Fine wine in 2025: a game of two halves?

After a rollercoaster 2025 for fine wine, the outlook today is more positive. But what will happen in 2026?

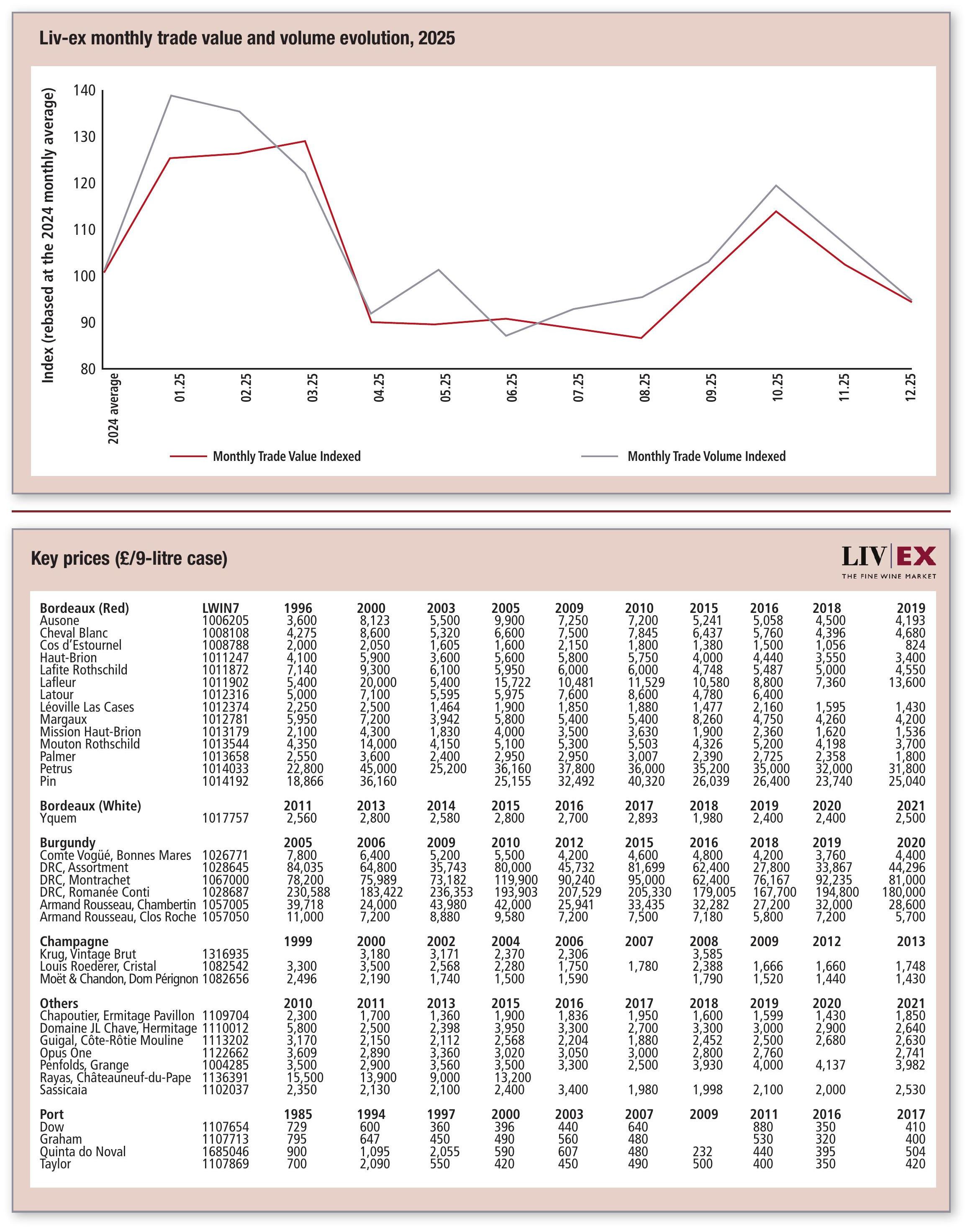

It took three years for the major Liv-ex indices to rise, but in September they finally did. They have since continued to find stability, giving the fine wine market a degree of optimism at the start of the year. Before looking ahead to 2026, a recap of the full 2025 fine wine market performance.

H1 Turbulence

After 2024’s consistent downward grind, 2025 started on a more positive note – trade value and volumes rose in the first two months, signs perhaps that the stock clear-out was well and truly under way. Then, on 13 March, US President Donald Trump threatened 200% tariffs on EU alcohol, a gut punch that winded the market. With 2 April’s ‘Liberation Day’ confirming tariffs on European wine at 15%, US buyers withdrew. This posed a problem to the fragile fine wine market. The results were immediate – April saw the Liv-ex indices post their biggest losses since 2023, with regions like Champagne and Italy, which had benefitted from consistent US demand, looking particularly vulnerable. After a Bordeaux en primeur campaign that saw even those producers who appeared to have priced sufficiently low find that collectors had lost interest, the market entered the summer lull.

H2 Optimism

However, as merchants returned from the break, some positive signs started to emerge. Bid:offer ratios – a barometer of market sentiment and a reliable indicator of future price movements – started to rise. Prices in turn followed suit, with major indices rising for three consecutive months from September. Trade value and volumes also rose in September and October, before falling back slightly in November and again in December as merchants closed for the Christmas break. The result of all this is that total trade value is down 5.8% on 2024. On the other hand, trade volumes were 7.2% above 2024.

What might 2026 have in store?

This time last year the outlook was bleak. We knew tariffs were likely and we knew prices had further to fall. What would happen if the US market withdrew? Would the Asian market remain stuck in the doldrums? Would the UK and European markets take up the slack? Twelve months on, the outlook is more positive. While we are at the very start of the recovery, we now know the answers to some of those questions. Tariffs, while not welcome, have not been disastrous for the secondary market as a whole (US buyers will of course be feeling the strain). Prices have fallen, but look to be stabilising, particularly at the top end. The Asian market is showing green shoots. The European market has stepped up, and looks set to continue to do so into next year.

What might the stumbling blocks be?

Partner Content

A small Burgundy 2024 crop was released in January. We expect prices to be held roughly where they were for the 2023 campaign, which itself was not a roaring success. As merchants reset at the start of the year, this could be an unwelcome challenge to overcome. The very promising (if somewhat heat- and drought-reduced) 2025 Bordeaux vintage will have to be released at prices that excite. Wines will need to be offered to end consumers at below the Market Price of comparable back vintages. Should stability continue to return in the first quarter, then an enticing en primeur campaign might kick the recovery up a gear.

How might the outlook turn positive?

The US trade continues to lobby for wine to be excluded from tariffs. While US merchants will naturally have to continue to import European wine when stocks dwindle (or shut up shop), all the time tariffs are in play US demand will continue to be muted. A clear argument would be that if the lobbying efforts are successful and a true unlocking of US demand were to join increased European and Asian demand, then we would see the market decisively turn the corner.

fine wine monitor – in association with

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It gives access to £100m-worth of wine and the ability to trade with more than 620 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

The highlights of the hors Bordeaux 2026 Spring collection

Santiago Marone Cinzano: 'my generation wants wines that are ready to drink'

Raise a glass to Cabernet excellence: enter The Global Cabernet Sauvignon Masters 2026