How has fine wine performed in the first half of 2022?

The fine wine market has continued to broaden in 2022. Data from the first half of the year shows which wines and regions are reflecting the shifting demands and changing shape of the secondary market.

The number of wine labels (measured as LWIN7s) traded in the first half of 2022 is already 78% of the record level achieved in the whole of last year. Meanwhile, the number of wines traded measured as LWIN11s (wines by vintage) is 70% of the 2021 record. At its current rate, it seems likely that trade will surpass that landmark by the end of the third quarter.

Most fine wine regions have traded more wines in the first half (H1) of 2022 versus H1 2021. The number of Champagnes traded year on year has seen the biggest jump, by 11.9%. The market’s broadening is also coming from the US (9.9%), Burgundy (8.7%), Italy (6.7%), and regions included in the ‘others’ category.

But for some, the broadening has stalled. Bordeaux fell back, with the number of wines traded down by 3.7% year on year. The number of Rhône wines has, so far, run flat.

BORDEAUX CONTINUES TO LOSE TRADE SHARE

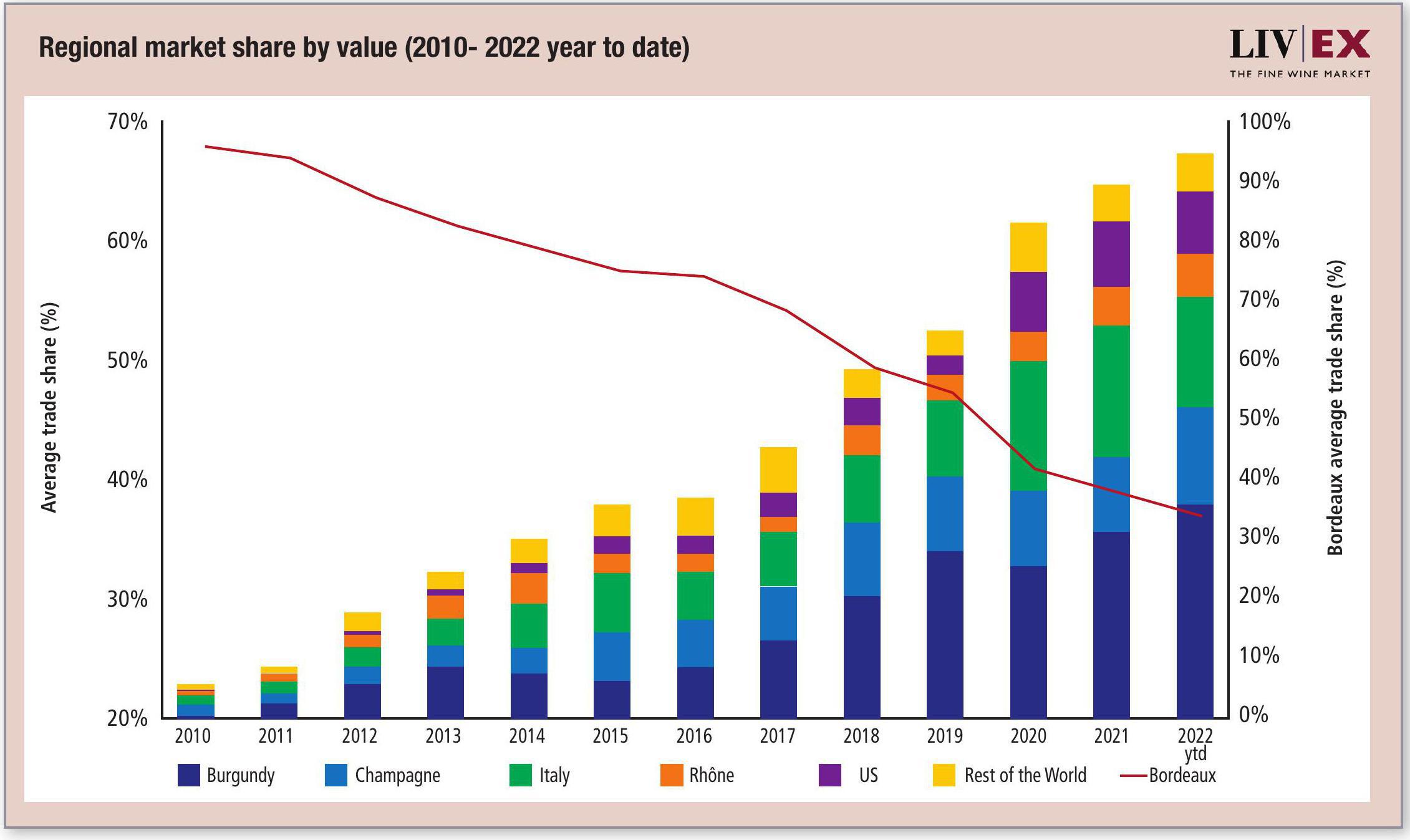

The increase in wines seeing active trade, and the regions they are coming from, has in turn affected regional trade share. Bordeaux has continued to lose market share to other regions, and now sits at its lowest level – 33.9% in the year to date.

Two years ago, Italy emerged as a big contender, almost doubling its trade share between 2018 and 2020, to take a 15.3% slice of the market in 2021. In the year to date, however, it has fallen back to 13%.

US IS STAGNANT

The US, which tripled its trade share between 2019 and 2020, has not grown any further. In the year to date, it stands at 7.3%, slightly down on the 7.6% share achieved in the first half of last year.

The Rhône (4.9%) and the ‘others’ (4.4%) have made small gains, but it is Champagne and Burgundy that have enjoyed the biggest growth.

Champagne’s trade share now sits at 11.4%, up from 8.8% at this same point in 2021. Burgundy accounts for 25.1% of the market, up from 22.0% in 2021. In some markets, such as the UK, Burgundy is the most-traded region, with a market share surpassing 35%. A snapshot of the five most traded wines by value so far this year is representative of the broader market trends. Three of the top five spots are Champagnes, corresponding with its growing trade share.

Louis Roederer’s Cristal is the second-most traded wine (LWIN7) by both value and volume this year. Its 2008 and 2014 vintages feature in the rankings, together with Dom Pérignon 2010.

The 2019 vintages of Screaming Eagle Cabernet Sauvignon and Château Lafite Rothschild’s Carruades de Lafite have also made it into the top five. Overall, the 2019 is the most traded vintage by value this year.

Liv-ex analysis is drawn from the world’s most comprehensive database of fine wine prices. The data reflects the real-time activity of Liv-ex’s 600 merchant members from around the globe.

Together they represent the largest pool of liquidity in the world – currently £100 million of bids and offers across 16,000 wines.

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

fine wine monitor – in association with

Related news

Areni Global: 'We have to find a way to make wine consumption safer' for women amid spiking fears