How important are UK buyers to the secondary market?

UK buyers may account for a smaller share of Liv-ex trading today, but their influence is still felt in pricing and market trends.

Though influenced by the international diversification of Liv-ex’s member base, UK buyers do appear to have lost some of the dominance they previously held over the secondary market.

In 2005, 74% of buyers hailed from the UK, accounting for 76% of purchasing (by volume). By 2010, they made up 56% of buyers and accounted for 55% of purchased volume. With the release of the 2009 and 2010 Bordeaux vintages capturing the attention of not only Asian buyers, but also UK buyers (historically Bordeaux’s largest export target), their share rose once again.

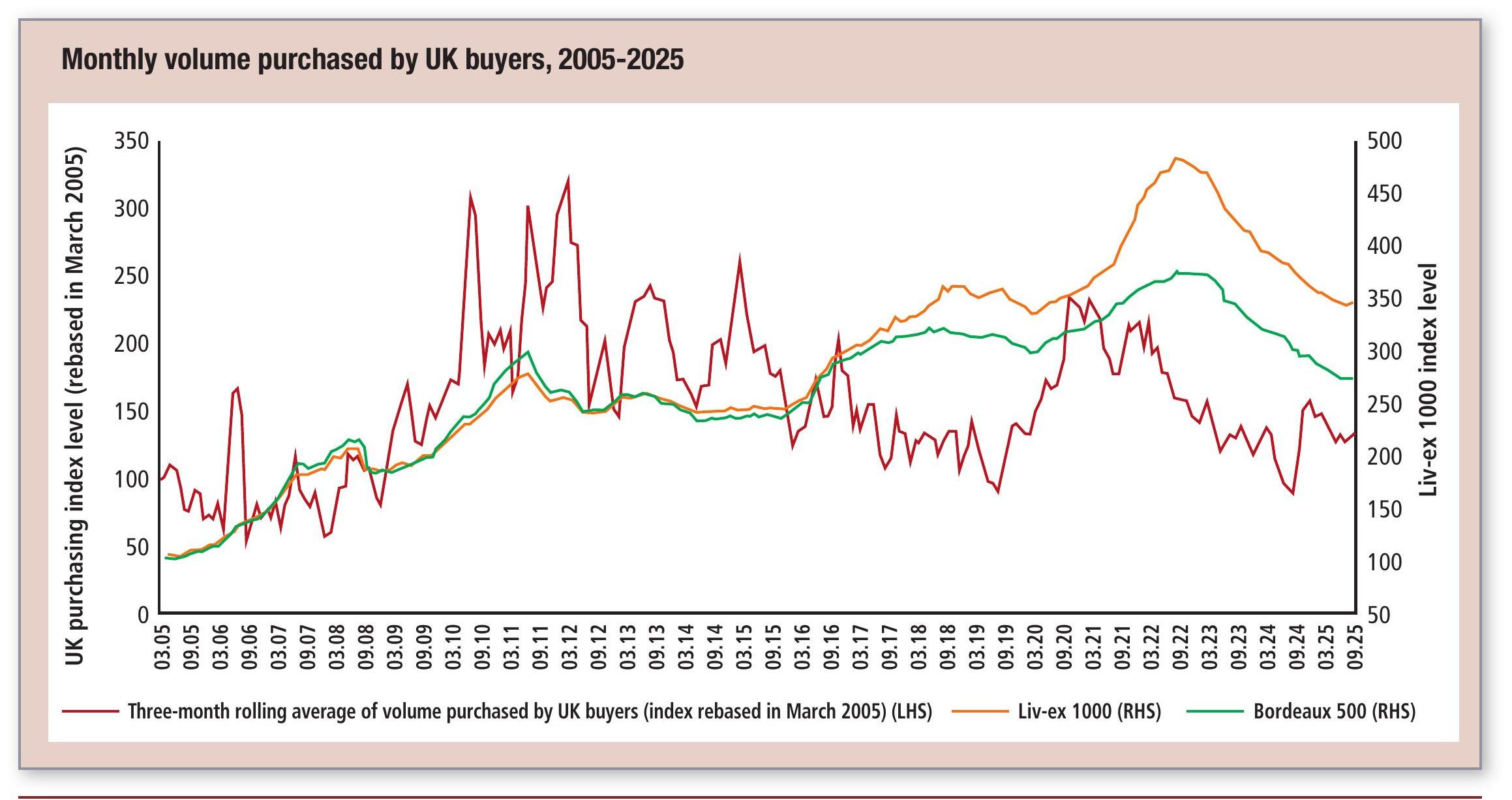

Disillusionment with en primeur pricing and, as a by-product, Bordeaux, set in quickly; a drop in trade levels followed. UK buyers have consistently maintained an approximate 30% share of traded volume over the past decade. Considering monthly purchasing (by volume) alongside the Liv-ex 1000 reveals a relationship between volumes purchased by UK buyers and price levels. Intuitively, when prices are driven down to levels where buyers see value, trade volumes rise.

The Liv-ex 1000 index is the broadest measure of the market; the strengthening of this relationship shows that, while UK buyers have ceded some of their market share, they have become more influential over a broader range of regions as their purchasing has diversified.

In 2020, for example, the Bordeaux 500 underperformed relative to the Liv-ex 1000. Where the uptick in UK purchasing in 2010 benefitted Bordeaux above other regions, the uptick in 2020 benefitted those other regions more than Bordeaux.

Until 2018, Bordeaux consistently comprised more than 50% of UK buyers’ annual purchasing. Since then, its share has declined, settling at around 30%, and generally neck-and-neck with Burgundy.

Which wines do UK buyers favour?

While Petrus and Château Lafite Rothschild are the top-traded wines of the year among UK buyers, Screaming Eagle’s Oakville Cabernet Sauvignon has superseded Château Mouton Rothschild to take third place, and Louis

Roederer’s Cristal has claimed fifth. Sassicaia and Domaine de la Romanée-Conti’s La Romanée Conti follow not far behind in sixth and seventh positions.

By 2015, first growths had been displaced by a broader range of Bordeaux’s heavy hitters and, by 2020, by wines from California, as well as Burgundy and Barolo. Bordeaux may once have dominated the UK’s fine wine market; it now shares its stage with other regions.

fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It gives access to £100m-worth of wine and the ability to trade with more than 620 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Garcés Silva: fresh thinking from Leyda

Christie's to sell Burgundies from renowned British collector Ian Mill KC