Portugese still wines and Port post-pandemic revival driven by innovation

Feature findings

• In 2021, all of the top 10 export destinations for total Portuguese wine were on the up, in value terms.

• In Port, two significant trends are increasingly apparent: the continued expansion of the premium or ‘special category’ segment; and Port’s ever-growing diversity.

• For Fladgate, Asia has been “very tricky”, as mainland China and Hong Kong have been hit by renewed lockdowns. But a “boom” in Port sales in South Korea has been a welcome bright spot.

• In all price segments, Port’s everexpanding diversity is a key factor in modernising its appeal among consumers.

• La Martiniquaise’s Douro wines are enjoying double-digit growth, with whites and rosés beating reds.

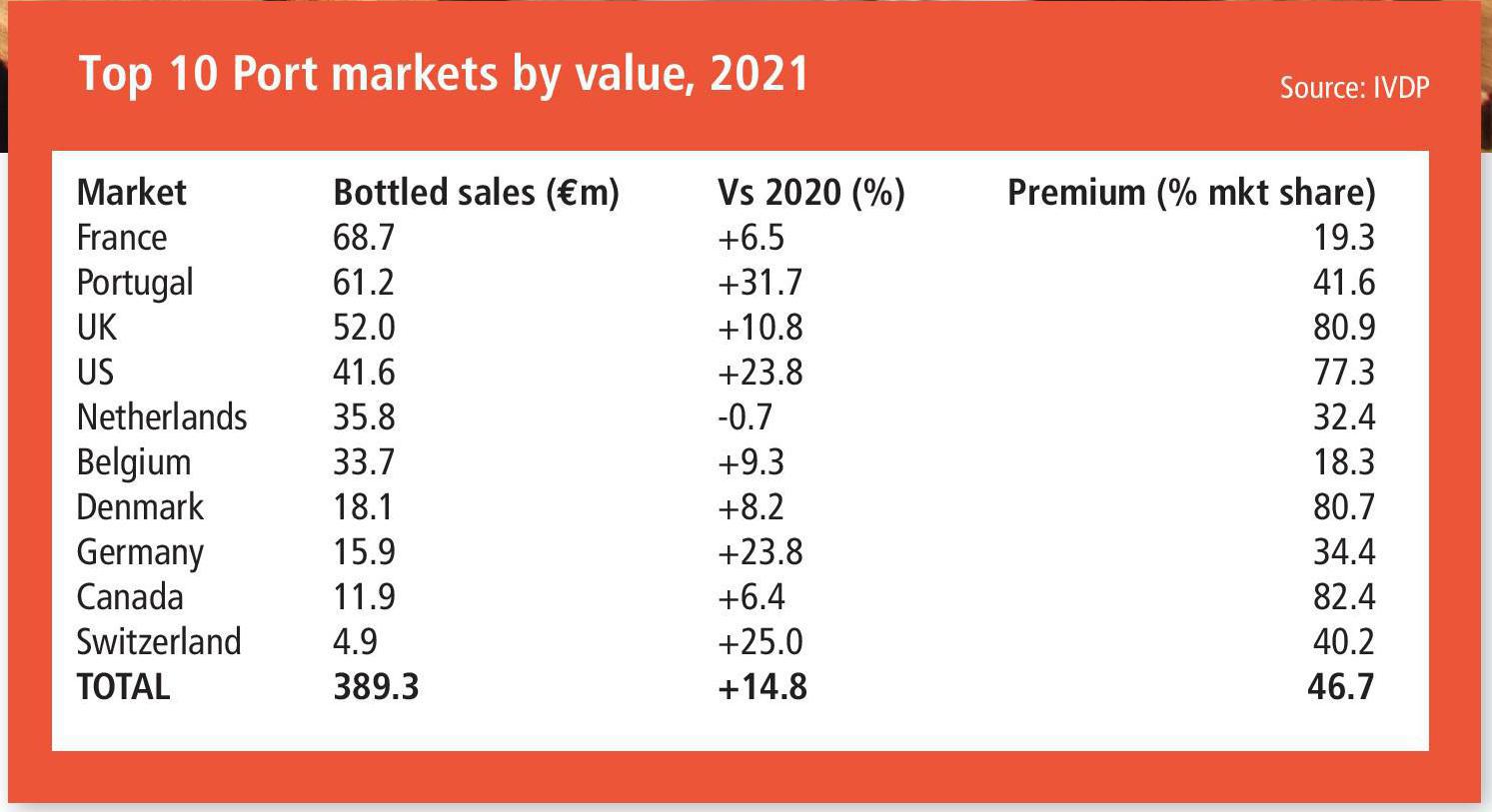

AFTER THE Covid-induced difficulties of 2020, last year was an overwhelmingly positive experience for Portugal’s wine and Port producers. Of the top 10 Port markets, only the Netherlands registered a value decline, while all of the top 10 export destinations for total Portuguese wine were on the up, in value terms.

Taking Port first, two significant trends are increasingly apparent: the continued expansion of the premium or ‘special category’ segment; and Port’s evergrowing diversity, which is enabling it to recruit new consumers and target fresh consumption occasions.

“Fundamentally what we’re seeing is a continuation of the growth in special categories,” says Adrian Bridge, CEO of The Fladgate Partnership. “There’s also a longer-term decline in the commodity end. It wouldn’t surprise me if, in the next year or two in value terms, quality Port outstrips commodity Port.”

This outlook was reflected by a record year for Port sales in 2021 for Fladgate – and, according to sales director Chris Forbes, the year to date has been similarly positive, with good growth for aged tawnies in the US and Canada, where the limited-edition Historical Collection also continues to sell well.

Cocktail hour: younger drinkers enjoy Port and tonic apéritifsAsia, however, has been “very tricky”, Forbes acknowledges, as mainland China and Hong Kong have been hit by renewed lockdowns, with Japan only gradually starting to reopen. In this rather gloomy scenario, the “boom” in Port sales in South Korea has been a welcome bright spot.

‘Last year, we also rereleased a small quantity of Dow’s, Graham’s and Warre’s 1994 vintage Ports from our own cellars, which proved popular, particularly in the on-trade’

