Rosé Champagne carves out an important niche for itself

While white Champagne rules the roost, pink expressions have made an impact on the secondary market, data from Liv-ex has found.

The history of rosé Champagne is relatively short in comparison with other fine wines. While historians at Champagne Ruinart have found documents recording sales of pink fizz dating back to 1764, most Champagne houses only introduced rosé to their portfolios in the 20th century, such as Dom Pérignon in 1959, and Louis Roederer in 1974 – as a partner for Cristal blanc.

The production of rosé requires a different approach and greater effort from Champagne producers, and many of the reputable houses have invested in vineyards that supply them with suitable red wines for their blends. Volumes are thus naturally more limited, and the wines command a premium compared with their white counterparts.

SECONDARY-MARKET DEMAND

Rosé Champagne has carved out its own niche in the secondary market. In 2014 it accounted for 16.4% of the total for the region. However, the secondary market for Champagne then was much smaller than it is now. In 2014, Champagne only represented 3% of the fine wine market, compared with 12.8% so far this year. Last year, rosé accounted for 16.1% of the total Champagne trade, principally driven by US buyers, who were taking advantage of the region’s exemption from President Donald Trump’s 25% tariffs on European wines.

Between 2020 and 2021, the value of rosé Champagne bought by US merchants increased by 230.1%.

However, so far this year its trade share has declined to 11.1%, because white Champagnes have led demand and price performance. As our recent Champagne report highlighted, only one rosé has featured among the top traded Champagnes year-to-date – Louis Roederer Cristal Rosé 2013.

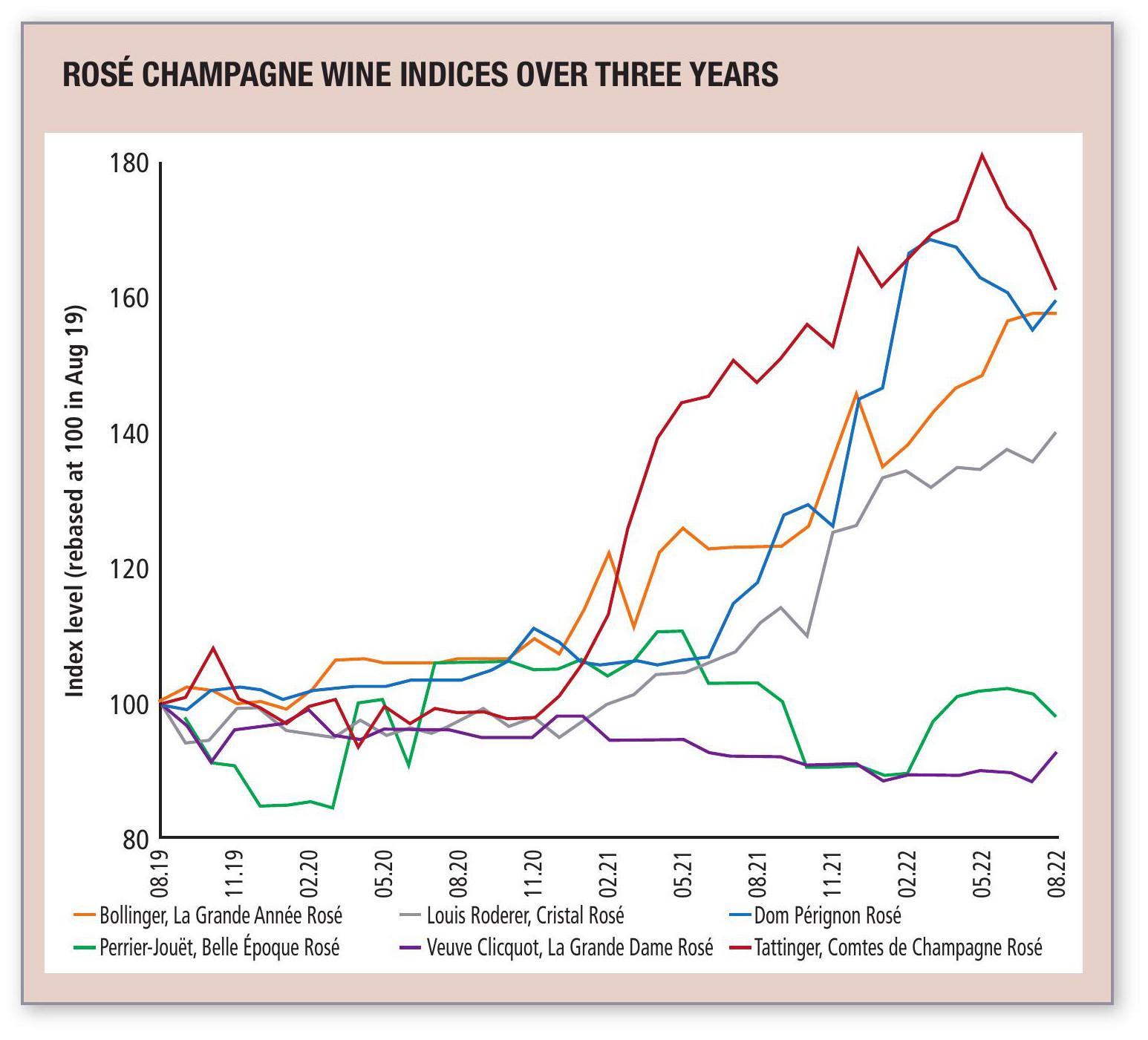

ROSÉ CHAMPAGNE PRICE PERFORMANCE

In terms of price performance, pink bubbles have also lagged behind white Champagne. On average, rosé Champagne prices have risen by 29.0%, compared with 52.3% for the Champagne 50 index over the past year.

This year’s rankings of the top 10 bestperforming wines from the region also featured just one rosé – Louis Roederer Cristal Rosé 2008.

When it comes to wine labels, Dom Pérignon Rosé has been the top performer in the past year, up by 34.8%. It has been followed by Bollinger La Grande Année Rosé, up by 27.9%. Over three years, however, Taittinger’s Comtes de Champagne Rosé has outperformed the rest, with a 61% increase. The wine is up by 9.5% in the past year.

THE DIRECTION OF THE MARKET

It remains to be seen what direction rosé Champagne might take as this market sector grows. It has always been a part of the secondary market for Champagne but the size of its presence has fluctuated – one strong year followed by declining trade over the next two. As the Champagne market expands, drawing in an increasing number of houses and growers, the volume of white Champagnes is naturally relegating the less commonly produced pinks to a smaller niche.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

However, the fact that brands such as Cristal, Comtes de Champagne, and Dom Pérignon have rosé cuvées of their own will be of great benefit to the rosé category.

Not only do these brands have the capacity to produce rosé at a reasonable scale, as the wider Champagne market evolves consumers can easily identify and trust these big names when looking for other options outside of white cuvées.

Of course, being produced in smaller quantities and with higher average prices, the market for rosé Champagne was always going to grow at a slower rate than that of the white wines. However, as this market segment evolves, this lack of liquidity, if it is coupled with rising demand, could one day make rosé Champagnes some of the best price performers around.

Liv-ex analysis is drawn from the world’s most comprehensive database of fine wine prices. The data reflects the real-time activity of Liv-ex’s 600 merchant members from around the globe. Together they represent the largest pool of liquidity in the world – currently £80 million of bids and offers across 16,000 wines.

Related news

Zamora Company to distribute Bottega sparkling wines in Spain

Cabernet Franc on track to become the official grape variety of New York State