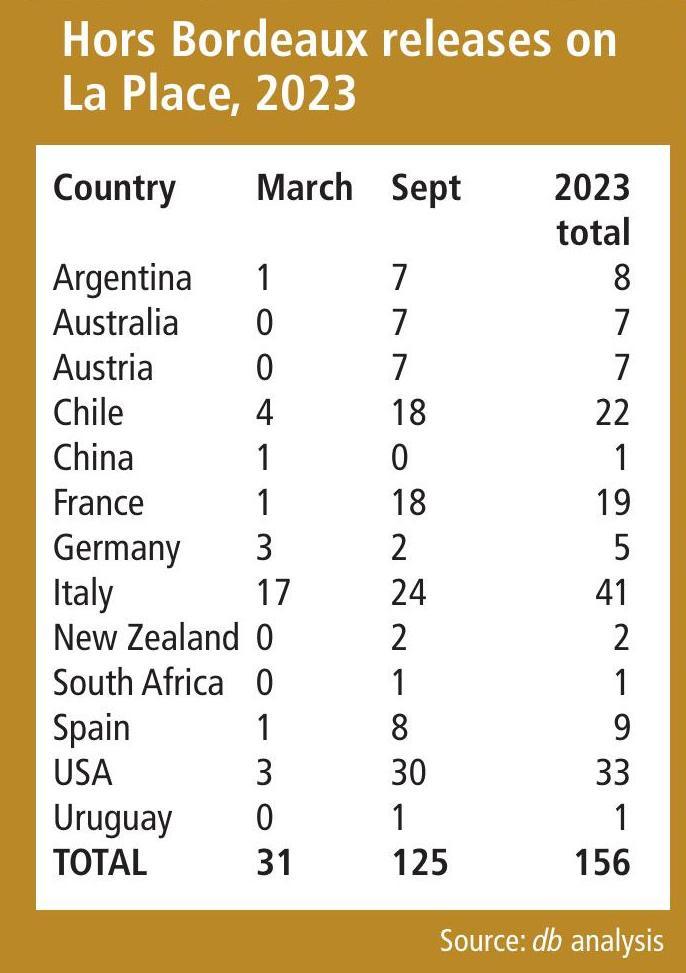

The campaign has rapidly expanded in the last few years. For example, in 2021 there were about 75 wines from eight countries in La Place’s September campaign, rising to roughly 100 wines from 11 countries in 2022.

Last year saw the numbers grow higher still, with a total of 156 wines from 13 countries across both the September campaign (which sometimes stretches into October) and the smaller campaign held in March, which is traditionally dominated by Italian wines.

Analysis of last year ’s releases shows that Italy not only had the largest number of wines released on La Place during 2023 (41 wines), but is also the country to have added the most this year (14 wines).

Italy is followed by France (notably the Rhône, but also Languedoc-Roussillon), Chile and the US, all of which numbers wines in double digits.

Spain and Germany added four wines each across 2023, with Australia adding three, New Zealand two and Argentina one.

Countries now represented on La Place also include outliers such as China (with Ao Yun) and Uruguay (Bodega Garzón’s Balasto), as well as South Africa (Klein Constantia Vin de Constance).

Négociants are looking to represent different styles, as well as different countries and regions.

New Zealand producer Craggy Range, which launched on La Place in September 2023, tells db that the estate originally proposed a different wine – a Bordeaux blend – which La Place dismissed as “they’ve already had a lot of New World Bordeaux blends in the last five or six years”, according to Ryan Morgan, business manager at Craggy Range.

This indicates that négociants are looking for something specific and unique from those newly joining the hors Bordeaux campaign.

This is a positive move. As well as giving an opening to producers in emerging markets, it expands the pool for those who have long bought from La Place.

Martyn Rolph, commercial manager at Berry Bros & Rudd, argues that the hors Bordeaux campaign on La Place has allowed access to brands the merchant didn’t have before.

“It gives the ability to create a lovely, structured campaign around some the most iconic wine releases in the world, and we were pretty successful at building that excitement and momentum,” he argues.

Rolph highlights in particular last year ’s launch of Italian producer Bibi Graetz’s Testamatta and Colore 2021 wines on La Place, which the Berry Bros team focused on heavily and which proved highly successful. “We have the core, loyal customer-followed brands we’re supporting, but we are also looking to add onto the periphery,” he explains.

Significant releases

One of the most significant releases hitting La Place this March is the Napa Cabernet Sauvignon from Stag’s Leap Wine Cellars, which famously beat some of Bordeaux’s top estates to win the 1976 Judgment of Paris.

It follows on from the ‘out-of-season’ release in January by premium Australian producer Penfolds’ of its entire Luxury & Icon collection through La Place across Europe, the Middle East and Africa (EMEA). In doing so, Penfolds appeared to take a leaf out of Domäne Serrig’s book. The latter became the first German winery to release all of its production on the French distribution system in November 2023.

Colin Hay, db’s Bordeaux correspondent and an expert on the institutions of La Place, argues that these additions show that the top-end releases that are symbolically significant are “still possible and viable” in the current market, a promising sign for both the short-term and the long-term future of the hors Bordeaux campaign.

Although Hay believes there is more room for growth – particularly from top end Australian and American wines (especially from Sonoma), and Champagnes, he concedes that 2024 is likely to see fewer new releases on La Place.

