Buyers playing it safe with ‘dependable regions’

Liv-ex’s bid-to-offer ratio provides a useful barometer of market sentiment – as buyers increasingly turn to the reliable wines of Bordeaux.

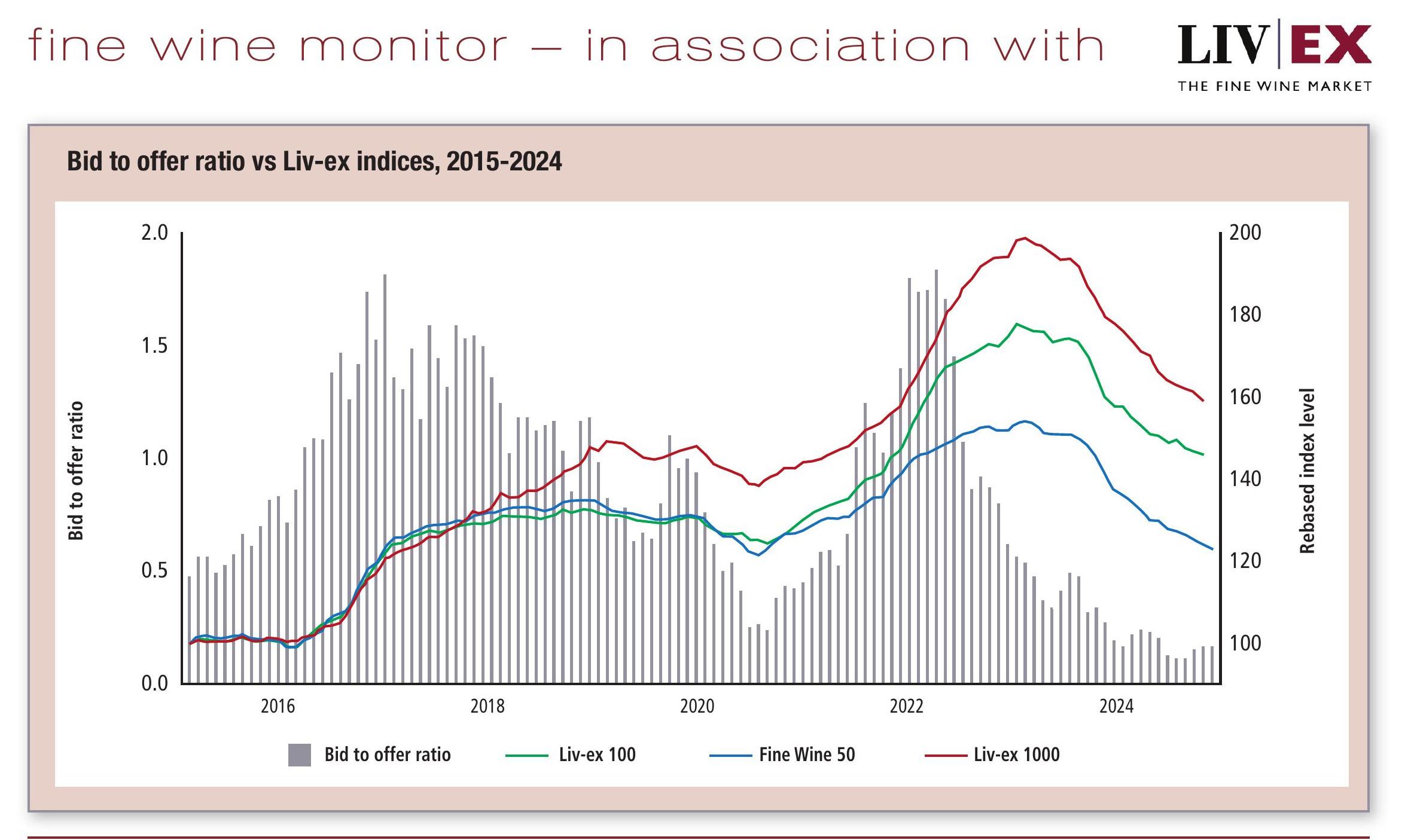

The bid-to-offer ratio, which compares the total number of bids to the total number of offers on the Liv-ex exchange, is one measure of market sentiment.

When market participants believe prices will rise, they are incentivised to place bids. Given that market participants collectively determine price movements, widespread changes in confidence generally predate trends. As shown in the chart below, the bid:offer ratio falling below 0.5 has, historically, been predictive of a market downturn. Conversely, a sustained ratio above 0.5 has been followed by an upward trend.

In early 2022, the bid:offer ratio fell sharply, pre-dating the turn of the market by more than six months. When participants lost faith in the market, they attempted to sell at what they believed to be the peak. Prices held for some time, until finally forced down. Once prices have found their floor – or market participants believe they have – we can expect increased demand.

Sitting at 0.17 at the time of writing, the bid:offer ratio on the exchange has reached new lows. However, the ratio’s upward trajectory over the last couple of months may be an early indication of slightly increasing demand in the secondary market. The question remains, then, for which wines is demand increasing?

Looking at the total value of bids on the exchange by region, the data suggests that the recent uptick in the bid:offer ratio can be largely attributed to increased demand for the wines of Bordeaux.

INCREASED DEMAND

During times of sustained upward movement, for example from April 2020 to January 2023, Burgundy and Champagne enjoy increased demand – although this demand came in later and more moderately than that for Bordeaux. Over the past year, bid exposure for Burgundy has fallen steadily and, for Champagne, has remained flat.

By contrast, demand for Bordeaux, overall higher than for any other region, has fluctuated. However, even in a market as uncertain as today’s, there remains liquidity in the region, making it a safer bet for investors.

Another way to look at sentiment is to consider the risers to fallers ratio. Since we expect demand to drive prices up, we may expect the risers:fallers ratio and bid:offer ratio to positively correlate with the Liv-ex indices.

While we can see certain spikes in the risers:fallers ratio in the past two years, the Liv-ex 1000 has maintained a steady downward trend. In September 2023, for example, the risers:fallers ratio rose sharply while the index continued to fall.

Although more than 30% of the Liv-ex 1000 components increased in price in June, those that fell did so by a greater magnitude. The fallers went down by an average of 2.85%, while the risers increased in value by an average of 0.03%. Slicing the data by price, we observe that less expensive wines are holding their value better on the secondary market. Month on month, overall traded volume is down by 2.8%, while traded value is down by 4.2%. We find that prices of the 500 most expensive wines have fallen, on average, by 0.84%. By contrast, prices of the 500 least expensive have fallen by only 0.12%. With the market down, it appears that buyers are playing it safe – turning to liquid, stable regions, and opting for lower-priced wines. Will sustained demand for Bordeaux be enough to spark interest in the broader market? Or are we just seeing business as usual?

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

How do people under 40 find their way into fine wine?

Will the new EU free trade agreement open up India to fine wine?

Fine wine defies downturn as US$250-plus bottles keep selling