Which Bordeaux vintages have been the most profitable?

Investing in Bordeaux en primeur is a recurring topic of discussion before each campaign. Factors such as the quality of the new vintage, allocations and current market conditions are on the minds of the trade when considering whether and what to buy. The key determinant, however, is price, argues Liv-ex.

The average price of the 2010 vintage, offered at record levels during the China-led bull run in 2011, had declined by 11% by the time the vintage became physically available two years later. This is just one of the examples where the inherent promise of future returns has not been immediately fulfilled.

According to a 2020 Liv-ex survey, merchant opinion was divided over the significance of en primeur. Of the respondents, 38% disagreed that it is the most important buying event of the year; another 17% were neutral. As last year’s opening report said, wine has been slower to sell.

But buying wine for investment is a long-term game, and en primeur continues to attract global interest. Today, the total margin since release (the average increase from the château release through to the price today) of some Bordeaux vintages exceeds 200%. Here we examine which have been the most profitable vintages for the supply chain from today’s perspective.

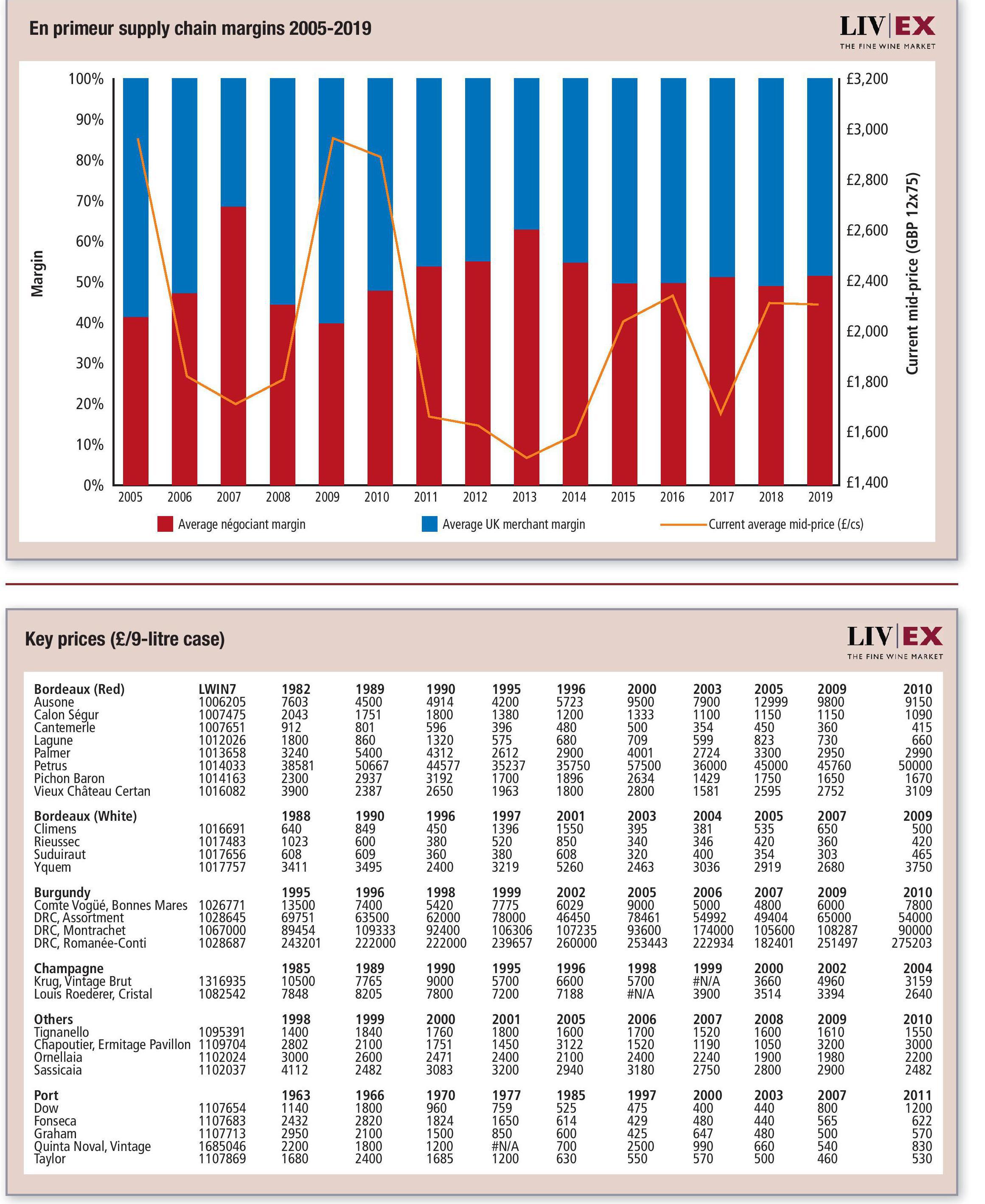

To calculate the average margins, Liv-ex calculated the average ex-château, exnégociant, ex-London and current mid-prices of the wines in the Bordeaux 500 index and split them by vintage. The margin was estimated based on the difference between the price at each point of delivery.

For the négociants

In the en primeur system, négociants buy from the châteaux, and are the first to apply a margin. Négociants have consistent margins on most vintages (17% on average), with 2014 providing a slight increase (22%). The 2008 has been the lowest-priced vintage since 2005, with an average ex-château price of €61 (£50.90) per bottle for the wines in the Bordeaux 500 index. The 2014 was also among the more affordable offerings, at €90 per bottle. The 2019, viewed as an ‘on’ vintage, was released at €115 per bottle on average. This represented a discount on the previous year, and the campaign, launched amid the first wave of the Covid-19 pandemic, revived the buying appetite for en primeur.

For UK merchants

UK merchants, who buy from the Bordeaux négociants and then sell on to their customers, have applied the highest margins on the 2005 (23%), 2008 (20%) and 2009 (25%) vintages.

The average price of the 2005 ex-négociant releases was €141 per bottle – around £96 per bottle at the time. UK merchants then offered the wine at £118 per bottle on average.

Total Margin

The total margin measures the total increase, from the château release to the average price of the vintage today. It includes the margins of the different supply chain players, like the négociants and merchants who have since traded the wines, and collectors.

As the table shows, the 2008 vintage has attracted the greatest margin for collectors, 108%, just ahead of the 2005 vintage (107%). The lowest-priced vintage on release, it is still among the most affordable Bordeaux. The lowest margin (-7%) has been for the 2017,

an ‘off’ vintage released at a high price after the very expensive 2016s.

The 2019 is a recent success story, with an average gain of 26% for buyers in a short space of time. The châteaux price positioning left room for profit for the supply chain and stimulated demand for Bordeaux. In March this year, 2019 was the most traded Bordeaux vintage by value and the second-most by volume.

fine wine monitor – in association with Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business.

It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Zamora Company to distribute Bottega sparkling wines in Spain

Cabernet Franc on track to become the official grape variety of New York State