ThaiBev makes major move in Asia beer market

The Chang beer owner plans to offload part of its business and dramatically increase its stake in another famous Asian brewer, supersizing its influence in the region.

ThaiBev, one of the largest brewers by volume in Southeast Asia, has agreed a share swap with fellow companies owned by tycoon Charoen Sirivadhanabhakdi in a reshuffle that will dictate the future of the business.

Crucially, the move will also see ThaiBev grab an even bigger stake in the Asian beer market, gaining a majority ownership in rival Tiger beer.

In 2012 ThaiBev acquired a 22% stake in Fraser & Neve, the biggest beverage company in Singapore and Malaysia, and maker of Tiger beer, in a deal worth US$2.21 billion. It incrementally increased its stake in the Singapore company in the years that followed.

Share swap

Now, ThaiBev which brews Chang beer, has engineered a share swap. It will transfer its 28.8% stake in Frasers Property (worth around US$1.6 billion) over to property firm TCC Assets. In return, TCC Assets will transfer over shares worth roughly the same amount in Fraser & Neve.

As a result of the swap, ThaiBev’s stake in Tiger brewer Fraser & Neve will leap from 28% to around 70% on completion of the deal.

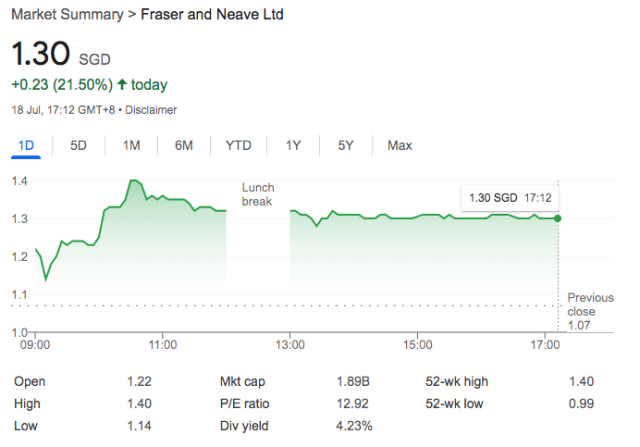

Following the news, stock in Fraser & Neve shot up by 26%.

Partner Content

Focus on drinks

ThaiBev stresses that offloading its property assets means it can focus exclusively on the drinks arm of the business, and mentioned alcohol-free as an area in which it sees potential for growth.

“Streamlining the company’s focus towards a pure-play beverage and food business by exiting the property business and increasing its exposure to non-alcoholic beverages and dairy could result in a potential re-rating in line with pure-play beverage and food peers,” ThaiBev said in a statement.

The deal is still pending approval from ThaiBev shareholders regarding the proposed share swap at a general meeting due to take place soon.

If it goes ahead, it will put ThaiBev in a dominant position within the Asia beer market. In 2017, ThaiBev strengthened its presence by acquiring a stake in Grand Royal Group (“ GRG ”), the largest operator in Myanmar’s whisky market, and a stake in Saigon Beer-Alcohol-Beverage Corporation (“SABECO”), Vietnam’s largest brewer.

ThaiBev has been listed on the Singapore Exchange since 2006.

Related news

Why we are witnessing the rise of Thai craft beer in America