Why tawny Port is back in fashion

Port used to be somewhat aloof, only turning up on special occasions. But in recent years producers have changed tack to turn tawny in particular into a drink for countless scenarios, reports Gabriel Stone.

Some friends are a constant presence, rarely out of the diary, their WhatsApp feed a stream of consciousness; others prefer to pop up every few years, keeping their powder dry for a major life event.

Until recently, Port tended to fall firmly into the latter category: a vintage declaration fanfare three times a decade, then silence.

But the past 10 years have confirmed a dynamic character transplant. Now barely a month goes by when a Port producer doesn’t proudly unveil shiny new treasure.

And invariably these really are treasures: how many regions can pull out such quantities of wine that regularly exceed the halfcentury age milestone and not uncommonly reach back into the 19 thcentury? Every release tells its own story, but there’s a single thread that links this hive of activity and it’s spun in a distinctly tawny hue.

Tawny Port is far from a fresh innovation. It has long been the traditional focus of Portuguese-owned houses, and a major driver of sales in markets such as France. British-owned houses may have sung the praises of vintage Port, yet in Porto their directors were more likely to be found rounding off lunch with a refreshing glass of tawny.

But while this approachable style offered Port an extra foothold as fortified sales slipped downhill, there was little sign of any higher aspiration, especially if it risked overshadowing vintage Port.

Then, in 2010, came Scion. Launched by Taylor’s, this tawny port dating back to 1855 carried a fair but bold price tag of £2,500 per bottle. It was a resounding success. Not to be outdone, 2014 saw Graham’s release its 1882 tawny Ne Oublie at the even steeper £4,510 mark.

Nor were British houses allowed to hog the limelight. Niepoort marked its 170thanniversary in 2012 by bottling a new edition of its “VV” (Vinho Velho), a tawny from the 1863 harvest. That same harvest was behind another Niepoort release in a Lalique decanter, which in 2019 broke the record for the most expensive Port sold at auction when Sotheby’s Hong Kong brought the hammer down at HK$1,054,000 (£102,636). Suddenly it seemed that every venerable milestone called for a special tawny release.

In 2015 Quinta do Crasto marked its 400thanniversary with the launch of Honore Very Old Tawny Port, whose components were over a century old. A year later Quinta do Vallado celebrated its 300 thbirthday with a 933-bottle run of ABF 1888, named after family ancestor António Bernardo Ferreira.

The enthusiastic reception of these seriously venerable, pricy Port expressions has sparked a trickle-down effect to bottlings that, while still decidedly premium, fall within the reach of a rather broader customer base. Graham’s now has The Cellar Master ’s Trilogy, a collection of single-harvest tawnies from 1950, 1974, and 1994. “Single-harvest tawnies are amazing wines, a snapshot of individual years,” enthuses Anthony Symington, market manager for Graham’s owner, Symington Family Estates. With packaging and a proposition that call to mind certain whisky brands, it comes as little surprise when he notes: “They’ve captured the attention of spirits connoisseurs and collectors.”

Over at Taylor’s, a more regular flow of single-harvest tawnies has sprung up, released when they hit their 50 thyear with obvious appeal for birthday and anniversary gifts. However, as the 2020s dawned, history threatened to undermine this success story. “We had lots of stock from the ’60s, but with Portugal’s social revolution and civil war there are very few stocks from the ’70s,” explains David Guimaraens, head winemaker at Taylor’s owner The Fladgate Partnership. “It’s not that we didn’t have stock from the ’70s, it’s just not registered as single harvest.”

In 2022 the solution – and a sign that these seriously old tawny Ports are no passing fad – came with the creation of three new categories by the Instituto dos Vinhos do Douro e do Porto (IVDP): 50 Year Old Tawny; 50 Year Old White Port; and, for wines older than 80, Very Very Old Tawny Port.

Taylor’s swiftly launched Golden Age, a 50-year-old tawny, and a luxuriously packaged Very Very Old Tawny Port, both now part of the house’s core range, albeit in limited quantities. It wasn’t alone. Sandeman, Quinta do Vallado and Kopke were also among those leaping at this opportunity.

Gabriela Coutinho, global marketing director at Kopke’s parent company, Sogevinus Fine Wines, welcomes the new classifications, noting: “It brings interest, diversity and dynamism to the category and attracts new customers.”

The house’s particularly impressive library of mature tawny stock puts it in a strong position to capitalise on current demand. However, Coutinho notes that categories such as 50 Year Old are particularly useful. “The blended tawnies are a fantastic way to enjoy Port, and they enable us to preserve our stocks of very old tawnies and white Ports for longer, as we don’t need to use as much of each vintage,” she explains.

