What’s behind the Italian love affair with La Place?

No fine wine-making country has embraced La Place de Bordeaux quite as much as Italy – but is the platform the right fit for all Italian producers? Gabriel Stone reports.

WHEN IS a place not a place? When it’s La Place de Bordeaux, of course. One of the wine trade’s many arcane idiosyncrasies is this historic institution with no physical form, but rather a network of around 300 merchants which acts as a commercial conduit between Bordeaux châteaux and their international customer base.

These days, a newcomer to the wine trade might also be forgiven for confusion about the second half of this system’s name. For, increasingly, La Place now deploys its vast trading network for wines made a long way from the banks of the Gironde.

That shift may have started with Chile and Napa, thanks to the link enjoyed by both Almaviva and Opus One with Pauillac first growth Château Mouton Rothschild; but today the large “hors Bordeaux” component of La Place’s portfolio is dominated by another country: Italy. Of the 70-odd wines offered in the system’s spring 2024 campaign, more than half were Italian. That’s an evolutionary leap when you consider that, in the 800-year history of La Place, no Italian wine featured until the appearance of Masseto and Solaia in 2008.

Early Tuscan lead

This early Tuscan lead has only strengthened since then, with the region dominating Italy’s representation in the spring 2024 campaign. But recent years have seen several big names from Italy’s other major fine wine region, Piedmont, adopt La Place as their route to market.

In 2023, both Ceretto and Borgogno released a selection of their top single-vineyard Barolo and (in the case of Ceretto) Barbaresco wines via La Place for the first time. Ceretto explained this move as “the culmination of a strategy pursued over several years to widen and diversify the global distribution of Ceretto’s Barolos and Barbarescos to wine consumers and collectors.”

For Italian producers, this tie-in with La Place offers not only overnight access to a host of important markets, but also the flattering aura that they have cemented their place in the fine wine “club”. It’s not difficult to see how being marketed alongside more traditional investment-grade collectors’ items could have a halo effect on consumer perceptions of your desirability. You could argue that such status is well-deserved, based on the quality and ever more demonstrable track record of these wines. However, it’s impossible to escape the nagging suspicion that the chief driver and beneficiary of Italy’s rise on La Place de Bordeaux is La Place itself.

Does La Place leave Italian producers vulnerable?

This Italian-led diversification has certainly brought fresh impetus to a system that lives or dies on its sales commission. It’s no coincidence either that expansion has come at a time when La Place’s core Bordeaux business has struggled to spark the same enthusiasm as it did in the 2000s. Yet the question an ambitious Italian producer being courted by La Place might want to ask themselves is whether this path leaves them vulnerable to the very same problems that now plague Bordeaux.

The roots of La Place lie in removing the need for Bordeaux châteaux to dirty their hands in the world of commerce. But, by offloading that task to the professional merchant class, these estates also became rather inevitably detached from market realities and the relationships that build real loyalty. The result is a product that today often feels too much about price, too little about emotional connection. That’s not very dolce vita.

Then there’s the concern that Italy may never enjoy equal standing with La Place’s core Bordeaux clientele when it comes to sales priorities.

Of several Bordeaux négociants contacted for this article, only one was prepared to offer any comment about the growing importance of Italy to their portfolio. Even then, there was no possibility of arranging a call for the next five months. That’s hardly conclusive evidence, but it certainly doesn’t help to alleviate suspicions that Italy and other countries are merely filling the void between Bordeaux campaigns.

When it comes to tracking the performance of Italian additions to La Place, Liv-ex senior communications executive Kate Hewitt warns that inclusion in this club “is not a path to instant success”. Instead, she suggests: “It is a useful component in brand development, but not an automatic green light to push prices beyond the limit the market is ready to pay.”

Hewitt flags Masseto as an example of a producer that has played this game well in recent years.

One step beyond

Sister brand Ornellaia, which joined La Place in 2015, has also reaped the benefits of this system’s unrivalled commercial network.

“We wanted to go one step beyond and have our wine reach those markets and customers where we didn’t have much presence,” explains Ornellaia commercial director Vianney Gravereaux. “La Place is a fantastic distribution machine that has its fingers on the pulse of all markets, with an amazing ability to adapt and to provide feedback to the producers.”

