Manufacturers search for the greenest solutions for closures

Whether closures firms make stoppers from cork or aluminium, they are all deeply invested in coming up with the greenest solutions, writes James Lawrence.

IT WAS in 1987 that a United Nations report, compiled by three-time Norwegian prime minster Doctor Gro Harlem Brundtland, first made explicit references to ‘sustainable development’ and the rising awareness of mankind’s impact on the environment. Thirty-five years later, we find ourselves in the midst of an unprecedented climate crisis. “All politics are now climate politics,” observes Geoff Mann, director of the Centre for Global Political Economy at Simon Fraser University, in Canada. Indifference to the green agenda is simply not a viable course of action for businesses operating in 2022. Maintaining historic levels of investment, however, may be difficult in light of rampant inflation and geopolitical instability.

Over the past decade, manufacturers of closures have keenly pursued environmentally sound policies. It appears to be a level playing field: natural cork, agglomerate, and screwcap manufacturers all make strong claims about their eco-friendly credentials.

However, as external scrutiny intensifies (environmental-impact assessments are becoming de rigueur), natural cork companies are quick to remind us about the biodegradability of this timehonoured stopper. As far as the cork industry is concerned, it will always be ahead in the sustainability PR war. This remains a point of contention in the wider closures market.

“Our sustainability credentials are uniquely strong, but even more can be done; we have launched a research-anddevelopment initiative that would allow for the shortening of the initial cork oak growth cycle from the current 25 years to about 12 to 14 years, without resorting to genetic modification, ” says Amorim’s marketing director, Carlos de Jesus.

CARBON FOOTPRINT

He also reports that Amorim’s 16th CO2footprint analysis revealed that “all of our still and sparkling wine stoppers deliver to our clients both significant negative carbon footprint and negative carbon balance”.

He adds: “This allows members of the wine trade to start incorporating this massive carbon dioxide sink into their own brand propositions, reducing wine’s carbon footprint, while still giving consumers worldwide yet another great reason to buy a bottle of wine that uses natural cork.”

Meanwhile, leading competitor MASilva was recently audited by the consultancy firm KPMG International, which analysed the complete environmental footprint of its natural and micro-agglomerate corks.

According to marketing manager Nuno Silva: “The analysis was carried out from a production-to-delivery perspective, including transport of stoppers to a customer in the Champagne region.” The environmental indicators under scrutiny included energy consumption (non-renewable sources) and atmospheric emissions (greenhouse gases, methane, and nitrous oxide). This was then measured against a carbon-sequestration calculation resulting from MASilva’s cork forests.

