Why prestige fizz is a top investment for 2024

Prestige Champagne may have retreated from its post-pandemic peak, but it remains a solid and dependable option for collectors, as Lucy Shaw discovers.

WHILE IT may have been an odd time to celebrate, sales of prestige cuvée Champagnes went bananas during the Covid-19 pandemic, and for the two-and-a-half years that followed, as wine lovers treated themselves to one of the few luxuries still available during lockdown.

“I don’t think anyone realised that what prestige cuvées needed was a global pandemic – sales exploded when it happened,” says Will Hargrove, head of fine wine at Corney & Barrow.

From April 2020 until October 2022, Champagne had a sparkling run as the top-performing fine wine category on the secondary market, seeing its value rise by 94% on the Liv-ex Champagne 50 index, while Bordeaux only saw gains of 25%.

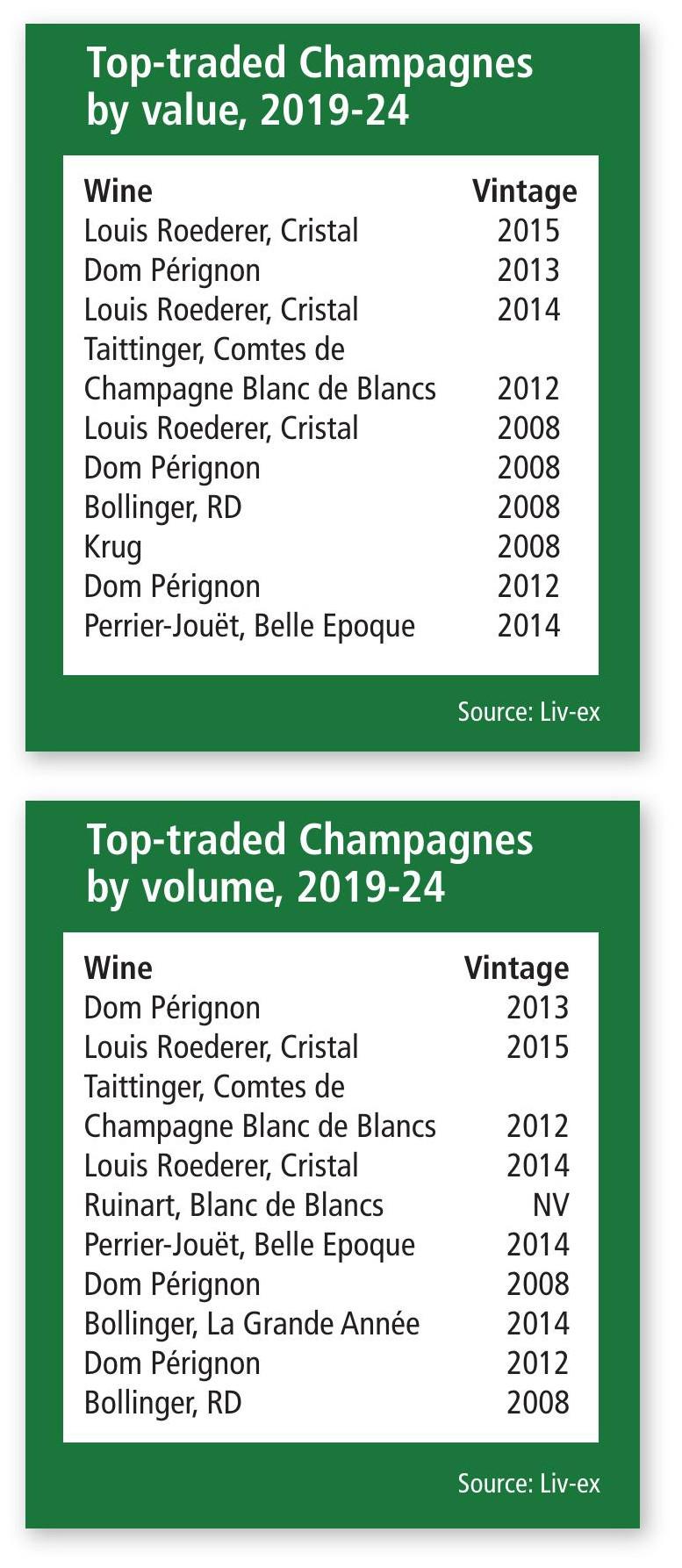

“The price of Burgundy was going up and people were looking for something new, so Champagne came into focus and offered relative value against other regions. People piled in and the market had a good time,” says Justin Gibbs, co-founder of Liv-ex, who believes that the quality and critical acclaim of the 2008 vintage helped to fuel the buying frenzy.

“The 2008s were just hitting the market and there was a lot of good press around Champagne at the time, so up it flew,” he explains.

But what goes up must come down, and rising interest rates, coupled with shrinking disposable incomes, have led to a -25% drop in value in the Champagne 50 off its October 2022 peak.

