Deep freeze: which brands thawed an icy fine wine market this year?

In a frosty trading climate, wine brands which adopted a considered approach to price increases fared best, according to this detailed Power 100 report compiled by Liv-ex.

While some may have been cautiously optimistic at the close of 2024, this year has not been as kind to fine wine as they might have hoped. We may have endured a gruelling 2024, but 2025 cut even closer to the bone. The continuation of the downturn, another unsuccessful en primeur campaign and the withdrawal of US buyers had a harsh impact on prices and, in turn, on businesses.

The summer progressed, and a mood of hopelessness took hold as prices continued to fall. What began as dejection, however, transformed into acceptance, and later into curiosity. Rising bid:offer ratios made it clear that these new, lower prices were indeed beginning to appeal.

Last year, the questions on everyone’s lips were: “Are we reaching the bottom?” and: “How much further can the market fall?” (Answers: “No” and: “Until prices reach a point to clear out an excess of stock.”) As we moved into the third quarter of 2025, however, a greater sense of agency emerged. The line of questioning shifted from: “When will it end?” into: “What should I be buying right now?” Yes, there remains excess stock, but there is greater confidence that it will clear, and hope that profitable opportunities lie ahead.

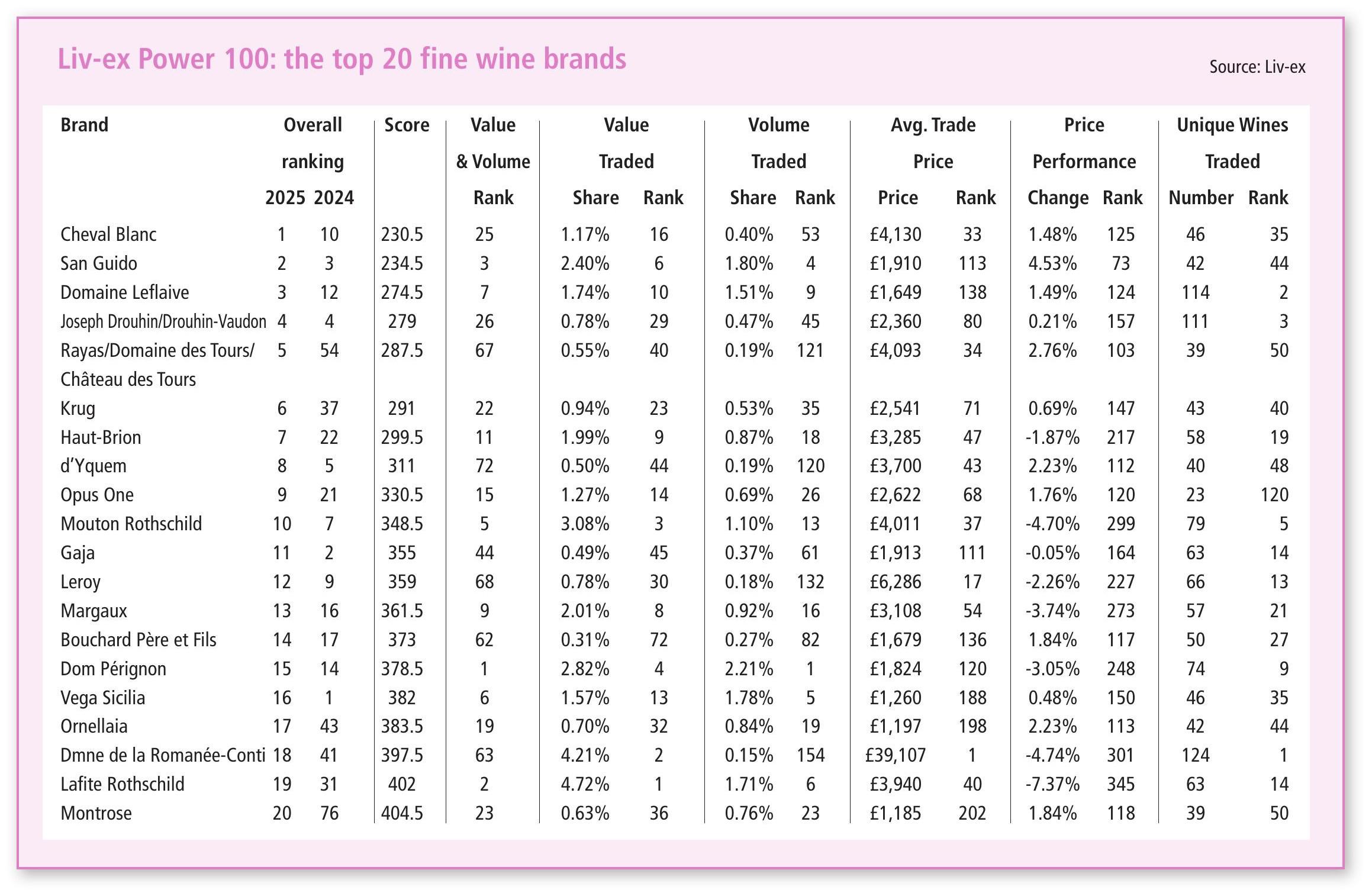

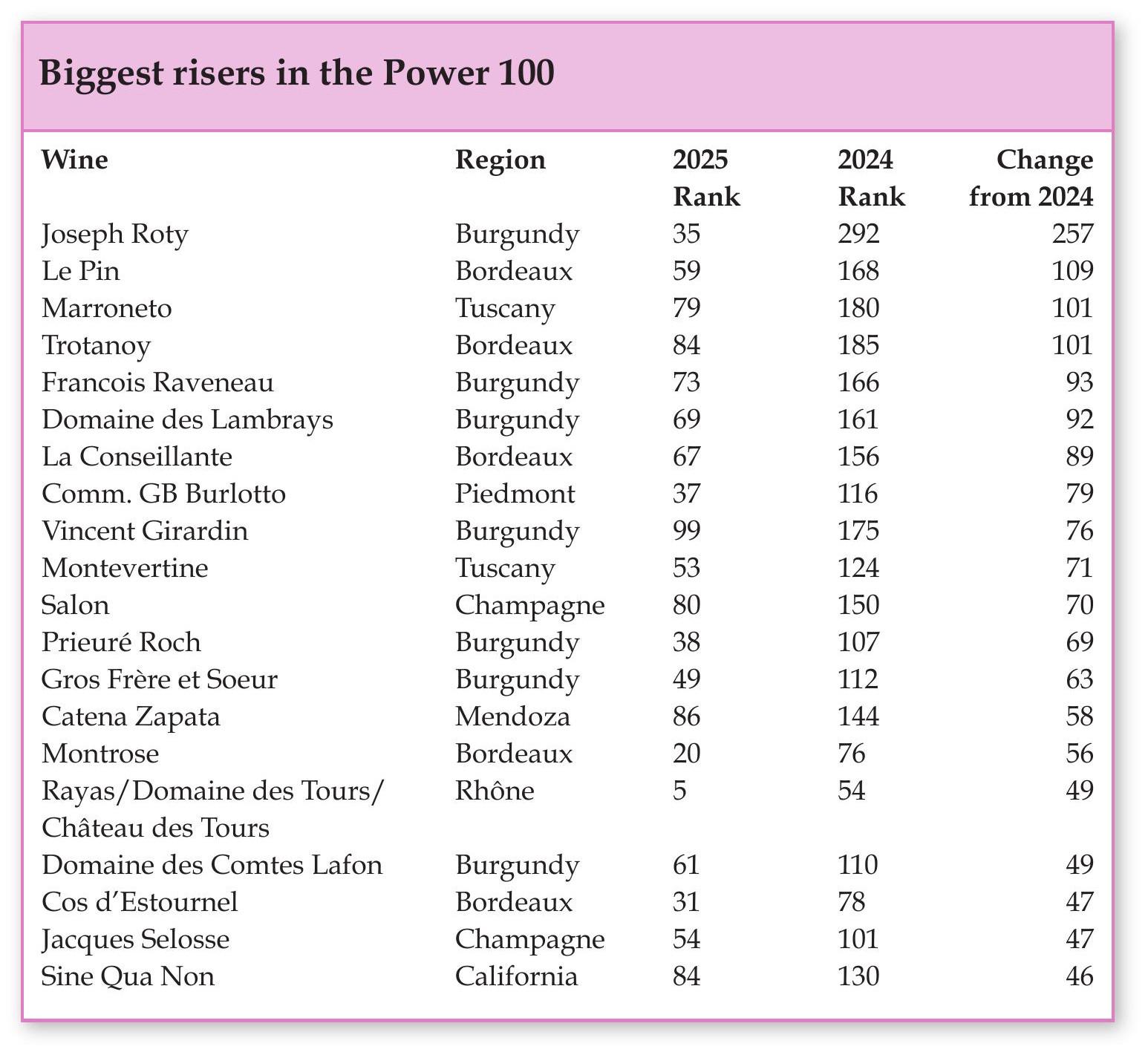

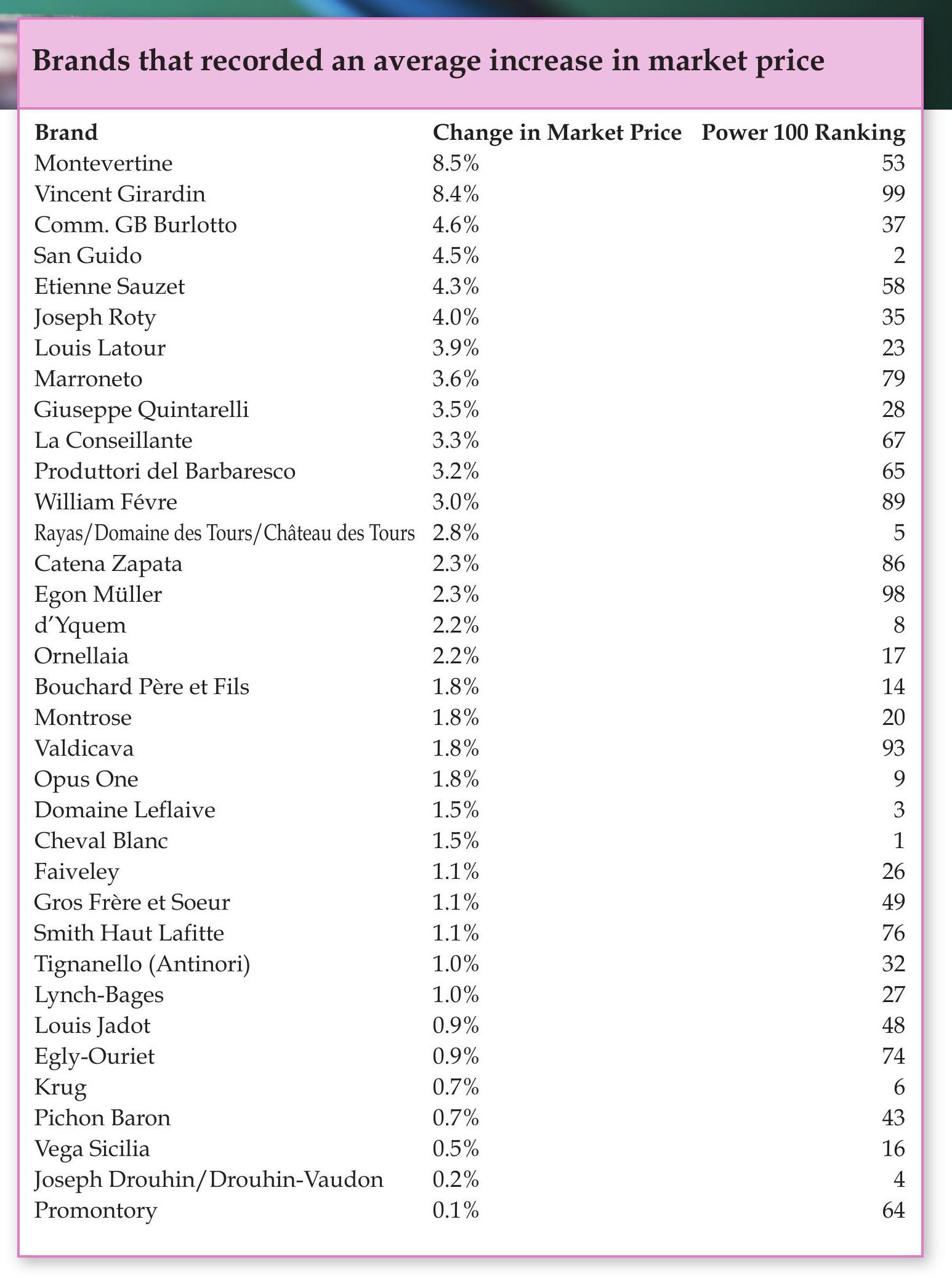

While two consecutive months of rises in Liv-ex’s key indices (in September and October) have provided the market with some respite and cause for optimism, the year has been a rocky one. Last year, only 11 brands in the Power 100 saw their prices increase on average. This year, 35 did. Where last year active trade alone was enough to secure a place among the top brands in the market, this year’s top performers overwhelmingly comprise wines that make sense to buyers – reasonable pricing, good liquidity and strong brand reputation all played key roles.

Bordeaux: a question of pricing

Cheval Blanc moved up nine places to claim the top spot as the year’s number one brand in the secondary market. It has not been immune to the downturn of the market – like almost all Bordeaux wines distributed en primeur via La Place, it has faced declines post-release.

But, through the past few campaigns, where other brands had taken advantage of better market conditions and found themselves in difficult positions when the market turned, Cheval Blanc implemented a more structured and consistent approach to their pricing. This has served the brand not only in its price performance, but in building its strong reputation for quality and relative value. Yquem provides another example of how fair pricing can positively impact a brand. While falling from fifth to eighth place, to feature among the top 10 – especially given weak demand for sweet wines in recent years – is a testament to the loyalty it has gained over time.

Raising release prices might provide temporary gain, but the market rewards consistency and trustworthiness in the longer term.

La Conseillante’s impressive performance this year (up 89 places) can be tracked back to similar reasons. The château has been tempered in its approach to release pricing, continuing to provide the draw that Bordeaux was once well-known for – exceptional quality in decent volumes at prices that lend themselves to drinking.

