Fine wine investment: core principals

We receive quite a lot of feedback to these weekly market reports most of which is complimentary but there are occasional criticisms and even the odd insult which always seems a peculiar way to respond to people who are trying to help.

Let us therefore be very clear: at Amphora Portfolio Management we are not desperate to get people to invest in fine wine. All we are trying to do is demystify the process whereby people can make money out of the temporary ownership of this tradeable good.

Undeniably many people have entered this market place over the years and come a cropper, so there can be little argument that there is a requirement for clarity over certain key steps, which we will touch on shortly. What is odd is that investment in fine wine seems to attract a degree of opprobrium from certain quarters entirely absent from investing in other “passion investments” like art, classic cars, stamps and coins, and so on.

Criticism often comes from misunderstanding, which is fine and simpler to clarify. Indignation though, in this context, seems to stem not from misrepresentation, which we at Amphora are indignant about too, but from people having the temerity to try and make money by understanding certain aspects of the market place better than other people. Yet that seems to us to be fine. In fact, not only is it fine, but it is the way every market place in the world works, whereby two parties quite comfortably occupy opposite sides of the same trade.

We have also noted that some people seem to take the position that wine is meant to be drunk, rather than traded, and it is the trading of it that makes it so expensive. This, as Baldrick might have said, is “gobbleaduke”. Quite simply, fine wine is more expensive than it used to be because the market for it has broadened out so much. If you have 100 people wanting something its price will not be so high as if you have 1,000 chasing it.

There are doubtless many things it is worthwhile trying to get in the way of, but human nature is not one of them. Personally I abhor the ubiquity of gambling companies sponsoring everything under the sun, but no amount of online ranting is going to stop it happening and who cares what I think anyway? Thus you get Ray Winstone telling everyone that he gambles “responsibly”.

This brings us back to the “certain key steps”. People are going to invest in fine wine whether people moan about it or not, and it is Amphora’s mission to help people do it responsibly. Some key principles are:

- Make sure you are buying at the right price.

- Make sure you know how you can redeem it when you want to exit the market.

- Make sure you do unequivocally OWN it while you think you own it. (i.e. have full title to the wine)

- Make sure you know how and where it is going to be stored while it is yours.

We don’t believe any of these are arguable. What everyone is at liberty to argue about is the advice, and there you pay your money and make your choice.

Partner Content

One of the core principles at the heart of our messages concerns secondary market liquidity, the relevant maxim being: “if you can’t sell it, it is not an investment”. For this reason we tend to populate most portfolios with wines which are no older than 20 years or so, and when we recommend wines produced in very limited quantities we acknowledge the impact on the risk profile of the portfolio.

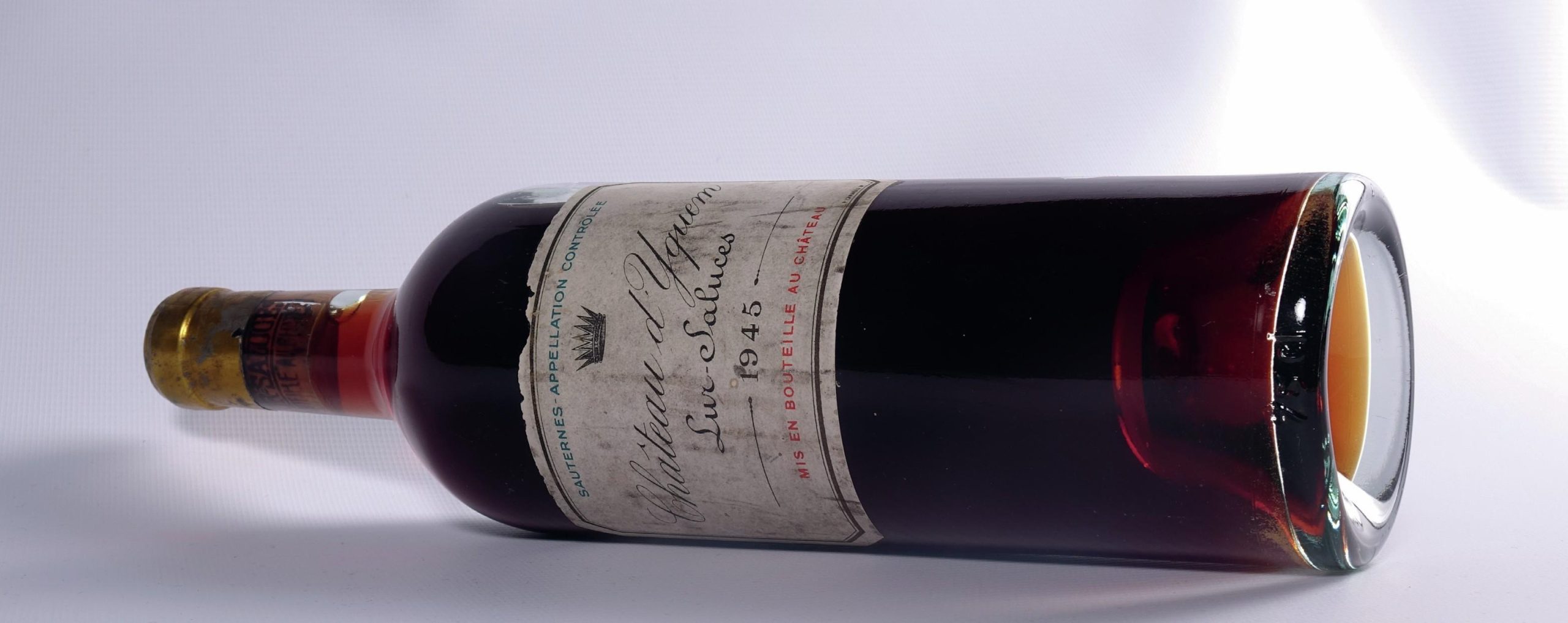

It is with interest therefore that we noticed the drinks business article last week about the 1951 Penfolds Grange auction. The reality is that as wines age they become scarcer, as they get consumed, obviously, and when this happens the secondary market is compromised. As supply to the market diminishes pricing becomes more irregular, more akin to the fine art market, where the ultimate determination is no more nor less than what any buyer is willing to pay on any given day.

This captures the difference between the investor and the collector in the fine wine market. The investor’s sole aim is to make money; the collector has other objectives, and for him or her ownership of something rare, exotic, and therefore difficult to price accurately may increase its attraction. The prospect of being the last person on earth to own a case of the 100 point-scoring 1961 Haut Brion might well entice a collector to part with a significant wedge but it would be unwise to base an investment strategy on it.

Even if you are a collector rather than an investor, you still owe it to yourself to try and buy your wines at the cheapest possible price. There are occasions when auctions fit the bill, usually when dealing in the very wines just mentioned, or when Sir Alex Ferguson sells wines whose labels he has personally signed. When wines are younger, though, you are usually better off accessing directly out of the market place. Again, this is where a company like Amphora can usually help.

Philip Staveley is head of research at Amphora Portfolio Management. After a career in the City running emerging markets businesses for such investment banks as Merrill Lynch and Deutsche Bank he now heads up the fine wine investment research proposition with Amphora

Many thanks Philip, I always enjoy reading your weekly column, which is written with that great combination of French elan and British common sense. Keep up the good work!