When will list prices reflect market reality?

Despite the fine wine market’s doldrums, release and list prices have stayed defiantly high – but, as activity begins to stir, might that be about to change?

It is no secret that the fine wine market has been bearish since October 2022. With an acceleration of the downturn across all major Liv-ex indices in September, it would seem that there is still a way to go before the market turns the corner – and yet we continue to see high release pricing out of Bordeaux and list prices remain head-and-shoulders above the market.

There appears to be a disconnect at each level.

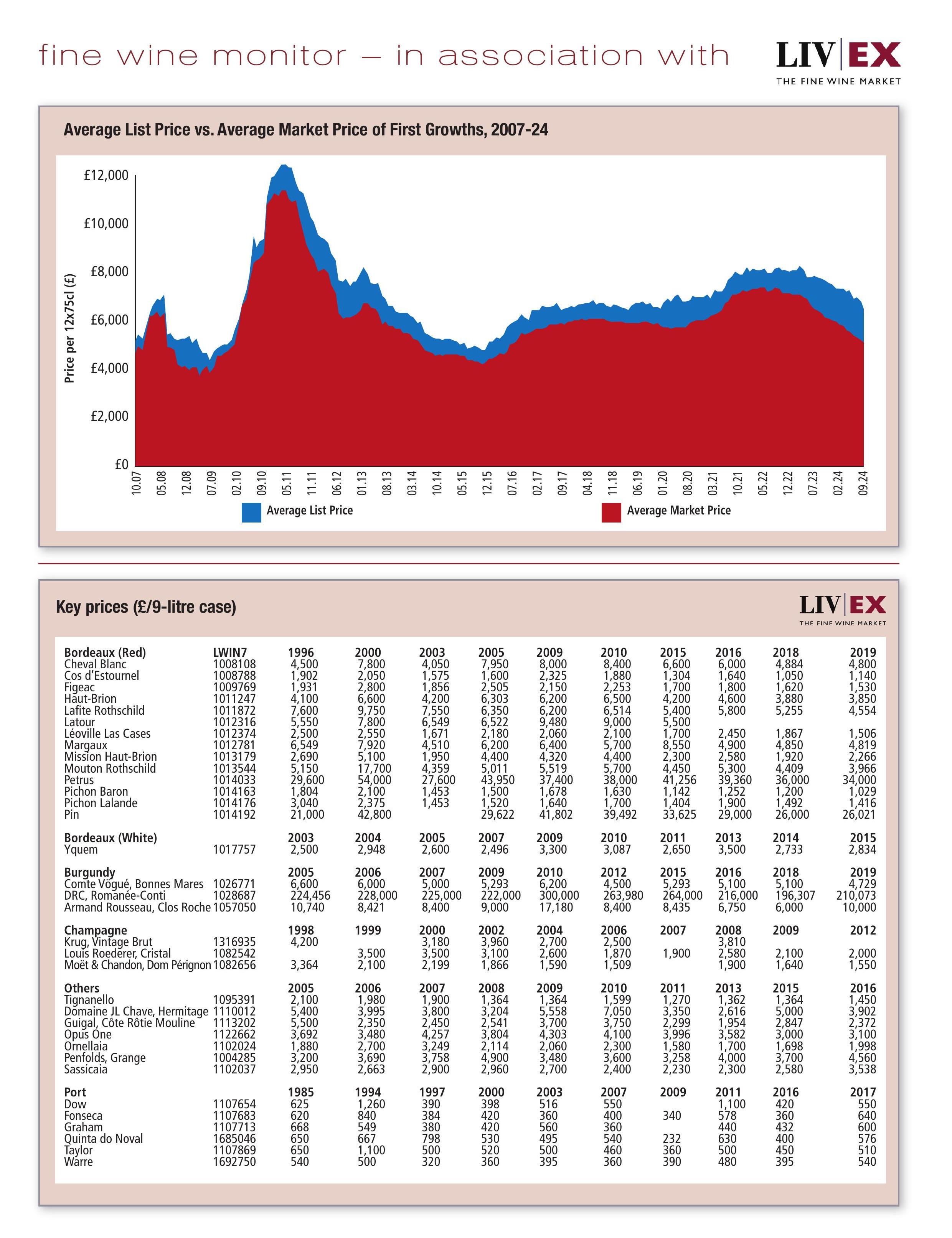

To gain an understanding of the behavioural interactions between the primary and secondary market, we have conducted an analysis of the varying difference between Market Prices and Average List Prices of the Bordeaux first growths over time.

Our analysis has shown that merchants are less responsive to downward movements in the market than they are to upward movements.

While understanding that the market is bearish, many will continue to list their stock at a historically high level. This is especially true now – the difference between Market Price and Average List Price is higher than ever across all vintages. At the peak of the market in April 2011, for example, the average list price for Château Lafite 2005 was only 6% higher than the Market Price. By February 2013, the Average List Price sat 25% above market. At the time of writing, the wine is listed, on average, 34.1% above its Market Price.

The graph below shows the Average List and Market Price for the first growths (minus Château Latour). All vintages from 2005 inclusive have been analysed, to account for scarcity-based volatility.

The relative flatness of List Prices in recent years is apparent. Although we can observe a widening of the gap during all down markets, this effect is especially prolonged and pronounced currently. With a large stimulus provided soon after lockdowns were enforced in March 2020 and drinking habits changing during the Covid-19 pandemic (consumers more willing to spend on wine to consume at home), Average List Prices were not forced down to align with the market before it gained upward momentum. This time around, merchants haven’t been so lucky.

In 2011, we observed similar resistance to market conditions, followed by two successive steep drops in Average List Price prior to recovery. List Prices similarly had to adjust down in 2009. There tends to be a sharper fall for Average List Prices than for Market Prices. When enough merchants drop their prices, so too must their competitors if they want to retain customers. In September, Average List Prices fell more sharply than Market Prices (5.1% vs 1.5%) – the largest month-on-month narrowing since April 2021. This is likely a sign that merchants may now be feeling the pressure to secure a competitive edge.

This was accompanied in September by an acceleration in the decline of the Liv-ex indices. While this may not sound like cheerful news, it does indicate that the market is coming to terms with its downward momentum. Finally, sellers who have been holding their offer prices are dropping down to meet bidders. This has been effective – the final week of September saw the highest number of unique buyers on the market since February. Demand exists at the right price, and it is this demand that will eventually allow prices to recover.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Queen Camilla gives speech at Vintners Hall

Master Winemaker 100: Alberto Stella

Australian Vintage sales dip 1.7% as turnaround plan targets stronger second half