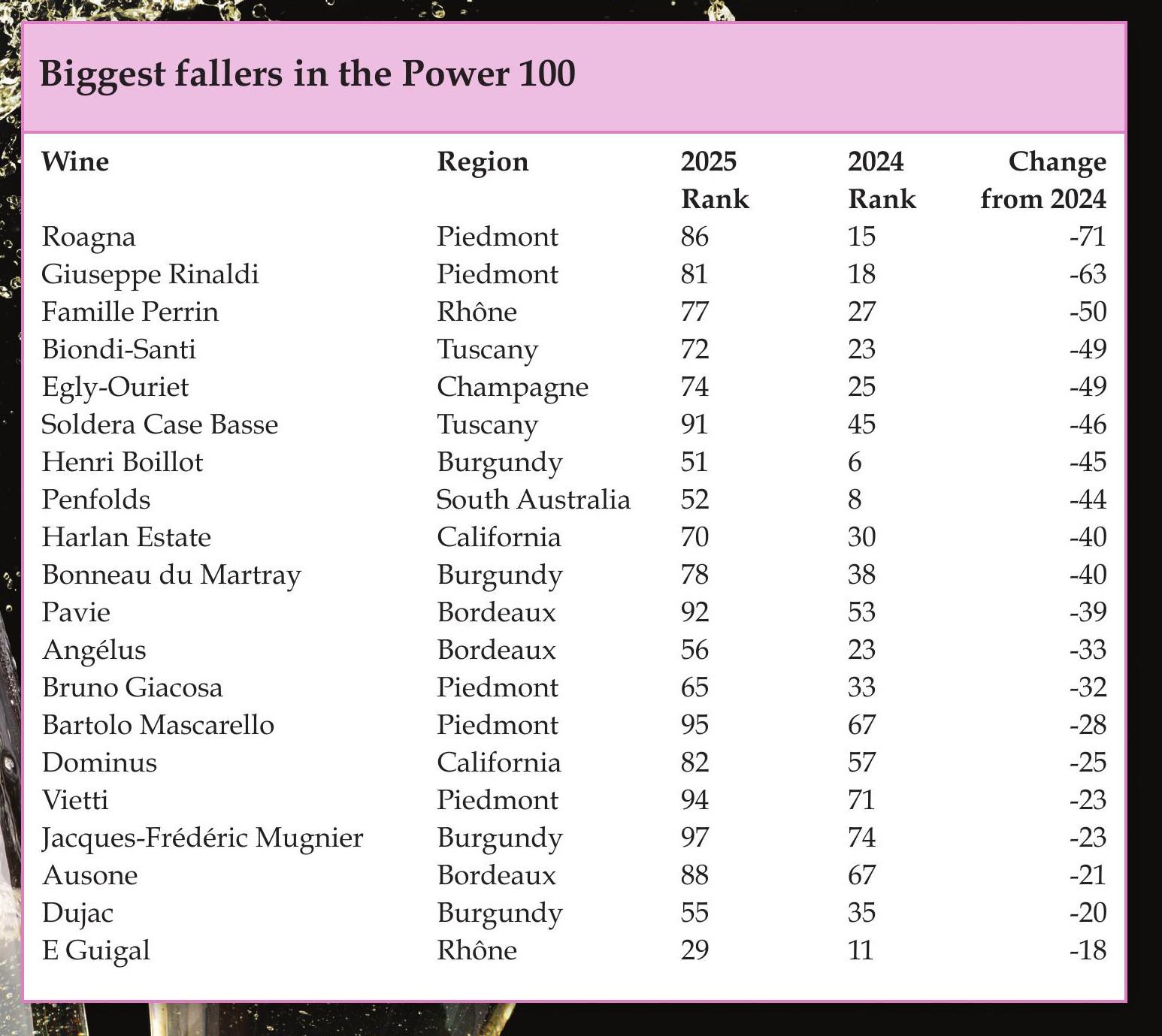

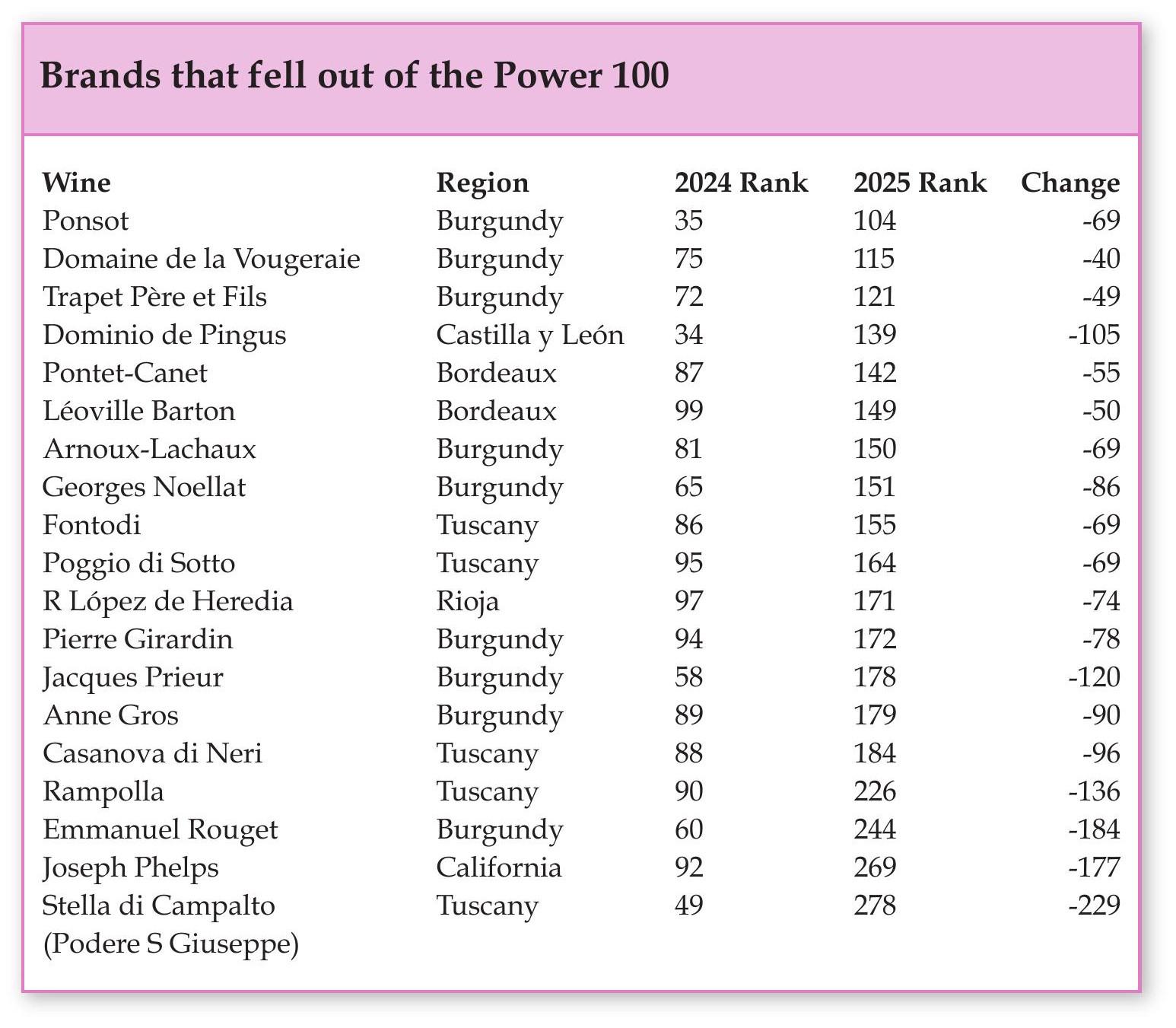

Pontet-Canet and Léoville Barton, both suffering the effects of over-ambitious release pricing, fell from the top 100. Pavie and Angélus, both of which were reclassified as Premier Grand Cru Classé A in 2012 and which, in turn, raised their prices, remained within the ranks but dropped several positions.

