International whiskey ups its game

While Scotch reigns supreme, an increasing number of distilleries from other countries are creating exciting whiskies, using local grains and barrels to attract younger consumers, Arabella Mileham discovers.

Say ‘malt whisky’ and the image that typically comes mind is of heather and glen, drams by a crackling fire, and oak casks ageing. However, increasingly, the whisky that is grabbing headlines and awards is coming from countries as wide ranging as England, Scandinavia, Australia, India and Taiwan, while Diageo and Pernod Ricard are ploughing significant investment into establishing new malt whisky distilleries in China.

Say ‘malt whisky’ and the image that typically comes mind is of heather and glen, drams by a crackling fire, and oak casks ageing. However, increasingly, the whisky that is grabbing headlines and awards is coming from countries as wide ranging as England, Scandinavia, Australia, India and Taiwan, while Diageo and Pernod Ricard are ploughing significant investment into establishing new malt whisky distilleries in China.

So, do traditional whisky-producing countries – and Scotch single malt in particular – have stiff competition from these new nations?

According to Dawn Davies MW, head buyer at The Whisky Exchange, and Speciality Drinks Group, yes.

“Absolutely. Since lockdown, people want to experiment more; they have more confidence, more knowledge as they have had more time to learn, and are more willing to look further afield,” she explains. “We’ve seen an increase in sales of non-Scotch malts – and we have had more ‘world other ’ whiskies than we’ve ever had before.”

Davies points to distilleries such as Westland in Seattle (which was bought by Rémy Cointreau in 2016), Starward, and Gospel in Australia, Thomson in New Zealand as well as Taiwan’s Kavalan, and Amrut in India (which opened in 1947, but started producing single malt in 1982) as examples.

“All these are starting to make some noise, and people are excited about it,” she explains.

Jen Baernreuther, on-trade commercial director at Speciality Drinks Group, notes that in traditional on-trade accounts – such as five-star hotels and private members clubs – there is still a big desire for well-known Scotch brands such as Glenfiddich, Glenlivet, Macallan, Balvenie, and traditional age-statement whiskies. However, there has been huge interest and growth in younger, fresher, more modern trendsetting origins, and independent bars, restaurants and hotels are looking to these to build a differentiated list, driven by the flavour and variety.

“It’s not always clearly defined as what type of whisky is in the bottle as these distilleries are experimenting with different grains, distillation methods and casks – there’s a real range of flavour,” Baernreuther explains.

ENGLISH DISTILLERIES

England has seen an explosion of new whisky-makers, with the number of whisky distilleries now sitting at 33. Many of these producers’ products are already on the shelves of multiple major retailers, competing with their betterknow Scottish cousins. However, England’s distilleries are already planning to launch their own marketing group to promote English and whisky over the next few months, and plenty of new expressions and innovations are in the pipeline.

The Cotswold Distillery’s cofounder Dan Szor says English whisky has undoubtedly benefited from the gin renaissance, as the UK is already considered a leader in the world of spirits innovation and trends.

“Consumers are increasingly sophisticated in their palates, and in their interest in authenticity,” he explains. “As a result, products that are local, that have a degree of provenance and terroir are catching their interest,” he explains.

For Baernreuther, the demand for local, sustainable, authentic products are key. She points out that the likes of the East London Liquor Company started out focusing on gin and vodka before turning to whisky. In May this year ELLC will launch its rye, “a really affordable, approachable, very local whisky” she points out, while London’s Bimber Distillery is releasing a rye in May too.

“This will be a huge launch for the ontrade, as a lot of drinks served tend to use that traditional style. Rye whisky will hit the spec in terms of taste and flavour, but it will be a local product,” she explains. “That will have a very big impact.”

Max Vaughan, co-founder of the White Peak Distillery in Derbyshire, which has just released its WireWorks whisky onto the market, acknowledges that a discernible ‘English whisky style’ has not yet been developed but that the focus has been on flavour creation – from using different grains, to longer fermentation times and careful wood programmes that will create the best possible liquid in the shortest possible time.

As he points out, unless new distillers have very deep pockets, they need to produce a whisky that can be sold young.

“We’re trying to promote a whisky that has a really great flavour at a young age. We all have constraints in terms of not having the benefit of sitting on our hands for 10 years, so we’ve all had to think very carefully from the word go about what our approach will be to give us a whisky that will come to fruition relatively young, a product that we can sell, and a business that can be sustainable,” he explains.

