Autopsy of an en primeur campaign: what do the numbers tell us?

As the négociants return from Vinexpo Asia in Singapore and the campaign enters its final phase, db’s Bordeaux correspondent Colin Hay pulls together the numbers that give us a clue as to the character of the campaign.

With just a handful of wines still to be released, the Bordeaux 2024 en primeur campaign is nearly over. That allows – for the first time – a real sense of perspective on a campaign which, although arguably the best choreographed of recent years, has largely failed to capture the focussed attention of the final consumer.

That comes despite considerable reductions on release prices and impressive discipline amongst the châteaux on their pricing. Those reductions relative to 2023 have closely followed the signal given by Lafite Rothschild on the 29 April, with few exceptions.

Amongst the star releases of the first half of the campaign were the following twelve.

| Wine |

2024 rating |

2024 r.p. (£/6, IB) |

2023 r.p. (£/6, IB) |

2022 r.p. (£/6, IB) |

Relative to 2022 |

| Lafite Rothschild | 94-96+ | 1713 (-31%) | 2460 (-31%) | 3575 | -52% |

| Mouton Rothschild | 95-97 | 1521 (-25%) | 2034 (-35%) | 3108 | -51% |

| Cheval Blanc | 95-97+ | 1650 (-26%) | 2340 (-19%) | 2880 | -43% |

| Montrose | 96-98+ | 507 (-30%) | 714 (-18%) | 873 | -42% |

| Carmes Haut-Brion | 96-98 | 354 (-22%) | 456 (-31%) | 660 | -46% |

| Gruaud Larose | 94-96 | 258 (-28%) | 358 (-15%) | 410 | -37% |

| Larcis Ducasse | 95-97 | 228 (-24%) | 283 (-35%) | 434 | -47% |

| Domaine de Chevalier | 92-94+ | 192 (-30%) | 275 (-19%) | 340 | -43% |

| Branaire Ducru | 92-94 | 159 (-18%) | 193 (-19%) | 237 | -33% |

| La Lagune | 92-94+ | 122 (-20%) | 165 (-24%) | 216 | -44% |

| Gloria | 92-94 | 120 (-12%) | 138 (-27%) | 188 | -36% |

| Laroque | 93-95 | 100 (-17%) | 120 (-18%) | 147 | -32% |

Table 1: Ex. London release prices, 2022-2024 (£, for 6 bottles, in bond)

As I noted in my mid-campaign report, a bottle of each would make for an impressive mixed case, for these are all well-rated by the critics and offered to the market at reductions of between 18% and 35% on the 2023 vintage – and a staggering 32% and 52% on the 2022 vintage.

Yet, with the partial but significant exception of Lafite Rothschild, none of these wines have thus far threatened to sell out in Bordeaux, far less in London or beyond.

So what of the second half of the campaign? The good news here is that, despite the palpable failure of the early releases to ignite the passions of the final consumer, price discipline has been maintained. Indeed, as the table below suggests, if anything the reductions in prices in the second half of the campaign have been greater.

| Wine |

2024 rating |

2024 r.p. (£/6, IB) |

2023 r.p. (£/6, IB) |

2022 r.p. (£/6, IB) |

Relative to 2022 |

| Ausone | 94-96+ | 1842 (-30%) | 2640 (-22%) | 3400 | -45.8% |

| Margaux | 93-95 | 1620 (-25%) | 2160 (-30%) | 3096 | -47.7% |

| Palmer | 94-96 | 942 (-35%) | 1440 (-20%) | 1789 | -47.3% |

| La Mission Haut-Brion | 93-95+ | 870 (-22%) | 1110 (-30%) | 1590 | -45.3% |

| Pavie | 95-97 | 816 (-41%) | 1392 (-22%) | 1788 | -54.4% |

| Leoville Las Cases | 93-95+ | 573 (-31%) | 831 (-40%) | 1386 | -58.7% |

| Figeac | 95-97+ | 564 (-37%) | 894 (-39%) | 1518 | -62.8% |

| Ducru Beaucaillou | 92-94+ | 528 (-29%) | 744 (-34%) | 1122 | –52.9% |

| Troplong-Mondot | 94-96+ | 432 (-19%) | 534 (-13%) | 612 | -29.4% |

| Léoville-Poyferré | 93-95 | 283 (-16%) | 337 (-34%) | 507 | -44.2% |

| Brane Cantenac | 92-94+ | 213 (-20%) | 267 (-26%) | 360 | -40.8% |

| Cantenac Brown | 92-94 | 171 (-12%) | 195 (-20%) | 243 | -29.6% |

Table 2: Ex. London release prices, 2022-2024 (£, for 6 bottles, in bond)

