Asia’s glimmer of hope

As signs of life emerge in the long-subdued Asian market, could it be that stocks of Burgundy are running short?

It is well-known that the Asian market has been subdued for a long time. However, over recent months we have been seeing what might be early indications of a reversal of fortunes.

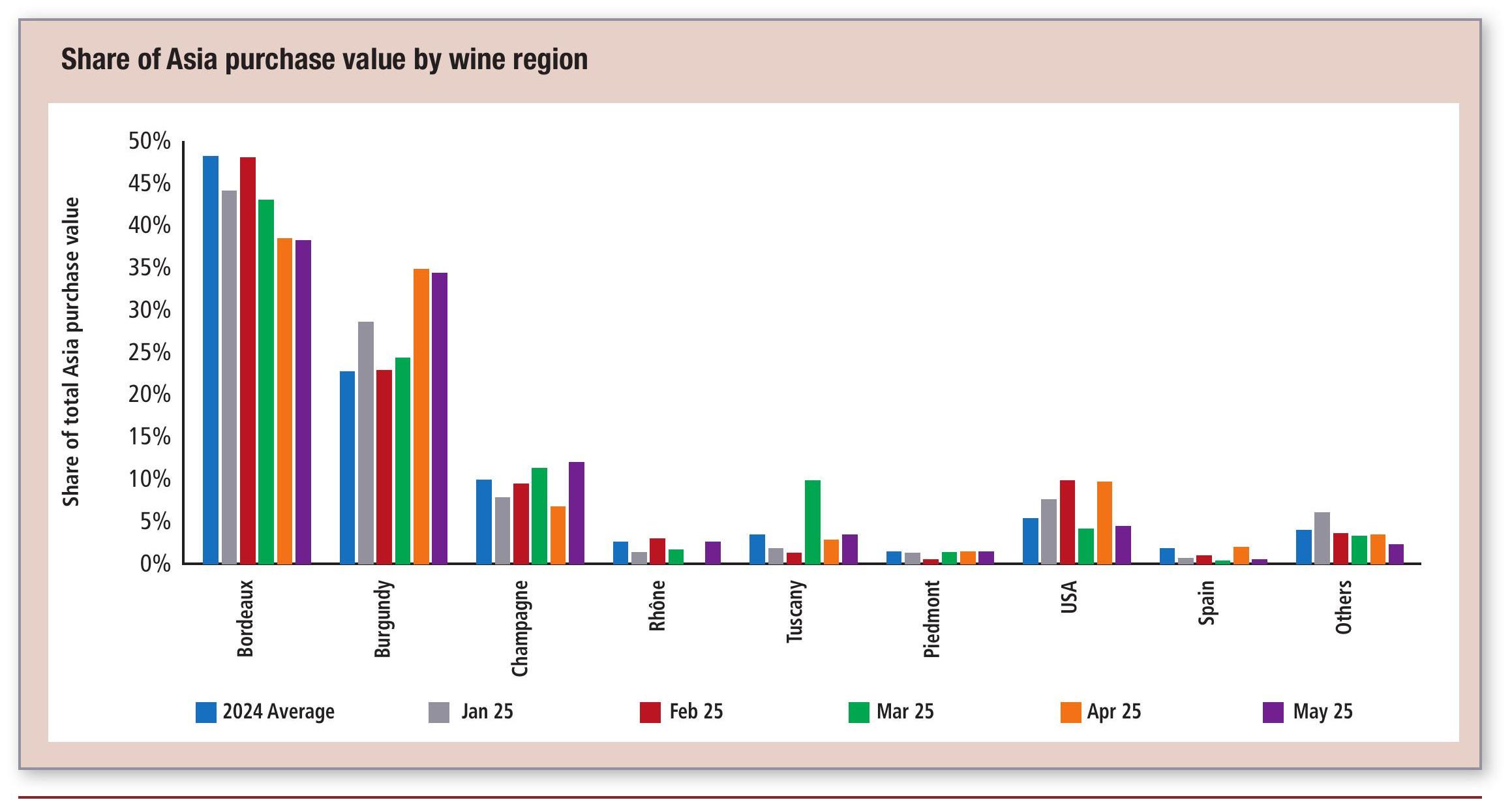

After a quiet January, Asian buying has been relatively buoyant, with the region’s share of total purchase value rising steadily each month. This comes at a time when the wider market has been under pressure due to the uncertainty surrounding tariffs and a Bordeaux en primeur campaign that left participants across the supply chain reeling. As the US market has taken a back seat, the Asian market has taken up some of the slack.

More notable is the fact that Asia’s increased share of purchase value is not simply the result of a US reduction. While that has undoubtedly contributed to the overall picture, Asian purchase value in May was up 10.1% on April, up 25.2% on May 2024, and 33.7% above the 2024 average.

What has Asia been buying?

April and May saw a notable uptick in Asian Burgundy purchasing. This has come at the expense of Bordeaux, which nonetheless continues to take the greatest share of Asian purchasing by value, but which has seen its lead eroded.

April and May saw a notable uptick in Asian Burgundy purchasing. This has come at the expense of Bordeaux, which nonetheless continues to take the greatest share of Asian purchasing by value, but which has seen its lead eroded.

While one must be cautious about reading too much into two months of data, this might be indicative of a change in the Asian stock cycle. It makes intuitive sense that, due to lower production volumes, Asian Burgundy stocks are likely to dwindle earlier than Bordeaux stocks. A look at regional purchase volumes might support this, with Burgundy taking the lead.

Liv-ex spoke to one of the region’s merchants, who said they had sensed a shift in sentiment since the start of April, with it being increasingly difficult to source top wines locally. This merchant is not alone. May saw a notable uptick in the number of unique Burgundy buyers in Asia, reaching its highest level in over two years.

Bid exposure and trade value

Since November 2024, indexed Asian Burgundy bid exposure and trade value have started to track each other. This would suggest that an increased number of bids are being placed with a real intent to purchase, rather than speculatively. One would assume that this is the result of either having demand lined up, or prices reaching a point that triggers a buy signal. At this stage, the former is more likely – confidence remains low and merchants will be unwilling to risk their own capital.

In contrast, Asian Bordeaux bid exposure and purchase value remain more volatile. This would again suggest that there remains enough Bordeaux available in the Asian market for the time being.

Looking ahead

While positive, these remain very early signs. Nevertheless, as much of Europe and the UK begins to wind down for the Northern Hemisphere summer and the US holds its breath for further tariff developments, the Asian market will be one to keep a close eye on. Should this momentum hold, there might just be some light at the end of the tunnel.

fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Garcés Silva: fresh thinking from Leyda

Christie's to sell Burgundies from renowned British collector Ian Mill KC