The price of success: how Champagne plans to balance supply and demand

Champagne has come roaring back since Covid-19, with exports hitting a new high. But this resurgence brings its own challenges, reports Patrick Schmitt MW.

FOLLOWING A week-long stint in Champagne at the start of this year, there was a single word that was repeatedly uttered by the managers of every major marque in the appellation. While it’s a term sometimes employed to explain the sales partitioning of a special release, single vineyard bottling, or sought-after prestige cuvée, it is rarely – if ever – used in relation to the entire stock of a large producer. So what was the word? It was ‘allocation’ – adescriptor that is, in essence, a euphemistic way of saying you’re ‘out of stock’. Uttered in reference to last year ’s sales by the many Champagne houses I visited in January, it reflected the fact that the leading players in the region were having to impose limits on what their customers could order, quite simply because demand had outstripped supply.

As a result, producers have been busy prioritising bottles for their most longstanding clients, or those who were good for their image – such as top-end restaurants – and best for their incomes. As CEO of Veuve Clicquot Jean-Marc Gallot says of 2022: “Growth has been so spectacular that in all honesty it has been a challenge to manage it; and we have had to make some choices, which has meant focusing on the on-trade and our key partners – those with a strong qualitative and value proposition.” From what the Champenois have been saying, allocating bottles is a tiresome process which, while a reflection of the extraordinary health of Champagne consumption since the Covid-related lockdowns of 2020, has been frustrating for the brand owners, as well as their sales forces and trade customers, who could be making more by selling more.

CAP ON SUPPLY

So what were the reasons why almost everyone in Champagne has had to resort to a system of allocating stocks in 2022? And will this cap on supply continue into 2023 and beyond? To start by answering the first question, the reason why demand has surpassed supply concerns, in part, a failure to adequately forecast the strong call for this fine French fizz post the initial shock of the pandemic.