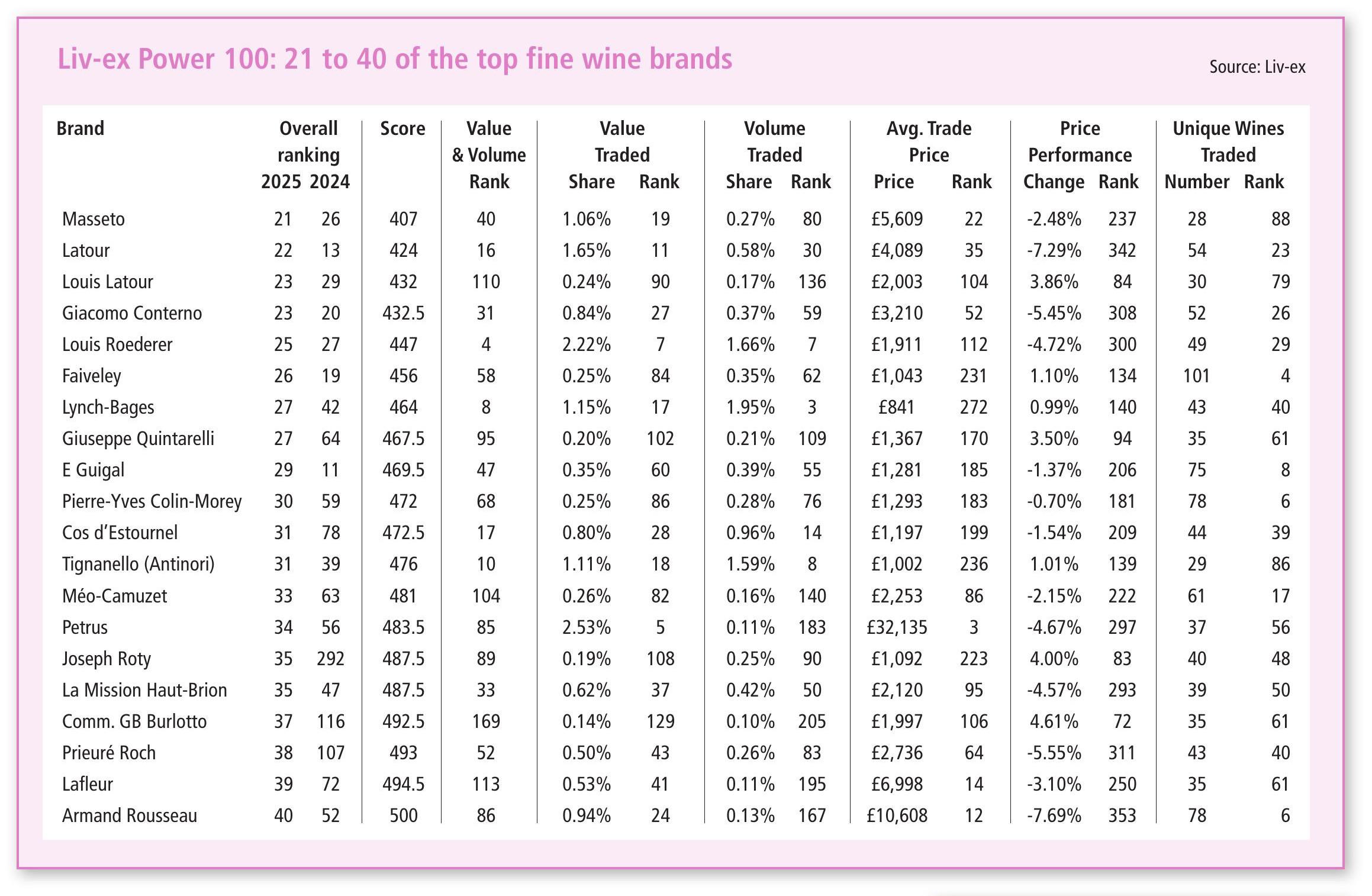

Pomerol’s most tightly allocated wines – Petrus, Le Pin and Lafleur – all climbed the ranks in 2025. This was not as a result of their price performance – all three continued to see declines – but instead of greater trade volumes and value.

Haut-Brion topped the first growths and was the only one to feature among the top 10, thanks largely to its higher rank in price performance. Given the underwhelming price performance of Haut-Brion relative to its release prices in recent years, this may strike readers as counter-intuitive. It was not the grand vin, however, driving its superior performance, but the blanc, which saw its price rise by more than 10% on average.

