Bordeaux en primeur: is it still working?

Thanks to a soft market and a difficult harvest, the 2024 En Primeur campaign could be more challenging than ever.

Reports out of Bordeaux on the 2024 vintage have not been resoundingly cheerful. According to writer Jane Anson, “strong mildew pressure, poor flowering and a relatively dry summer” characterised the growing season. Funding for constant green harvesting and new cellar technologies may go some way towards protecting the quality of the wines from the wealthier châteaux, but yields are set to be notably low across the board.

While en primeur is over six months away, châteaux, négociants and merchants will be beginning to plan their pricing and buying strategies now. Châteaux will have to take a hit to their margins to release the 2024s at the right price – the price at which buying en primeur is still profitable at each level of the supply chain.

Is en primeur still working?

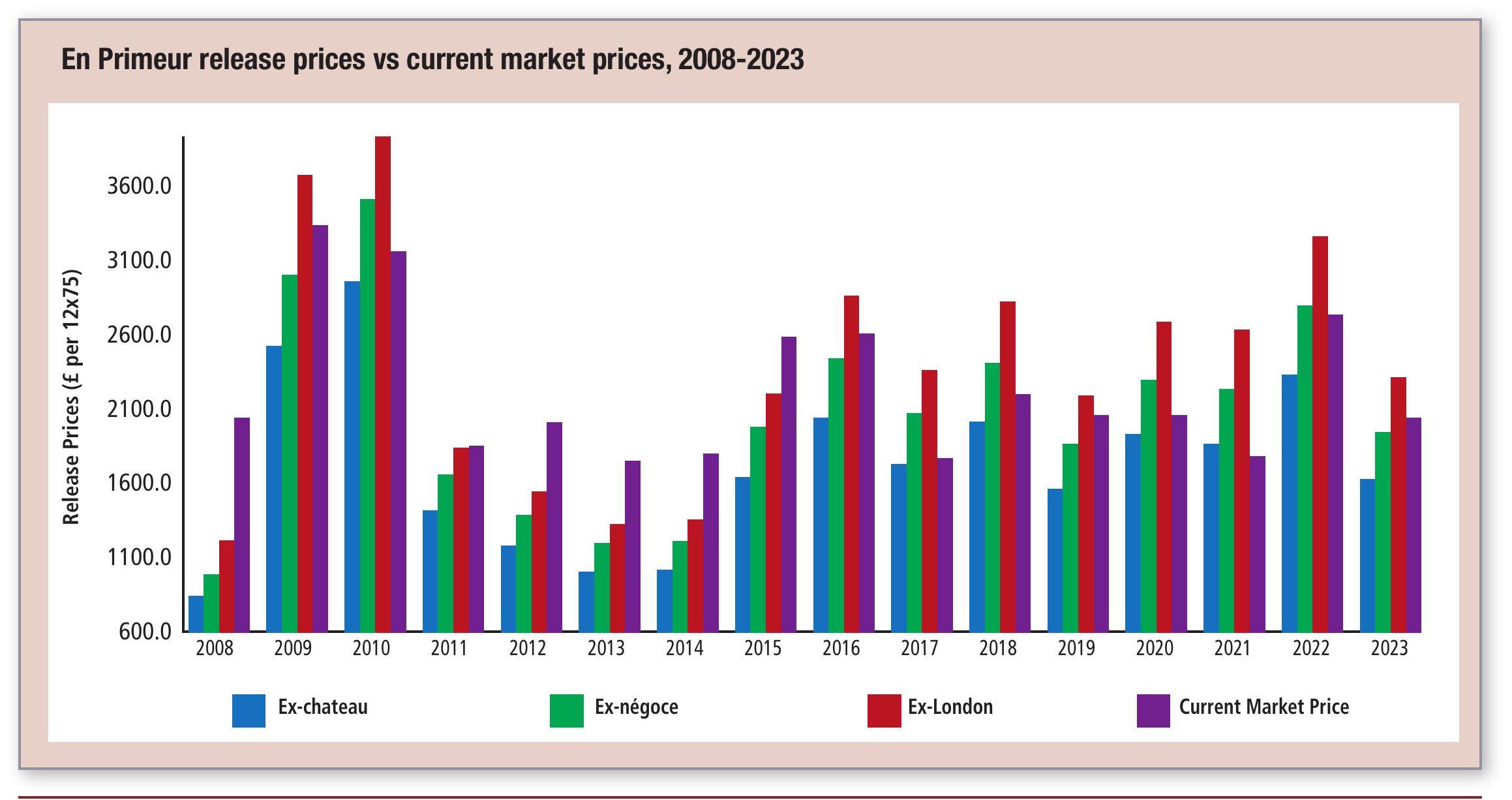

Currently, the Market Prices of all vintages after 2015 sit, on average, below ex-London release prices. End consumers, therefore, would have been better off buying now than at release. Except for the 2016, 2019 and not-yet-physical 2023 vintages, Market Prices for all post-2015 vintages sit lower than ex-négociant prices. As the downturn of the market continues, we are beginning to see trade prices of some Bordeaux wines fall below their ex-château prices. At this stage, it becomes cheaper for négociants to purchase wine on the market, rather than directly from châteaux, rendering En Primeur unprofitable, even for négociants.

Why are ex-château prices so high?

Over the past 10 years, many châteaux have poured funds into new wineries, technologies and marketing. Anecdotally, production costs have, in some cases, tripled. With consumer preferences moving away from Robert Parker claret, and a subdued Chinese market, supply far outweighs demand. Having spent lavishly during prosperous times, châteaux are now sitting on full warehouses and debt. Even though release prices are high, they may mark the lower limit of profitability.

Châteaux that can afford to lower prices, but choose not to, may be waiting on the market to turn, holding back the vast majority of their stock in hopes of re-releasing in more bullish years. With an increasing number of the Bordelais looking to sell their properties, it is also possible that some are keeping release prices high to drive up asset evaluations.

What happens if the en primeur system fails?

That the end of the négociant distribution system – ‘cutting out the middleman’ – will necessarily benefit end consumers is a fallacy. Négociant networks are efficient and well-built; it will be a difficult and expensive endeavour for châteaux to build their own. In other words, if négociants are cut out, prices offered to UK merchant

s and consumers are unlikely to be lower. Moreover, not all châteaux will be able to construct their own networks. Already, the less wealthy châteaux are feeling financial pressure, with about 50 put up for sale this year alone.

What can we expect from the next en primeur campaign?

The 2024 en Primeurs should be met with tempered expectations. On the one hand, with low scores and yields expected, châteaux may be more willing to slash prices – it makes more rational sense to take a lower margin on a small number of poorly rated wines (as was the case with the 2013 vintage). On the other hand, lower yields may put even more pressure on châteaux that are already struggling for cash.

(Data for this article was drawn from all 50 LWIN7s of the Bordeaux 500 for which an ex-château, ex-négociantand, ex-London prices were available, from vintages 2008-23 – 23 different wines and 368 total vintages across sub-indices)

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Fine wine defies downturn as US$250-plus bottles keep selling

VIK 2022: ‘the beginning of a journey toward self-sufficiency’