Castello di Fonterutoli distributes its Siepi ‘Super Tuscan’ flagship via La Place. Like Gravereaux, export director Giovanni Mazzei is full of enthusiasm for “the exposure to such an amazing customer base”, but tempers this with the acknowledgement that there is a trade-off.

“The disadvantages are losing the control of some of your distribution and being more subject to market volatility,” he explains. Although La Place ensures ready international availability of his wine, “it needs to be supported with loads of activities in the market”.

Prêt-à-porter service

While some producers are happy to make bespoke alterations to La Place’s prêt-à-porter service, for others this option simply doesn’t offer the right fit.

“Pio Cesare has been kindly invited… to be part of La Place de Bordeaux many times,” reveals Federica Boffa, fifth-generation owner of this venerable Piedmont producer. “Even if we have a huge respect for this section of the wine industry, which has contributed to increasung the attention and the investment on premium wine in the world, we have decided not to join.”

It helps that Pio Cesare already benefits from 100 years of developing its own export markets. With a presence in around 55 countries, the company places particular importance on its partnership in the US and UK with another likeminded family, the Rouzauds of Champagne Louis Roederer.

Old hand: Ornellaia has been traded on La Place since 2015

Then there’s the issue of volume. “The production of Pio Cesare wines is very small and very limited – we act with a very strict artisanal philosophy – which could not match the requests of both our actual partners and La Place,” explains Boffa. She also stresses the importance to Pio Cesare of its on-trade customer base, which she describes as “the strongest aspect and asset of our brand, which our partners have contributed to creating in all those years and which we do not want to lose”.

This loyalty to existing trade relationships will resonate particularly powerfully with importers and agencies. After all, their work – often over decades – to build a loyal, carefully balanced customer base for a wine is inevitably undermined when its producer chooses to add a parallel route to market.

“Building a market for a producer is about much more than making a sale,” insists Liberty Wines CEO Tom Platt.

“It is about building a broad base of distribution and ensuring that the wines are sold in the best restaurants and independent wine merchants throughout the UK. This can’t be done by putting the wine on La Place, where visibility tends to be lost as soon as it is sold.”

Upbeat report

Over at Berry Bros. & Rudd (BBR), head of buying Martyn Rolph balances an upbeat report on Italy’s fine wine performance with concerns about the longer-term impact of La Place’s growing involvement in this category. He cites the country’s run of “excellent recent vintages” as a helpful factor, with the merchant’s Brunello 2021 campaign in March proving “hugely successful”.

While interest in Barolo is also on the rise, Rolph confirms: “It’s a region that still requires significant effort as regards educating customers.” That’s worth bearing in mind for the growing number of Piedmont producers being courted by La Place. It also helps to explain why, with the exception of a scattering of Amarone di Valpolicella, the system retains such a narrow regional focus.

You certainly need a pretty stellar reputation to jostle for attention in this increasingly crowded marketplace. “Producers are competing for exposure during the condensed La Place release period, and we have to be selective in regard to who we promote,” warns Rolph. “Some less established brands may see greater success if they choose to release outside of this busy period, whilst building their name.”

Relationship building

Rolph also shares Platt’s reservation about the impact of La Place on the relationship building that lies at the heart of the traditional wine trade.

“Selling via La Place can place limits on our ability to brand build by working in close partnership with producers,” he remarks. “So many producers make brilliant wine; that alone sometimes isn’t enough.”

Occasionally it looks possible to have your cake and eat it. Tuscany’s Bibi Graetz has just started working directly with BBR for certain wines, including a global exclusive for its 2021 Balocchi di Cabernet Franc. Meanwhile other wines, Testamatta and Colore, are due to join La Place’s September releases.

Growing success

It might be tempting to draw a link between Italy’s growing success in the fine wine market and the country’s growing presence on La Place. Yet there’s an argument that these achievements have come despite, not because of, this sales channel.