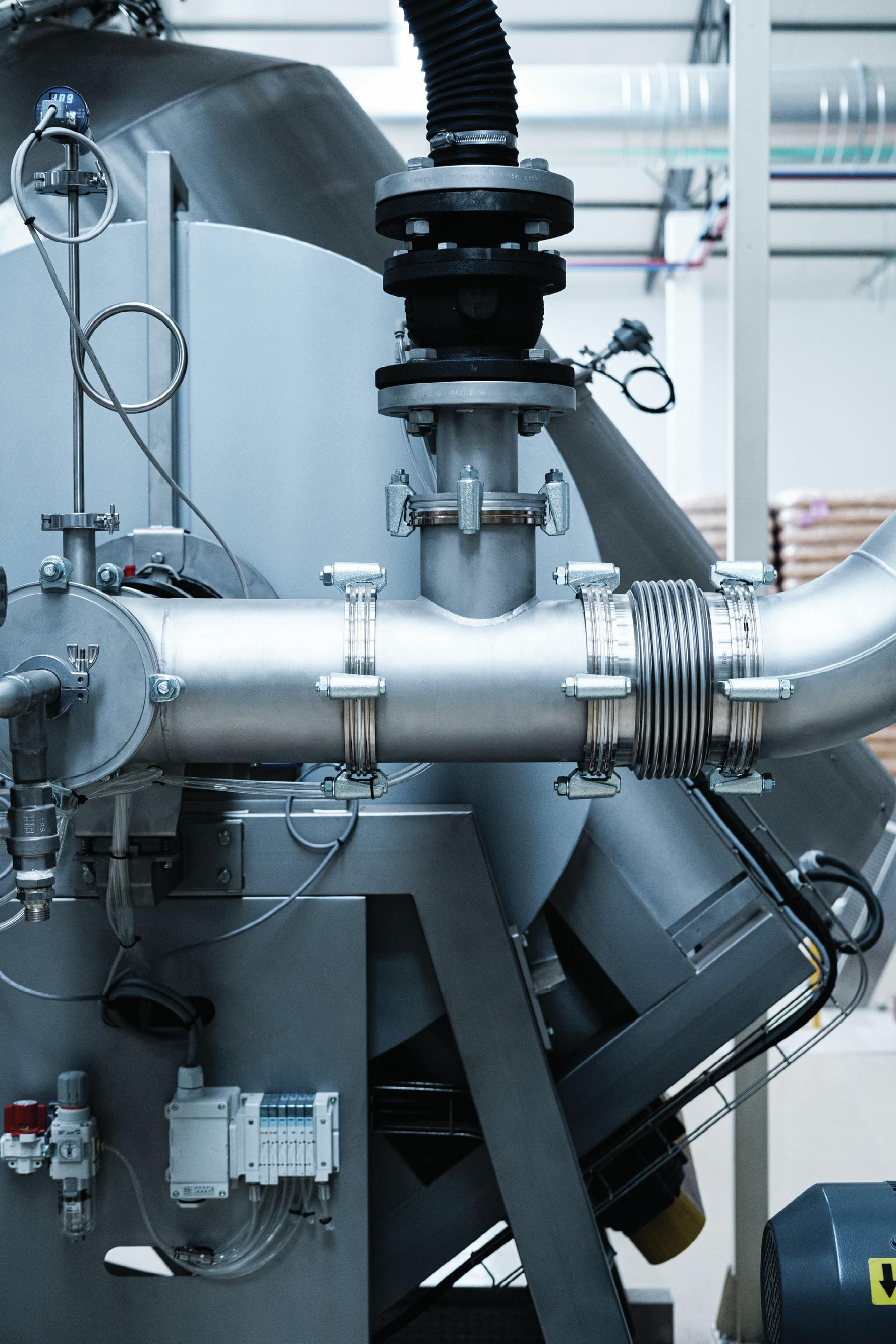

“The study revealed that a single cork stopper can offset the carbon footprint of a glass bottle, as a packaging component,” says Silva. “We have a responsibility to share with our stakeholders the carbon footprint that comes from industrial activities, which reflects on their final product. So we are committed to reducing our fossil-energy consumption by 60% before 2028, in all four of our industrial units in Portugal. The company already has three biomass boilers installed, which run on cork powder that comes out from the stopperproduction units – this means that the sustainable principle of circular economy is fully applied.”

“We agree that cork is an eco-friendly material, but despite its sustainability, cork also involves a great deal of water used during its manufacture,” responds Giorgia Giubilato, marketing specialist at Tapì. “This is why Tapì has come up with several other sustainable solutions such as NEOS Technology, an innovative system that reduces a product’s carbon footprint by using polymers derived from renewable sources.”

Meanwhile, Astro has developed an innovative printing-and-drying system using special lamps – this affords a 75% reduction in emissions, according to the firm.

‘The wine-loss rate induced by a type of closure is more important than the closure material in gauging the environmental footprint of a bottle of wine’

Bertrand Daru, sustainability and strategic development director at Amcor Capsules, advances the discussion.

“According to a study led by [environmental sustainability consultancy] Quantis, the closure itself only represents between 0.001% to 3% of the total score for a bottle of wine. The wine-loss rate induced by a type of closure is more important than the closure material in gauging the environmental footprint of a bottle of wine,” he says.