“Champagne has had the gloss taken off of it. The current economic climate has taken the wind out of people’s sails and put them in a bit of a funk,” says Gibbs, who reveals that over the last few years Champagne prices have been more volatile – and trading more speculative – than usual.

“Krug 2008 was released in October 2021 and had doubled in price by October 2022, but now it’s back to where it started. Prices shot up over that period and have since pulled back,” he says.

Interesting territory

This may be bad news for those hoping to make a quick buck from their bottles, but Gibbs feels that Champagne has found its correct place in the market.

“I think we’re getting into interesting territory,” he says. “Champagne was undervalued before the pandemic, then it got over-valued. Now it’s coming back into being correctly valued again. The Grandes Marques are the first growths of Champagne and you can still pay around £150 for their top wines, whereas first growth Bordeaux is £400 a bottle and grand cru Burgundy costs £1,000 a bottle, so prestige cuvées still feel like relative value.”

Matthew O’Connell, CEO of LiveTrade – Bordeaux Index’s fine wine trading platform – believes Champagne has rightfully earned its place within fine wine portfolios.

“Viewed across a multi-year cycle, Champagne has been a good investment,” he says. “Prices became a little frothy in 2022, and have naturally settled, but always higher than previously. There isn’t a single Champagne that is cheaper now than it was in mid-2021, and the category has substantially outperformed Bordeaux, with three-year price gains more akin to Burgundy.”

Despite prices having yo-yoed at the top end since the pandemic, prestige Champagne still represents good value for money, according to Gareth Birchley, buying director at Burns & German Vintners.

“Historically, prestige cuvées have been the lowest-risk components of a traditional fine wine portfolio, with a solid return on investment year on year. They still represent excellent value for money against Burgundy and, generally, against Bordeaux,” he says, revealing that, while 2008 remains the most in-demand Champagne vintage, there’s still a lot of it sloshing about.

“The supply of 2008 in the market is plentiful, which has probably contributed to the downturn. It’s not being consumed as readily as other vintages, and huge volumes were bought for resale,” Birchley explains.

While rosé Champagne consumption is on the rise, Gibbs of Liv-ex says the category has yet to make a substantial splash in the fine wine trading arena, due to tiny volumes.

“Rosé prestige cuvées trade at a premium – Cristal Rosé 2008 was released at £5,000 a case versus £1,900 a case for the blanc – so I’m not sure who the collector profile is. It’s not an active part of the market by any means, and does better at clubs, restaurants and hotels,” he says.

Hot property: Clos des Goisses is now hugely sought-after

It’s a similar story for Krug’s single-vineyard cuvées – Clos du Mesnil and Clos d’Ambonnay – which haven’t developed a significant presence on the secondary market.

“Top-tier micro-cuvées like Clos du Mesnil and Clos d’Ambonnay are seen a lot less than they were due to their small volumes. These wines still have their followers, but the demand is much higher for the more available prestige cuvées,” says Birchley.

Increasing regularity

Having traditionally been made only a few times per decade, market-leading prestige cuvées such as Cristal and Dom Pérignon are being released with increasing regularity, leaving merchants wondering whether you can have too much of a good thing.

Laurence Walker, of fine wine merchant Hedonism in London’s affluent Mayfair district, believes the higher frequency of prestige cuvée releases is leading customers to become more brand-loyal and less vintage-sensitive. “The concept of more regular vintage releases is a double-edged sword,” says O’Connell of Bordeaux Index. “Yes, there tends to be more wine about, but equally the regularity holds attention better.”

Hargrove of Corney & Barrow feels the Champenois should adopt a Bordelais approach to pricing that reflects the quality of the vintage, quantity on offer and anticipated demand. “When people see Champagne vintages like 2008 and 2012 taken very seriously – and then a house comes out with a lesser vintage at a higher price, people are starting to question that now,” he says.

For Philipponnat, whose top-tier Clos des Goisses is produced every year like a grand cru Burgundy, annual releases aren’t putting people off buying the wine. “Following the release of the 2014 vintage in January 2024, the whole available volume has been underwritten by our customers and distributors, including La Place de Bordeaux and London merchants,” reveals Charles Philipponnat, who runs the maison.

Trading up: drinking less but better

Fizz fanatics around the globe are showing a preference for drinking less but better Champagne. While shipment volumes in 2023 were down in nine of Champagne’s top 10 export markets, value rose in six key destinations, including the UK (+1%), Japan (+4%) and Germany (+9%), with Italy and Spain seeing value gains of +7% and +17% respectively, according to Comité Champagne data.

“Champagne exports now account for almost 60% of total sales, compared to 45% a decade ago. Exports to the UK came to a value of more than €550 million in 2023, which was a record year for Champagne in terms of global value,” says Victoria Henson, director of the UK’s Champagne Bureau, who adds that an increasing number of vintage Champagnes and prestige cuvées have been exported to the UK since 2021.

