Ribera Del Duero propels increase in the value of fine Spanish wines

The value share of Spanish wine has more than doubled in the last 12 months, with Ribera del Duero leading the charge.

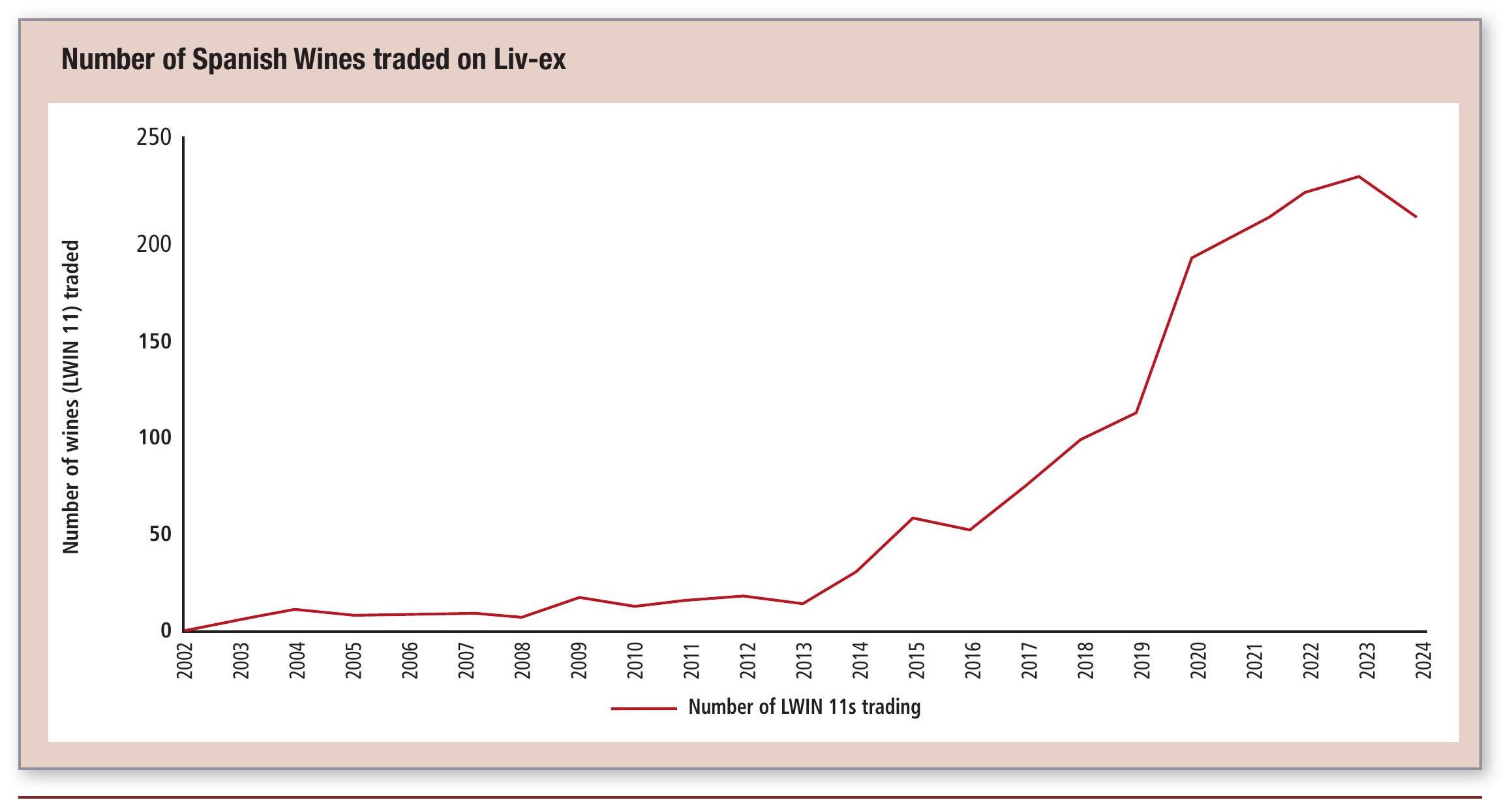

Although not as sought-after as its French or Italian counterparts, the demand for Spanish wine has enjoyed a sustained increase over recent years. So far, 2024 has seen Spain’s performance on the secondary market gather momentum. Year to date, Spain’s share of trade value has more than doubled compared to the same period in 2023 (2.2% vs 0.9%). At the same time, in volume terms, Spanish wines have accounted for 3.7% of all litre volume traded in 2024 on Liv-ex — 20.5% more than the US (albeit at 35.5% of value).