Szor agrees: “Financially, it’s not possible for a small distiller to wait that long and nor do we need to. We’re saying ‘Look at what we can make in what is traditionally considered a short amount of time’.”

One of the key aspects enabling English and other international distilleries to disrupt the category is their relative freedom from the strict regulations that governs producers of Scotch whisky, for example, or Bourbon.

As David Vitale of Melbourne distillery Starward Distillery points out, “our regulations in Australia are so broad you can shoot a cannon through them!”

He argues that the “elegantly simple” Australian definition of whisky as a fermented grain mash that is distilled and aged in wood for a minimum of two years gives producers an opportunity to make something distinctive and different to other whiskies from around the world.

“We are a country famous for excellent export-quality grain, malted barley and rye. We have amazing wine barrels on our doorstep, so we can have wine go out and whisky go in with minimal intervention. And all of a sudden, those two simple things have given us a new palate to explore from a flavour perspective.”

ANCHORED IN TRADITION

While some interpret the heritage and regulations of Scotch as “holding the category back” Vitale disagrees.

“There are lovely stories to be told by Scotch whisky distilleries. They are anchored in tradition, history and place – those things are what make Scotch so beautiful. The same goes for America or Ireland, where the whiskey tradition is at least 100 or 200 years old. Starward can’t compete on that level, newer producers can’t – but we can have a genuine conversation about innovation, and a new drinking occasion for whisky,” he explains.

To illustrate the point, Vitale stresses that whiskies have traditionally been drunk after dinner, but he wanted Starward to celebrate his home town of Melbourne, a great foodie destination.

“Crafting a whisky that goes with food is certainly a challenge but wine is food-friendly – so why not whisky?” he asks.

“We’re getting consumers to think of it as an approachable and versatile ingredient, whether it’s served neat or mixed.”

Lark Distillery, one of Tasmania’s oldest distilleries, ays its caters for two types of consumers, making recognisable malty, oily, lightly peated styles that “an Old World whisky drinker would recognise and feel comfortable with”, as well as unconventional whiskies that play with beer pairings, and different peating regimes and diverse cask creations to appeal to new whisky drinkers.

“The distillers of Australia have let their imagination run wild, creating new flavour profiles and drinking experiences that people keep returning to, and ones that are proudly Australian,” Lark’s head distiller, Chris Thomson, says. “We have everything from the large million-litreplus facilities to the micro distilleries, the single malt, the sour mash, the 100%-rye and Australian native grains whiskey.”

International judges are taking note. This year Tasmanian single malt Sullivans Cove won ‘best single cask single malt’ at the World Whisky Awards, a win that sales manager Sam Cumming says not only super-charged demand but had a huge impact on the wider Tasmanian industry. “It has legitimised the region as a burgeoning whisky powerhouse on the international stage,” he says. “As a distillery outside of Scotland and Japan, these awards have also drawn attention to other up-and-coming new world regions, something the distillery is very proud of.”

