Cristal rules the Champagne roost in 2022

Champagne is enjoying a strong year, and the Louis Roederer flagship brand is in especially high demand with buyers. But which of the most recent five vintages should they go for?

So far this year there has been one brand that has been near the top of the trade discussion every month – Louis Roederer’s Cristal. At the time of writing it has been the second-mosttraded wine brand by value (just behind Château Lafite Rothschild), and the most-traded brand by volume.

On an individual wine level (LWIN11), its 2008 vintage has been the top-traded wine by value overall, followed by its 2014 vintage.

Champagne is having a strong year in the secondary market. The Champagne 50 index is up by 24.8% in the year to date, the secondbest-performing sub-index of the Liv-ex Fine Wine 1000 (the Burgundy 150 is up by 28.5%).

The Champagne 50 has been the bestperforming sub-index for the past five months in a row, rising by 2.1% in October while the Burgundy 150 rose by just 0.7%. There are several brands contributing to this, not least Dom Pérignon, whose 2012 vintage has seen very high levels of trade. Nonetheless, the real driver has been Cristal. As the chart on the next page shows, the brand’s price performance has outperformed the Champagne 50 this year, rising by 37.5%.

The most in-demand vintages have been those from 2008 onwards – five vintages in total. The 2014 was only released this February yet has still taken a leading share of both the brand’s and overall market’s trade.

The four vintages released before it (2008, 2009, 2012, and 2013) have all outperformed the Champagne 50 as well, as the chart shows.

BRAND STRENGTH

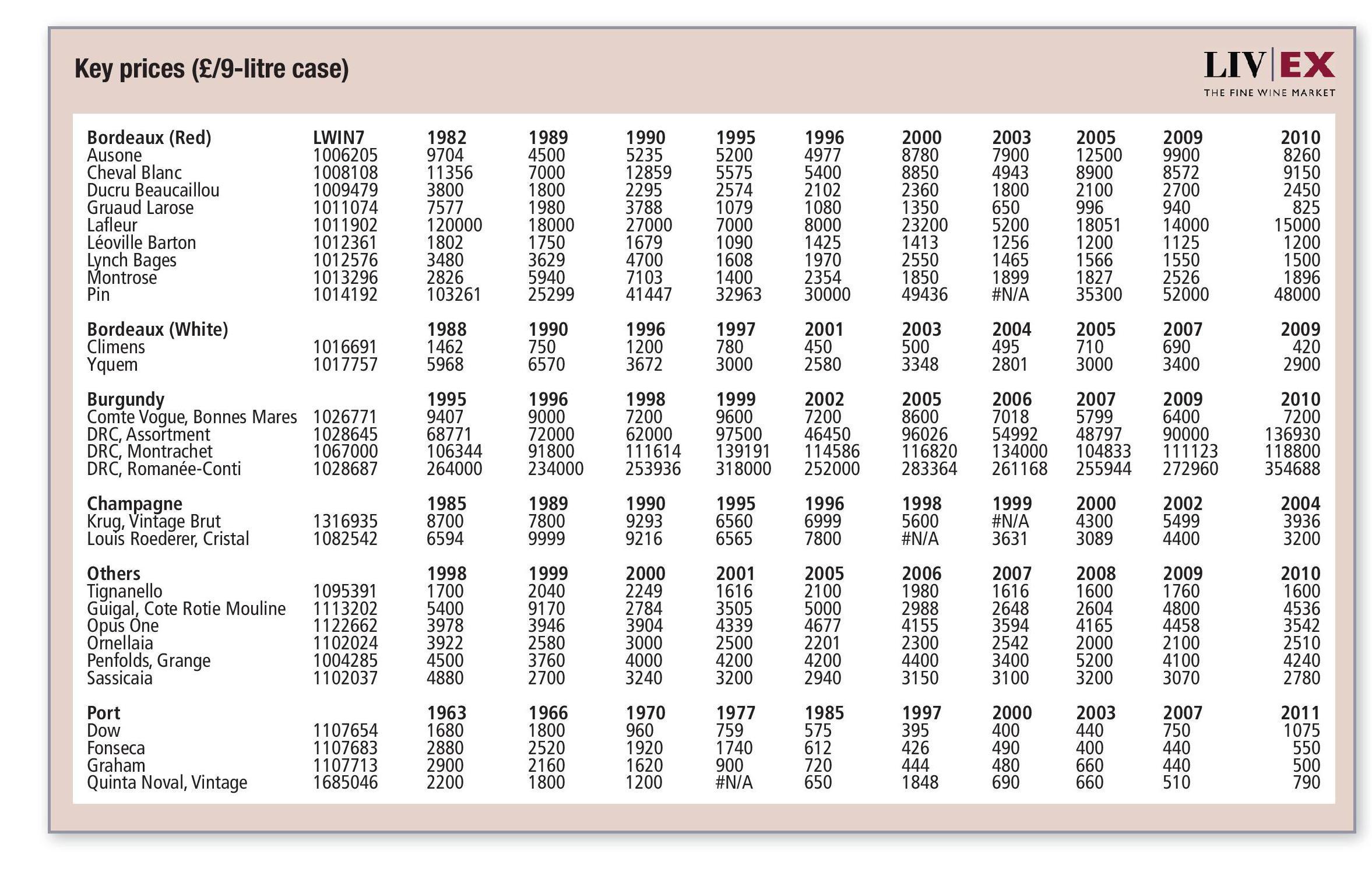

Cristal is a brand par excellence. Its secondary market performance is based on the strength of its brand, rather than the strength of an individual vintage. The 2008 continues to sell because it is a known great vintage, while the 2014 is the latest one, and the market frequently favours whatever is newest. Yet this short attention span means surprises and value can lie in store for those who look a little deeper. The table shows that the five most recent vintages have all risen in price since release.