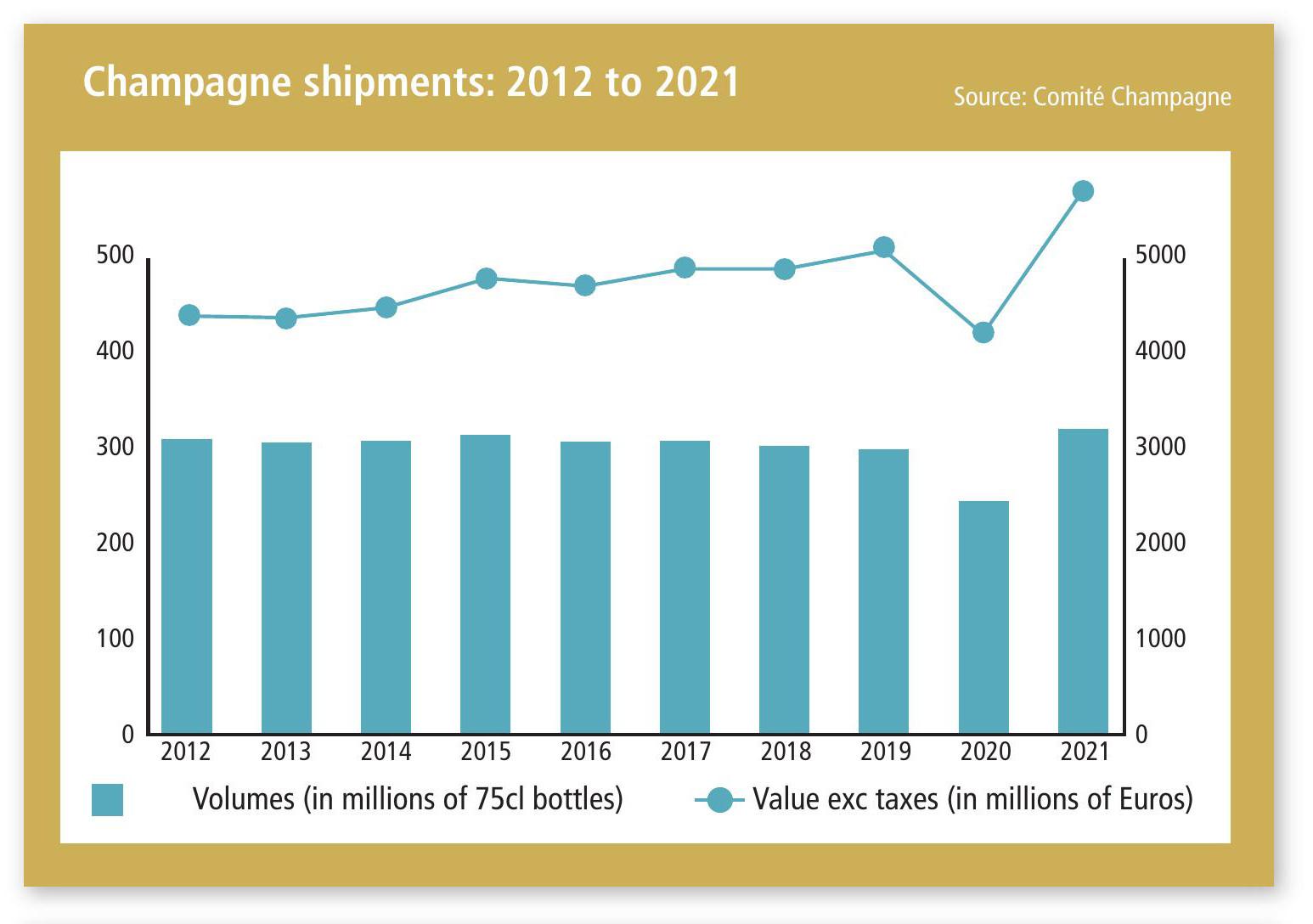

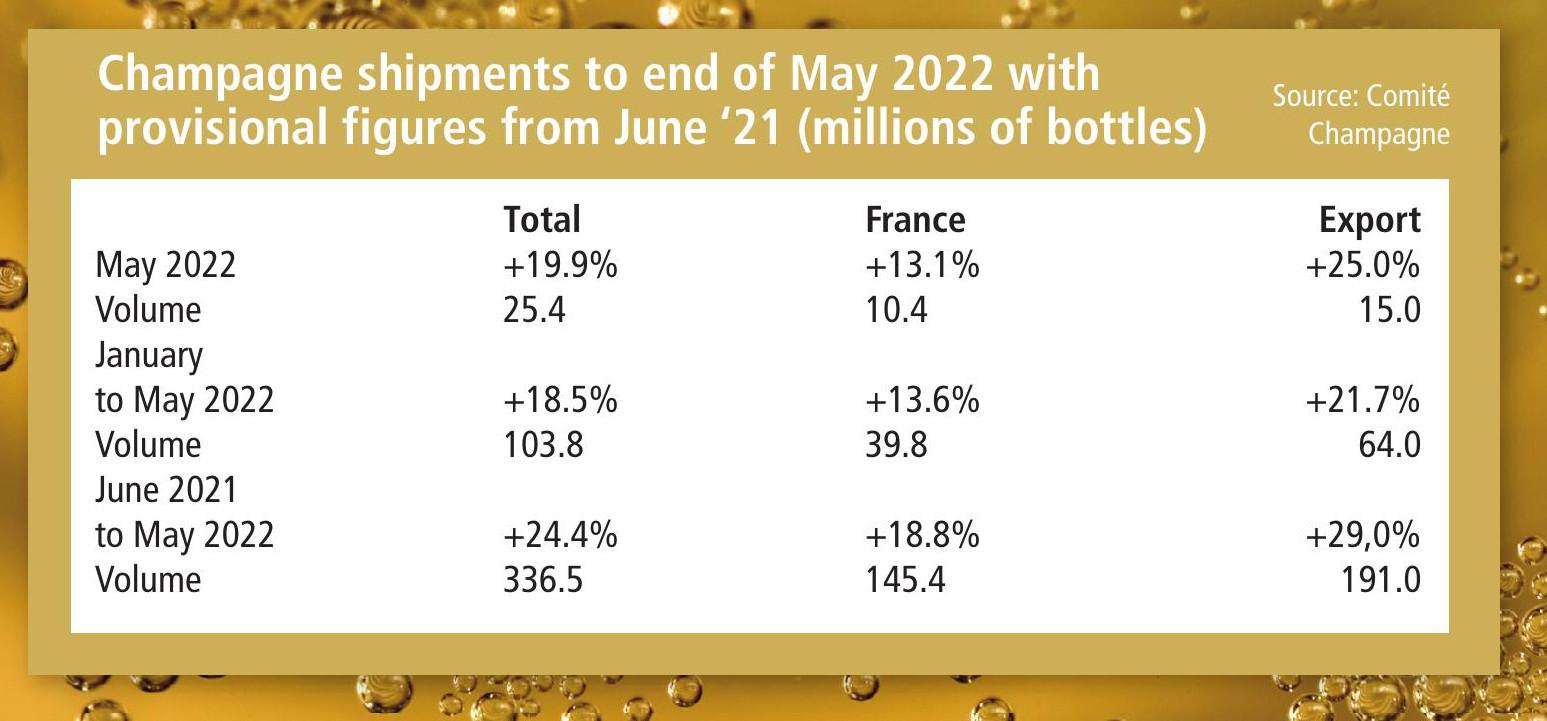

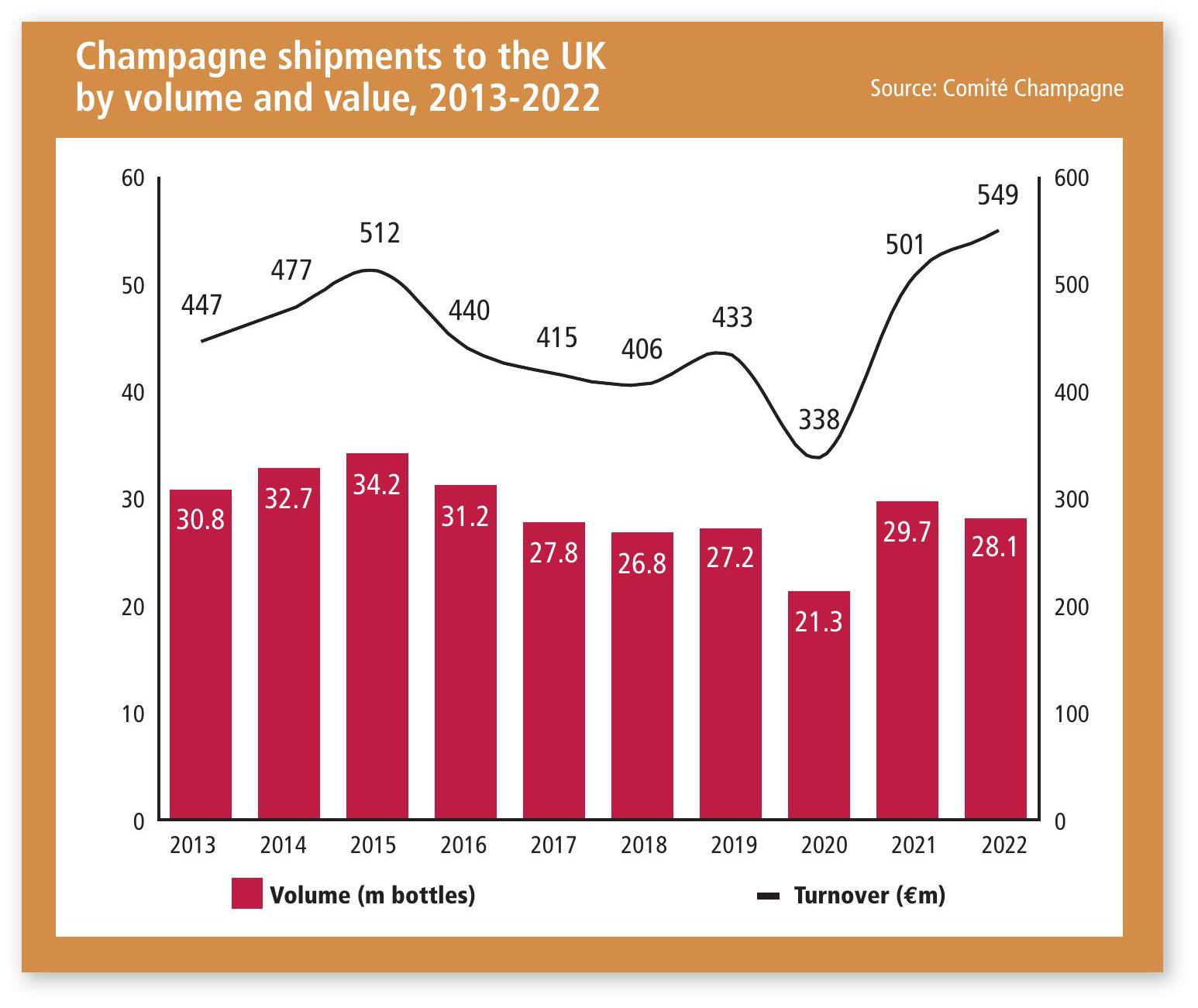

As Bollinger MD Charles-Armand de Belenet admits: “Champagne has had two fantastic years in 2021 and 2022, but it is important to keep in mind that this was a surprise; no-one was expecting such a rebound.” Not only did Champagne shipments grow by as much as 75 million bottles during the course of 2021 – albeit off the historically low Covid trading year of just 245m bottles in 2020 – but then the region saw continued growth during 2022, hitting 326m bottles – anear record in volume (see table, p14). However, last year ’s total was capped by supply, with Comité Champagne co-president Maxime Toubart telling db that, had producers had the stocks, the shipments could have reached 335m bottles. De Belenet thinks it could have been even higher, commenting that his business “could easily have sold 20% more [in 2022], and it’s the same for a lot of the top-end houses, so the real demand is much higher than 326m [for the region], maybe 10-20% more”.

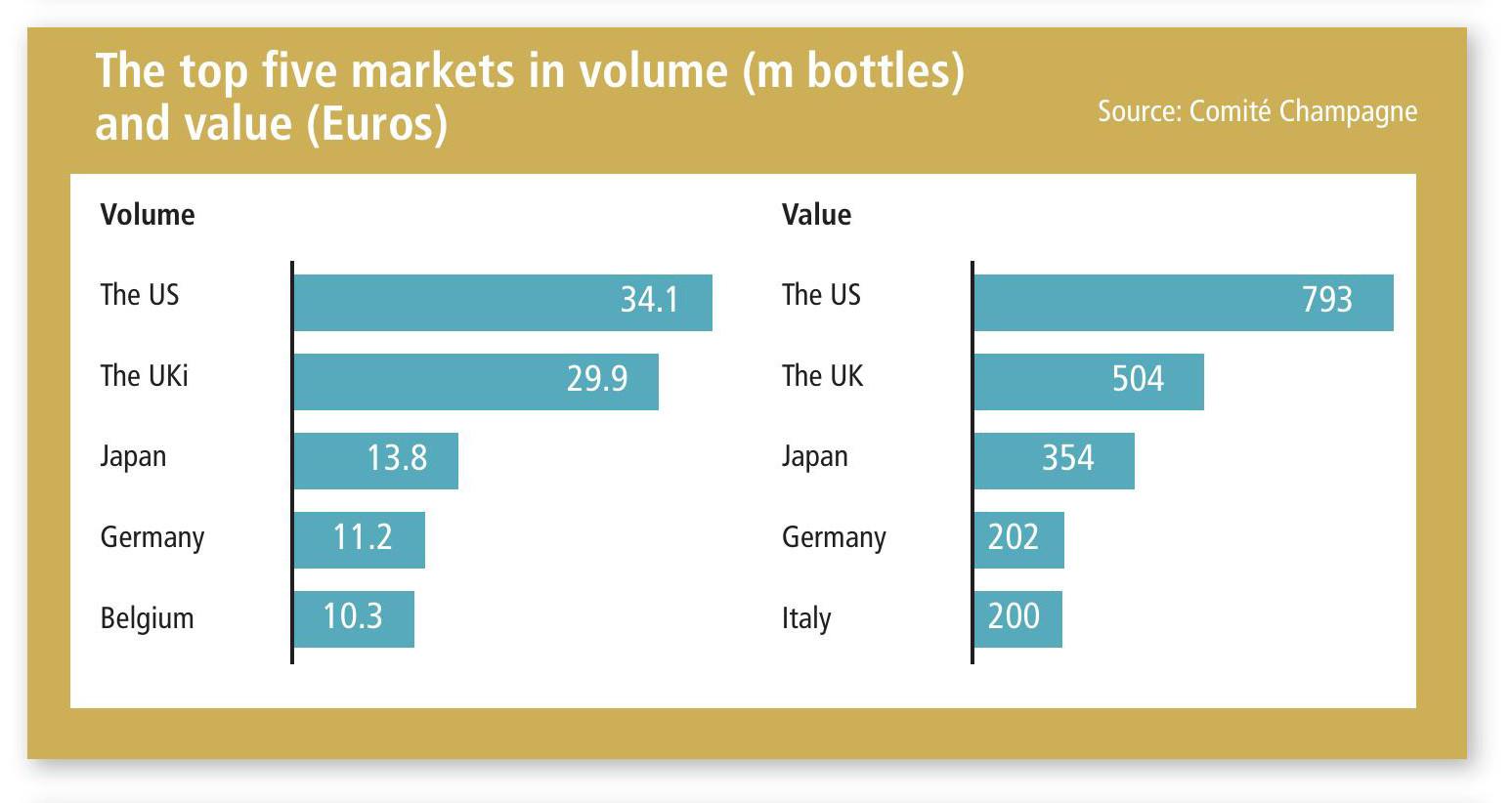

A number of factors are driving this bounceback, giving hope to the idea that a larger market for Champagne is here to stay. Indeed, should the recent surge in demand be related simply to a post-pandemic euphoria, then it might be expected that the total market for Champagne will head back to its sub- 300m bottle annual figure, which was the level of shipments pre-Covid. Major socio-political and economic shocks aside, that is considered unlikely, as the pandemic accelerated a change in the way Champagne is consumed, particular in its largest export market: the US. In this huge market, Champagne has managed to attract new drinkers, making it a driving force of growth in 2021, reaching a new level that was sustained, if not expanded, in 2022.