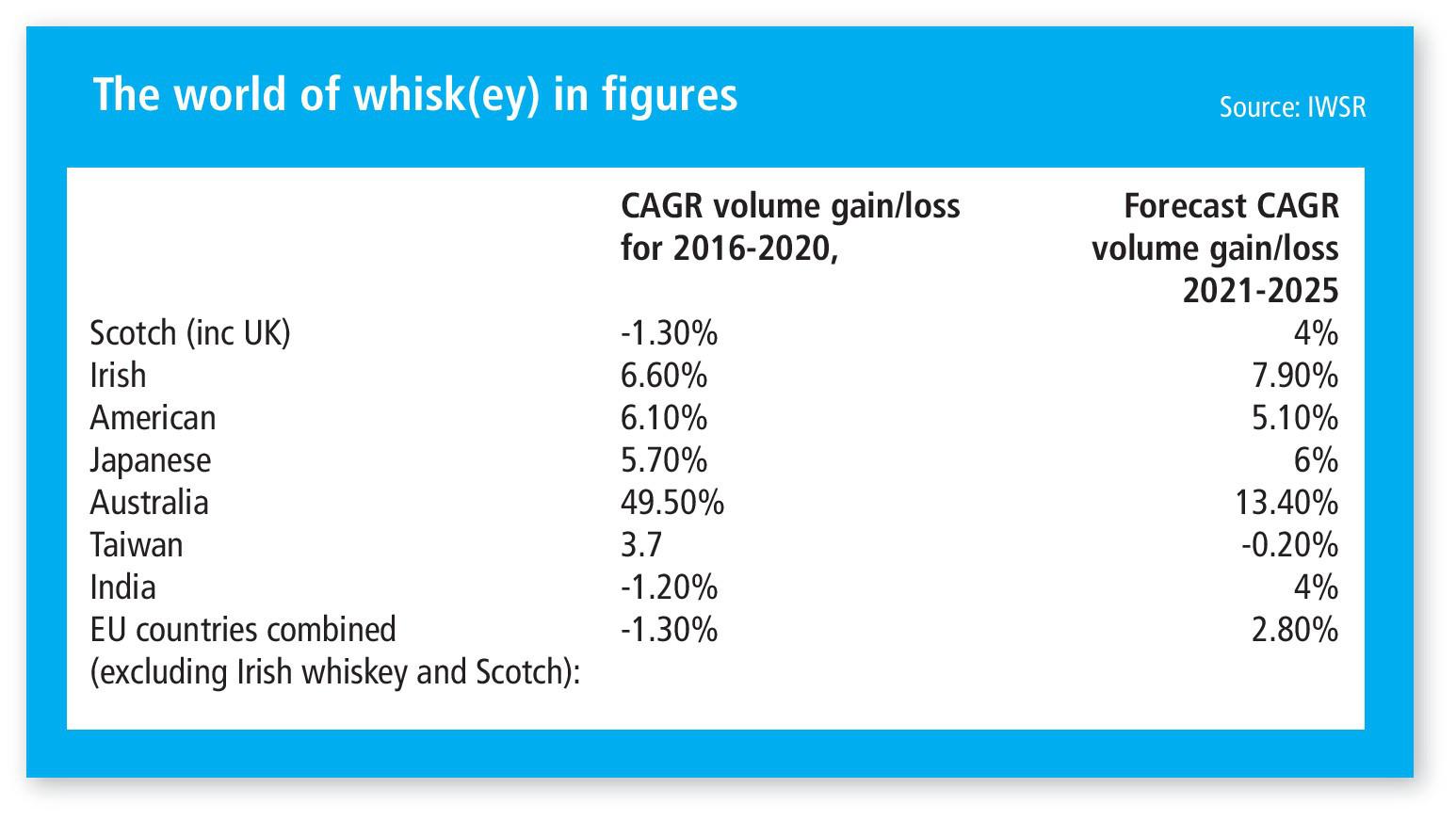

Already Australia has seen CAGR growth of 49% between 2016 and 2020, according to the IWSR, and further growth of 13.4% is forecast over the next four years. However, Dawn Davies voices a note of caution. “The problem Australia has is price, as much of its whiskey is still not affordable,” she states. Its relatively small production creates scarcity, and while this isn’t a problem when catering for the local market, when exporting, small distilleries don’t necessarily think about the impact of duty or transportation fees, she says.

“If you don’t have an allegiance to Australian whiskey and already have access to so many whiskies at a much better price, you’re going to be reluctant to spend those prices,” she explains.

And what about Japan? The country has seen strong growth in recent year – up by 5.7% between 2016 and 2020. However, Davies notes its fluctuating pricing, which may put people off. There is also the potential disillusionment about the “smoke and mirrors” way in which a lot of world whisky is blended and bottled under the guise of Japanese whisky, which she says may deter buyers.

“We’ve separated out our Japanese whisky, and if it’s not 100% Japanese, we put it into the world blend category. So we are trying to spread the message.”

There is no doubt that many newer distilleries want to be disruptors, to celebrate their own regions and bring a new interpretation to the category. Baernreuther points to the Scandinavian distilleries of Stauning, Abasolo and Sweden’s The Box, as well as Japan’s Chichibu as trailblazers. “The Scandi countries are very good – they want to demonstrate the scope, change perceptions and show that age isn’t everything,” she argues.

Gregory Gatti, vice-president, global sales & strategy at WhistlePig Rye Whiskey argues that the distilleries led by young and hungry whiskey enthusiasts simply want to “push the boundaries of what whiskey has to offer”.

HERITAGE GRAINS

One thing they tend to have in common is experimentation, Davies explains: “Because a lot of Newer World distillers are small, we’re seeing more experimentation with yeasts and heritage grains; that’s where it’s interesting, and that’s where the great flavours are coming through.”