For the Port trade’s cohort of expert blenders, these new categories posed an intriguing challenge.

“It was very funny to make this blend because we knew nothing about 50 Year Old tawny,” says Francisco Ferreira of Quinta do Vallado. “There was none in the market so we couldn’t compare.”

In the end, the estate’s expression incorporated a small amount of 70-year-old wine alongside a rather >special 8% component from 1880. An initial 1,000-bottle run soon sold out, as did the next 1,000 bottles.

“It’s a good problem to have,” smiles Ferreira, who estimates that at the present annual rate of 3,000 bottles he still has enough 1880 stocks to maintain the same blend for 36 years. “And then it will not be my problem,” he smiles.

At Quinta da Pedra Alta, the team is also concerned with longevity. “For our winemaker João Pires, it’s all about the quality of the components he has to work with, including a small proportion of material that is more than 50 years old,” says Andy Brown, commercial director. “The reaction to our 10 Year Old indicates we are on the right path. We have a few barrels of very old Port but are currently using this as a small part of the 10 YO tawny blend, rather than bottling it, to keep the style of our 10 YO consistent.”

Widening the appeal

The vast majority of serious old tawny releases make vintage Port, supposedly the category’s pinnacle, look rather inexpensive. Yet far from treading on vintage’s toes, they appear to be opening up Port’s appeal to a new audience. While vintage moves in an elite world of critics and knowledgeable wine enthusiasts, tawny stands immediately ready to drink, with no decanting required, its soft and sweet profile easy to enjoy and, once opened, a shelf life measured in weeks rather than days.

Such accessibility does not come at the cost of often quite glorious complexity. Nor is it difficult for the more casual consumer to appreciate the history through which the most mature examples have lived. No-one sums up this appeal more eloquently than Cristiano van Zeller of Van Zellers & Co, which is preparing to release a tawny laid down before the outbreak of the American Civil War (see boxout, next page).

“All these old tawny ports have an incredible sense of poetry; their own sense of history and challenges throughout time, how they were preserved and how they will be enjoyed in the future,” he reflects. “These bottles are little poems.”

2023 tawny release highlights

The steady stream of seriously mature tawny Port that has been trickling out of producers’ warehouses shows little sign of drying up just yet. This year alone, Quinta do Vallado plans to launch a Very Old Tawny containing wine between 40 and 150 years old, while Van Zellers & Co will offer a special edition of just 25 cases containing a bottle each of 1860, 1870, and 1888 tawny Port.

Both producers are part of the Douro Boys group, which recently marked its 20th anniversary by unveiling a jointly blended 50 Year Old tawny Port. Containing components dating back to 1860, the 950 bottles were offered en primeur at €500 each, with the majority snapped up at a launch event held in Porto for the international trade in April.

These special bottlings aren’t just useful to mark producers’ own milestones. Hot on the heels of a suitably venerable tawny to mark the 2022 Platinum Jubilee of Queen Elizabeth II, April 2023 saw Taylor’s release another Very Very Old Tawny Port to commemorate the coronation of Charles III.

“I love the definition,” mused David Guimaraens, technical director and head winemaker at Taylor’s parent company, The Fladgate Partnership, at a preview of the new blend, which carries a regal recommended retail price of £425.

“It’s the sort of Port you can sit with in the corner and contemplate on your own. Then you can just sniff the empty glass.”