“In 2020, the Cork Quality Council estimated that 3% of the corks it tested each year are contaminated by TCA. Furthermore, we have to consider that recyclable doesn’t mean that the product is indeed recycled. Aluminium is one of the most recycled materials in the world. Over the past few years, Amcor has been working on using more recycled content in our screwcaps, and we continue to pursue our goals.”

Yet while all sectors have made enormous progress in recycling and carbon sequestration, the reliance (albeit diminishing) on plastic remains the big elephant in the room. In 2018, the European Parliament voted for a complete ban on a range of single-use plastics throughout the union, in a bid to stop pollution of the oceans. Nonetheless, certain agglomerate and screwcap brands still contain plastic; agglomerate cork can contain up to 25% of artificial resins, used to stick cork granules together into a stopper shape. Moreover, although aluminium is indeed recyclable, massmarket closures often use polyvinylidene chloride (PVDC) in the barrier layer. PVDC contains chlorine, making it more cumbersome and expensive to recycle.

Various solutions have been proposed in response to the plastic problem, designed to offer customers green solutions and close the sustainable gap between cork and its rivals. Investment in bioplastics has become a major driving force of R&D: they are fully biodegradable, but not recyclable. Several years ago, Amcor launched a range of PVDC-free liners called Stelvin Inside. In 2019, Guala Closures unveiled Greencap – arevolutionary seal that allows consumers to fully separate the closure from the bottle neck. The closure incorporates 100% aluminium, as plastic has been removed from the manufacturing process involved in creating the cover for the bottle neck. There is no shortage of innovation from the industry’s key players.

Meanwhile, Isabelle Gruard, Sparflex’s group marketing director, says: “Sparflex offers different sustainable solutions, such as our Absolute Green Line technology. This is a generation of foils and still wine polylaminate capsules produced with biobased polyethylene made from sugar cane and water-based ink, some renewable resources that replace oil and solvents used for standard capsules and foils.

“We have two new product launches coming up in November, both related to the circular economy, which use recycled materials. They will be available for foils and capsules.”

Tapì’s Giubilato adds: “Nearly two years ago now, we introduced NEOS Technology into our green range.

“The goal for each year is to keep increasing the biopolymer component within each closure, eliminating the use of polymers from non-renewable sources as much as possible.”

But while this investment into ecofriendly polymers is laudable, inflation and supply chain pressures could affect R&D budgets in the coming years. The innovation-driven growth model is dependant on ready and affordable credit. Unfortunately, many economists fear that interest rate hikes are inevitable.

“Amcor has been impacted by the current situation. Most suppliers were faced with disruption which led to delays and soaring costs,” explains Amcor ’s managing director, Yannick Magnon.

“Furthermore, the transport flows, and especially the sea freight that was requisitioned to cope with the demand of households and other industries, almost quadrupled in price.

“The rapid inflation has significantly increased all our costs, including important raw materials such as aluminium (but not exclusively), putting us in a position of asking our customers to help shoulder the burden of this unexpected situation.”

Nuno Silva expands on the theme. “MASilva encountered some heavy constraints due to inflation: energy prices doubled and, in some cases, transport costs increased by four times,” he says.

“International catastrophes such as climate change, war, and raw material shortages are all influencing corporate management strategies. Countries and individuals are obligated to adapt. We are no exception.” For many years, healthy competition between closure firms has kept sustainability at the heart of key business decisions. Whether this momentum can be maintained in the current context is now open to debate. Moreover, as Sparflex’s Gruard underlines, manufacturers have to balance sustainability against client satisfaction. “We are focused on having the best possible impact on sustainability, while keeping the technical performance and quality that our customers demand. The alternative for PVC, PET+, is a good example. The PET+ capsule contains 20% recycled content, and has a good recyclability, so we are able to reduce our carbon footprint by 25%,” she says.

Can we predict what lies ahead for the closures industry? There are at least two possible scenarios. One involves using research and development to augment manufacturing efficiency, and fight rampant inflation.

“A major part of our response has been to speed up the implementation of different efficiency initiatives, with a growing support from AI-based technologies, especially on the shop floor,” says de Jesus.