Head of Champagne Drappier, Michel Drappier, explains. “When sales increased in 2021, we thought we were selling what we had not sold during Covid, but that was not the case; it was the start of a new era of consumption of Champagne at home,” he says. The trend was particularly acute in the US, where pandemic rules on socialising outdoors encouraged people to entertain in their houses. “In the US, Champagne was a party drink; people did not drink it at home, where they had beer and spirts and wine,” Drappier says, outlining pre-pandemic consumer habits. “But since Covid, US consumers have started to enjoy Champagne at home, and order and drink expensive bottles, which, with their big houses and apartments, they have room to stock. You can see it in our sales figures; we are up 40-60% in the US, where we are now on allocation.”

Not only that, but US consumers, now they are going out more regularly again, are increasingly drinking Champagne in bars and restaurants in place of cocktails, as well as enjoying it with meals in place of wine. Furthermore, there is a long way to go, with almost 34m bottles shipped to a market that comprises at least 250m adults, making it one of the lowest Champagne consumers per capita in the world. It’s why de Belenet notes that “the US may be Champagne’s largest export market, but it’s still an emerging market”. And it’s why he has such a bullish forecast: “I’m very confident regarding the future for Champagne, because the US is one of the most resilient economies in the world.”

Among the other major markets for Champagne, Japan is notable for its 20% rise in shipments of the fine fizz. Comité Champagne co-president David Chatillon says: “The Japanese market is booming. The growth began after other markets – it started at the end of 2022 – but it has really rebounded.” Such a delayed recovery in Japan resulted from its longer period of lockdown and, like the US, this re-opened market is also seeing new consumer behaviour. “The Japanese didn’t drink Champagne at home, so when the restaurants closed in Japan, Champagne sales went down dramatically,” recalls Drappier. But now, the Japanese are enjoying Champagne in the on-trade again, as well as at home, having started to consume it during the prolonged Covid restrictions in the country. Following the lockdowns, it also appears that Champagne is being increasingly being drunk with meals in all mature Champagne markets.

This latter post-Covid development explains the rise in Champagne sales in Europe, where it’s not believed that there are new Champagne drinkers, but it’s thought that existing consumers are opening more bottles. These people are drinking the French fizz before and with food when dining or entertaining at home. In the UK, it’s supposed that wine enthusiasts are drinking more Champagne because it offers good value, relative to fine Burgundy at least. Pol Roger UK MD James Simpson MW says:

“We put our prices up 12% in January, but when Burgundy prices are up 20-40%, suddenly 12% on Champagne doesn’t look so scary: a bottle of Pol Roger looks cheaper than a village Meursault.”

