This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Why a leading wine brand is lowering its alcohol level

One of the Britain’s best-selling wine brands, Isla Negra, will soon have a lower ABV in a bid to remain affordable as alcohol duty rises in the UK, db learnt during an exclusive interview last month.

News of the move came during a discussion on the current challenges for wine brands in the UK with Simon Doyle, who is managing director at the UK office for Concha y Toro – the owner of Isla Negra, as well as Casillero del Diablo.

Commenting on a planned duty increase for wine from 1 August – which will see wine taxed by around 44p more per bottle – he said that the Concha y Toro was looking at ways to try and reduce such a rise by making changes to one of its key products.

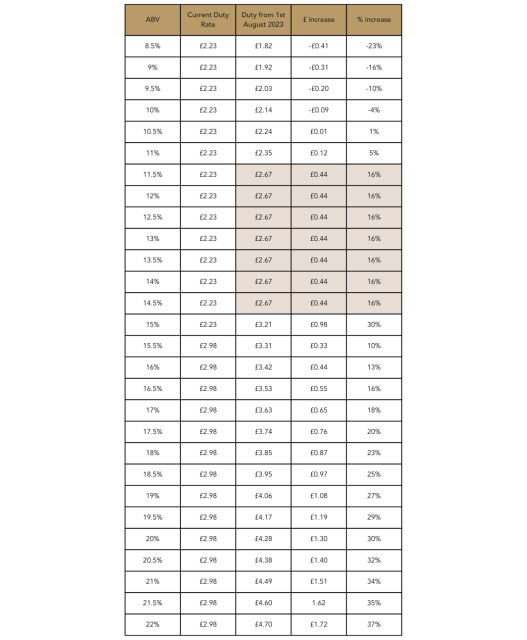

Pointing out that at least a 9% rise in duty will take it up from £2.23 to £2.67 per bottle, he said that VAT would then be placed on top of that, as well as a retailer margin of 18-20%, meaning that an entry-level wine could see its on-shelf price rise by at least 65p.

“When someone only has £5 to spend on a bottle, you have got to really work to see how you can mitigate these costs,” he said, before commenting, “And the only way to do that is to reduce your duty exposure – no-one has the efficiencies to do it any other way.”

Referring to a change for wine duty that will broadly tax alcohol according to strength, the only way for wine producers to lower their duty exposure is to drop the abv on wines to below 11.5% and that way avoid being taxed at the 12.5% abv rate, which will apply for all wine between 11.5% and 14.5% abv (see table, bottom).

While noting that any major changes aren’t possible on a brand like Casillero del Diablo, which “puts quality first,” he said that lowering abv on a “larger scale and lower-alcohol” label like Isla Negra is a route Concha y Toro is prepared to make to prevent a sudden rise in retail prices.

“We can afford to reduce the abv to offset some of the excise duty to get to 11% or 10.5% from around 12%,” he said, speaking about Isla Negra.

Telling db that this move is being planned for Isla Negra’s best-selling lines, which are Sauvignon Blanc and Merlot, he said that he hopes to have the white and red wines in the UK market with 10.5 to 11% abvs from September.

Acknowledging that reducing alcohol levels in wine can lighten the mouth-feel, he said that the samples he has tried of the lower abv Isla Negra are “really good”.

Wine between 11.5% and 14.5% abv will be treated as if it is 12.5% from 1 August, meaning that some 90% of all still wine will suffer at least a 9% duty rise. Meanwhile, from 1 February 2025, wine is due to be taxed according to strength, with wines taxed incrementally by 0.5% abv, between 11.5% and 14.5%.

As for how Concha y Toro is bringing down the abv of Isla Negra wines, Doyle told db that the company was using the spinning cone method of de-alcoholisation, which does add a small cost to the production of Isla Negra, but not enough to offset the reduced duty exposure.

The group is also looking at further ways to reduce the cost of Isla Negra and some other wines in its portfolio, including lighter bottles, shipping in bulk, and moving to alternative formats such as Tetrapak.

Notably he told db that Concha y Toro had moved its ‘reserva level’ Casillero del Diablo wines to UK-filling last year, commenting that by shipping the wine from Chile in bulk, the group can get “3.5 times more liquid in the same size container than you would in a glass bottle form.”

More generally, he said that wine brands were concerned about rising on-shelf prices for drinkers, and particularly at a time when consumers are seeing their disposable incomes fall.

“We are all worried about inflation and excise duty that will add a good 10% to the cost of a bottle of wine, and wine has not been able to pass on production cost increases like other categories have,” he said.

“The average level of inflation on wine is 4%, but for other categories, it is 15-18%, and excise duty [increases on wine from 1 August] will drive us towards that level,” he added.

Continuing, he said, “There is pressure to find mitigations, but the concern is that they just aren’t there.

“It’s why investing in brands is critical, because if you are charging more for brands, you have to justify why,” he concluded.

Read more

Casillero del Diablo campaign features The Last of Us’ Pedro Pascal