“The more corks we produce, the more zero-emission cork dust biomass is available to us. We now top a full 66% of energy needs being met this way. a “We are working hard, every day, to minimise the impact upon our customers but, eventually, there is no escape from what is a global phenomenon.”

Future investment in sustainability projects will be given intense oversight, to ensure they merit the expense and deliver ample environmental rewards.

Dominique Tourneix, chief executive officer at the Oeneo Group, has long argued for a rigorous analysis of the benefits of various strands of the sustainability matrix – not least recycling. “I have the feeling that, sometimes, we are facing in the field of sustainability communication what I call ‘environmental imposture’,” said Tourneix. “Do we ever see a carbonfootprint evaluation of the collection processes required to recycle products? What is worth doing for heavy packaging like glass – implementing a specific collection stream – may not warrant the same effort for light packaging. Has anyone compared the actual environmental impact between specific flow chains and a common one where plastic packaging can be collected with other streams?”

Tourneix advocates a transparent and measured approach to sustainability, grounded in an evidence-led metric, which should heighten consumer trust and engagement. That is something that all closure firms, regardless of their respective green credentials, can rally behind in a capricious age. db

The fight against fraud

According to Maureen Downey, one of the world’s leading experts on counterfeit labels, fraud costs the wine industry around US$3 billion (£2.5bn) per year. Fortunately, the closures industry is helping producers – and consumers – to fight back. The development of sophisticated anti-counterfeiting technology has been made a top priority by screwcap and cork manufacturers. “For still wines and spirits, we have different anti-counterfeiting solutions at Sparflex, such as the use of special coded inks,” says Isabelle Gruard. “It involves using a smaller screwcap (15mm instead of 60mm high) in combination with a PET+ heat-shrinking capsule to seal the screwcap, and thereby avoid any counterfeiting.”

She adds: “For sparkling wines, the notion of traceability remains central as well. Therefore, in partnership with the brand-protection leader Advanced Track and Trace and the SGV (Champagne Winegrowers’ Union), we developed the CLOE foil – an intelligent foil that allows the winemaker to ensure the total traceability of their bottles and to protect them against counterfeiting.”

The foil relies on a combination of unique identifiable elements on the inside and outside of the material: unit serial number, QR code, and a high-security hologram.

Amcor has also pioneered several innovations to fight wine-and-spirits fraud. “For beverages sealed under screwcap, Amcor developed Impressions, our latest innovation. This is a technology developed in collaboration with the Selig Group that enables brands to customise closure liners,” says Catherine Fontinha, product marketing director.

According to Fontinha, the CMYK colour printing technology allows brands to print anything from QR codes to colourful logos, for direct and digital engagement with consumers. “As the printed liner is only accessible when a customer has already bought and opened the product, it makes it a formidable traceability-andauthentication tool,” she says. “Indeed, it is also possible to print micro-impressions on your liner that enables the authentication of the bottle.”

Meanwhile, Tapì has launched a product that aims to fight fraud head on. It is called TEMA –Tamper Evident Monoblocco – or the ‘belt’ closure. “This is a plastic belt applied to the closure,” explains Giorgia Giubilato. “This belt guarantees the product is perfectly sealed, resolving the all-too-common issue of counterfeited and forged goods. In essence, the belt must be removed to consume the product.”

However, Carlos de Jesus believes that “when you produce natural corks for some of the world’s most prestigious wines and spirits, a key part of this is to have a ‘Fort Knox approach’ to the security of the supply chain.” He emphasises that the distribution model is based on a direct relationship between Amorim and the client, so “they know exactly who is ordering what, when and where”.

In addition, Amorim is now able to incorporate NFC technology, (near-field communication, a method of wireless data transfer), especially for its spirits closures, to interface with smartphones. “We also have physical-alteration capabilities integrated with some of our products that do not necessarily rely on electronic communications to provide protection against counterfeiting,” he says.

Related news

Niepoort adopts Legacy cork by Cork Supply