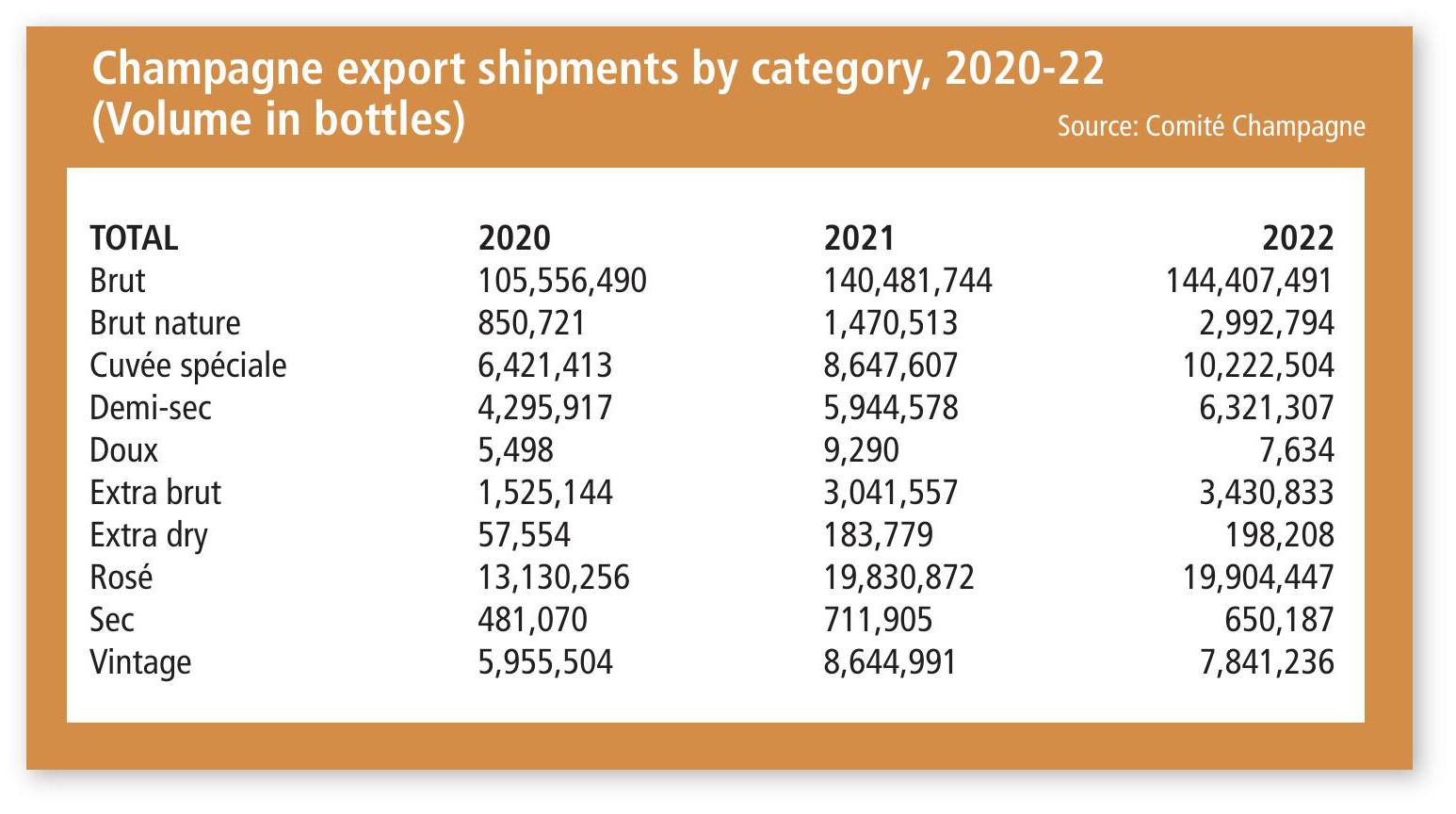

INFLATIONARY PRESSURES

Of course, with demand outpacing supply, on top of inflationary pressures for Champagne producers, the cost of the fizz has gone up markedly over the course of last year and this year too. And one market in particular has reacted less well to Champagne’s increasing prices: France. This means that exports, not domestic sales, have driven growth in Champagne shipments; exports were up 4.3% in 2022, reaching 187.5m bottles. This compares to 138.4m bottles distributed within France, where there was a decline of 1.7% on 2021. Chatillon explains: “France is the only market that is down, and that’s because the penetration rate is very high: the French drink two bottles per person per year, and the combination of price inflation and fewer promotions has had an impact on sales.”

This has been felt especially in the grande distribution, according to Chatillon, which is France’s supermarket sector, where Champagne can sell for extremely low prices in high volumes – but only if there’s the stock to fuel such a footfalldriving retail technique. Supplies for French retailers may have been redirected to higher-value sectors of the market, and/or different countries, and hence Champagne has become not only a more broadly distributed product, but also a higher turnover business. Confirming the domestic sales trend for Champagne, Vranken-Pommery Monopole chairman Paul-François Vranken says: “In France, the low prices disappeared, so day-to-day consumption has been decreasing.” He continues: “For the rest of the world, Champagne is for exceptional occasions, and in France, it was daily, but now it is moving to exceptional moments too.”

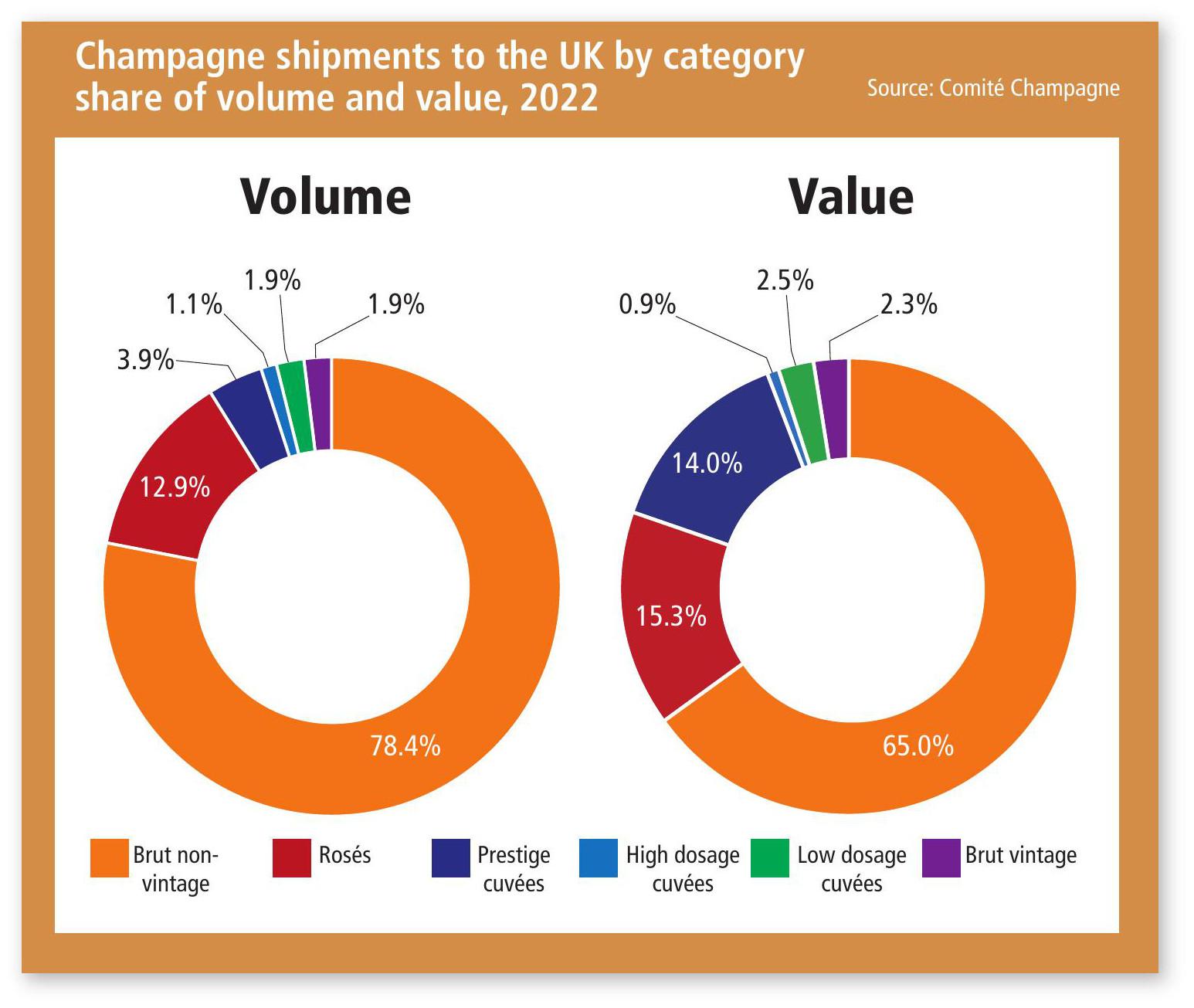

Overall, however, the heads of the region are keen to stress that the sales developments in Champagne are positive. Not only is demand higher than shipments, but turnover has reached a new record in 2022. The combination of increasing volumes, coupled with higher Champagne prices – aproduct of limited supply, rising production costs, and greater sales of pricier cuvées – has pushed up the value of shipments to a new record, with the global sum surpassing €6 billion for the first time.

