Fine Wine Monitor: What’s bringing ‘The Rest of the World 60’ down?

As the fine wine sector has cooled cult wines from California, Spain, Australia and Chile have seen their market value eroded. db investigates why.

One quarter into 2024, the Rest of the World 60 is one of the worst-performing sub-indices of the Liv-ex 1000.

The index, which tracks the price performance of the 10 most recent physical vintages of six wines from Spain, Chile, the US and Australia, is down 3.9% since 1 January, behind the Burgundy 150 (-6%) and the Rhône 100 (-4.5%).

The make-up of this index is an interesting one, as it features three California wines (Screaming Eagle, Dominus and Opus One), Vega Sicilia Unico from Spain, Penfolds Grange from Australia and, the most addition, Seña from Chile. California wines have their own index (not a subset of the Liv-ex 1000) with the California 50, which is down 4.3% year-to-date. Are the California components of the Rest of the World 60 driving the index’s recent underperformance?

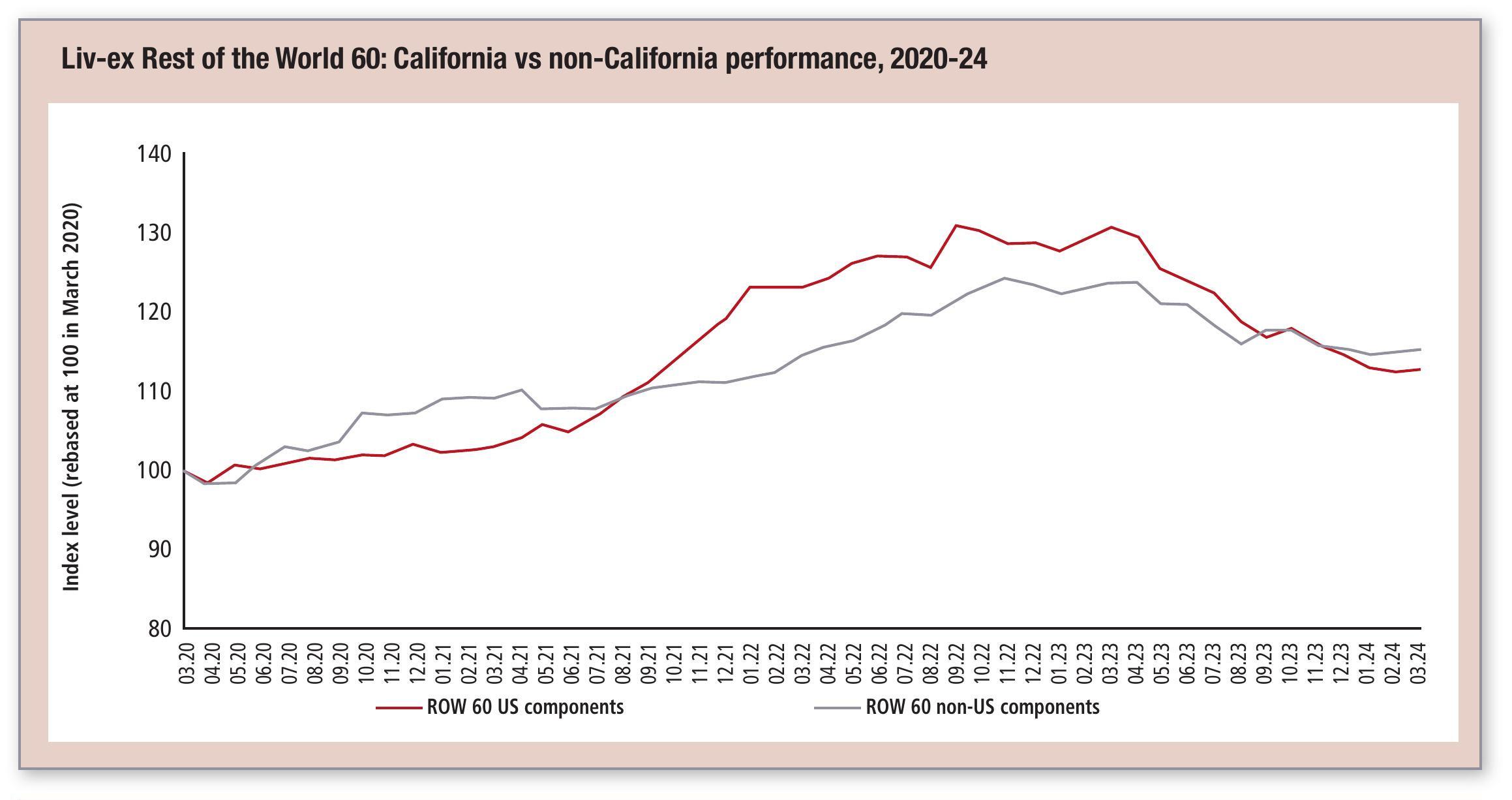

Looking at the last year, it certainly seems so. While both US and non-US components of the index fell year-on-year, the California wines suffered the most, about 4% lower than the others.

However, the Liv-ex graph (above) shows that, while the California components of the Rest of the World 60 may be currently bringing the index down, they also clearly outperformed their non-US components during the 2021/22 fine wine market boom. (NB: as Seña was only added to the index in January 2023, the non-US components in this graph do not include the wine.)

Indeed, as fine wine prices skyrocketed in Bordeaux and Burgundy, they did so too in California. The region’s ‘cult wines’ surged in popularity during that time, and California had two new entrants in the 2022 Liv-ex Power 100: Scarecrow and Realm Cellars.

These wines consequently fell out of the Power 100 in 2023, as did Dominus, which narrowly missed out on a place in the rankings. These relatively “new” wines, which command very high prices, prove harder for collectors to measure in terms of relative value, in the current market.

That can be said of most of the components of the Rest of the World 60, as they are less familiar to most collectors and thus have a narrower market than the known names of Bordeaux, for example.

Producers and négociants will be hoping that recent releases (Vega Sicilia Unico 2014, Promontory 2019, Ao Yun 2020, etc) will refocus buyers’ attention on the broader fine wine market, but that may take some time. Their “place” in the fine wine world is in its infancy.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Areni Global: 'We have to find a way to make wine consumption safer' for women amid spiking fears

All the medallists from The Global Cabernet Franc Masters 2026