Looking to the past to find value in Bordeaux back vintages

Younger collectors frustrated at the lack of transparency of en primeur could snap up quality drops from earlier years, Liv-ex argues.

With the new crop of wines now tasted, the global fine wine trade has turned its attention to the heart of the matter – the question of Bordeaux release prices.

Colin Hay recently reported the following for the drinks business: “The négociants that I speak to are expecting increases in release prices of around 20%-25% (in euros) on average, with the anticipated range of release price increases being between 10% and 35% or so (for the classed growths and their peers, rising towards the top). La Place is anxious about such potential price increases, given the difficult prevailing market conditions, and the négociants have been lobbying strenuously behind the scenes since Vinexpo Paris (if not before) to exert a downward pressure on release price inflation (contrary to what some commentators seem to suggest).” Liv-ex’s Bordeaux 2022 report delves deeper into the changing en primeur system, and the factors and strategies influencing recent campaigns’ pricing.

We note that the current system is very much geared towards the châteaux (it is their wine, after all), which, in turn, are keeping the supply chain (relatively) happy by allocating them a fixed margin. But perversely, the ultimate supplier of capital to the system, the collector, is paying the price as the returns from buying and storing wines are gradually eroded. Feedback from Liv-ex members also suggests that collectors are increasingly taking part in en primeur campaigns through habit, for the ‘experience’ or simply to request big-bottle formats. Some note that the next generation of buyers, far more used to transparency and freeflowing information, are already growing skeptical of the process, particularly given the limited upside and opportunity cost involved. Ultimately, the choice of whether to buy or stand aside lies with the collector.

Those that are in it for the experience (and the choice of bottling format) might not be fazed by the anticipated price rises, but to a new generation of informed collector who has experience and access to other markets, and to whom transparency is not just commonplace, but fundamental to confidence, this might all seem too complex and risky an affair. Do they need to buy today, or can they afford to wait? Much of the data suggests the latter.

If the collector does choose to wait this one out, it may be interesting to offer them older vintages of Bordeaux currently available on the secondary market.

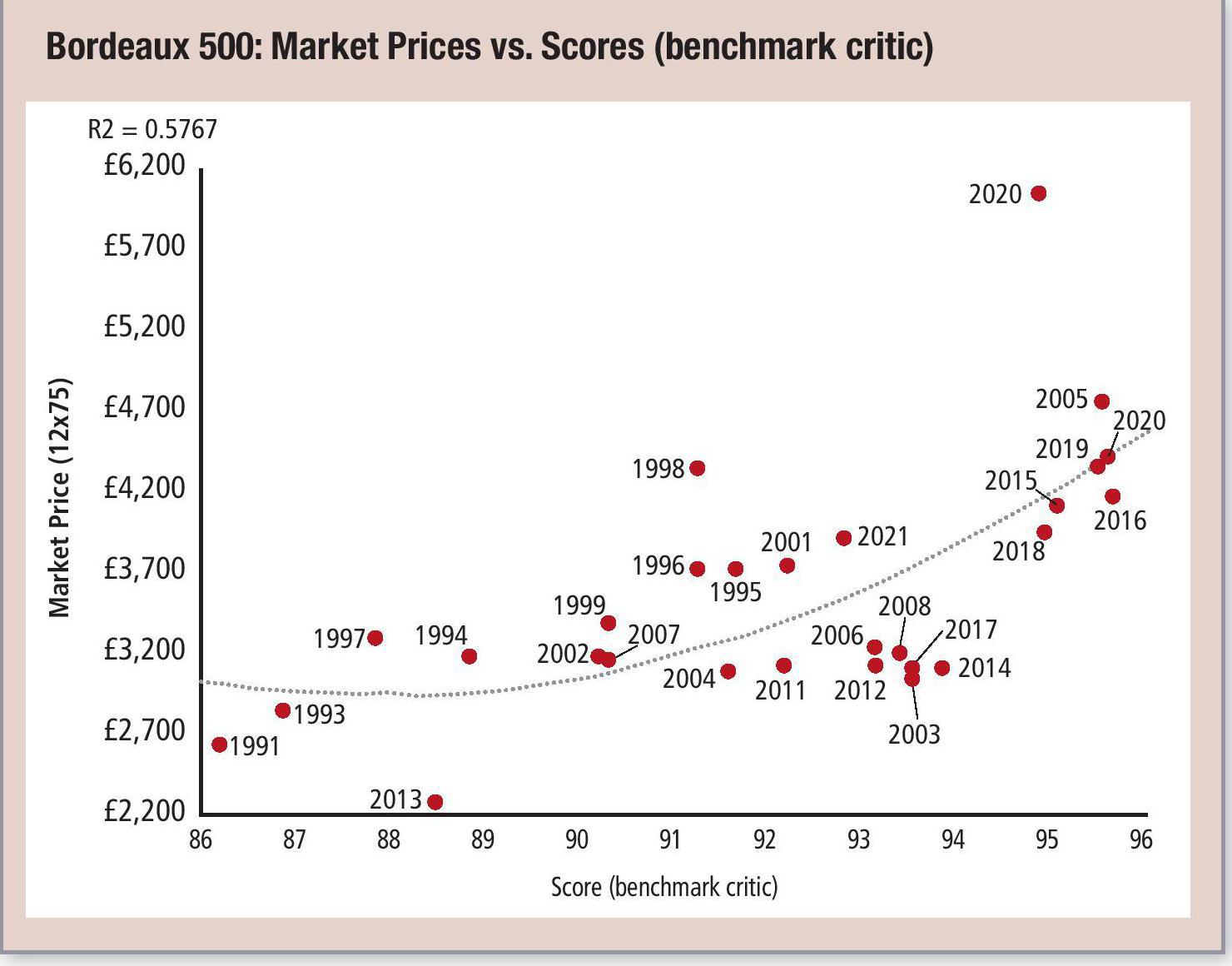

The chart below shows the average Market Prices of 30 Bordeaux vintages (1991- 2021) compared with their average critic scores (Robert Parker until 2013, and Neal Martin until 2021).

According to Liv-ex’s Fair Value methodology, prices are 57.7% correlated to these critic scores. The methodology hypothesises that, over time, wines will tend to lean toward their Fair Value price. Typically, though not always, the most ‘undervalued’ wines provide the best returns as the price moves up to Fair Value in the secondary market, whereas ‘overvalued’ wines provide the worst return. As such, the vintages below the trend line might offer relative value compared with their peers.

Average scores are the most recent ‘Benchmark Critic’ scores. i.e. Robert Parker (1991-2013) and Neal Martin (2013-2021) scores (from Vinous and the Wine Advocate) for the 50 wines found in the Bordeaux 500 index. Prices shown are the average Liv-ex Market Prices. The Market Price is the best listed price for a wine in the secondary market. Unless otherwise stated, it is standardised to 12x75cl. Interestingly, many of the vintages that fall below the trend line are from relatively recent ‘off’ vintages, such as 2003, 2004, 2006, 2008, 2011, 2012, 2013, 2014 and 2017.

From the ‘on’ vintages, 2018 and 2016 also notably feature just below the line, while 2015, 2019 and 2020 are just below too. Despite falling above the trend line, in absolute terms, some older vintages might offer better alternatives for those looking for wines with bottle age that are within their drinking windows. For example, the 1995 and 1996 vintages are available (on average) for less than the 2021 vintage. Buyers can also find 1998 Bordeaux for less than 2020.

fine wine monitor – in association with

Related news

Areni Global: 'We have to find a way to make wine consumption safer' for women amid spiking fears

All the medallists from The Global Cabernet Franc Masters 2026