The table again presents the release prices of a virtual mixed case of twelve bottles, all unveiled after my mid-term report was published. It seeks also to capture the diversity of credible en primeur purchases – with well-rated wines at (nearly) all price points (from Ausone, offered at £1,842 to Cantenac-Brown at £171 for a case of 6 bottles, in bond).

It makes for interesting reading. First, it shows that the price reduction trend established in the first half of the campaign has continued. The wines in our virtual mixed case are offered to the market at reductions of between 12 and 41% relative to the 2023 vintage and between 30 and a staggering 63% relative to the 2022 vintage.

But what it also shows is a slightly greater diversity in release price strategies in the second half of the campaign – compare, for instance, Figeac with its appellation co-resident Troplong-Mondot or Palmer with its Margaux near-neighbour Cantenac Brown.

Partner Content

Perhaps most interestingly of all it also shows that it is no longer the most expensive wines of the region (the first growths of the 1855 classification and the former premiers grands crus classes A of Saint-Émilion, such as Ausone) that have reduced their prices the most. The prize for the greatest reductions in release price (relative to the 2023 or 2022 vintage) now passes to a rather different category of wines – to the ‘new’ Premier Grands Crus Classés A of Saint-Émilion, (Figeac and Pavie) and to the ‘super-seconds’ of the Médoc (Las Cases and Ducru).

Each of these wines can be purchased today for less than half of their 2022 release price – a striking indication either of the exceptional value for money to be found in 2024 or of the failure of the market to have accepted their release price repositioning in earlier vintages, depending on your point of view!

‘Downward recalibration’

Either way, what is clear – as is strikingly revealed I think in the following figure – is that we have seen a very significant downward recalibration in prices. It has been well-noted that the 2024 release prices are the lowest since 2014 and, in some cases even 2013.

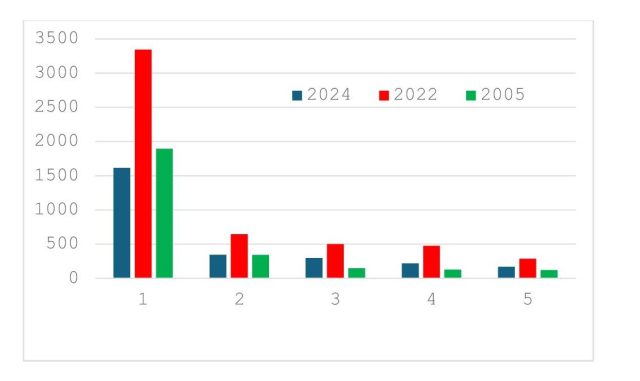

Figure 1 puts this in a still wider context – plotting the average release price for a number of vintages for the classed growths of the Médoc by place in the classification. What it shows is that the 2024 release prices are on a par not just with those of 2013 or 2014. They come out in fact somewhat below those for the 2005 vintage, nearly two decades ago (and without any control for the depreciation of sterling after Brexit or for compound inflation). Needless to say, over that 20-year period Bordeaux has progressed massively in terms of the quality of both its vineyard management and wine-making. Yet today’s releases are brought to the market, above all for the first and second growths, below the same properties’ 2005 release prices. It is difficult to think of another luxury good for which that is the case.

