Which fine wine regions are performing best?

The secondary fine wine market has reached new heights over the past two years. But as prices of the top wines continue to rise, where should investors look when wanting to buy the top wines of the world?

The secondary fine wine market has reached new heights over the past two years. Although the Liv-ex 100 closed in July down on the previous month, the Liv-ex 1000 was up slightly (by 0.4%). Both of the leading fine wine indices are at their highest ever levels.

But as prices of the top wines continue to rise, where should investors look when wanting to buy the top wines of the world? Broadly speaking, the leading wines of their respective regions are consistent with the wines that make up our regional indices (i.e. the components of the Liv-ex 1000 index).

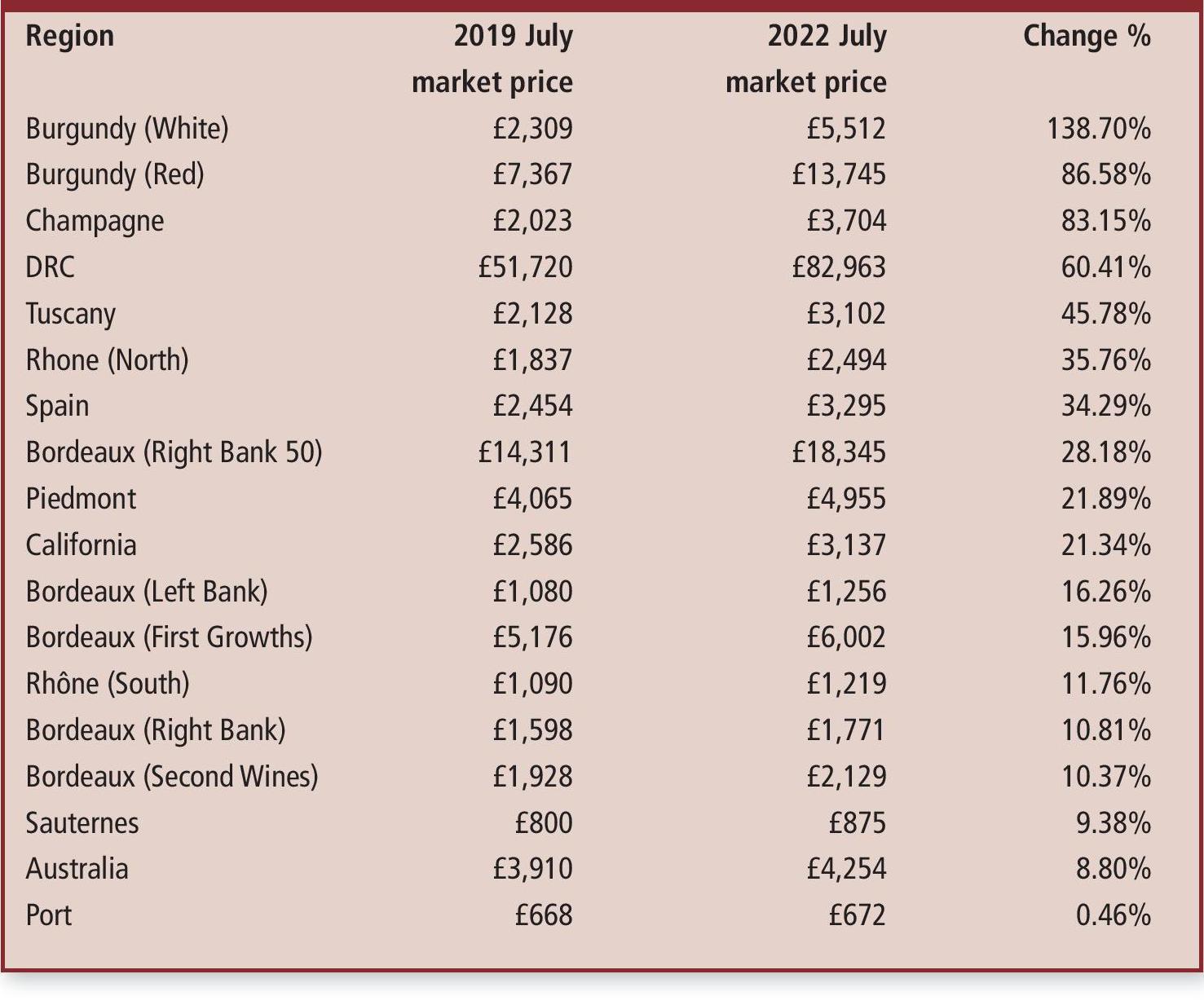

To give a better idea of the price changes in the secondary market, we have split many of these indices down further, as shown in the table on the next page.

For example, the Rest of the World 60 has been split into California, Spain, Australia, and Port. The Rhône 100 has been split into its northern and southern components, and Italy has been divided into Tuscany and Piedmont.

Where wines of great rarity and price might have an impact on the average, we have also kept them separate. For example, Domaine de la Romanée-Conti has been separated from red and white Burgundy, and estates in the Right Bank 50 (Pétrus, Lafleur, Le Pin, Ausone, and Cheval Blanc) set apart away from the other Right Bank wines.

The final regions can be found in the table, which shows the average market price for each, both now and three years ago. Unsurprisingly, prices of Burgundy and Champagne have risen the most over the past three years. The Burgundy 150 and Champagne 50 indices have been the best performers since July 2019, rising by 57% and 79% respectively. The Champagne 50 has been outperforming the Burgundy 150 since May 2021.

Cristal, Krug, Dom Pérignon, and Salon have been the main drivers behind Champagne’s rise, with the 2008, 2012 and 2014 vintages being in particularly high demand from the former three.

