Fine wine investment: the road ahead

An important thing to note about investing is that over the longer term, as short term trends are unwound, many sectors tend to polarise towards the same spot. It is a bit like going from London to Edinburgh: the start and end points may be the same, but there are many different routes you can take to get there.

If you are a younger person you will likely be advised to overweight your pension plan with equities. This is because, although the journey may be volatile and actually quite uncomfortable from time to time, longer term returns from equities are higher than most of the other mainstream alternatives (bonds, cash and so on), and if time is your friend you are advised to try and ignore short term concerns for the greater long term good.

That is all well and good, but a whole investment industry exists to try and allow investors to take advantage of the short term vacillations, because if you are successful you can engineer even higher returns than those offered by the indices. Amphora Portfolio Management sees its mission as trying to enable fine wine investors to do just that.

The Liv-ex Fine Wine 1000 is the broadest index available, and while we have been at pains to highlight sectoral outperformance within it from time to time, as you can see from this chart, there is little to choose over the long term between it and the Bordeaux 500. It is when you drill down into the Bordeaux 500 that things get interesting.

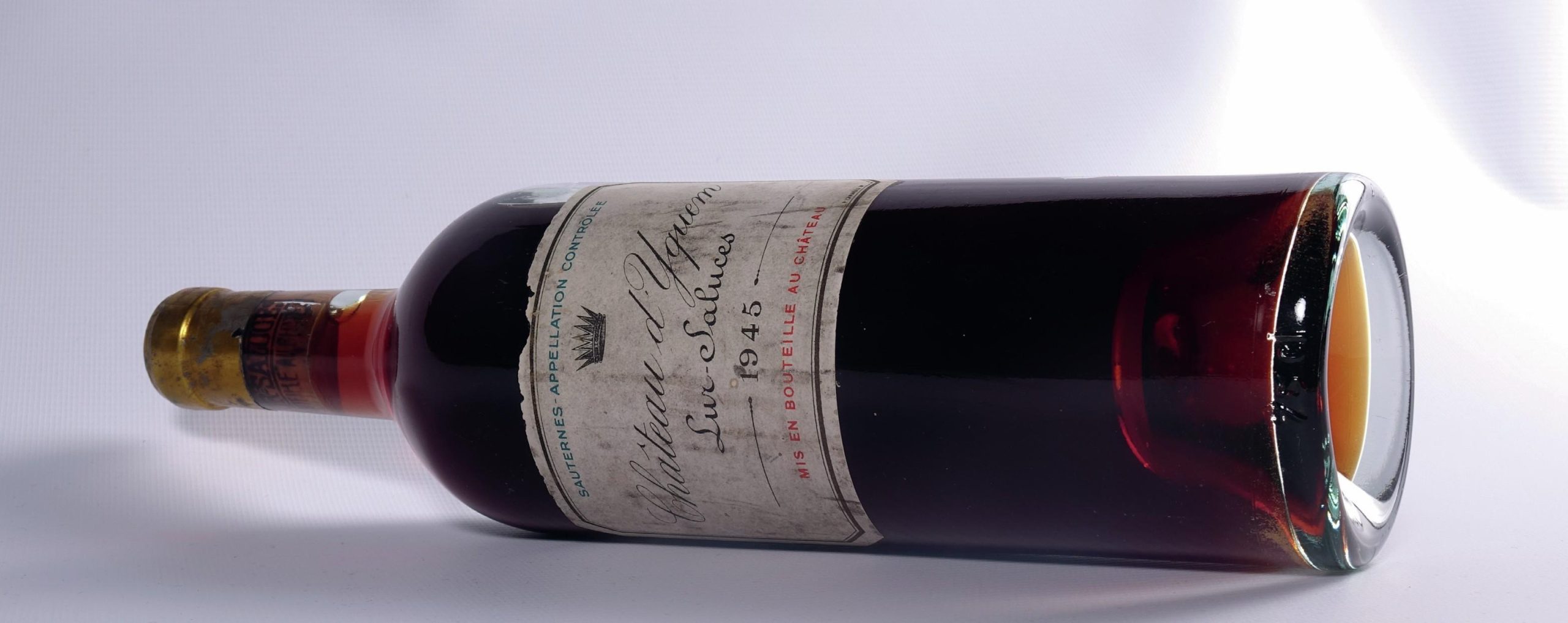

A broad index is a composition of smaller sub-indices, and from this chart you can see why people spend a bit of time trying to figure out which sub-indices they should overweight. If your portfolio is full of Yquem you have lost out in investment terms to the Second Wines by a margin of 700%. If you’d bought the index (in practice you can’t, but it is worth mentioning that in mainstream markets active managers are under increasing pressure to match, let alone beat the benchmarks), you would have multiplied your investment by about three, whereas had you bought the Second wines sub-index you would have more than doubled that.

The degree of Second wines outperformance on this chart is striking. The 2008 correction was pretty muted and while we often talk about the performance of the first growths in the run up to 2011, the Second wines clearly carried the day. Why might that have been? We know that the market at that point was driven by the Chinese “red obsession”, and it seems likely that the combination of first growth name and Super Second price was the driving force.

It isn’t as simple as being “all about price” though. The second best performance came from the blue chip (and expensive) Liv-ex 50 constituents, and the third, also ahead of the benchmark, was the Right Bank 50. This is interesting because it is made up of Ausone, Cheval Blanc (both theoretical underperformers), Lafleur, Petrus and Le Pin, so hardly the cheap end of the market.

Post correction, in the period from mid 2011 to the end of 2016, we see this picture:

Partner Content

Well it’s not quite all about the Right Bank but from a Bordeaux perspective that was the optimal place to be. The Right Bank 100 is obviously everything else on the Right Bank bar the Right Bank 50 constituents listed above, but crucially in this case, includes Angelus and Pavie. Angelus and Pavie were elevated to ‘Grand Cru Classé A’ status in September 2012 and as you can see from the chart that’s exactly when the green line pops above the 100 parapet.

Other things to point out are that this phase seems to act as a reaction to the earlier rally, in so far as the underperformers are the outperformers from pre June 2011: the Liv-ex 50 and the Second wines. This seems only to be expected.

Finally we look at the relative performances in the narrower focus of the current rally. Interestingly enough it looks broadly familiar. Second wines way ahead and Sauternes way behind. Homing in though we also notice that all the outperformers are on the Left Bank, although the Liv-ex 50 and the Left Bank 200 (largely the Super Seconds) are only a tad ahead of the game. It is also reasonable to suggest that the Right Bank underperformance in this phase, however marginal, partly reflects their outperformance in the consolidation phase (July 2011 – January 2015).

The conclusions we can draw from this are that perhaps the fine wine investment market may be somewhat more dynamic that people give it credit for. At Amphora we certainly maintain that an investment in fine wine is not a short term punt. Investors should consider operating on a five year view or more, but within the context of that everyone should be alive to what is going on, on a quarterly basis at least. Then you can switch in accordance with the way the various winds in the market place are blowing, thus targeting the highest possible investment return.

If you haven’t been keeping as close an eye on your portfolio, very probably it is not worth what you thought it was. It may well be worth considerably more! Consider getting it audited, a service Amphora happily offers.

Philip Staveley is head of research at Amphora Portfolio Management. After a career in the City running emerging markets businesses for such investment banks as Merrill Lynch and Deutsche Bank he now heads up the fine wine investment research proposition with Amphora.