But just as the 2013 is the surprise best performer this year, the 2009 would have netted the greatest return on investment to date. The 2009 has the lowest score of these five vintages but its performance highlights the brand power of Cristal over vintage quality.

OPPORTUNITY KNOCKS

However, for those looking to buy the best Cristal possible for their money, using the Fair Value methodology we can assess which of these vintages offers the best opportunity.

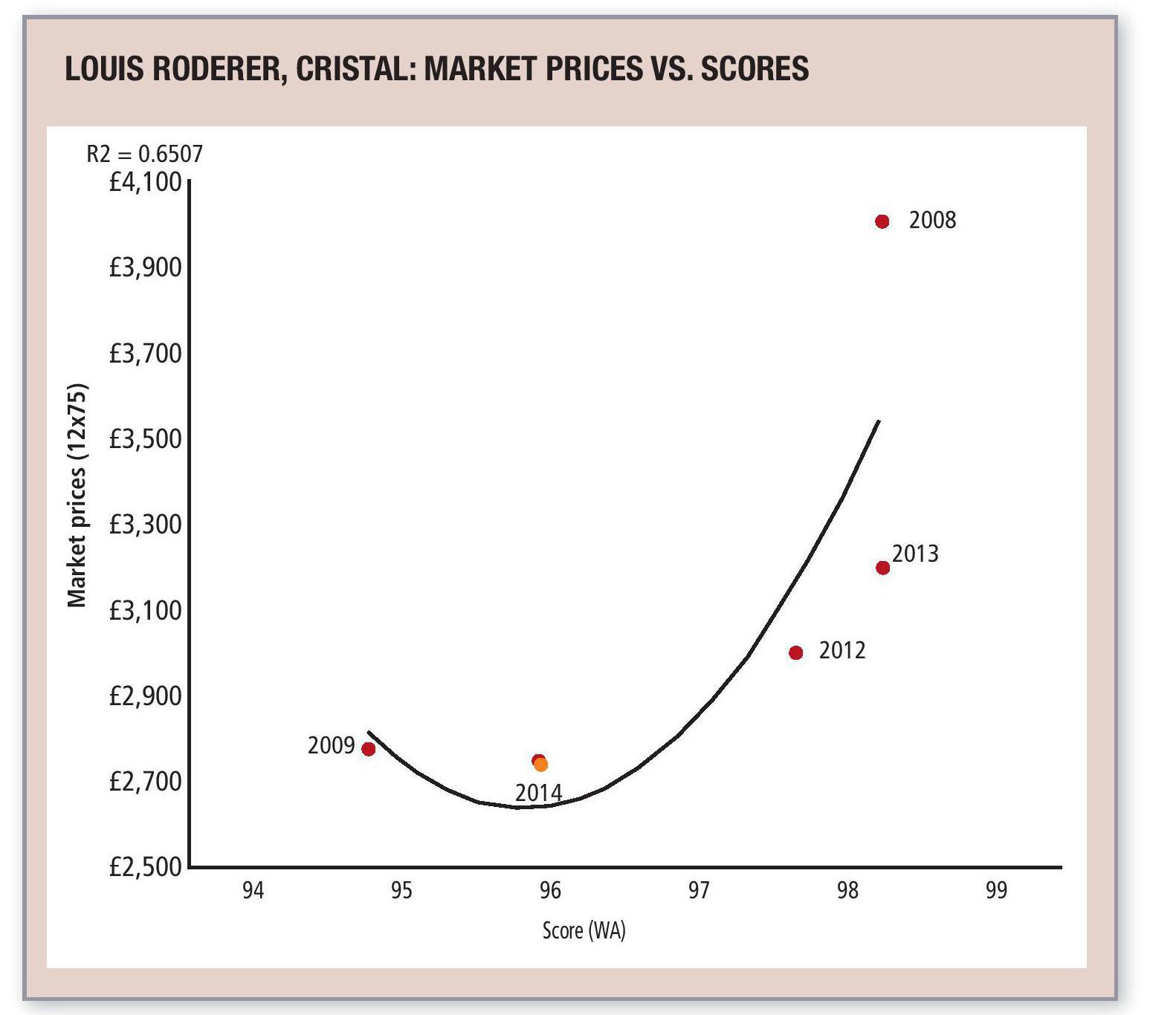

The chart compares the current market prices of the latest Cristals with the scores of William Kelley at The Wine Advocate.

Here we can see that, at its current price, the 2014 looks a little overvalued. Meanwhile, the 98-point 2013 is arguably the best-value Cristal at present, closely followed by the 97+ 2012.

However, scores are opinions, and opinions can differ. At their current prices, these five Cristal vintages have a much better correlation with the scores of Antonio Galloni at Vinous. The new 2014 looks to be the sensible buy right now. Though, interestingly, the 2012 continues to offer good value in both instances.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

fine wine monitor – in association with

Related news

Queen Camilla gives speech at Vintners Hall

Master Winemaker 100: Alberto Stella

Australian Vintage sales dip 1.7% as turnaround plan targets stronger second half