This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Will ‘benchmark’ fine wines ever fall from grace?

Are emblematic wines from top regions recession-proof – or will gravity have its say? db finds out.

Back in July, the drinks business asked where all the benchmark wines had gone. The article rightfully pointed out that stratospheric price increases meant many of the world’s top wines, which also happen to be ‘benchmarks’ for a particular region, are completely inaccessible to most people, even sommeliers in training.

Petrus, for example, has seen its value rise by 452.2% since the inception of its index in January 2003. Despite a few dips and troughs, the wine’s price has steadily increased throughout the years and a bottle now retails for several thousand pounds.

Le Pin, which is considered to be the benchmark for garagiste wines, displays this trend even more clearly, and has recorded a rise in value of 551.4% over the last 20 years, placing it firmly out of reach of all but a handful of buyers.

The picture is even more challenging in Burgundy, where Domaine de la Romanée-Conti has seen a rise of 1,071.7% since 2003. A single bottle, such as the 2018 vintage of La Romanée-Conti, can cost upwards of £20,000.

Salon, which is considered the benchmark Champagne, exhibits the steep rise in value typical of wines from the region in summer 2021, when it benefitted from a boost in demand post-Covid-19. The Salon index has risen 1,620.3% since its inception.

However, while these benchmark wines have witnessed extraordinary price increases, they are not immune to the current downturn.

The question that arises is this: at these elevated prices, where the air is thin and buyers are few and far between, might these benchmark wines lead the pack down, or does their relative rarity protect them from the rigours of market downturns?

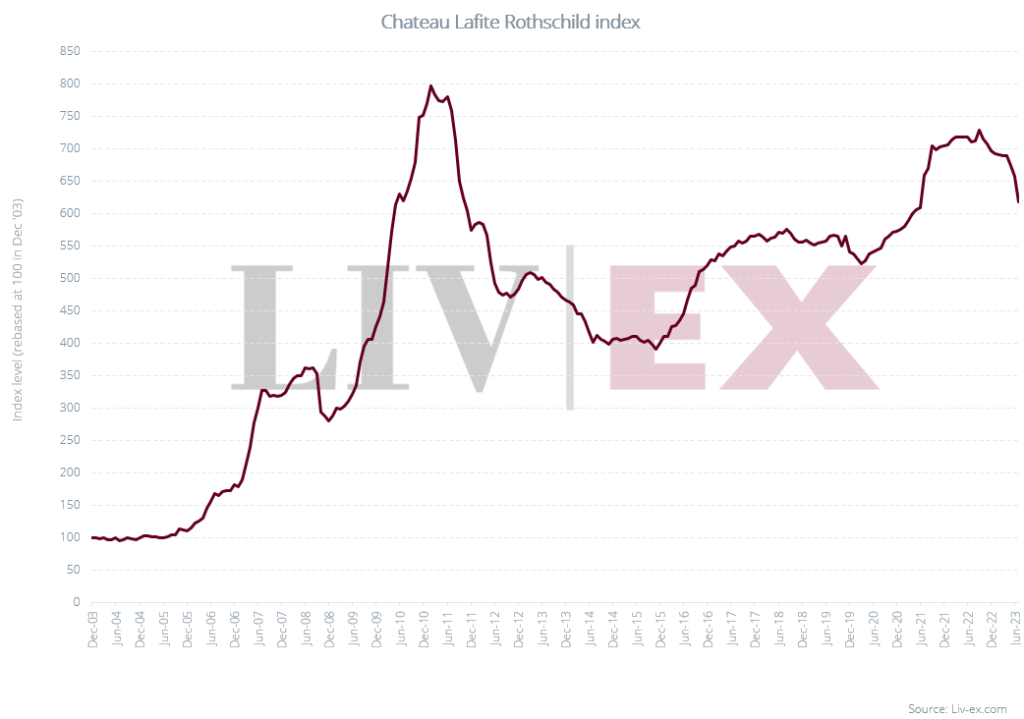

The case of Château Lafite Rothschild hints at an answer. During the Asia-led boom for fine wine (2005-11), Lafite became a ‘super brand’ in China and prices skyrocketed, as shown on the chart. When the market cooled, prices halved. In subsequent years, Lafite found its footing and rallied hard, but it has yet to reach the heights achieved during these years of frenzied activity, suggesting that benchmark wines aren’t immune to broader market machinations. Gravity can be a potent force.

The extent to which these benchmark wines will see their prices fall (and for how long) remains to be seen, but the broadening of the secondary market offers alternatives to buyers seeking more affordable options in tougher times.

fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com