Burgundy: mid-range prevails

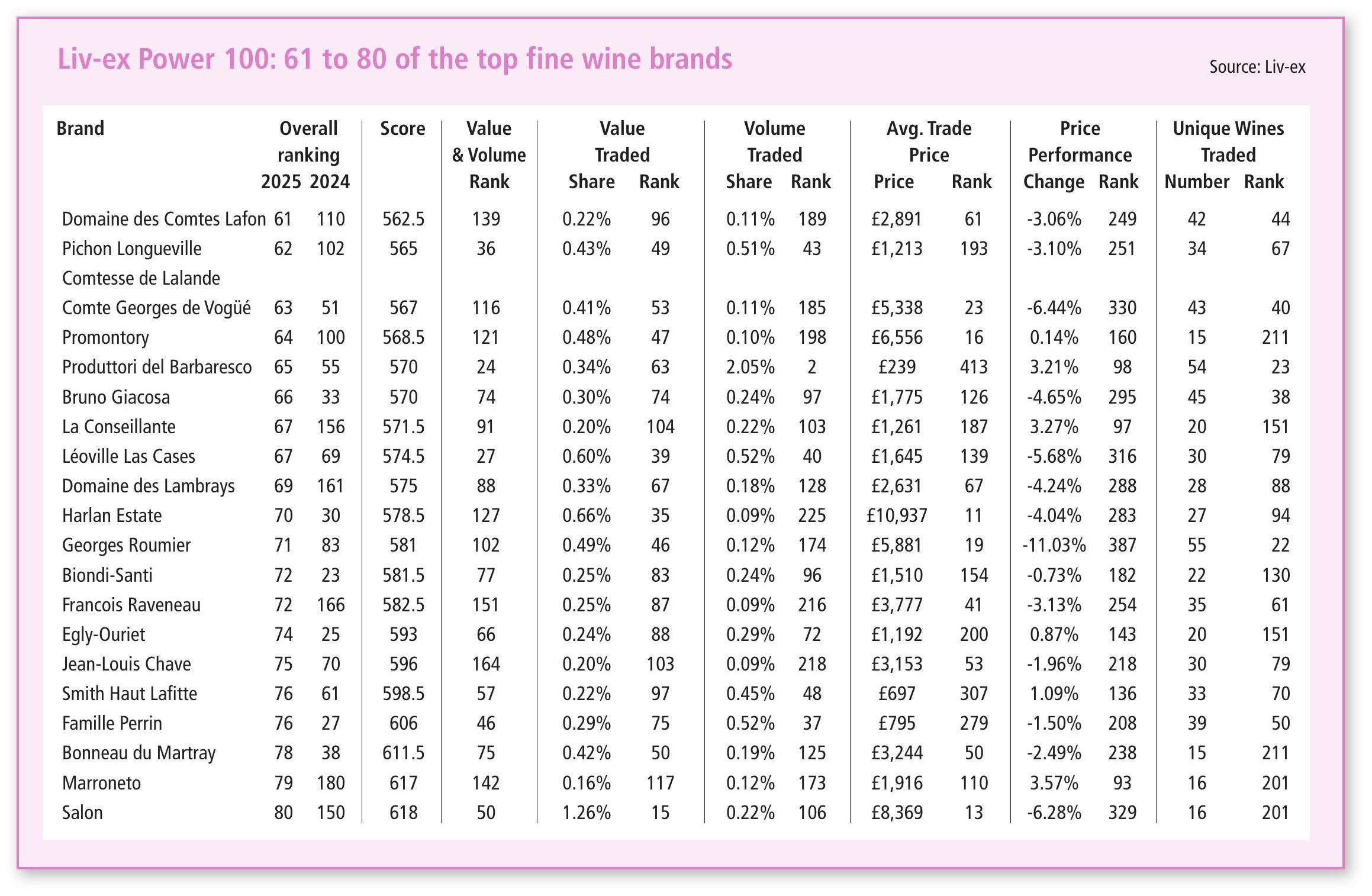

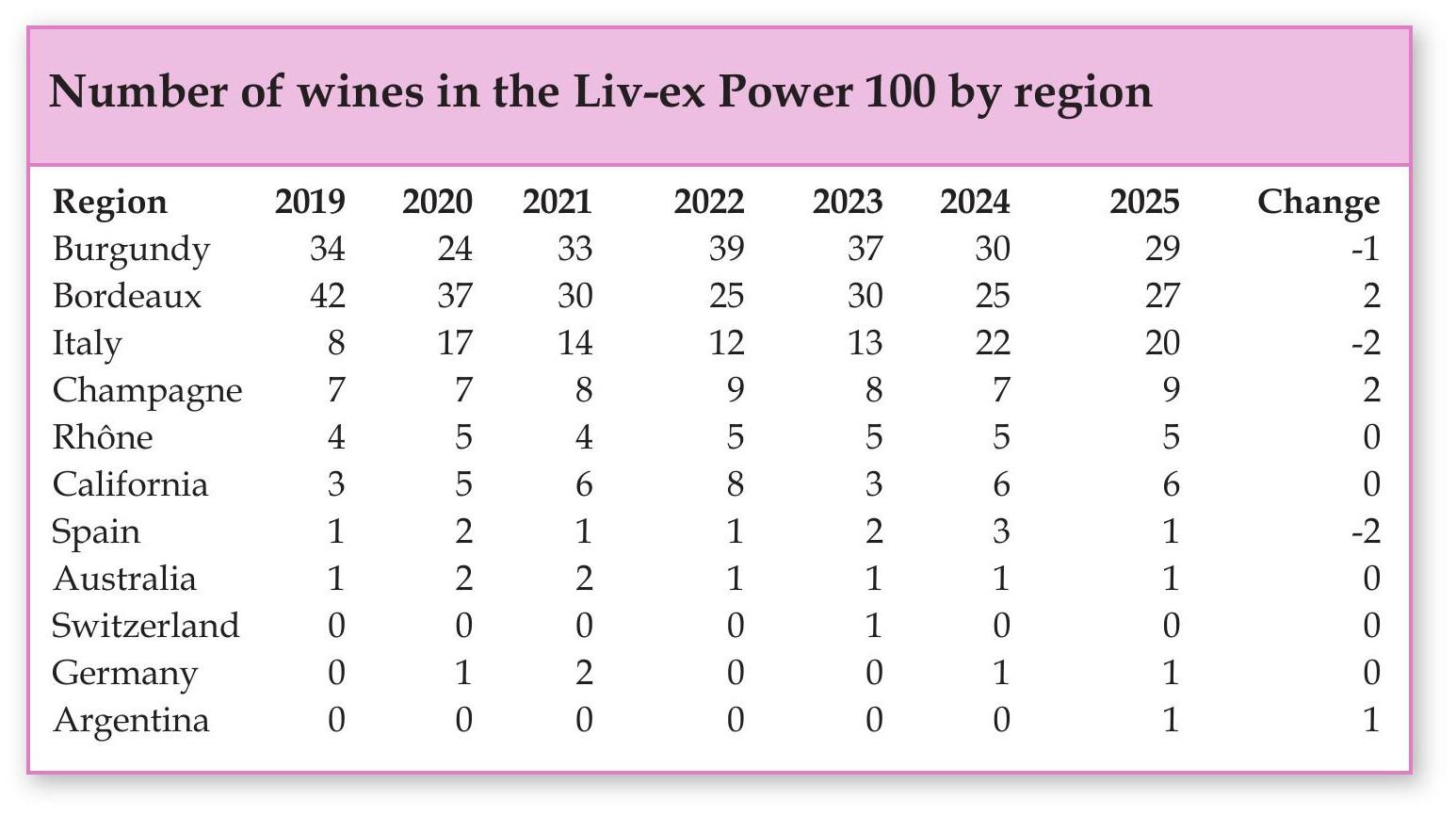

Given that most Burgundy brands produce multiple wines under both domaine and maison labels, the Power 100 is inherently skewed in their favour. Domaine de la Romanée-Conti, Drouhin and Leflaive, ranking respectively first, second and third by number of unique wines traded, were the primary beneficiaries of this. Nevertheless, Burgundy saw more brands enter and exit the Power 100 than any other region.

This year, 10 Burgundy brands fell out, while nine climbed in.