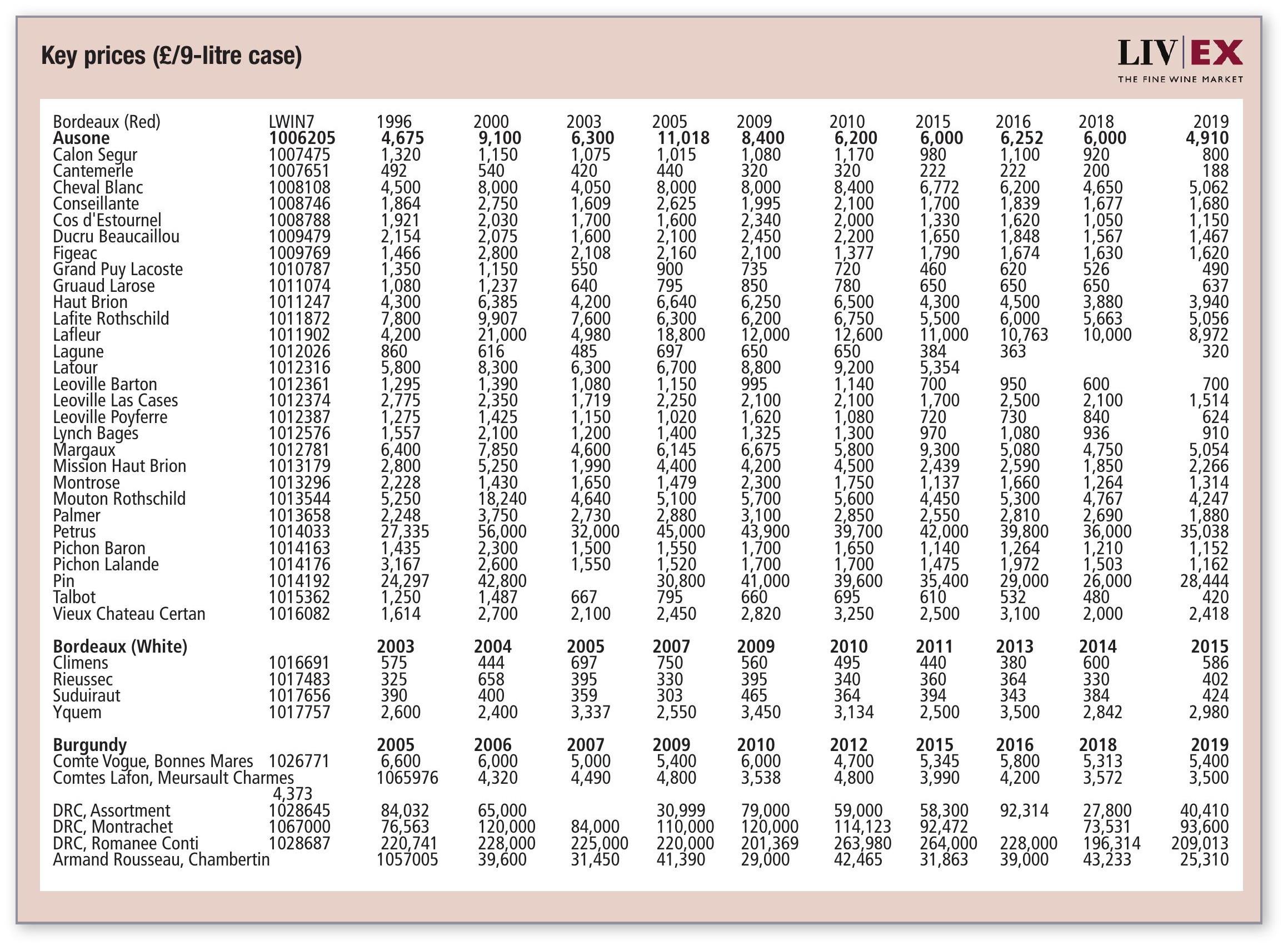

Spanish wine has gained a well-deserved reputation for its good value: highly rated wines at low prices. La Rioja Alta’s 904 Gran Reserva Seleccion Especial 2015, for example, was awarded 95 points by Josh Raynolds (Vinous) and is currently available at a market price of £590 per 12×75 – less than £50 a bottle. Finding similar quality-to-price ratios in regions such as California and Burgundy is a near-impossible task. So far this year, the average traded price of a case of 12 Bordeaux wines is £1,862. By contrast, the average cost of a case of Spanish wine sits at £1,051.

Looking at where this surge in demand for Spanish wine is coming from, last year US buying accounted for 43.4% of the total, Europe 30.5%, the UK 21.3%, and Asia 4.9%. In 2024 the US has accounted for 57.0% against Europe at 18.8%, Asia at 12.8% and the UK at 11.4%. It would seem therefore that the US is driving most of the increased interest.

Ribera del Duero has long been the focus region for Spanish fine wine investors. In 2014, the region accounted for 85.0% of all Spanish wine traded on Liv-ex by value. So far this year, it has taken 63.7% of Spanish market share by value. Rioja has taken the second largest share (28.8% in 2024 year-to-date) with increased demand for brands such as La Rioja Alta and Marques de Murrieta. Again, this demand seems to be driven by the US. Ten years ago, UK buyers accounted for 47.7% of total Rioja traded, whereas so far in 2024, the US has accounted for 48.7%.

Despite some success from other regions and brands, Ribera del Duero’s Vega Sicilia, accounting for 54.0% of the country’s trade, continues to be the darling of Spanish fine wine. Founded in 1864, Vega Sicilia has a longstanding reputation for excellence, particularly for its flagship wine, Único. Nowadays, Vega Sicilia maintains low production volumes, with limited availability in turn driving up demand and prices over time.

Partner Content

Considering the last 10 physical vintages of Único, the 2004 and 2014 vintages come in as the highest rated, both boasting 98-point scores from Robert Parker’s Wine Advocate. While the 2004 was originally awarded 97 points by the publication, it was rescored up a point in 2023. The wine first hit the UK market at £1,920 per 12×75 and last changed hands for £2,888 per 12×75, making it one of the best value vintages currently available.

The 2013 also currently looks like an attractive option. Just entering its drinking window, and scoring 97 points with the Wine Advocate, it is available at £2,883 significant discount to the similarly rated 2009 and 2010.

fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

VIK 2022: ‘the beginning of a journey toward self-sufficiency’