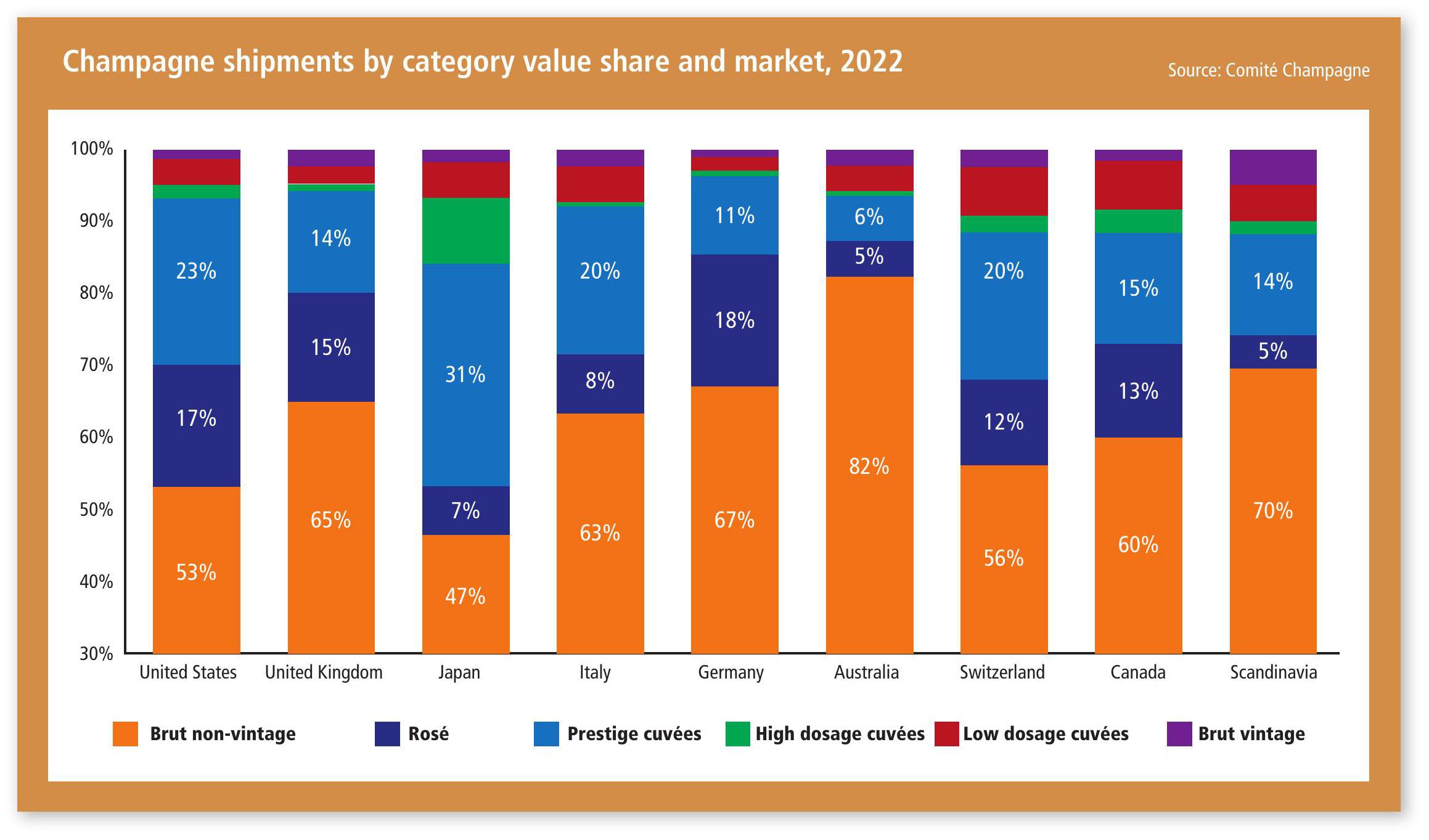

As de Belenet observes: “The top end of the market is booming; the more premium you are, the more demand you have.” Similarly, Champagne Gosset president Jean-Pierre Cointreau says: “It is a fascinating period for Champagne because there is a high level of shipments and increasing quality.” He also sees a positive future for Champagne exports due to emerging markets. “You now see in Asia that when people have celebration drinks, it is a glass with bubbles – this is very positive for exports of Champagne.”

Meanwhile, Champagne de Venoge president Gilles de la Bassetière highlights the potential of Africa. “What’s really moving is Africa; we have a lot of new importers and new demand,” he says. “For example, we are now selling more Champagne in The Democratic Republic of the Congo than we are in England.” He notes the increasing wealth of DRC is built on rare earth mineral mining for batteries.

For Vranken, a future growth area for Champagne is India. “The greatest markets today are Anglo-Saxon, from the US and Canada to England and Australia, but other markets are opening, and we see a future for Champagne in India,” he says. “India is not open today, there are enormous taxes and it is very complex, but it is a very Anglo-Saxon market, with many more Champagne consumers than China, and in India, they like bubbles – it is a market with considerable potential for Champagne.”

QUESTION MARKS

Nevertheless, there are question marks over the sustainability of Champagne’s current position – anear record in shipments and a new peak in turnover. One of these relates to supplying the current level of demand in the future, and the second concerns the cost of making Champagne. Initially, to consider supplies, the current limits are not about to go away. With the average ageing period for a bottle of Champagne being two years, and for the majority of the Grandes Marques around three years, producers are now selling Brut NVs based on the 2020 and 2021 harvests – both of which were small (the first due to limits on yields to guard against a feared future oversupply following Covid, and the second due to poor weather conditions). Indeed, at a time when shipments are 326m bottles, Champagne houses are disgorging bottles based on harvests that yielded fewer than 250m and 210m bottles in 2020 and 2021 respectively. And these lower-production vintages are coming at a time when Champagne houses have cleared any excess stock to meet the unexpected high post-Covid demand. As Bollinger ’s de Belenet states: “The number of bottles houses will be able to release this year will be below 326m, and far below… so we should not be surprised to see the Champagne market decrease due to the fact there is low availability.”