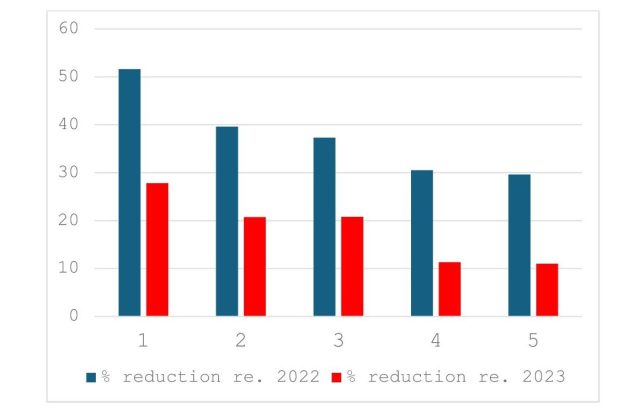

The reason for this is made clear in Figure 2. This shows, again by place in the 1855 classification for the grands crus classés of the Médoc, the percentage reduction in 2024 release prices relative to those for the 2023 and 2022 vintages. The numbers are dramatic.

What it reveals is a kind of ‘concertina effect’. When market conditions are good and the reputation of a vintage is high, we see a divergence in prices, with the first growths increasing their prices by more than the seconds, the seconds more than the thirds, and so on. When market conditions are less favourable and the reputation of the vintage less propitious (as in 2024) we see price convergence – the concertina closes, with price reductions driven from the top by the firsts and (as we have seen in the second half of the present campaign) the ‘super seconds’.

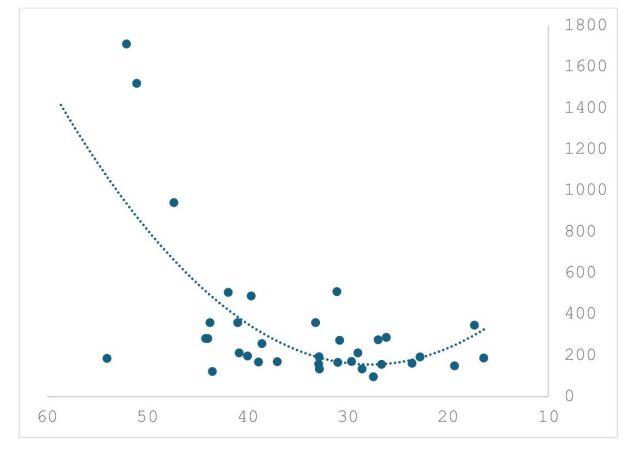

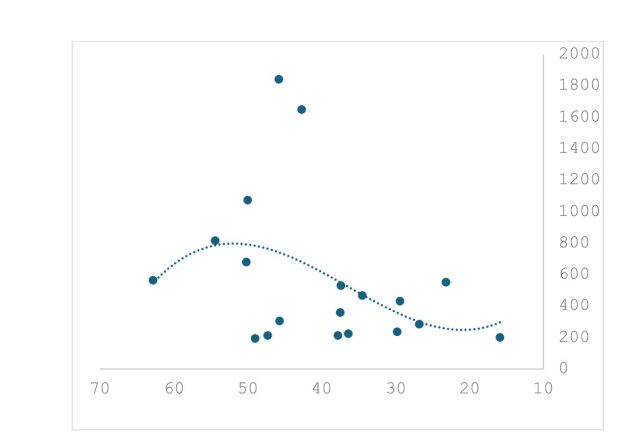

The overall effect is perhaps most strikingly visualised if we plot price reductions against the release price itself, as in Figure 3 (for the classed growths of the Médoc) and Figure 4 (for their right-bank peers).

These two plots and the comparison between them reveals much about the current crisis afflicting Bordeaux.

Figure 3: Price reduction (%) by release price, 2024 (Médoc classed growths)

The first plot – that for the Médoc – is the more easily interpreted. For it shows exactly what one might expect to see, namely an exponential decay in release price reduction as the release price falls (with the more expensive first growths reducing their prices the most). The only mild surprise here is the modest rise in release prices suggested by the best-fit curve in the bottom right-hand corner of the plot. This might well be just an artefact of the process of fitting the curve to the data. But it certainly suggests that the least expensive classed growths of the Médoc (such as the fourth and fifth growths of the Haut-Médoc appellation) felt the need to reduce their release prices rather more than their typically more expensive peers (the wines to their right in the plot). That strikes me as very credible and indicative of the wider lack of demand for young classed growth Bordeaux at any and all price points.