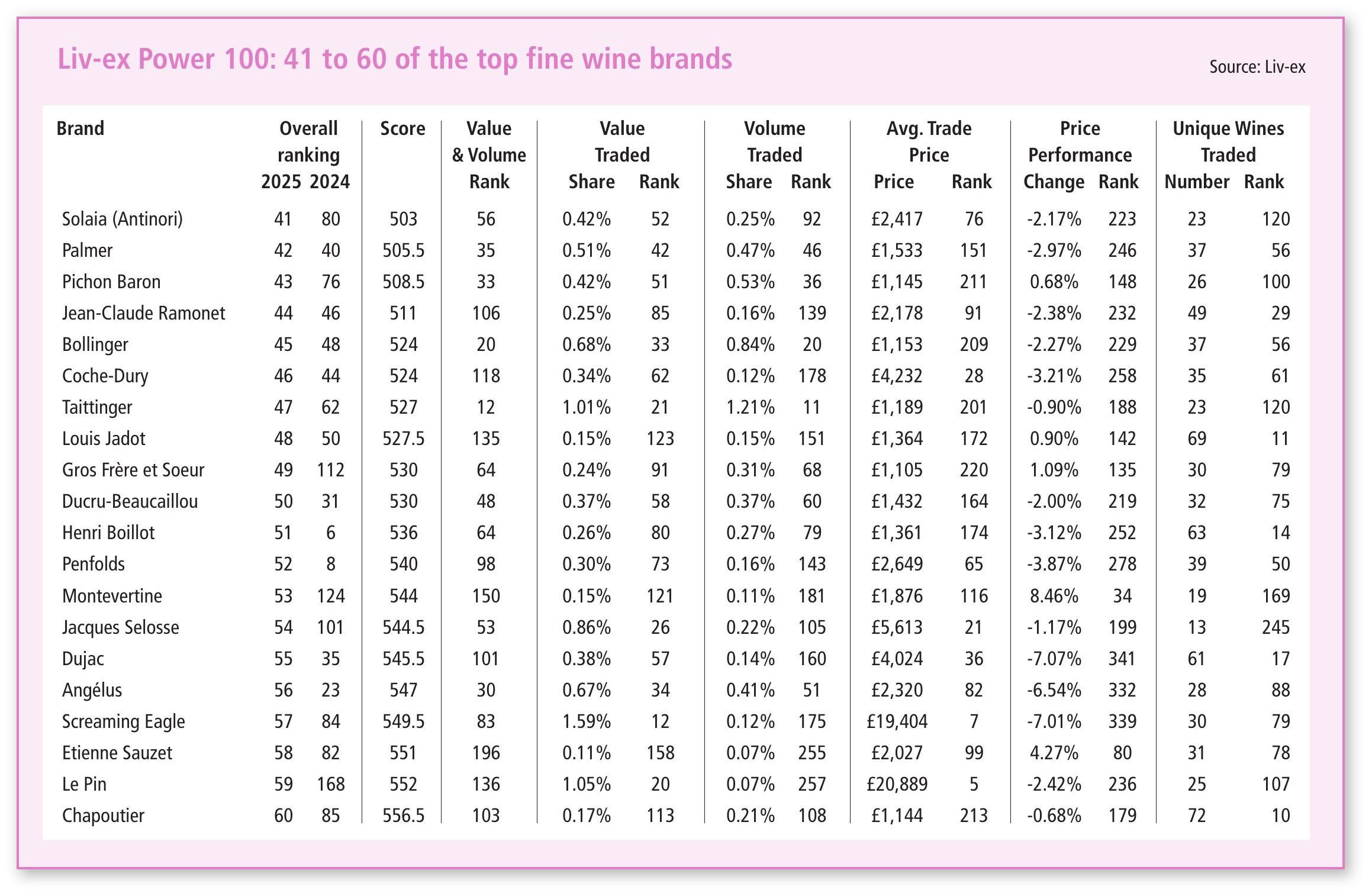

The climbers are relatively varied in style, but they are largely concentrated under the £2,000 per case mark – in the scheme of Burgundies, mid-range. In recent years, we have seen Burgundy’s share of the market grow, replacing Bordeaux for many as a dinner table go-to. Where Burgundy might once have derived its status from its investables, the market is growing increasingly partial to wines that lend themselves to uncorking.

Italy: Super Tuscans

Having taken bronze last year, San Guido claimed silver this year, solidifying its reputation as not only one of the most important, but also one of the most reliable brands on the market. On average, prices of San Guido’s wines (Sassicaia, but also Guidalberto and Le Difese) rose by 4.5%. As one of the most liquid brands on the market, it was its trade volume and value rank (sixth and fourth respectively) that drove its performance.

Traditional Tuscan brands – Chianti and Brunello producers – fared less well, with five representatives falling out of the Power 100. This is likely to have been driven by the withdrawal of US buyers following President Donald Trump’s introduction of tariffs. Over this period, US buyers accounted for more than half of the Italian regions’ purchasing.

Demand for Super Tuscans is, by contrast, more diverse.

While the breadth of Brunello’s and Chianti’s trading actively has slimmed, a select few have managed to maintain or strengthen their positions. Ornellaia, Masseto, Tignanello and Solaia sit substantially higher in the rankings, but Montevertine, Biondi-Santi, Marroneto, Soldera Case Basse and Valdicava make the grade nonetheless.

Champagne: Selosse and Salon enter the ranks

While upward movements of the Champagne 50 and improvements in sentiment around Champagne have only really come to fruition over the past two months (the Power 100 cuts off at the end of September) the region nevertheless performed well in this year’s Power 100. Two new entrants into the 100 brought Champagne’s regional total up to nine, matching its all-time best performance of 2022.

Jacques Selosse and Salon both entering the top 100 suggests some confidence returning to the market. For brands such as these – the cream of the crop – to rise again through the ranks, buyers must accept a level of risk (high prices and illiquid markets). As the market turns from a peak, buyers tend to steer clear of higher-valued wines, from which they stand to lose the most. The opposite is true at the bottom of the cycle.

Krug placed higher than any other Champagne brand overall, owing largely to its positive price performance; though up a modest 0.6%, all other ranked Champagnes (with the exception of the less frequently traded Egly-Ouriet, up 0.8%) saw declines.

Dom Pérignon, the top-traded brand by volume and fourth top-traded by value, followed in 15th place overall.

The rest of the world

Notably, Vega Sicilia has tumbled from its finish in first place in 2024 to 16th place this year. A favourite of US buyers, the brand has not been spared from the effects of tariffs. Although Unico and Alión continue to trade actively (Vega Sicilia ranking fifth by traded volume), it has lost some of the price support that US buyers afforded. Prices remained flat on average, pushing it down the rankings.

Argentina’s Catena Zapata leapt 77 spots to 86th place in this year’s listOpus One was the top-ranking Californian wine, claiming ninth place overall. Although the recently released 2021 vintage of Opus has seen its trade prices decline, other vintages have been relatively stable, averaging at a 1.8% increase over the period.

Finishing in 54th place last year, Château Rayas in the southern Rhône Valley climbed 49 places into fifth spot this year. Its strong performance was driven squarely by price. Having seen a sharp correction over the past two years, it has recently rebounded, up 2.7% on average, these increases backed by substantial trade. The drinks business and Liv-ex extend condolences to the family and friends of Emmanuel Reynaud, long-time owner and winemaker at Château Rayas, who died in November. He leaves behind an impressive legacy – one that will no doubt be carried on by his children.

