This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

‘Pockets of strength’ during Q3 hint at potential stabilisation of the fine wine market

The fine wine market may be looking at a “turning point’, according to a Q3 report from Liv-ex, following a volatile September marked by contrasting trends.

The fine wine market may be looking for a “turning point’ following a volatile September, a new report from Liv-ex has said, with the fourth quarter proving key to showing which direction it is heading in.

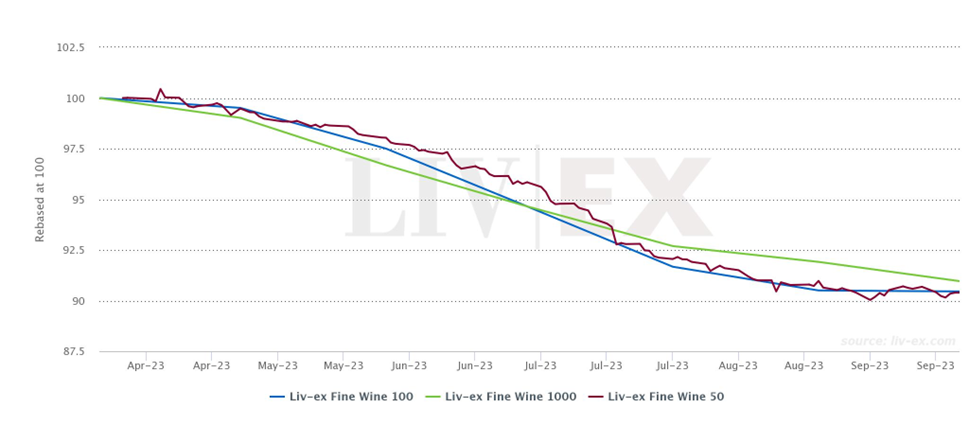

The latest Q3 report noted that although there had been downward movement across the Liv-ex indices in the quarter, there were some “contradictory” trends across the market during September, and with the slower declines in the Liv-ex 100 – the 100 most traded fine wines – than previous months “hinting at a potential stabilisation”. However, this was in contrast to the direction of the Liv-ex Fine Wine 1000, recognised as the broadest measure of the market, which saw an even faster decline than the previous month, “suggesting turbulence at the global level”. Meanwhile the declines of the Bordeaux 500 were a mirror to the previous month’s decline.

With “no clear bottom in sight”, the fourth quarter will reveal which direction the market heads in, the report said – although the “pockets of strength” and shifting dynamics in trade “reflect the resilience and adaptability of the market”.

Justin Gibbs, deputy chairman and exchange director of Liv-ex said noted that not only had the market headwinds had “not abated” a year after the market downturn began, but in fact, “quite the opposite”.

“With Chinese demand side-lined and higher interest rates weighing on stock holding strategies, both at the merchant and collector level, risk aversion remains pervasive,” he said. However, he added that fine wine had always been a “relatively steady ship in a storm and recent trade dynamics suggest some are beginning to sniff an opportunity” even though the momentum, “for now, remains with the bears.”

Which regions are doing well?

Bordeaux retained the lion’s share of the fine wine market, despite this year’s tricky en primeur campaign, and although it fell from 41.6% in the second quarter to 38.3% in Q3, it remains higher than the average share across 2022. Demand is being fuelled by European and American buyers, the report noted – no doubt buoyed by the strong dollar, with the percentage of US buyers now higher than those from Europe.

In terms of bis received during the third quarter, the most sought-after wines were from Bordeaux, wit renowned brands and “exceptional vintages such as 2016 and 2019”, showing strength. Tuscany also emerged as a popular region in Q3, with “significant buyer interest” for Super Tuscan wines.

In terms of market share, Burgundy and the USA declined, but Champagne increased (to 15.2%), along with the Rhône (to 3.0%), Tuscany (to 8.8%), Piedmont (to 3.6%) and the ‘Others’ category.

The declines in Champagne since last October, which has seen market prices fall 16% since its peak a year ago, actually helped to boost its popularity in the most recent quarter, stimulating demand as buyers seized an opportunity to acquire wines “at sharp prices” – more evidence of a buyer’s market. As a results, Champagnes took the top spot in volume terms, with Dom Pérignon 2013 and Louis Roederer Cristal 2015 topping the list, and Taittinger Comtes de Champagne Blanc de Blancs 2012 also making the top seven in volume terms. And although the Dom Pérignon 2013 vintage has fallen 7.1% in value since its release in January, the brand overall has seen rises of around 67% in the last five years, or 130% over the last decade.