But it is Figure 4 that is perhaps the more interesting of the two plots and it takes just a little bit more interpretation. It shows, once again, price reductions plotted against the release price itself but now for the leading wines of the right-bank (the St-Emilion grands crus classés and their peers in Pomerol).

This is no longer just a story of the exponential decay in release price reduction as the release price falls – though such an effect is clearly present in the middle of the distribution. To understand this plot we need to know the identities of some of the wines here. The two data points at the top of the graph (the wines with the highest release prices) are the former premier grands crus classés A wines Ausone and Cheval Blanc. Their release price reductions, are considerable (at 46% and 43% respectively relative to 2022). But they are trumped by the less expensive wines to their left on the plot and above the best fit curve. These are the ‘new/newer’ (if in the case of the first, still former) premier grands crus classés A wines, Angélus, Pavie and (with a price reduction of over 60%) Figeac.

What this reveals – or, at least, reminds us – is that these wines have struggled to find a stable (release) price point that the market will accept and, in seeking to establish one, have felt the need to reduce their price the most. Time will tell if they have succeeded.

‘Exceptional opportunity’

That brings me to my conclusion. It comes in two parts. The first is simply to note once again that precisely because of these unprecedented price reductions, the 2024 vintage represents are exceptional opportunity for genuine Bordeaux lovers.

It is easy to find reasons for not purchasing the 2024 vintage, above all when release prices and secondary market prices seem unlikely to rise any time soon – and for as long as global demand remains suppressed. But it is difficult not to see Bordeaux’s current crisis as requiring the châteaux to start reining in their production costs if many of them are not to lose money on every single bottle of wine that they produce. We have I think reached a tipping point.

With hindsight I suspect that the 2024 vintage may well be viewed as the last to be made in the way we are now familiar with – with the properties maximising on quality regardless of the implications for the cost of production. If rising production costs cannot be passed on to the final consumer, either because there are fewer final consumers to pass them onto or those that remain are simply unwilling to purchase at that price, then production costs need to fall. That can only come at the expense of quality.

If that is correct, it is no longer possible to imagine that quality will continue to rise relative to the character of the vintage from one year to the next – as has been the case now for well over a decade. And if that is true, then 2024 looks like a very interesting proposition, whether today or at some point in the not-too-distant future.

Let me sign off, then, with a final virtual mixed case of twelve of the wines with the greatest price reductions relative to their 2022 release prices. Of these, Carmes Haut-Brion is essentially sold out in Bordeaux and Lafite Rothschild is close to so doing. But for me all of these wines look like attractive offerings even in the most challenging of economic times.

| Wine | 2024 rating | 2024 (£/6, IB) |

Relative to 2022 r.p. |

| Figeac | 95-97+ | 564 | -62.8% |

| Leoville-Las-Cases | 93-95+ | 573 | -58.7% |

| Pavie | 95-97 | 816 | -54.4% |

| d’Issan | 94-96 | 186 | -54.0% |

| Ducru-Beaucaillou | 92-94+ | 528 | -52.9% |

| Lafite-Rothschild | 94-96+ | 1713 | -52.1% |

| Mouton-Rothschild | 95-97 | 1521 | -51.1% |

| La Fleur-Pétrus | 94-96 | 680 | -50.2% |

| Angélus | 95-97 | 1074 | -50.0% |

| Larcis Ducasse | 95-97 | 228 | -47.5% |

| Palmer | 94-96 | 942 | -47.3% |

| Carmes Haut-Brion | 96-98 | 660 | -46.4% |

Table 3: The top 12 greatest discounts

(ex. London release prices, 2022-2024, £, for 6 bottles, in bond)

Related news

Burgundy en primeur: wonderful wines, but allocations severely impacted

Bordelaise needs to 'recreate trust' in Bordeaux en primeur

Margaux and Grand Puy-Lacoste rounds off latest en primeur releases