While global warming has been causing chaos in hotter regions, it has, thus far, helped to make vintage Champagne easier to produce.

“With five of the past 15 vintages seeing picking starting in August, there have been more years in which the quality of the grapes warrants a release of Pol Roger vintage,” says James Simpson MW, managing director of Pol Roger Portfolio.

“Indeed, the recently released 2018 vintage is the first of a trio of potentially great vintages in a row.” While vintage Champagne releases may be on the rise, preserving acidity levels in the grapes is becoming increasingly challenging, and Philipponnat has started to train his vines higher in order to do so. He has also over-grafted Chardonnay onto Pinot Noir vines in the easternmost part of the Clos des Goisses vineyard, which, according to Philipponnat, “is probably the hottest slope in the whole of Champagne”.

For Séverine Frerson, cellar master at Perrier-Jouët, nailing her picking dates is vital. “Climate change is bringing new challenges, but through diligent grape monitoring we can have a precisely timed harvest, which ensures optimum maturity and a balanced sugar-acidity ratio in our grapes,” she says.

At GH Mumm, new cellar master Yann Munier is seeking to continue the work of his predecessors in selecting the finest grand cru plots from the best years for top drop Cuvée Lalou. “A prestige cuvée must be the quintessential expression of a house’s style. For us it starts with the best Pinot Noir,” says Munier, who believes that shrinking acidity levels in Champagne grapes constitute “the greatest threat” to the region.

Meanwhile, Emilien Boutillat is tackling the issue at Rare by blocking malolactic fermentation in certain components of the blend, “in order to preserve the minerality, freshness and ageing potential of our most recent blends”.

It’s a battle winemakers need to win, not only to preserve the freshness and vitality of their Champagnes, but also to ensure that they age well. While most Champagne is uncorked around the time of its release, a thirst for older expressions among avid collectors is fuelling a small but growing trend for extra-aged Champagnes among the Grandes Marques.

To coincide with Pol Roger’s 175th anniversary this year, the house is due to release six vinothèque wines in bottle and magnum in September – Champagnes that have undergone an extended period of post-disgorgement ageing in its cellars. Among them are 1998 and 1999 vintages of Cuvée Sir Winston Churchill, which will feature the prestige cuvée’s original black label and the wine’s disgorgement date.

“We believe in the ageing potential of our wines after disgorgement, and have been holding back a proportion of Cuvée Sir Winston for a while,” says Laurent d’Harcourt, Pol Roger’s managing director. “These wines have had 10-15 years of extra ageing under cork and are darker in colour, with more nutty, buttery, toasty aromas and notes of acacia honey and black fruit. While rich in character, the acidity of the grand cru Chardonnay in the blend has kept the wines incredibly fresh.”

The intention with the vinothèque range is to show that, while Pol Roger’s cuvées are released when they’re ready to drink, they have the ability to age further.

Also giving some of its wines extra time is Louis Roederer which, in addition to its ultra-rare vinothèque releases of Cristal, launched a Late Release vintage series in 2022 of five wines going back to 1990 that had continued to age in the Roederer cellars post disgorgement.

Plenty of bottle: Charles Philipponnat

A quintet of Late Release rosés, dating back to 1995, will hit the UK this autumn. “Reaching the peak of maturity, yet still as fresh as ever, these original disgorgement Champagnes illustrate their exceptional cellaring potential,” says chef de cave Jean-Baptiste Lécaillon, who believes his wines can age for up to 30 years.

Opting for extra time on the lees rather than under cork, in 2021 Piper-Heidsieck launched a library collection called HorsSérie with the 1971 vintage, which had spent the last half-century ageing in Piper’s cellars, following up with the 1982 vintage in 2022.

“The Hors-Série collection gives me carte blanche to transmit and enrich Piper-Heidsieck’s heritage. Each cuvée is striking in its uniqueness, whether it’s the length of ageing, a singular blend or a particular tasting ritual,” says cellar master Emilien Boutillat, who reveals that a third release from the collection is planned for 2024.

While market conditions may be challenging in traditional hotspots such as the UK and US, Champagne is benefitting from a growing thirst for the French fizz both in the UAE, where sales have skyrocketed over the last 12 months, and in Asia, where high rollers are splashing their cash on the top labels at nightclubs.

“There’s a lot of conspicuous consumption of Champagne in Singapore, at swanky spots like the Marquee club,” reports Richard Hemming MW, head of wine at 67 Pall Mall Singapore.

“Tables will regularly buy half-a-dozen bottles of Dom Pérignon and Perrier-Jouët Belle Epoque that come with sparklers sticking out of them and a big celebration when they’re delivered to the table – the whole point is to be seen doing it.”

Given their rarity, craftsmanship and ageing potential, no matter how hard times may be, prestige cuvées will always find an audience.

Related news

Queen Camilla gives speech at Vintners Hall

Sotheby's to offer wine cellar of New York sculptor Joel Shapiro

Will the new EU free trade agreement open up India to fine wine?