Also, in the longer term, Champagne is unlikely to see production increase much beyond the current level of consumption. Not only is it a fully-planted fixed area of 34,000 hectares, but average yields are gradually declining for a couple of reasons. One of these is due to more sustainable vineyard practices, particularly a move away from using herbicides and allowing ground cover plants to compete with the vines – which brings down yields by around 15%. The second cause – climatic extremes aside – is the rise in average age of vines in Champagne, with very little replacement taking place due to the loss in income that growers removing vines would face, even if the plants are yielding less and less each year.

It’s why Champagne Philipponnat president Charles Philipponnat would like to see the appellation enlarged – something that has been considered for many years, and now seems to be back on the table. “I’ve always been in favour of increasing the vineyard area, which we can do without losing quality – quite the opposite in fact with the places being considered,” he says. “If we did, it would release the pressure in the market, and allow for some growth and more moderate price increases, so I wish we could resume with the extension of the appellation.”

As for the other issue, the cost of producing Champagne, that too is an issue for the region’s producers. The price of grapes from the bountiful 2022 harvest has gone up more than 10%, taking the base level fee for a kilogram of grapes in Champagne beyond €7. Then there are further cost increases, from cartons, boxes and, notably, glass, which has gone up by as much as 40%. On top of this are rising interest rates, which are a major factor if you are borrowing money to finance maturing Champagne stocks. The result is a minimum price rise for brut NV Champagne of 10% this year, with more increases expected as other production expenses go up too – notably salaries for staff, which are rising to keep pace with inflation. The fear is that Champagne, which has built its success of being an accessible luxury, will become too expensive for many of its current consumers, who will, as a result, drink less, or may move to alternatives, be they other less expensive and increasingly fine sparkling wines, or other drinks, such as fashionable Provençal rosé.

It should be added that, with the supply of Champagne now and in the near future falling below the level of demand, a rise in on-shelf bottle prices may be a good way to bring the market back into balance. In other words, slowing consumption due to rising prices would bring an end to the Champagne shortage. However, there is a concern with this theory. Firstly, it presupposes that demand will gradually taper as Champagne prices go up. And, secondly, that this controlled decline in consumption will be even. However, there’s a fear that, as Brut NV Champagnes surpass certain psychological price barriers, demand will drop dramatically rather than gradually, while the impact will be the greatest on smaller players and weaker labels, who have neither the brand strength nor the marketing budgets to encourage their customers to buy their fizz at inflated prices.

On the point of brand strength, it is also notable that even famous marques are being cautious about passing on price increases, despite having to allocate stock. Their approach appears to be one of imposing incremental increases, with a lingering fear that, should the demand for Champagne take a downturn, even a strong name may be sold at discounted prices – an approach that does long-term damage to a maison’s image. “We are strong believers in cycles in the vine and in business,” says Champagne Billecart-Salmon CEO Mathieu Roland-Billecart.

“At the moment, it’s a high point: in 2022, we were blessed by the gods, it was an amazing viticultural year, and on the sales side, we have clients queuing.” He continues: “But we will see how long that lasts; the last time Champagne shipped over 320m bottles was in 2006, 2007 and 2008, and then we had the crisis. As a family we have been around long enough to know not to be too enthusiastic when things are good – and there are a lot of headwinds too.”

It’s a feeling echoed at another house that’s managing allocations, Bollinger. As the producer ’s MD de Belenet says: “What I’ve learnt in Champagne is that you want to avoid being up and then down. It’s much better to move step by step than have huge increases; Champagne is about the long-term strategy.”

Certainly, it appears that Champagne is looking to manage its future both carefully and collectively. Despite the boom times being enjoyed by the region now, aside from the concerns for the future that have been raised already, there a lingering threat that tomorrow’s climate won’t be kind to the region. It’s why the Comité Champagne is earmarking more funds for viticultural research, changing rules to allow altered vine spacing and even authorising a new disease-resistant hybrid grape called Voltis. On top of this, the appellation has made changes to the rules regarding how much wine producers can hold in reserve – avital tool for offsetting years when harvests are poor, but a store of juice that has been dwindling due to the recent, aforementioned small vintages.

So, whether it’s due to rising demand or falling supply, Champagne looks set to become an increasingly expensive product. With consumption increasingly disconnected from political and economic woes, and production limited by humans and nature, Champagne is an appellation that can only plan for growth in value, not volume. Post the pandemic, this is a product that has not lost any of its lustre; on the contrary, it has gained in desirability. As Michel Drappier says: “We are so happy, because we thought we were old-fashioned, and we feared we might become like Madeira – the king of wines for centuries, but almost dead today. However, now we are like Burgundy: the orders are much higher than what we have.”

Feature findings

• Champagne’s remarkable post-Covid recovery has forced houses to allocate volumes as demand outstrips supply around the world.

• Lucrative markets such as the US and Japan have bounced back strongly – and producers could have sold millions of extra bottles last year, if supplies had been adequate.

• A number of factors are driving price increases, leading to softer demand in what is still Champagne’s largest global market: France.

• There is little prospect of increasing production in the short term, sparking calls for plans to expand the appellation to be revived.

• Some fear that rising prices may alienate Champagne’s core consumers, prompting them to drink less or leave the category altogether.

Brand news: Pol Roger’s huge investment

Pol Roger is nearing the completion of the biggest single investment in the house’s 174-year history, as it finalises a new production and storage facility in Epernay. Just in time for its 175th anniversary in 2024, the major overhaul of the company headquarters, between the Avenue de Champagne and Rue Winston Churchill, will improve efficiencies and capacity.