Bridge attributes this to a Samsung global conference held in Porto in January 2018, when the company booked up The Yeatman Hotel for a month. As a direct result, Porto began to see increasing numbers of South Korean visitors, and interest in Port rose in the country. “That essentially put Porto on the map,” he says. “I believe that has been an important catalyst for awareness – there is an interest that can be capitalised on to drive sales.” For Harry Symington, communications and vintage Port manager at Symington Family Estates (SFE), 2021 was characterised by continued difficulties for the on-trade, but more soaring demand in retail, with markets including Portugal, UK, France, Germany and the US all showing significant value and volume growth.

As on-trade sales continue to recover in 2022, this is bringing renewed momentum for premium Port sales – everything from Graham’s aged tawnies to reserve rubies such as Cockburn’s Special Reserve in the UK, Graham’s Six Grapes in the US, and Graham’s LBV globally.

Symington also highlights “huge growth” in the UK for single-quinta vintages, such as Graham’s Quinta dos Malvedos, Dow’s Quinta do Bomfim and Warre’s Quinta da Cavadinha. He adds: “Last year, we also rereleased a small quantity of Dow’s, Graham’s and Warre’s 1994 vintage Ports from our own cellars, which proved popular, particularly in the on-trade.”

The premiumisation trend is even taking root in France, a country traditionally awash with cheap commodity Port sipped as an apéritif. Here, Fladgate’s distribution arrangement with Champagne Philipponnat is bearing fruit, says Forbes, while Bridge describes a generational shift in which younger consumers are rediscovering Port – but LBVs and reserve rubies and tawnies, rather than the cheaper liquid enjoyed by their grandparents.

PREMIUM PORT

Both Fladgate and SFE are squarely focused on premium Port, but producers with a greater emphasis on the commodity markets of continental Europe are also seeing an uptick for their higher-priced products.

“We have observed this with our Cruz 10yo reference, and we have also seen it recently with the launch of our Decanter Colheita 2011 at the end of last year in Portugal,” says Constance Descamps, international marketing manager for Porto Cruz at La Martiniquaise.

Similarly, António Saraiva, winemaker and general manager at Vranken Pommery-owned Porto Rozès, reports positive trends in Denmark, Portugal, and Belgium, but disappointing sales in France, one of the company’s biggest markets. “One fantastic thing about Port is the premium categories, and we are facing an unexpected growth in the aged tawnies, and some less volume in the ruby categories, especially in vintage and LBVs,” Saraiva says.