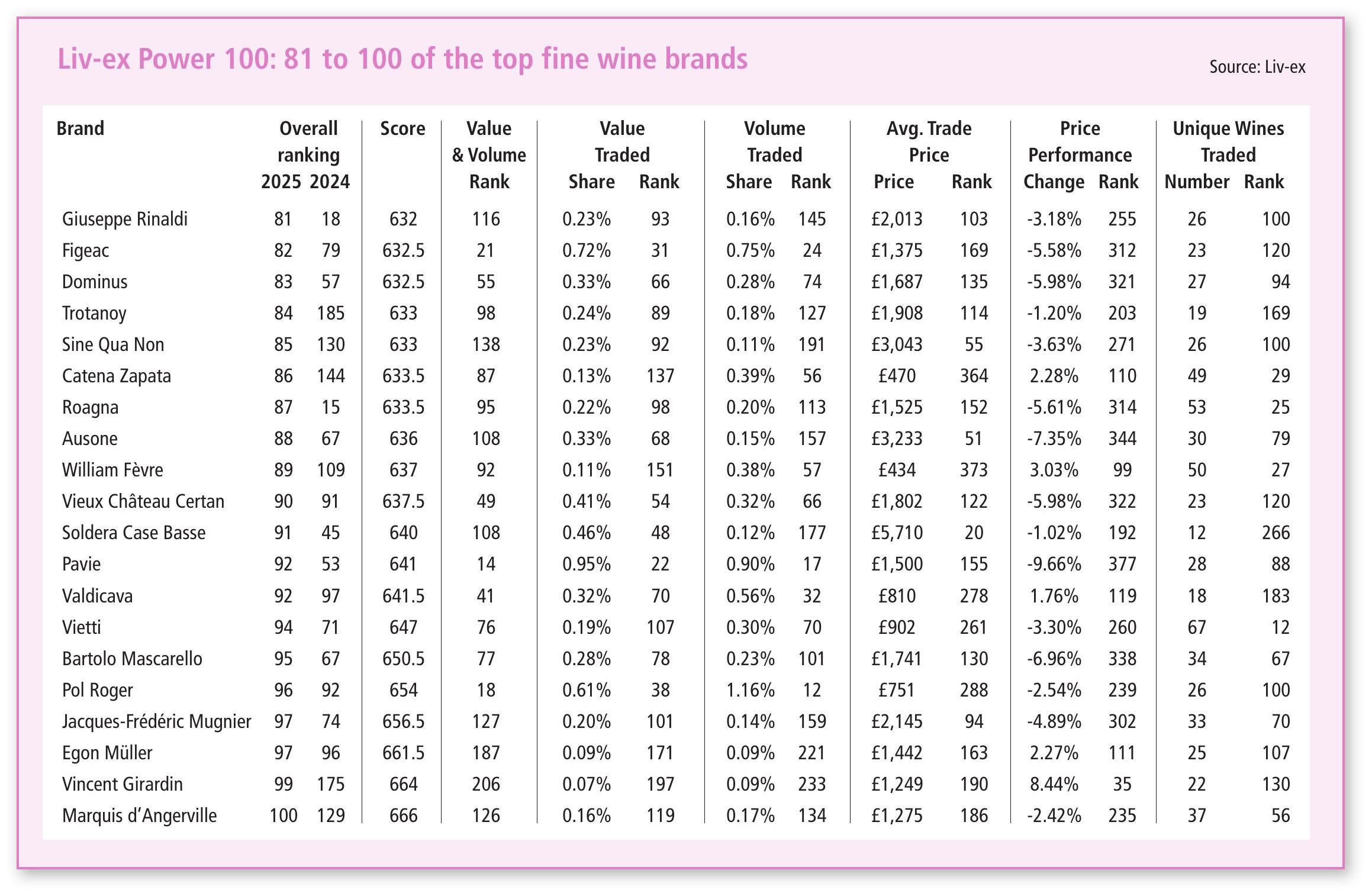

Below are charts relating to regional share, biggest risers and fallers in this year’s list and average market price increases.

Hammer prices in 2025

This year fine wine brands raised their prices anywhere from a modest 0.1% (for Napa Valley’s Promontory) to a heftier 8.5% (for Super Tuscan Montevertine). Burgundy producer Vincent Girardin saw the second highest price increase of the year after Montevertine, with an 8.4% jump on its 2024 prices.

Conclusion

This year’s Power 100 is, geographically speaking, a mixed bag, the top 10 brands alone hailing from six different regions. It is clear, however, that the market has rewarded coherent pricing.

Wines that fared best, climbing into or moving up the rankings, tended to offer high quality at slightly more affordable prices. Iconic wines such as Petrus, Le Pin, Salon and Selosse certainly do not fall into this camp, but nevertheless made significant advances.

We can view the upticks in trade for wines of this calibre as a sign that the market is seeing a return of confidence. Whether it will be sustained through both the Burgundy 2024 and Bordeaux 2025 campaigns will depend largely on how release prices are received.

Power 100 methodology

To calculate the rankings, Liv-ex took a list of all wines traded on Liv-ex in the last year (1 October 2024 to 30 September 2025) and grouped these by brand. Burgundy labels with both maisons and domaines were combined as one. Liv-ex then identified brands that had traded at least three wines or vintages with a total trade value of at least £10,000. Brands were ranked using four criteria: year-on-year price performance (based on the Market Price for a case of wine on 1 October 2024 versus 30 September 2025); trading performance on Liv-ex (by value and volume); number of wines and vintages traded; and average price of the wines in a brand. The individual rankings were combined with a weighting of 1.0 for each criterion, except trading performance, which had a weighting of 1.5 (as it combined two criteria).

To compare last year’s brand performances to those of this year check out the Power 100 fine wine list 2024.

Related news

How do people under 40 find their way into fine wine?

Will the new EU free trade agreement open up India to fine wine?

Fine wine defies downturn as US$250-plus bottles keep selling