According to Pol Roger CEO Laurent d’Harcourt, the producer is spending €40-50m on the improvements, which would make it “much more comfortable”. He said the existing production site was “too narrow” for Pol’s current output of 2-2.1m bottles. Noting that the company had decided against moving this aspect of production to a site outside Epernay, d’Harcourt added: “I think we will remain as one of the only houses to have everything on the same site: the winemaking, bottling, tasting, reception area and office.”

Brand news: Champagne Gosset gears up for milestone with new look

Champagne Gosset unveiled a new logo at ProWein in March as the Champagne house gears up for a significant anniversary next year. Founded in 1584, Gosset is the oldest wine house in Champagne, and will celebrate its 440th birthday in 2024, an occasion it is already working towards with a refresh of the brand’s appearance this year. Gosset has created an updated logo, which has been designed to “reconnect” with the Champagne brand’s past, according to Thibaut Le Mailloux, marketing and communications director at the house.

Continuing, he explained that the long-standing look of Gosset’s packaging was linked to Albert Gosset – co-founder of the Rochas perfume house – who created the brand’s hallmark ‘neck medallion’ label when working at the family Champagne business from the 1970s. The logo was designed to look like a jewel adorning the bottle, while Albert Gosset employed gold foil on the capsule, which was “a graphic code from the perfume industry”, according to Le Mailloux. “We wanted to reconnect with this history,” he said, adding: “We wanted to reboot the classic cues from Gosset.” As part of this, the house has dropped its old CG (Champagne Gosset) logo and created a new monogram, while returning to gold cues and foils in place of the silver ones currently used.

Odilon de Varine, Gosset’s head winemaker and general manager, told db at ProWein that “silver was cold and we want the warmth of gold”, referring to the new colour scheme. “We are re-asserting our identity, he said. “But the wine hasn’t changed.”

Brand news: Mumm Champagne to open restaurant in Reims

Champagne GH Mumm has opened a restaurant in Reims called La Table des Chefs, which served its first dishes to the public on 12 May. The restaurant is located in Maison Cordon Rouge – the historic headquarters of the Champagne house at 31 Rue du Champ de Mars – and is open for lunch and dinner from Thursdays to Mondays. Based on the model of an artist residency, La Table des Chefs offers young chefs the opportunity to take turns running the kitchen for a period of three months.

Inaugurating the restaurant is Mallory Gabsi, who was named Young Chef of the Year by the Michelin Guide in 2023, and holds one star at his eponymous restaurant near the Arc de Triomphe in Paris. Accompanying him is Raimonds Tomsons, ASI Best Sommelier of the World 2023, who has created a wine list “based on the great French wine regions”, along with expressions from elsewhere in Europe and the New World.

As for the Champagnes, he has drawn on some of the old vintages from the GH Mumm Oenothèque.

Speaking to the drinks business earlier this year about the restaurant, François-Xavier Morizot, VP for Champagnes Mumm & Perrier-Jouët at parent company Pernod Ricard, said that the decision to open up this historic Mumm property to the public was in keeping with a move upmarket for the brand. Describing La Table des Chefs as “bistronomy” in terms of its positioning, he explained that “it is aligned with our strategy of premiumisation”. Confident that GH Mumm would have no problem filling the restaurant, he said that it would serve a latent demand for dining in this part of Reims, which is about a 20-minute walk from the cathedral in the centre of the city. “We have a cellar tour at number 34 on the same street, and so we want to have this offer for our visitors, who often ask us when they have finished their tour: ‘Where can I have lunch or dinner?’,” he explained. Morizot continued: “There are not many places in this area of Reims, so we will be in a position to offer this new experience to our consumers.” He also noted that this area of the city is changing, with a new sports centre, and commented that “it is very different from what it was three to four years ago”, adding: “We want to re-energise the part of Reims.”

Finally, he said that the house was given the confidence to open a restaurant based on the success the group has had doing something similar with fellow Pernod Ricard Champagne house, Perrier-Jouët. In Epernay, Perrier-Jouët offers a fine dining experience at Maison Belle Epoque, as well as a Champagne bar, which Morizot said had been a success, commenting that the group is “very happy with the results”.

Brand news: Besserat de Bellefon marks milestone anniversary with new cuvée

This year, Champagne Besserat de Bellefon is celebrating 180 years since its foundation in 1843. To mark the event, the producer is launching a limited-edition anniversary cuvée, in magnum and in bottle. Blended for this anniversary by Besserat de Bellefon’s cellar master, Cédric Thiébault, it is made up of a blend of the best crus from two great years, 2012 and 2015. Described as having “a wonderful brilliance and a delicate straw-gold colour”, it features aromas of “white flowers” and “gently toasted bread”, along with notes of “coconut and liquorice”. The palate features “a lovely creamy train of bubbles”, with “fresh fruit notes such as nectarine or apricot”. The finish is said to be “characterised by minerality and tension”, with a hint of “iodine”. This new cuvée will be released in limited quantities, with just 1,800 bottles and 180 magnums available worldwide. The recommended retail price is £160 for the bottle, and £370 for the magnum.

In 1843, Edmond Besserat, from Hautvillers, founded the Champagne house in Aÿ. The wedding of Yvonne Méric de Bellefon, a member of the “Champagne nobility”, to Edmond Besserat II marks the beginning of the Champagne Besserat de Bellefon name. In 1930, Monsieur Degas, director of La Samaritaine De Luxe restaurant, challenged Victor Besserat, a skilled taster, with a bold bet: “Do create a wine of Champagne, smooth enough to pair and accompany any meal, and I will order 1,000 bottles instead of 100…” Cuvée des Moines was born – aChampagne specially elaborated for gastronomy, and a partner of the greatest chefs ever since.

This is the origin of the house’s signature style, which is a Champagne with a low pressure and no malolactic fermentation.

Related news

Ruinart enlists Tadashi Kawamata for 2026 Conversations with Nature series

Why Champagne performed better in 2025 than the figures suggest

Alice Tétienne steers Champagne Henriot to a sustainable future