“We don’t think that distribution via La Place has aided the Italian fine wine market,” is the blunt assessment of Matthew O’Connell, CEO of the LiveTrade platform run by merchant Bordeaux Index. “One of the issues we find is that the cross-regional nature of these releases can obscure collector focus on the key wines being released at the time, as well as understanding of the regional vintage dynamics.”

Pros and cons: Giovanni Mazzei says there are trade-offs in using La Place

Instead, O’Connell joins others in emphasising the importance of brand recognition. “There are clearly a lot of high-quality wines being made in Tuscany,” he observes, “but the demand for and price performance of individual names has most relied on recognition and consumer following rather than outright quality considerations, although there is obviously usually some connection between the two.”

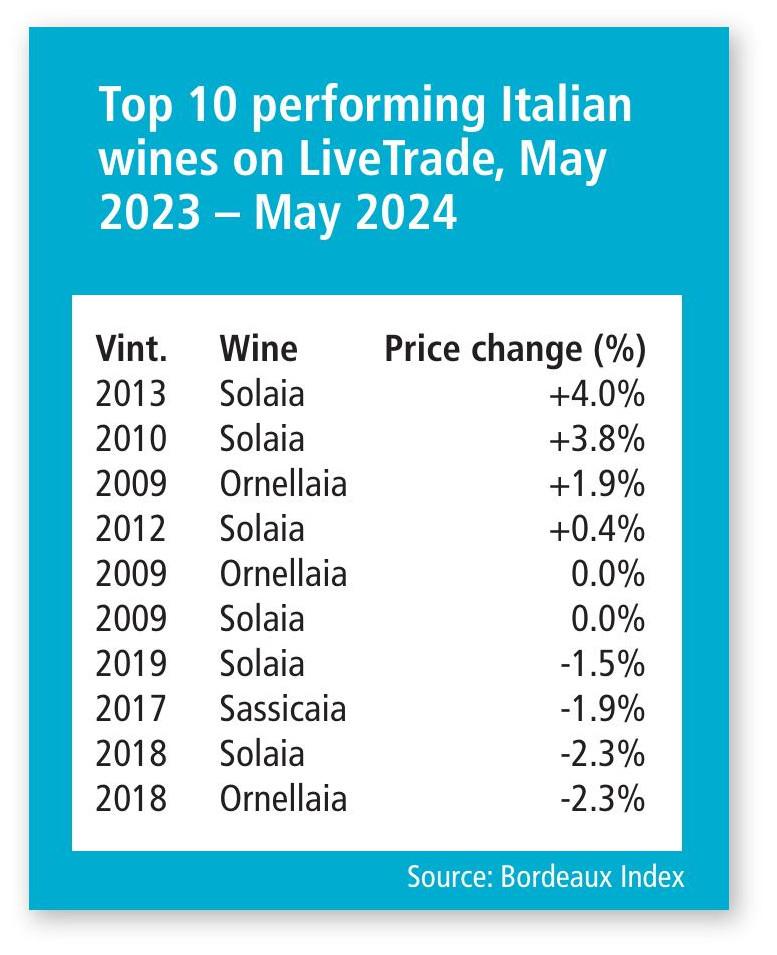

A quick look at the top Italian performers on LiveTrade over the last year shows just how narrowly focused that consumer following remains.

Wave of expansion

As more and more producers from around the world pile onto La Place’s bandwagon, this challenge to stand out from the crowd looks set to become harder, yet more urgent than ever.

“La Place de Bordeaux seems to be riding the wave of expansion,” observes Hewitt of Liv-ex. “At present, all players can benefit from it: producers get more exposure, négociants can exploit more sources of revenue and fine wine merchants enjoy a wider choice of wines to offer their customers, who amass a more diversified portfolio, which lessens the risk of losses during a potential market downturn.”

Despite this short-term benefit, however, Hewitt warns: “There may yet be a saturation point where the benefits of being released through La Place are lost in an enormous jumble of releases.”

Any producer, Italian or not, who is seduced by the allure of La Place should give careful thought to whether this is really the place to be.

Related news

Liv-ex: AI will 'filter out the noise' to provide more relevant fine wine data