Burgundy – global wealth creation and the value of luxury

After something of a slump in 2019, Burgundy is strong again, to the extent that it is now considered a luxury item.

Liv-ex’s latest extended report, Burgundy – for the few, not the many, pointed out that Burgundy seems to be playing in a league of its own. Stratospheric prices have limited its top names to the ultra-wealthy, and value has become harder to find.

The following paragraphs look at some of the additional insights that didn’t make it into the report, including the cause of rising prices for luxury goods, along with other investment options outside of Burgundy – in the worlds of both fashion and wine.

In 2018 Burgundy prices appeared to have peaked. They declined consistently throughout 2019 (the Burgundy 150 was the worst performing index, down by 8.8%) but the factors behind that slowdown were different from now – as highlighted in our January report. Burgundy’s recovery was triggered by the Covid-19 pandemic and the lockdown that followed in 2020.

Collectors and enthusiasts, no longer able to visit restaurants and hotels to drink the best wines, went online and shopped hard. Speculators joined the party, and prices rocketed, as the chart shows.

ALTERNATIVE ASSETS

The extended period of cheap money and huge government spending combined with the money saved through lockdown further boosted the wealth of high-net-worth individuals (HNWIs). As highlighted in our report on the fine wine market in 2022, this money had to go somewhere. First mainstream assets were the big beneficiaries – from equities to residential property. But so too, were alternatives.

The rise in the Burgundy 150 index neatly correlates with the rise in the number of HNWIs during the pandemic.

Rising prices were not limited to the top end of the wine market.

According to reports by both Deloitte and CapGemini, Covid and the accompanying lockdown sparked renewed interest in other alternative investments, from modern art to classic cars, and even to fashion.

For example, the average price of a Chanel Medium Classic Flap handbag rose by more than 50% between 2019 and 2022.

In 2021, one could get almost 10 Chanel Medium Classic Flap bags for the same price of a case of Domaine de La Romanée-Conti (on average).

THE DRC RATIO

However, for those focusing on fine wine investments, comparing Burgundy’s brightest star (Domaine de La Romanée-Conti) with the top names of other regions shows that the price gap between Burgundy and the rest of the fine wine market continued to widen.

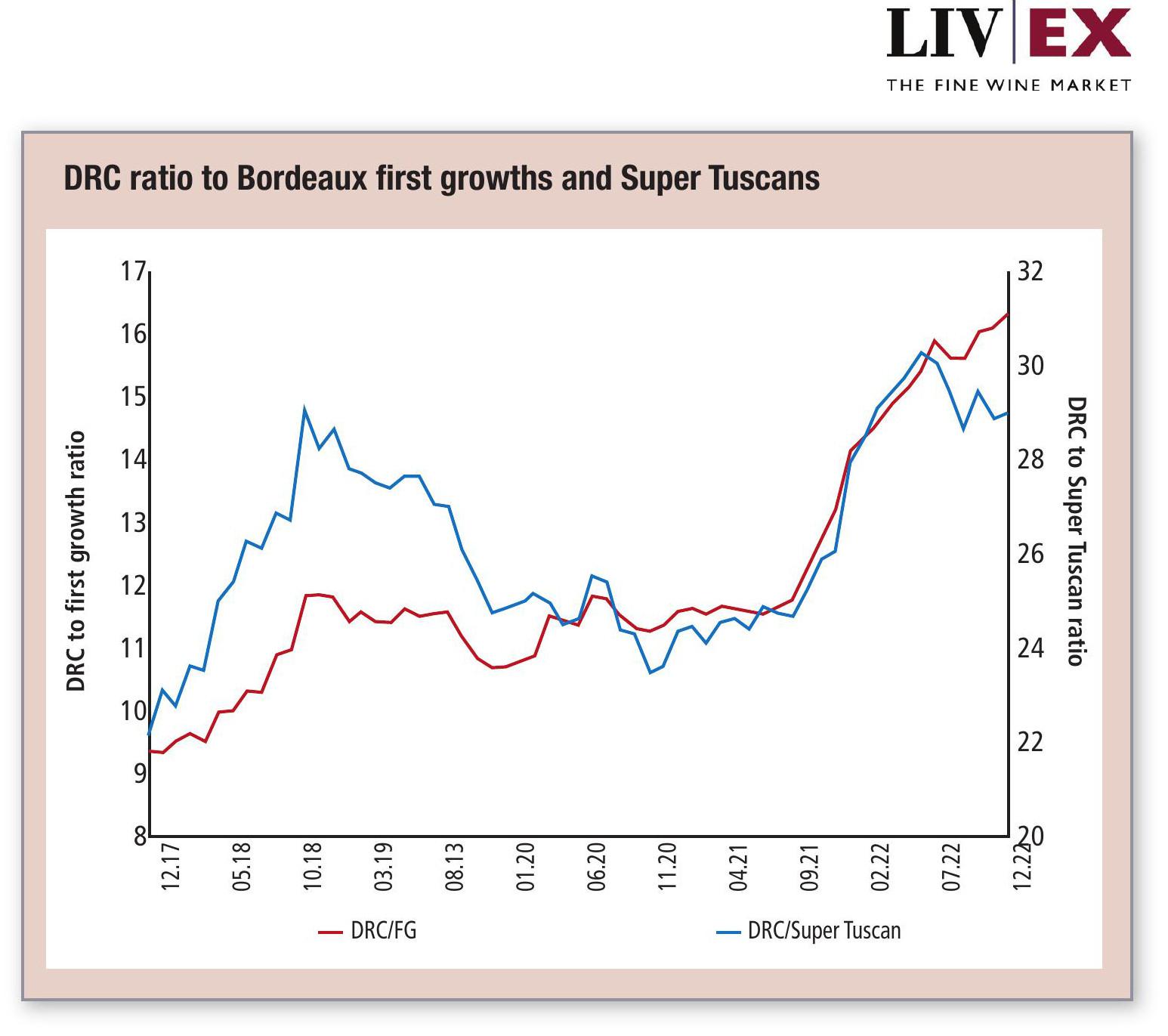

In 2019, one could buy 10 cases of a First Growth (on average) for the same price of a case of Domaine de La Romanée-Conti. Today, one can get 16.3 cases of first growths – or 29 cases of Super Tuscans. The price ratio between DRC and the first growths has continued to grow since December 2017. However, the price ratio between DRC and the Super Tuscans has been more volatile. As the chart shows, for the price of one DRC case, one could buy 29 cases of Super Tuscans in both 2018 and today. However, in November 2020, when the Super Tuscans were at the height of the market, as highlighted in our Power 100 report that year, one could only buy 24 cases.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Areni Global: 'We have to find a way to make wine consumption safer' for women amid spiking fears

All the medallists from The Global Cabernet Franc Masters 2026