This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

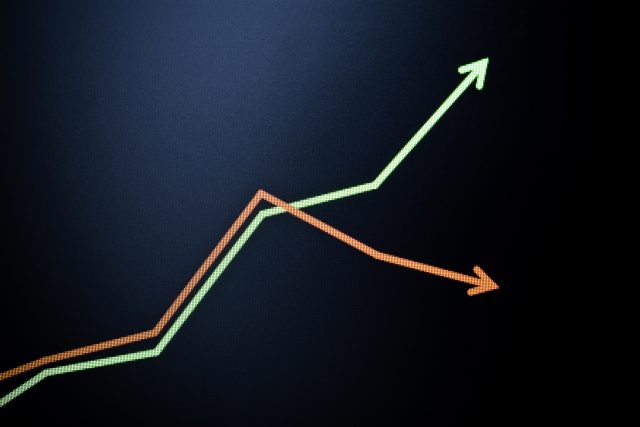

Is the premiumisation trend coming to an end?

Premiumisation was the buzz word of 2022, with US consumers trading up in both wine and spirits, but the upward trajectory of this trend is beginning to slow, as cost-of-living pressures take their toll. Could drinkers be turning their backs on high-end products?

Trading up experienced an overall dip among US consumers in the first quarter of 2023, according to data from the Distilled Spirits Council of the United States (DISCUS).

DISCUS economist Hasan Bakir said that the trend “grew drastically” during the pandemic, noting that it’s “only natural to see that growth normalise and level off” as Covid recovery continues.

Growth of the category is set to continue in the US, according to Richard Halstead, head of consumer insights at IWSR, albeit at a rate “more moderate than previously”.

Inflationary pressures and the cost-of-living crisis are partly to blame for moderating the trend, the 2023 Drizly Consumer Report has suggested. Two thirds (66%) of survey respondents reported changing their alcohol purchasing behaviours over the last 12 months as a result of inflation. Almost a fifth (17%) reported buying cheaper brands than they normally do, and 14% said they have switched to buying less-expensive beverage categories.

“As consumers prioritised essential purchases like rent and groceries, they have had less money to spend on non-necessities like high-end spirits,” Bakir said of the trend.

Mark Meek, CEO, IWSR Drinks Market Analysis, said in a recent report: “The key trends that have underpinned the industry, such as premiumisation, will evolve as consumers respond to the increased cost of living crisis. The industry will, however, still deliver pockets of significant value growth.”

He noted that in mature markets, premiumisation “looks to be embedded into consumer purchasing behaviours”, although “at slower growth rates”.

On Drizly, the overall average unit price of products sold has seen a steady rise since 2019, growing nearly 17% over the last five years to reach $20.16 in 2023.

However, the average remains relatively flat in 2023 year to date.

Wine has helped push the trend forward. Over the last five years the average unit price for wine increased more than 20%, totaling $19.57 in 2023 following a slight increase over the previous year. Within the top-selling wine subcategories, sparkling wine commands the highest average unit price, followed by red wine, rosé, and white wine.

However, spirits are beginning to lag behind. On Drizly, the average unit price for spirits is 2.7% higher today than in 2019, but it has declined in 2023 year to date and currently sits below the 2020 level.

Liz Paquette, head of consumer insights at Drizly, said that while the spirits category saw the most significant growth in premiumisation in the early years of the pandemic, “it appears that has slowed down” based on the current data.

Tequila has the highest average unit price within the top-selling spirits subcategories on Drizly at $48.60 – up from $39.32 in 2019.

Whiskey and vodka rank next, at $37.78 and $21.78 respectively. However, the average unit price for both whiskey and vodka declined slightly in 2023 year to date, with vodka’s current unit price just below the 2019 level, suggesting that the trend in trading up is slowing for the spirits category, as consumers tighten their purse strings in the midst of ongoing financial pressures.