In all price segments, Port’s everexpanding diversity is a key factor in modernising its appeal among consumers. Beyond the traditional ruby and tawny categories – although these too have seen their fair share of innovation with high-end aged tawnies and singlequinta vintages – there is white Port, pink Port, and, most recently, Portonic RTDs – a mixture of Port and tonic.

The moral imperative: Portugal explores ESG

ESG – Environmental, Social and Governance – is arguably the most important issue facing the drinks industry in 2022, and Port and wine producers the length and breadth of Portugal are increasingly taking action to meet their responsibilities.

The Porto Protocol Foundation non-profit organisation set up by Taylor Fladgate has its roots firmly embedded in Portugal, but both its remit and its membership are global, with a focus on sharing practical advice and resources that enable wineries of all size to take action across a range of environmental issues.

Other, individual initiatives go back many years. Esporão now has about 18% of Portugal’s organically farmed vineyards, and, after more than a decade, is well on the way to transitioning its Herdade do Esporão (Alentejo) and Quinta dos Murças (Douro) estates to full organic certification.

The company has also erased the distinction in working conditions between its office-based and field workers, allowing all to benefit from transportation to and from work, a hot, sit-down lunch, health insurance, access to a company-paid lawyer or psychologist, a bonus scheme and performance-based career advancement.

Elsewhere, the Cartuxa winery in the Alentejo began working on sustainable farming in the late 1990s, says head winemaker Pedro Baptista.

“Since then, we have used many practices that contribute to increasing the level of natural fertility of our soils and reducing, year after year, the quantity of fertilisers use,” he adds.

“In the past 12 years, we have been increasing year on year the surface area of organic farming. Measures like reducing the amount of water used in the winery (divided by five in 10 years), production of our own energy with solar power, or reducing the weight of our bottles, are being taken in the most recent years.”

The Alentejo region – with some of the highest summer temperatures in Europe – is also the centre of the Wines of Alentejo Sustainability Programme (WASP). Work on the initiative began in 2013, and, following its launch in May 2015, it has pursued 10 goals, from increasing economic viability to providing greater transparency in the supply chain.

WASP now has more than 500 members, with examples of recent initiatives including preserving cork forests and improving energy, waste and water management, from wineries including Herdade de Coelheiros, the Adega de Borba co-operative, and Herdade do Mouchão.

Increasingly, producers are showcasing their environmental credentials through new wines, such as Symington Family Estates’ Altano Rewilding Edition, which benefits Rewilding Portugal’s conservation efforts in the Greater Côa Valley – and Rozès’ imminent Terras do Grifo organic and capsule-free white and rosé Douro wines, with recycled paper, water inks, and corks made with beeswax.

‘One fantastic thing about Port is the premium categories, and we are facing an unexpected growth in the aged tawnies, and some less volume in the ruby categories, especially in vintage and LBVs’

Over the rooftops: Porto

“The category is developing, innovating and resisting the tumult of time and of the market, as shown by the innovations of Pink or Portonic, which have the will to seduce younger audiences through modern consumption methods,” says Descamps, highlighting Porto Cruz’s summer Cruz Fresco campaign in Portugal, France, and Belgium, which champions the Port-and-tonic serve. The company has also partnered with tonic maker Schweppes in the three countries for outdoor advertising, in-store displays and promotions.

“Fifty years ago, the Port market used to be just ruby and vintage,” says Bridge. Since then, the innovation stream has been more or less constant, from LBV to reserve rubies, pinks and RTDs.

“You’re able to capture the attention of different age groups of consumers,” Bridge adds.

“It’s an inherent strength of Port, that it has the capacity to innovate.”

‘The category is developing, innovating and resisting the tumult of time and of the market, as shown by the innovations of Pink or Portonic’

Port is also still a dominant feature of Portugal’s presence in the fine wine sphere, accounting for 98% of Portugal’s trade by value, and 94% of the number of Portuguese wines traded, in 2021, according to Liv-ex figures. While last year the Port 50 index was more or less flat, some wines recorded double-digit price increases, with Dow’s and Graham’s the best performers (rising by 44.5% and 44.1% respectively).

