Export value of Australian wine continues on downward slope

Australian wine exports declined by 10% in value to AU$1.87 billion in the year to July 2023, but dropped just 1% in volume over the same period, driven by a reduction in demand for wine shipped in bottle in the US.

Wine Australia’s latest Export Report, released last week, cited a reduction in exports to the US as largely driving the decline in value. The decline of “lower-priced packaged exports”, accounting for wine shipped in bottle, was responsible for the continued value decline in the US, Wine Australia said.

Exports to the UK also continued their downward trend, following the two years of elevated shipments due to pre-Brexit demand and Covid-related market impacts.

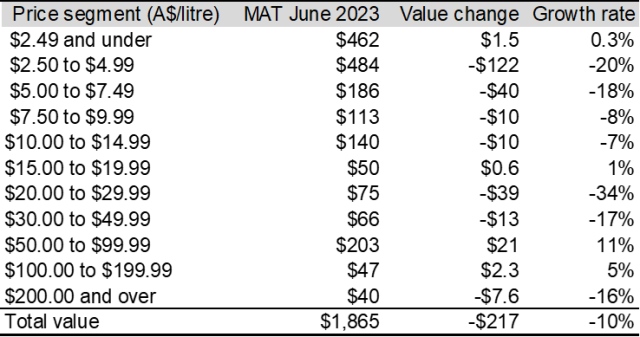

Peter Bailey, market insights manager at Wine Australia, said that more than half of the decline in the country’s wine export value took place in shipments with an average value of AU$2.50-$4.99 per litre free on board (FOB). This price tier generally accounts for Australian wine exported in bottle rather than bulk wines, and tend to be sold in lower priced retail segments.

“Wine consumption in mature markets is in decline, driven by decreases in the commercial price segments. This is impacting Australia’s export performance, especially in the US, as Australia is very exposed to the price segments in decline,” Mr. Bailey said.

Partner Content

Figure: Exports by price segment (million AUD FOB)

Global wine consumption was down 3% in volume in 2022, according to IWSR — a figure which Wine Australia has cited in relation to the country’s declining export figures.

In comparison to value, volume export figures were relatively stable, falling just 1% to 621 million litres in the year ended June 2023. A short-term, supply-driven increase in unpackaged wine shipments (meaning those exported in bulk), especially to Canada, was outweighed by declines in volume to many of Australia’s export destinations.

Bailey noted that an easement of the shipping challenges of the last couple of years has allowed “Australian exporters to catch up and ease pressure on inventory”, resulting in a growth of “unpackaged shipments”.

Related news

Wine Origins Alliance welcomes two new members