Meanwhile, white Burgundy’s success has been driven by demand for Montrachet and some of its adjacent appellations, such as Chevalier- and Bâtard-Montrachet.

The rising price of Tuscan and Northern Rhône wines also fits the pattern seen in recent years, with both regions finding an increasingly enthusiastic audience who appreciate what they have to offer in terms of quality and value.

The surprising addition so far up the table is Spain – represented by Vega Sicilia Unico – which has risen by 34.2% in value. As mentioned above, all of the Unico vintages in the Rest of the World 60 at least held their value in July. Back in 2019, the Californian components of the Rest of the World 60 comprised Opus One and Dominus only. Since then those wines have risen by 21.3% on average. However, Screaming Eagle was added to the index, and if we include that estate then the average entry point for Californian wine rises to £14,885 (12x75cl).

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

fine wine monitor – in association with

The Bordeaux wines have seen more subdued increases in value. As noted, the region’s trade share has been in decline in recent years. Over the past three years it has accounted for 39.5% of total trade by value.

The most accessible entry points into fine wine, Sauternes and Port, have seen the smallest changes to their average price since 2019, and remain under £1,000 per case on average.

And likewise, both Left and Right Bank Bordeaux, as well as wines from the southern Rhône continue to offer wines to potential new buyers that are, on average, under £2,000 a case.

• Liv-ex analysis is drawn from the world’s most comprehensive database of fine wine prices. The data reflects the real time activity of Liv-ex’s 600 merchant members from across the globe. Together they represent the largest pool of liquidity in the world – currently £80m of bids and offers across 16,000 wines. Independent data, direct from the market.

Average case price in the Liv-ex 1000, 2019-2022

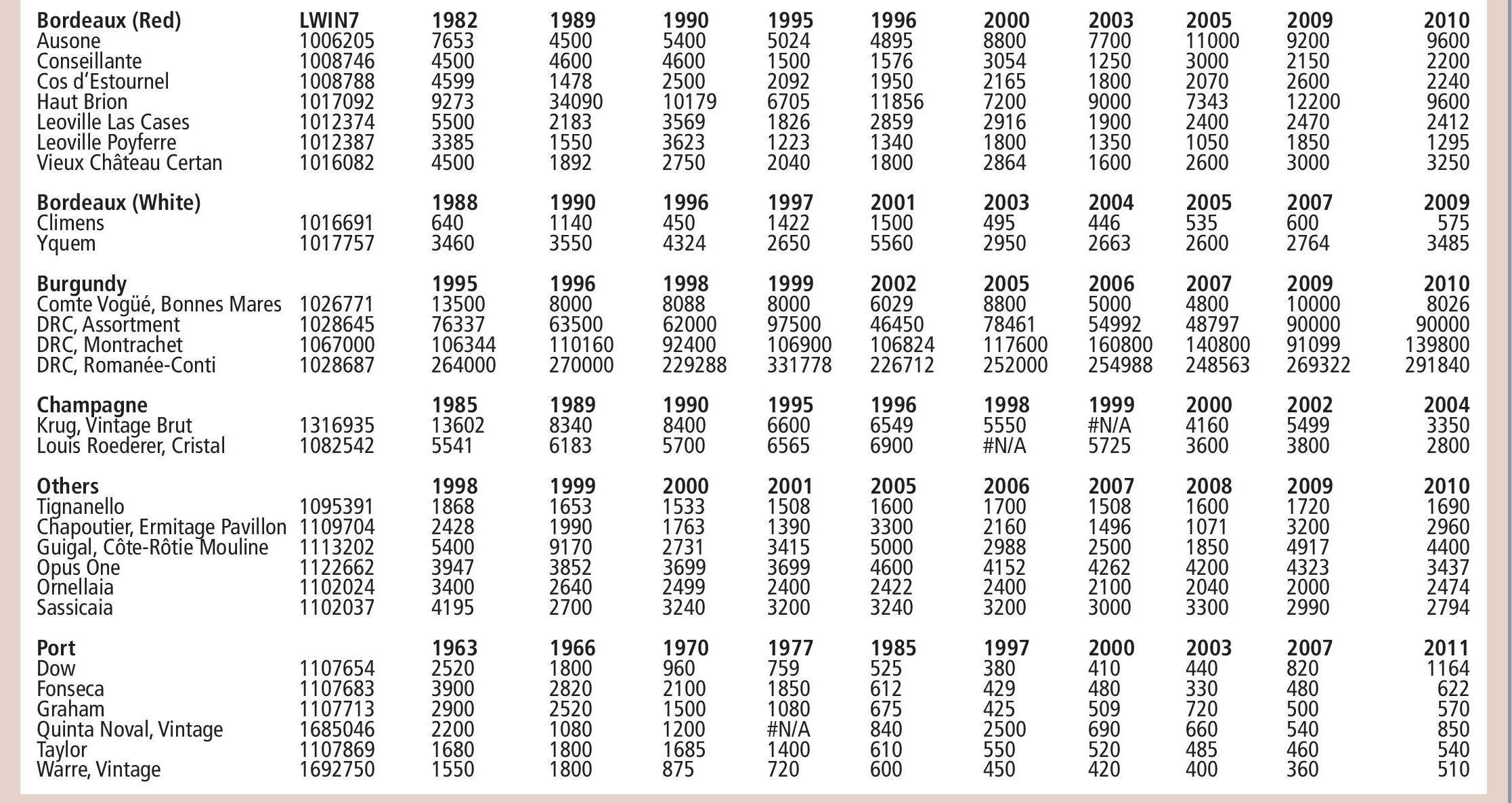

Key prices (£/9-litre case)

Related news

Garcés Silva: fresh thinking from Leyda

Christie's to sell Burgundies from renowned British collector Ian Mill KC