Château Lafite Rothschild: What goes up must come down

Historically a ‘super brand’ for Chinese collectors, Château Lafite Rothschild has undergone a substantial price correction in the past 18 months, db discovers.

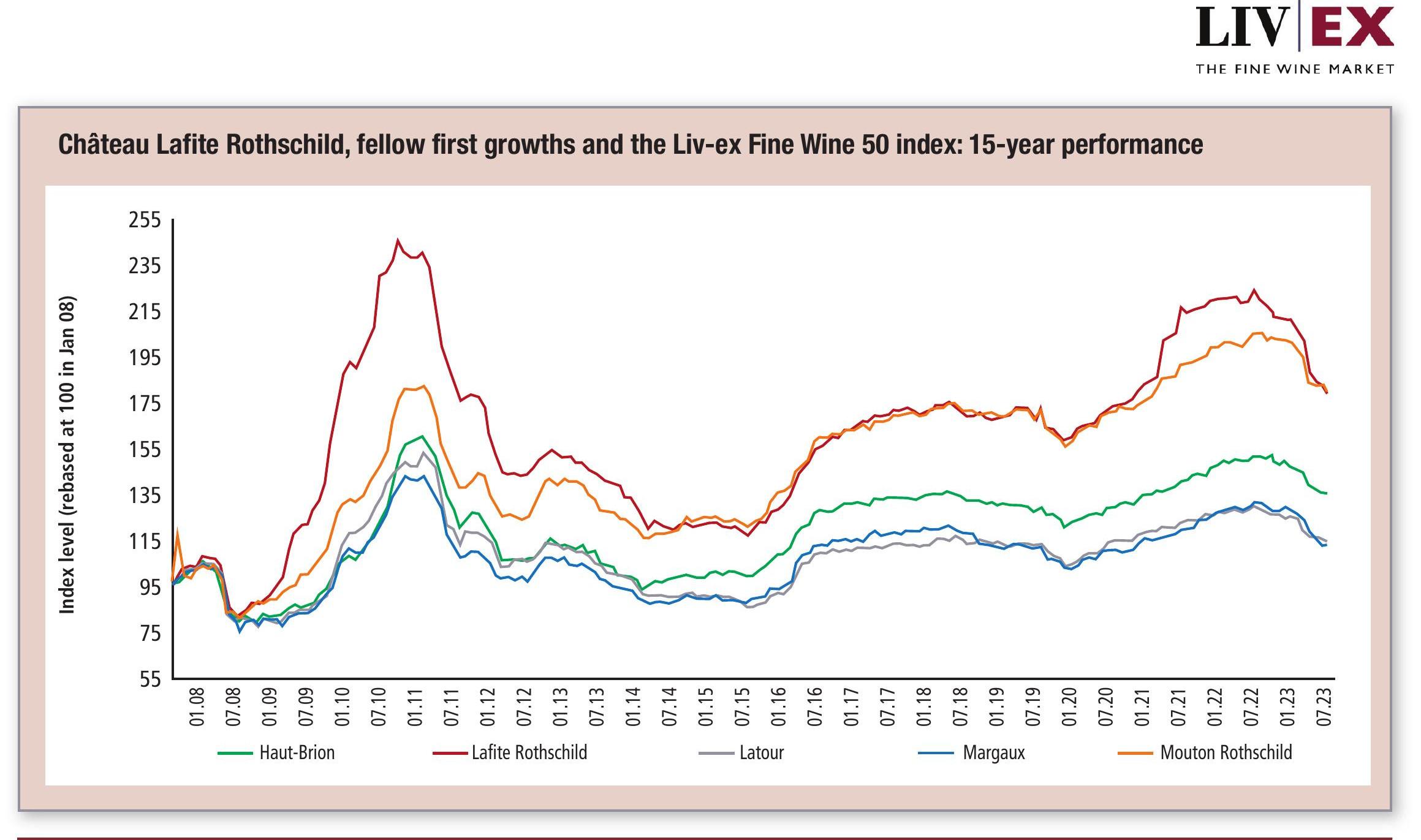

Château Lafite Rothschild is one of the five wines that feature on the Liv-ex Fine Wine 50 index, which tracks the daily price movements of the Bordeaux first growths. The index has declined by 13.7% over the last 12 months, and by 10.1% over the last two years.

Lafite has been an important contributor to this decline, being the worst performer within the index. The wine’s vintages within the Fine Wine 50 have, on average, experienced a 17.8% drop in their one-year performance, and a 15.7% decrease in their two-year performance.

So, what lies behind this relative fall from grace for one of fine wine’s most illustrious names? During the Asia-led boom of 2009 to 2011, Château Lafite Rothschild emerged as a ‘super brand’ in China, reaching unprecedented heights in terms of both prestige and price.

However, the subsequent market correction in 2011 marked the beginning of a challenging period for Lafite; prices experienced a significant decline (the index saw a 39.2% drop between its peak in June 2011 and August 2012), and the dynamics around the brand began to shift. Fast-forward to the present day and Lafite is, like the fine wine market as a whole, undergoing another price correction.

The strength of the demand and ensuing price increases of Lafite can be seen by looking at fellow first growth Château Mouton Rothschild. As the chart above shows, the two brands’ indices had followed remarkably similar trajectories from July 2014 until July 2021, when Lafite rose to much greater heights than Mouton. Since its peak in the summer of 2022, Château Lafite has retraced 19.8%, compared to Château Mouton’s 12.7% fall.

Changes in Lafite’s prices are closely tied to the Asian market. Once a powerhouse of demand, Asia is facing challenges, such as increased regulation, anti-corruption drives and an oversaturation of wine in the region. Consequently, demand has waned and UK merchants, who were accustomed to catering to the Asian market, have found themselves with excess stock.

fine wine monitor – in association with Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Areni Global: 'We have to find a way to make wine consumption safer' for women amid spiking fears