The majority of March’s campaign will come from producers who have released previously. And some of those, including Vérité from Sonoma County, have decided not to release their back vintages (often in mixed cases) as they have done during previous years.

Hay, who has spent the last few weeks tasting the March 2024 offerings, notes that some producers may be quietly planning “in the background” for a future release, but are holding their wines back for now until market conditions improve.

This is a significant observation. The September 2023 campaign followed a poor Bordeaux en primeur, at a time when the market had already started to stall. And, as any merchant will tell you, selling into a market that is on a downward trend is never easy, especially if many feel the pricing doesn’t stack up.

“La Place last year was challenging across the board, given the economic situation,” BBR’s Rolph says.

He explains that, when working direct with wineries and producers, merchants can give their views on where new releases should be pitched, but being one step removed by buying on La Place makes this trickier.

Partner Content

“One of the challenges last year was the economic headwinds,” Rolph explains. “But the pricing, if you’re comparing it perhaps to the vintage or two before, doesn’t give a reason to buy – particularly if the producer ’s wines from the previous year are now selling on the secondary market cheaper.”

“We need to be confident that we’re selling a wine to a customer at a price that we think is going to be stable, and won’t then appear through the rest of the trade significantly cheaper. We can’t control the wider market, but where we think that’s likely, we have to be very cautious.”

Rolph would, he says, like to see “considered” pricing, that accounts for the performance of recent vintages at release, and where the vintage may have dipped on the secondary market post-release.

“It obviously undermines customer confidence if the pricing doesn’t remain stable, so it’s really important for merchants, and ultimately the brands, to price at a level where they’re almost hedging against that not happening.”

Justin Gibbs, deputy chairman and exchange director at fine wine global marketplace Liv-ex, agrees, arguing that wines do not appear to have been selling their whole allocation.

“There are still plenty of them, and they are, by and large, available for below their release price. So has it been a success? The data suggests it has not been,” he says.

“La Place is an incredibly efficient distribution system, but only when the price is right. When it’s wrong, these wines back up, and a lot end up sitting in warehouses in Bordeaux. They’ve got the prices wrong. That’s the crux of the problem.”

If this is the case, there may be pushback from négociants who don’t want – and cannot afford – to be tying up funds storing excess stock, making them reluctant to take on more.

“I think the tide is turning slightly,” Marc Ditcham, senior fine wine buyer and broker at Corney & Barrow, agrees.

“I think you will see a big difference in September 2024, maybe not immediately, but you might find wines being split between fewer négociants – maybe just one or two rather than five or more.”

Gibbs also argues that the currently packed schedule means that even some well-known wines might be getting lost under the weight of wines coming through on a daily basis during the annual September campaign. “It probably needs to be a less crowded place at that time of year and they need to think much harder about the pricing,” he says.

From a merchant’s point of view, the September campaign has become “a bit frenzied in recent years, with no logic behind the releases”, Ditcham says. Other unnecessary complications have included pricing errors (“They got the recommended selling price wrong by including VAT, which usually isn’t added to wines coming out of Bordeaux”), or not providing wines to taste before the campaign starts.

Ditcham says: “There’s only so much buyers can get behind and support these wines” if they haven’t even tried them.

It’s not only about pricing, though. As Hay points out, it is easier to sell wines which already have a reputation, especially in a challenging market.

“Quite a few wines on La Place have been sought out because they’re very good, but they don’t yet have that reputation,” he says. “It is difficult to construct a reputation in three months in a market when conditions are terrible. Properties that have sold the least of their allocation are those which are maybe making wonderful wines that the critics and négociants like (and that’s why the courtiers sought them in the first place), but aren’t terribly famous. There are a few wines from Chile and Argentina that fit that bill. They are interesting wines, but now is not necessarily the best time to have brought them to the market.”

However, producers seem sanguine, and trust La Place to build that reputation. As Craggy Range’s Morgan puts it, “the press around us launching on La Place has been just as valuable as the sales”. In his view, “top-level global producers aren’t joining La Place to increase sales”, but rather to cement themselves as “an icon brand”.

The New Zealand estate has therefore taken a “high-value, low-volume” approach to La Place, with a limited number of négociants (two), and the expectation that the process will in all likelihood be a slow burner.

“I don’t think joining La Place was a gamble, though,” Morgan argues. “It’s new business, and it’s certainly paid off in terms of opening us up to new markets like Taiwan, South Korea, Austria and Switzerland, where people are now buying our wines through La Place.”

There also seems to be growing awareness among négociants that they may need to alter their approach, given the current market conditions. After two weeks’ tasting in Bordeaux, Hay is confident of this, even if the Bordelais don’t want to discuss it openly (one négociant declined an interview, saying they “prefer to let the properties speak for themselves”).

Hay adds: “There is some indication that the négociants are acknowledging they need to work differently and train their teams to sell these wines more actively, particularly where the traditional market for the wine is different from that of Bordeaux.”

They are also expressing greater hope in the market returning to more normal conditions, after “more positive conversations” with potential buyers. “That’s not to say that the market is shooting upwards, but it is possibly to suggest that there’s a bit more optimism than there was,” Hay concludes.

Read more:

Stars of the Spring hors Bordeaux campaign – the 2024 edition

Related news

VIK 2022: ‘the beginning of a journey toward self-sufficiency’