But as she points out, these could be in Scotland, Ireland or the US as much as anywhere else – and, indeed, there is a lot of innovation coming from traditional whisky-producing countries.

American distiller Westland, for example –a US producer that is leading the charge for American malt whiskey – is working with breeders, growers and maltsters in Washington State, to develop new varieties of barley that are bred for flavour rather than yield, and that have not been used in whiskey making before.

Westland’s marketing director Steve Hawley argues that although it is still in its infancy, the potential for American single malt is “immense”, as distilleries have the freedom to explore “aspects of single malt that have been neglected, or sometimes even dismissed, for many generations”.

He says: “There are more than 200 distilleries in the US making single malt and that only stands to grow as consumer education and appetite grows. Many consumers are being converted from Bourbon but there’s also a growing appreciation for the fact that great single malt doesn’t only come from Scotland anymore. There are exceptional single malts being made all over the world, and America is just now starting to have a larger voice in that conversation.”

Eric Pope, director of exports at Redwood Empire Whiskey, California’s largest whiskey producer, argues that these new distilleries in non-whiskey states have been instrumental in accelerating innovation in the category.

“Consumers love it – especially those ‘whiskey explorers’ that seek new expressions and limited releases,” he notes. “Over the last few years, you can see the more established players being inspired by smaller whiskey producers that weren’t ‘stifled’ by tradition.”

This is also true of Scotland, which is seeing its own explosion of independent distilleries. “They are not funded by big corporations and because they are privately funded they have to make money initially, which means producing a lot of gin,” Baernreuther notes. “The Isle of Harris is a wonderful example – it has produced some great gins, but the end goal is ultimately whisky.”

While Davies argues convincingly that Scotch is so strong it is unlikely to be toppled any time soon, she says that Ireland is likely to become the main challenger to Scotland’s crown, particularly if the price of premium Scotch continues to rise.

There is an established whiskey tradition in Ireland, and the affordable and great-quality liquid coming out of the new distilleries, as well as its soft fruit, ripe and approachable style is something that consumers can “get their heads around”, she says.

“It’s an easy way to get into a category, so for me the opportunity lies with the new whisky drinker who will eventually drive those trends,” she says.

The lighter, sweeter and more citrus flavour of Irish whiskey has been a hit for mixologists who are helping to bring a younger demographic (25-35 year olds) to the category, as well as more women, Denis Hurley, commercial and key accounts manager at West Cork Distillers points out.

“The days of whiskey being seen as a shot to accompany a pint of beer in a male-dominated pub is slowly being replaced by drinkers looking for a broader tasting experience, whether that be neat, on the rocks or in a cocktail, such as an Irish whiskey sour or a Friskey Whiskey,” he explains.

This has brought a competitive edge to the market, leading to reinvigorated consumer interest in Irish whiskey. “The quality of the liquid in the industry is superb right now, and with much more innovation across whiskey products, it is capturing the interest of consumers the world over,” he says.

In addition, new whisky drinkers are exploring different finishes, Hurley says, pointing to West Cork Distillers’ exploration of cask finishing whiskey – from rum, Port and Sherry finishes to more innovative methods of infusing stout and IPA in a cask to produce a different taste profile. Producers in Ireland are showing the variety of flavour profile, Donal O’Gallachoir of Glendalough, in Co. Wicklow says.

Glendalough, for example, is experimenting with indigenous oaks from the Wicklow Mountains – “it celebrates and ultimately protects the terroir driven flavour profile that went by the wayside” O’Gallachoir argues that these innovations are successfully challenging consumers’ preconceptions about Irish whiskey and “kick-starting Irish whiskey out of its pigeonhole”.

IRISH RESURGENCE

And it seems to be working – Irish whiskey has seen resurgence in recent years, with CAGR volume growth of 6.6% for 2016-2020, according to the IWSR, and further growth of 7.9% forecast for 2021-2025.

“It’s getting people from being very driven towards one brand or one style to having their minds blown,” O’Gallachoir explains. “It gets them to geek out about Irish whiskey and in turn become more of a world whiskey consumer. Once you get them out of being a brand-name-only drinker, it opens up the whole world.”

And as O’Gallachoir, Vitale and many others are keen to point out, when it comes to the whisky category, “a rising tide raises all ships”.

While Scotch need have no fears, the consumer is definitely gaining a whole host of options.

Related news

Why comfort-food cocktails are dominating bar menus in 2025

Chivas Brothers weathers mixed markets as first half sales fall 5%