It’s not all about top-end tawny

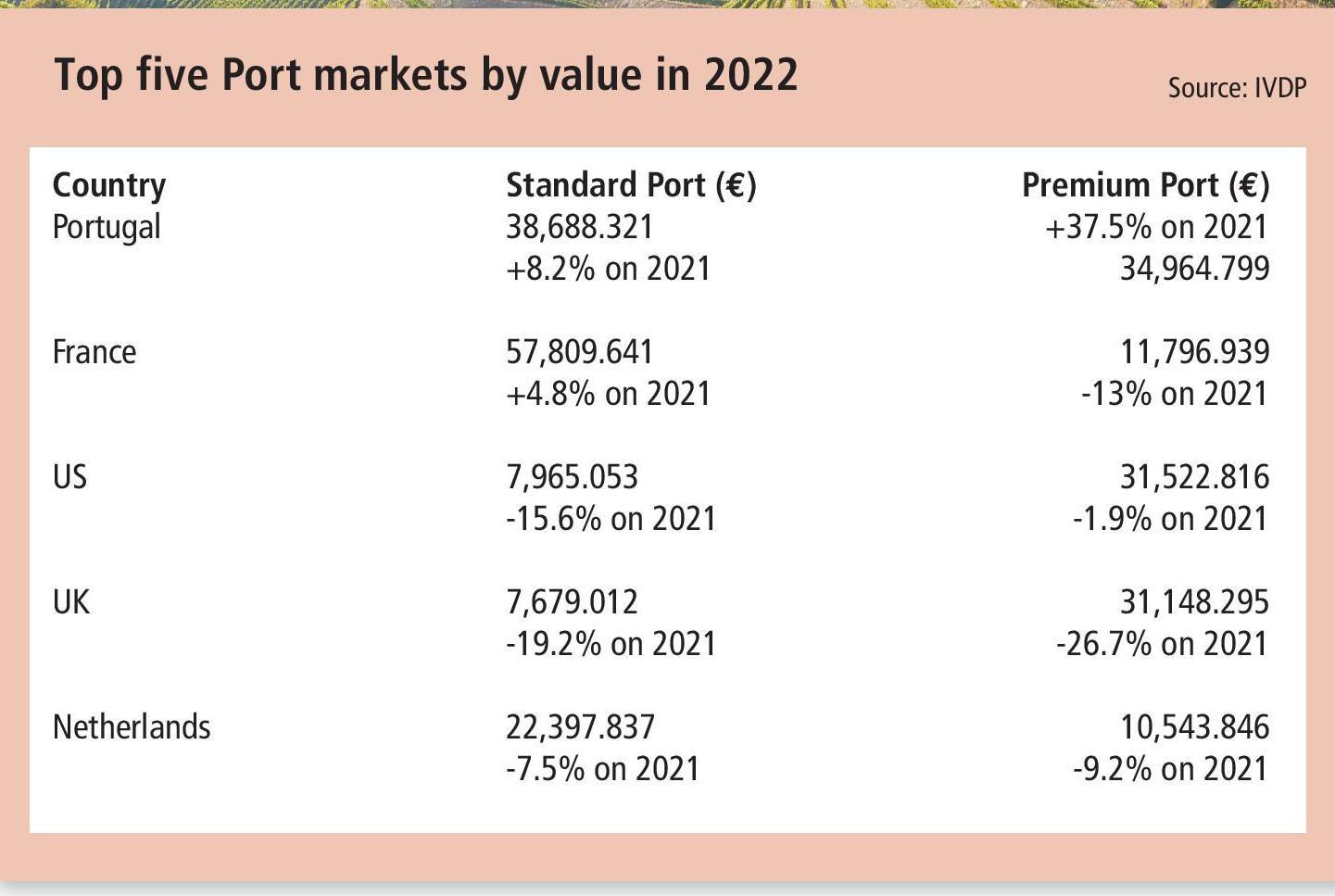

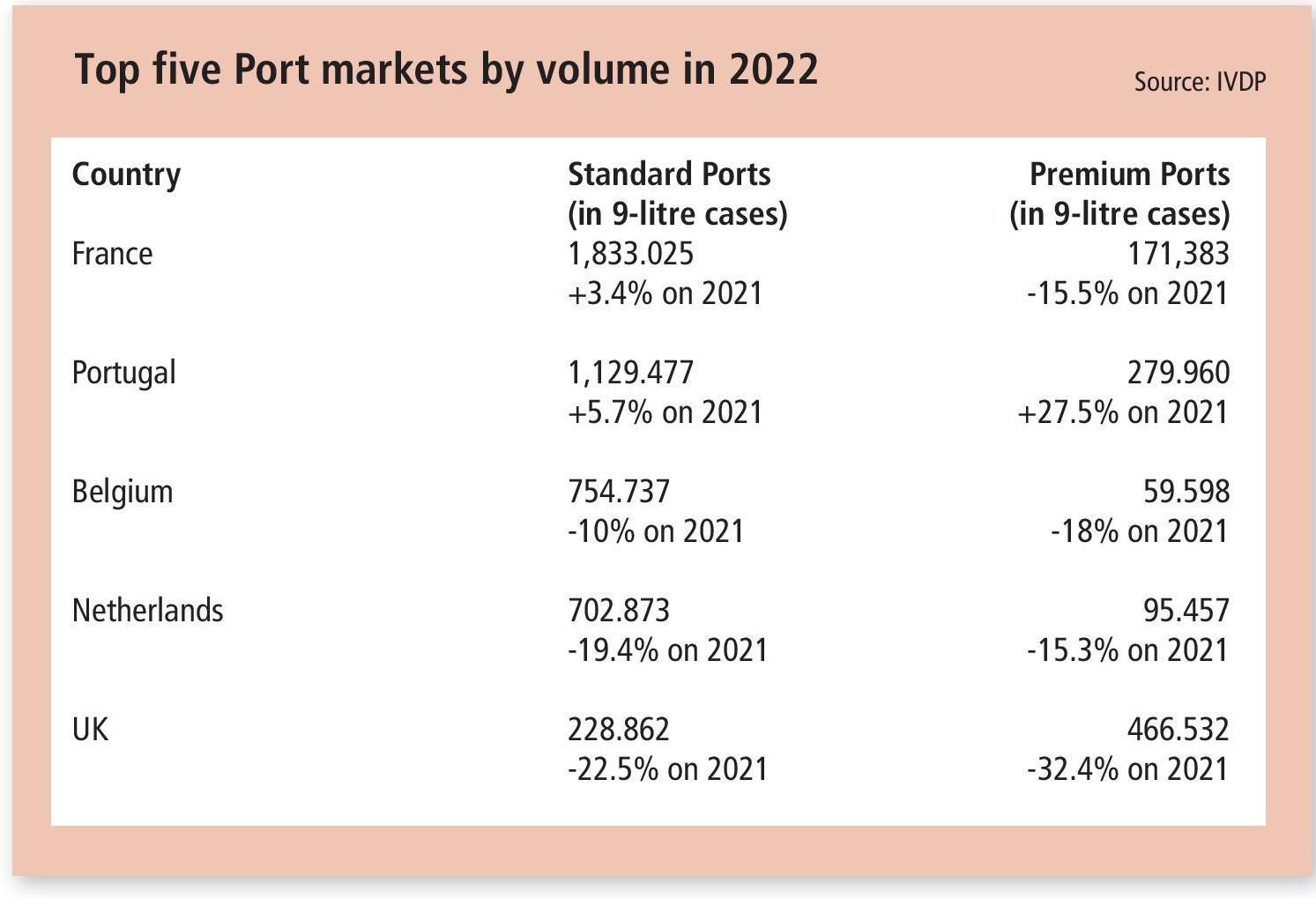

They may not be new or quite so venerable, but let’s not overlook the energetic performance of more mainstream tawny styles. IVDP figures show global value sales of aged tawny leapt from €59.2 million in 2012 to hit €100.6m in 2022, a 70% increase in just a decade.

As special category styles boom, it’s no secret that the commodity end of the tawny Port market is in long-term decline. Jorge Dias, general director of Granvinhos, whose portfolio includes Porto Cruz and Dalva, sums up the problem.

“In the last few years the only category growing is very aged tawny, but the Douro is not sustainable only with these great wines. We must maintain big volumes.”

Recognising that much of its core French apéritif customer base was switching to drinks such as Apérol Spritz, since 2011 the company has invested heavily in promoting its portfolio in cocktails. As indeed has Croft through its Croft Pink and Tonic in a can, and new Reserve Tawny, which comes housed in modern, youthful packaging to target the mixology world.

“Around 50% of Port is purchased by people aged 45 years or over, which by default means that a significant proportion of younger consumers are also enjoying the category,” says Chris Forbes, sales director for Croft.

“Millennials have grown up in a uniquely rich media environment, where they are content savvy and want to garner as much knowledge about products as possible. Social media has allowed us to create new moments of consumption such as serving an aged tawny Port lightly chilled by the pool, while hiking or in the back garden during summer.”

At Sogevinus Fine Wines, Gabriela Coutinho, global marketing director, points to Asia as an opportunity. “South Korea is booming for Kopke tawnies,” she reports. “It is one of our strongest markets, due in part to the sweetness, which appeals to their palate. Tawny Port is also used a lot in cocktails in South Korea, as well as being drunk over ice in bars and nightclubs. The aesthetic of the retro, hand-painted bottle also appeals to the design sensitive Koreans.”

Anthony Symington flags up strong sales in the US, Scandinavia, and, a more recent development, Portugal itself. “It came from nowhere to market number four, which is great,” he reports, pointing to the country’s growing middle class and tourism boom in Porto.

“With all the development and buzz around Portugal I really think there’s a huge opportunity for us.” Croft’s Chris Forbes echoes that sentiment when he says: “Port is one of the key experiences visitors want to have when coming to Portugal, which has led to Portugal becoming the largest Port market in the world in value, which would not have been easy to predict a few years ago. That experience is happening across all different levels, from cocktails to premium Ports and is a golden opportunity.”

Related news

Queen Camilla gives speech at Vintners Hall

Master Winemaker 100: Alberto Stella

Australian Vintage sales dip 1.7% as turnaround plan targets stronger second half