Innovations: Porto Cruz is adding new tastes to its range

But could Port’s dominance be challenged? Some merchants, such as Justerini & Brooks, have recently made an effort recently to expand their Portuguese wine offerings. “We have seen a burgeoning demand for small family estates and indigenous varieties from Spain in particular over recent years,” explains J&B buyer Mark Dearing. “Portugal seemed to me a natural next step.”

Dearing acknowledges that Portugal’s diversity and complexity is at once both attractive and difficult to communicate, with plenty of interest beyond the Douro.

‘Mountainous old vineyards in the Dão region have huge appeal. Field blends, granitic soils, high elevations, no need for excessive gloss or oak ageing; authentic wines’

“Mountainous old vineyards in the Dão region have huge appeal,” he says. “Field blends, granitic soils, high elevations, no need for excessive gloss or oak ageing; authentic wines. I’d also highlight a refinement and more quality approach being taken in Bairrada with regard to Baga – traditionally a bit rustic, but in the right hands a hugely characterful grape variety. Vinho Verde, defying expectations, has great potential when it comes to fresh whites, provided yields are controlled and the fruit is given a chance to show at its best.”

Even so, the Douro remains the shining star of Portuguese wine, giving the valley’s wines – in Saraiva’s words – “immediate legitimacy” because of the associations with Port. Saraiva outlines growth for Rozès’ Terras do Grifo, especially at Reserva and Grand Reserva level, but also positive trends for Douro whites and rosés, sourced from high-altitude vineyards. “There are not so many wine regions in Europe with this capacity,” he points out.

Meanwhile, Descamps reports continued double-digit growth for La Martiniquaise’s Douro wines, singling out Belgium, the US, Switzerland, and the UK as particular highlights. Whites and rosés are outstripping reds in growth terms, she says, echoing Saraiva’s words on Reserva and Grande Reserva reds – with sales rising at five times the rate of standard wines.

ESTATE WINES

While still firmly rooted in the Douro Valley, Symington Family Estates is rolling out wines from the company’s Alentejo estate, Quinta da Fonte Souto: an Alfrocheiro as its first single-varietal red, launched this year, following last year ’s unveiling of a rosé, made with Aragonez.

In the Douro, the company continues its mission to, in Harry Symington’s words, “produce the most elegant expression of a Douro DOC” with the Chryseia Prats + Symington joint venture, established in 2000. “Over the past two decades, we believe this wine has significantly contributed to the development of Portugal’s fine wine category and the growing interest in Portuguese wine that we see today,” Symington says.

River view: the Douro flowing through Porto

‘Over the past three years, we have refocused our portfolio, launching new wines, and increasing our efforts on communications with the help and commitment of our local partners’

Portuguese wine is increasingly seeing an enhanced premium focus that is driving value growth in the markets, as well as changing perceptions among trade and consumers alike. “Over the past three years, we have refocused our portfolio, launching new wines, and increasing our efforts on communications with the help and commitment of our local partners and teams that have been a great support to build our brands in their markets during these challenging times,” says Nuno Cabral, chief marketing and sales officer at Esporão. The result for the company was sales growth of 15% in 2021, its strongest year to date, with even better performances from estate wines Herdade do Esporão in the Alentejo, Quinta dos Murças in the Douro, and Quinta do Ameal in Vinho Verde.

In Port and unfortified wine – reds, whites and rosés, and at all price points – one factor is key to driving increased awareness, appreciation and sales of Portuguese wines: tourism. As this begins to open up again after the pandemic, it’s not only boosting sales in Portugal’s bars and restaurants, but also embedding a positive lifestyle image of the country in the hearts and minds of its visitors.

However, there is also tension, thanks to the supply-chain crisis, rising costs and the impact on consumers’ disposable incomes. Producers that postponed price hikes during the pandemic are now facing a difficult choice. “We need to raise prices in certain areas,” says Bridge, “and we’ve probably needed to do that for a while. The average age of a Taylor ’s Port is seven years, so it takes a bit of time for increased costs to feed through the system, and we also need to respect the consumer, because they are being squeezed on the other side. After all, we are a discretionary luxury item, so we need to be responsible and stay affordable for our customers.”

Related news

How do people under 40 find their way into fine wine?

‘Bonkers’ rosé sales in UK driven by four wine brands

How a visit to California convinced Mirabeau to sell to Concha y Toro